WANAN YOSSINGKUM/iStock via Getty Images

By Coco Zhang, ESG Research and Padhraic Garvey, CFA, Regional Head of Research, Americas

This year has been one of change for the global sustainable finance market. After several years of rapid growth fueled by the first waves of net-zero announcements and Covid-related sustainability financing, the market was disrupted in 2022 on the back of geopolitical tensions, uncertain economic outlooks, and higher financing costs. From that re-basing, 2023 has been a testing year for sustainable finance, partly due to caution from regional anti-ESG movements and greater Environmental, Social, and Governance scrutiny. Ahead we expect investors to continue to demand higher-quality issuance, with policies mandating sustainability data disclosure serving as an important tool to benchmark against. Despite these headwinds, issuance volumes through 2023 have been decent, and there have in fact been some quite dramatic changes within the breakdown.

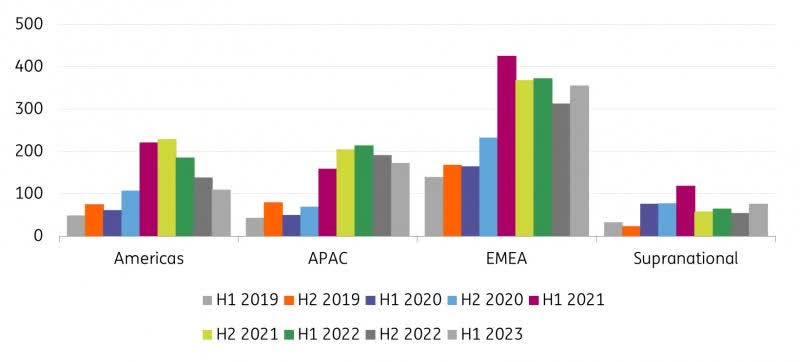

Global issuance volume of 2023 possibly to exceed that of 2022

Global sustainable finance product issuance totaled $717bn in the first half of 2023. Although this volume registered a 7% year-on-year decrease, it is higher than the second half of 2022 and the whole year’s volume for 2023 still has the potential to exceed 2022’s volume. The cautious optimism is caused by multiple factors. A higher ESG data disclosure outlook can create a more easily workable environment for issuance, clean energy policies such as the US Inflation Reduction Act can continue to spur sustainability efforts, increasingly extreme weather events could motivate issuers to finance long-term climate mitigation, and sustained government efforts can increase the issuance of sovereign ESG debt.

Global issuance of sustainable finance products

Volume in $bn

Bloomberg New Energy Finance, ING Research

Note: The 2023 number is from January-June.

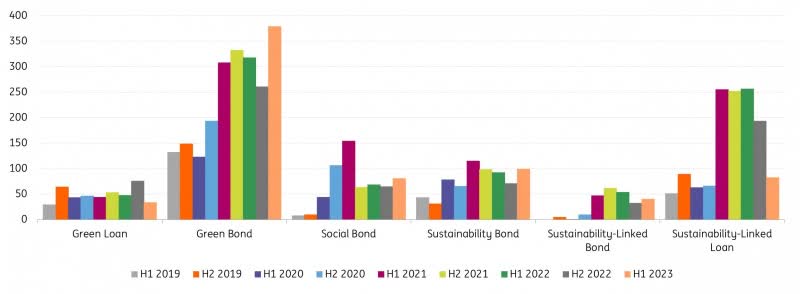

EMEA remains the most resilient while Americas face headwinds

We are seeing some regional differences in terms of volume growth. The region of Europe, Middle East, and Africa (EMEA) has been the most resilient market, with issuance in the first half of 2023 recovering from the second half of 2022, back to a level comparable to the first half of 2022 and the second half of 2021. This is largely driven by a consistently developing sustainable finance policy environment in Europe (more on this below).

The Americas, in contrast, experienced a 21% decrease in issuance in the first half of 2023 compared to the second half of 2022, an extension of consecutive half-year drops since the second half of 2021. While likely not a determinative factor, the backdrop of anti-ESG voices has introduced disruption, uncertainty, and risks for both investors and issuers. There has in consequence been, understandably, an extra layer of questioning when it comes to issuing sustainable finance products.

One ongoing positive underpinning for the US is the Inflation Reduction Act (IRA). With $370 billion planned on energy security and climate change, the IRA has shaken up the clean energy space in the US. The tax credits under the IRA are expected to support not only relatively more established technologies such as wind, solar, electric vehicles, and nuclear but also emerging technologies such as hydrogen and CCS. Meanwhile, there is also significant direct funding available through government agencies in grants (c.$82bn) and loans (c.$40bn). Such funding will be crucial in readying the technologies for private investment and widespread adoption.

