bjdlzx

The ink is not even dry on the driftwood acquisition when Vital Energy (NYSE:VTLE) made another acquisition. Management is once again proving market fears wrong that the company would run out of competitive drilling sites before another acquisition becomes available.

There is still the possibility that the legacy acreage will become competitive as North America increases the ability to export natural gas. At that point the gas prices in North America would join the far stronger world market which would favorably impact the legacy acreage.

But in the meantime, management is definitely not waiting for that possibility. Instead, they are looking for and finding accretive deals now that the price of oil has backtracked from the levels of fiscal year 2022. Since there are a fair number of opinions that liquids prices and natural gas prices should head upwards in the future (at least by sometime in 2024), this appears to be a good deal. Furthermore, management can hedge the acquisition if there are not hedges already in place to protect cash flow.

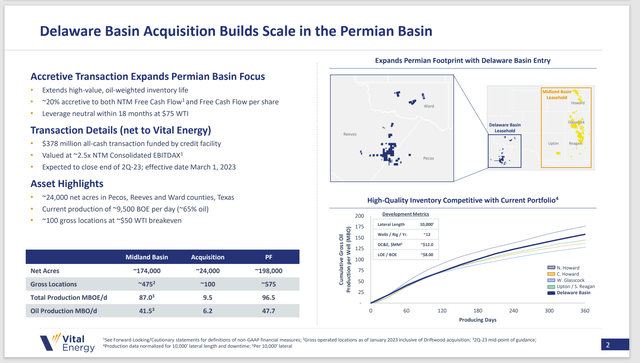

Now management did mention that the deal price was about 2.5 times EBITDAX for the new acquisition. That implies an EBITDAX of about $151.2 million. Given the expenses of the company and some preliminary projections for the acreage made by management, that should be plenty of money to run the one rig planned on by management while allowing plenty of cash “to fall to the bottom line”. That low multiple for the sales price also appears to have a roughly 20% “just in case” oil price variance built in that should prove sufficient.

Vital Energy Summary Of Latest Acquisition (Vital Energy Delaware Basin Acquisition)

My personal opinion is that those locations are going to be profitable at far lower prices than the WTI $50 reported by management. I think that is very conservative to say the least. Reeves County represents some of the best acreage in the business. It does not go to “average” just because Vital purchased it. Even the acreage in the other counties is darn good in that area.

But management can and is likely using some very conservative methodology to back up the purchase using all cash. The potential financial risk needs to be “covered” with some very conservative operating risk assumptions.

Now management is talking about operating one rig to maintain production after the previous operator used two rigs. That could well work out. However, the first-year decline rate is likely to be steep the first year after acquisition because the previous operator likely maximized production for a good price. Going to one rig should lower that first year decline due to lessor activity. Then the one rig strategy may well allow for some future growth. An additional upside to the scenario is advancing technology and any improvements management can make after acquisition with superior (current) operating practices.

This is kind of a “treadmill” strategy in that the name of the game is to be conservative enough that free cash flow increases faster that debt service needs. So far, management has included stock in most deals to keep leverage down. As far as deals go, this is a relatively small deal. So, the leverage risk is probably not that great. Any perception of risk increase can easily be corrected in the next deal by using more stock or by publicly offering stock along with a deal that is all cash. Right now, it appears that management knows what it is doing.

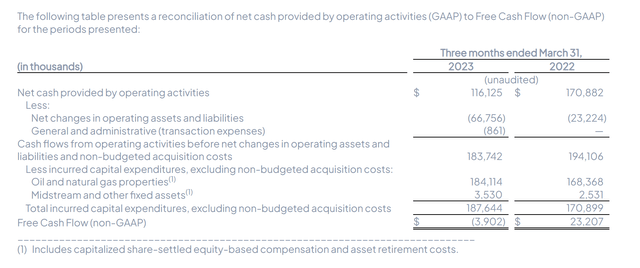

Vital Energy Free Cash Flow Calculation (Vital Energy First Quarter 2023, Earnings Press Release)

Probably the most important measure is the cash flow from operating activities before changes in working capital accounts. Despite the sizable decline in commodity prices, this company made darn good headway in maintaining cash flow. That is exactly what a hedging program is supposed to do.

On the other hand, non-cash working capital accounts did use roughly $67 million in cash. So there really was only $116 million in “free cash” to spend on anything in the first quarter. That is one of the weaknesses of the free cash flow calculation (it does not necessarily calculate free cash flow despite the description).

Now admittedly, the change in working capital is likely to be a timing issue that will “bounce back” unless commodity prices climb so much as to require a change in the working capital outlook.

The other thing is that management stated that capital expenditures were moved into the first quarter for the reasons noted in the press release. That is yet another timing difference that accounts for the negative free cash flow.

This management, as is the case with many managements, really does not spend generated cash flow on acquisitions. Instead, the management uses a mixture of stock and debt to keep the financial leverage within reason. So, in the eyes of management, spending generated cash and regular business expenses in general, is a “closed system” requiring discipline whereas acquisitions represent their own closed system with different justifications.

Now the end result of this should be climbing cash flow, as more profitable wells replace declining legacy production because the percentage of oil (and more profitable production in general) is climbing while gassier (and less profitable production in general) is declining. Ideally this happens even though overall production remains steady. This process should also decrease the overall corporate breakeven.

Key Idea

This management intends to accelerate the increasing cash flow process through a conservative strategy of accretive acquisitions that use stock as needed to keep the financial leverage risk improving.

The market has long worried about the old management strategy. But the market will also worry about management’s ability to run the newly constituted company with “all these acquisitions”. In some ways that is a bit much because there is history running several of the acquisitions for a couple of years which is long enough. However, there is no telling with Mr. Market about when “enough” gets met.

The other market worry is the debt and debt ratio. Now this management already has a debt upgrade since it took over some years back. Obviously, the idea is to get more debt upgrades as they influence the stock price quite a bit in the current market. Management intends to continue to increase cash flow by first developing the most profitable locations and also by acquiring profitable properties. That should result in a fast transformation. As long as management sticks with what it knows, then the chances of failure for this strategy are slim.