Trade tensions continue to escalate, making it nearly impossible for markets to find a bottom even after the recent slump. A 104% U.S. tariff on goods from China took effect Wednesday at midnight. China then announced a retaliatory 84% duty on American products , sending futures tumbling. Dow Jones Industrial Average futures were down more than 800 points at one point, while S & P 500 and Nasdaq-100 futures shed 0.6% and 0.3%, respectively. The latest moves come after a sharp rebound in equities Tuesday fizzled. The S & P 500 briefly rose as much as 4% in the previous session before ending the day down more than 1%. Bonds, traditionally seen as an alternative to riskier stocks when volatility grows, haven’t fared much better — confounding investors. The yield on the benchmark 10-year Treasury note soared 17 basis points to trade above 4.4% and briefly spiked above 4.5% for the first time since Feb. 20. The 30-year Treasury bond yield also hit highs not seen since November 2023. U.S. crude oil futures fell more than 6% on Wednesday, sending the U.S. benchmark down $4.01 per barrel, or 6.7%, to $55.57 in early morning trading. US10Y 5D mountain 10-year Treasury note yield in past 5 days “There’s no sign yet that the market is managing to successfully find a bottom, and it feels like no asset class has been spared as investors continue to price in a growing probability of a U.S. recession,” wrote Deutsche Bank macro strategist Henry Allen. JPMorgan Chase CEO Jamie Dimon voiced recession concerns as well on Wednesday, noting that an economic contraction is the “likely outcome” from the current tariff turmoil. “When you see a 2000-point decline [in the Dow Jones Industrial Average], it sort of feeds on itself,” the head of the nation’s largest bank said . “It makes you feel like you’re losing money in your 401(k), you’re losing money in your pension. You’ve got to cut back.” Victoria Green, founding partner of G Squared Private Wealth, pointed to Walmart as a potential safe haven stock in the midst of the tariff tumult. But even the country’s largest retailer on Wednesday scrapped its quarterly operating income outlook because of rising duties on imported goods. Elsewhere Wednesday morning on Wall Street, Bernstein downgraded Ford Motor to underperform from market perform, citing tariff fears. “It is time to confront some hard truths, once more: vehicle tariffs have commenced, and parts tariffs are likely to follow within a month. We … find significant downside not priced by the market yet,” the firm said in a note. “As tariff pressures intensify and consumer sentiment weakens, we expect Ford’s shares to remain under pressure.” Get Your Ticket to Pro LIVE Join us at the New York Stock Exchange! Uncertain markets? Gain an edge with CNBC Pro LIVE , an exclusive, inaugural event at the historic New York Stock Exchange. In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12. Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles, and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!

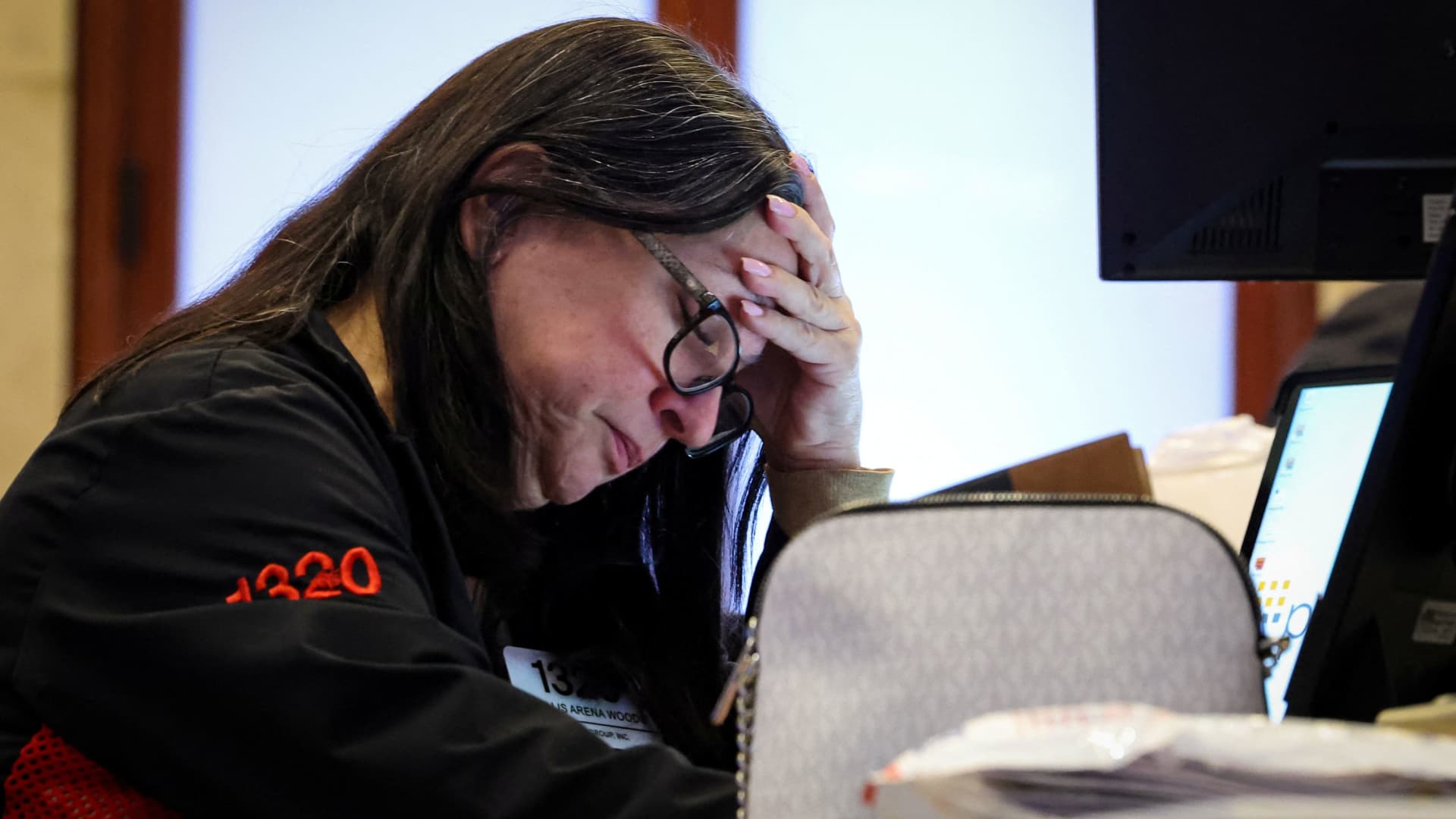

Finding a bottom in the stock, bond and oil markets is even tougher now