The Asia Pacific (APAC) region has also seen a decline in the first half of 2023 compared to the previous half. Such a drop might have stemmed from a more cautious global market generally, but there can still be hope for APAC to catch up on issuance in the second half of 2023. Green products are looking to be a key growth force for the APAC market with a considerable need to finance decarbonisation as well as government support for clean energy adoption.

Global sustainable finance issuance by region

Volume in $bn

Bloomberg New Energy Finance, ING Research

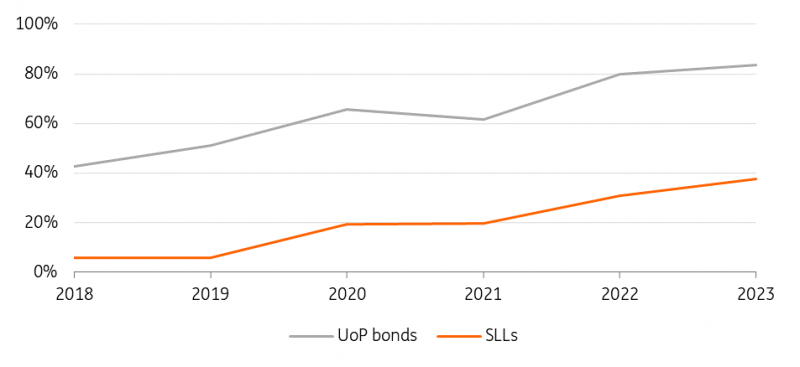

Green bonds have been the driving force for growth

Of particular note, the use of proceed bonds (or UoP bonds, which include green, social, and sustainability bonds) is seeing exceptional growth this year. During the first half of 2023, the use of proceed bond issuance – especially green bond issuance – beat the records set in the second half of 2021. There has been mounting awareness that companies need to carefully avoid greenwashing behavior, and the use of proceed bonds are gaining ground because the financing is directly tied to specific green or social projects under an issuer’s sustainable finance framework. For green bonds specifically, strong policy support across regions for energy transition technologies will provide an extra boost for issuance.

Global sustainable finance issuance by product

Volume in $bn

Bloomberg New Energy Finance, ING Research

While green bonds have been holding strong, we are seeing issuers become more cautious with sustainability-linked products, especially sustainability-linked loans (SLLs). In the first half of 2023, SLL issuance dropped by 57% compared to the second half of 2022. The drop is partly a result of fewer large-size SLL deals. In 2022, there were 11 SLLs of at least $4bn, while in the first half of 2023, there was only one. Indeed, the drop in the first half comes to 63% when compared to the average of first-half and second-half issuance in 2022, while the decrease in the number of deals was slightly lower, at 59%, for the same period. In APAC, specifically, a substantial decline in the number of SLL deals is led by China and Australia, the two largest countries by volume issued. In China, one transaction in the first half of 2022 of $4.5bn accounted for 25% of the total first-half SLL volume.

An interesting nuance is that there has also been a trend of smaller issuance volumes. Globally, the share of SLL deals of less than $0.05bn has gone up from 8.1% in the first half of 2019 to 28% in the first half of 2023. And the size of an issuing company is also trending smaller. In the Americas, the average revenue of corporate SLL issuers decreased in the second half of 2022 and first half of 2023 to $2.5bn and $3bn respectively, compared to an average size of $4.9bn in the second half of 2021 and first half of 2022, when issuance volume of SLLs was at a much higher level. Both of these seem to indicate that SLLs are gaining ground among smaller companies after the initial wave of adoption among large corporates.

We have also observed that for both SLLs and the use of proceed bonds, there is strong product stickiness with repeat issuances as a percentage of total issuances growing over the past few years. This could partly be due to the potential negative perception regarding an issuer’s ESG ambitions from going back to vanilla financings. There is also a marked difference with UoP bond deals made up almost entirely by repeat issuers whereas new issuers make up the majority of SLLs. For many issuers, SLLs are the first step in engaging in sustainable finance as the companies develop their ESG capex plans to benchmarkable size sufficient for UoP issuances.

Share of repeat issuances from a company as a percentage of total market issuances of the same product type

Share of repeat issuances from a company as a percentage of total market issuances of the same product type

Sustainability-linked products will likely remain a useful tool for the future, but their growth will have to be accompanied by a general increase in company interim sustainability target setting, as well as more rigorous sustainability data reporting.

