While 2024’s first quarter showed steady oil and gas activity, political and regulatory hurdles – most notably the administration’s recent pause on U.S. liquified natural gas (LNG) exports exports – have created widespread worry amongst exploration and production (E&P) firms.

The recent Dallas Fed Energy Survey, conducted between March 13 and March 21 and representing 147 energy firms from E&P and oilfield services, provided insights into the current state of the space, with many raising the alarm about increasing “uncertainty,” administration “virtue signaling,” and energy policies that “hamper growth.”

Oil and Gas Production Remain at Record Levels

The new survey showed that across the board, oil and gas activity remained fairly close to the results of the previous 2023 fourth quarter survey. Oil and gas production decreased in the first quarter with oil falling from 5.3 to -4.1 on the business activity index from 2023’s fourth quarter and gas falling from 17.9 to -17.0. Despite these decreases, U.S. production levels remain impressive as the United States continues to produce oil and gas at record breaking amounts.

Export Pause Brings Wariness

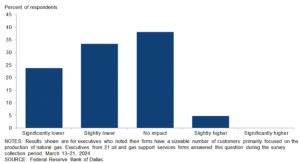

In addition to data on oil and gas activity, the Dallas Fed questioned survey participants on recent policy developments including the Biden administration’s pause on LNG exports. Over 70 percent of gas firms surveyed say that the indefinite pause will cause production to be lower in five years:

“Among executives who indicated their firms are primarily focused on the production of natural gas, slightly under half—48 percent—expect their firms’ natural gas production five years from now to be slightly lower than their expectations before the pause. Twenty-four percent said significantly lower.”

But even more telling is the quotes pulled from the survey respondents, with a large number of E&P executives emphasizing the need for the administration to reverse course:

“Our no-impact answer to the LNG pause question assumes that the pause is lifted within the next year. With a longer pause or a future ban, we would expect a negative impact to U.S. natural gas pricing.” (emphasis added)

This comment is especially notable as pause supporters argue that a ban is needed to secure domestic energy prices, something EID and experts have repeatedly highlighted as untrue.

Survey respondents also echoed that the LNG pause with harm the U.S. economy:

“The signal sent to our international LNG customers was not good. Other suppliers will fill the void, which will permanently increase the U.S. trade deficit and ultimately harm our economy.”

Executives also expressed their frustration at the political motivations behind the pause saying:

“Continued ignorance and pandering by the administration. Using an influencer to highlight a positive climate impact from stopping LNG exports (sorry, pausing) will call the stability of our supply into question while causing the displacement of cleaner natural gas with less clean coal.”

Methane

In addition, the surveyors asked participants about what they feel will be the impacts of the Environmental Protection Agency’s (EPA) recently proposed methane charge; a new fee that will be placed on “wasteful methane emissions” from the oil and gas sector. The survey showed:

“The most-selected response among E&P firms was “slightly negative,” chosen by 46 percent of respondents. Another 34 percent selected “significantly negative,” while 19 percent selected “neutral,” and 1 percent expect a positive impact.”

Industry and business groups, such as the Independent Petroleum Association of America (IPAA), have highlighted that the methane tax will disproportionately impact small producers, a sentiment which was echoed by survey respondents:

“The strength of the market has increased, but the methane detection enforcement procedures for small producers is a looming crisis.” (emphasis added)

Similarly, other respondents highlighted how policies like these hamper additional growth for the industry:

“LNG, Bureau of Land Management leasing delays, additional permitting costs, time required and many other policies from Washington and certain governors are hampering growth and collectively are comprehensively debasing the industry.”

“Washington continues to pick business winners and losers, and this practice hampers cooperation and fairness across all sectors. The open denigration and policy blocking of hydrocarbons, a vital part of energy, needs to stop. Soundbites to undermine an entire industry that is critical to our country’s standing in the world do no one any good.” (emphasis added)

Bipartisan Political Uncertainty Plagues Stakeholders

Geopolitical uncertainty and the tense domestic political atmosphere were also large topics mentioned by respondents:

“The volatility in geopolitical risk is more concerning than a year ago. Domestic political uncertainty has increased — no confidence in either party to lead.”

“We are once again entering an unnecessary period of uncertainty due to inept energy policies.”

“Until the next administration is decided, we’re in a state of flux when it comes to making certain business decisions.”

Bottom Line: The oil and gas industry continues to produce at record levels, but there is widespread consensus that burdensome regulations and illogical energy policies hinder growth, stifle U.S. domestic energy production, and threaten energy security. As one executive put it:

“The administration needs to reverse course and show support for American energy while working on common sense solutions that continue the efforts to make production and use of these vital resources as clean as practically possible. Our modern society simply cannot function without the use of fossil fuels. The decision to invest the immense amount of capital needed to provide these vital resources cannot be made if the current level of uncertainty isn’t changed.”

The post Oil and Gas Maintain Production Levels; LNG Pause and Regulatory Threats Loom appeared first on .