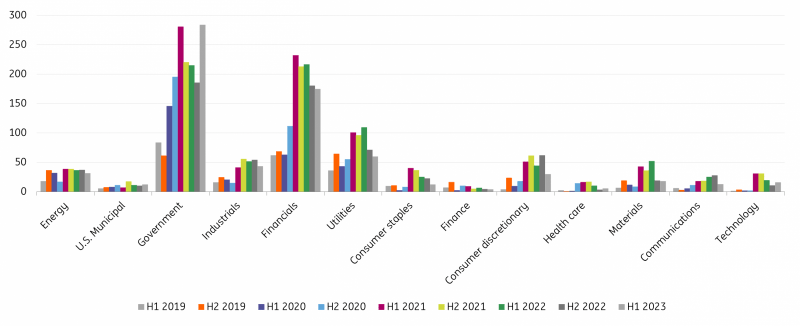

Stronger government issuance growth, but corporate ESG bond shows resilience

There is also a stark difference in issuance between the public and private sectors. The growth in the first half of 2023 is almost exclusively coming from governments, whereas all analysed sectors but the technology and healthcare sectors saw drops in the first half of 2023 compared to the second half of 2022.

Global sustainable finance issuance by sector

Volume in $bn

Bloomberg New Energy Finance, ING Research

Nevertheless, despite the large role of government entities in supporting sustainable finance market growth, for ESG bonds only, corporate issuance is still showing resilience when compared with the broader bond market. Excluding sovereign, supranational, and agencies (SSAs), the share of ESG bond issuance as a percentage of total bond issuance slid slightly from 2022’s record of 10.6% to 10% for the first six months of 2023. It’s probable that this percentage can still increase for the rest of the year.

In terms of product type within different sectors, there has been a major shift in product preference towards UoP instruments as discussed earlier. This change is seen across all regions and across almost all industries, including the energy, consumer discretionary, utilities, and technology sectors we analysed below, except for industrials and healthcare, for which there are rather limited options for the use of proceeds financings at this point.

For green bonds, issuance has either been sustained at a somewhat flat level or increased in the energy, consumer discretionary, and utilities sectors, while it registered a decline in the technology sector. The direction of travel in green loan issuance is more mixed, with the energy and technology sectors seeing an increase and the consumer discretionary and utilities sectors experiencing a decrease. All this has in general resulted in green products taking up a larger share of these sectors’ issuance volumes.

Issuance of sustainable finance products in selected sectors

Volume in $bn

Bloomberg New Energy Finance, ING Research

Only around a quarter of S&P 500 companies have issued one or more sustainable finance products. S&P 500 companies in the Energy and Healthcare sectors have the lowest sustainable finance adoption rate, at 9%, whereas companies in the Utilities sector have the highest, at 83% followed by the Real Estate sector, at 65%. Hard-to-abate sectors, such as Energy, Material, and Industrials, have relatively low adoption rates. This demonstrates the dual challenge for hard-to-abate sectors: effectively lowering emissions and showcasing the credibility of their sustainable finance products.

Policy is still pointing at greater disclosure transparency and standardisation despite turbulence

As mentioned above, transparent and standardised sustainability reporting is essential in assuring the credibility of an issuer’s ESG products, helping to boost investor confidence and to drive the healthy growth of the global sustainable finance market. Policies and initiatives need to play a role here, and we are seeing more efforts ramped up in this area.

In late June, the International Financial Reporting Standards Foundation’s International Sustainability Standards Board (ISSB) launched its sustainability and climate disclosure standards. The ISSB signals an important convergence of different reporting standards and frameworks such as the Taskforce on Climate-related Financial Disclosure (TCFD), offering companies an overarching framework. Already having support from G7 and G20 countries, the ISSB is expecting wide adoption over time.

The EU has a relatively more unified ESG policy environment, where disclosure requirements (Corporate Sustainability Reporting Directive, or CSRD), the sustainable activity classification system (Taxonomy), and the Green Bond Standard reinforce each other. Admittedly, complying with all the regulatory requirements can meet difficulties around necessary data and interpretation. And many of the bloc’s policies are still evolving, with the newly adopted European Sustainability Reporting Standards (ESRS) introducing more flexibility around ESG materiality and Scope 3 emissions disclosure. Still, the EU’s more established and complex ESG system can support smoother growth in sustainable finance issuance.

In the US, although more than 30 states have passed or proposed anti-ESG investment bills, the Securities and Exchange Commission (SEC) is slowly advancing in mandating climate-related disclosure and aims to release the final proposed rules this October. The final rules will likely allow more flexibility – for instance, Scope 3 emissions data may no longer be required. Even if less strict relative to original plans, these rules will be revolutionary for the US market, facilitating a large step closer to European and other peers.

In Asia, several economies already have their own guidelines and taxonomies, such as Japan’s green, social, and climate transition finance guidelines, China’s Green Bond Principles, South Korea’s Korea Green Taxonomy, etc. Yet Asia is more of a follower rather than a trendsetter, and several jurisdictions have adopted the EU’s system or the widely accepted international frameworks. The ISSB is likely to have a considerable impact on APAC – Singapore, for instance, has already proposed ISSB-aligned disclosure from listed companies starting in 2025. Nevertheless, we would expect more lenient local specifications in policy setting. For example, the Association of Southeast Asian Nations’ (ASEAN’s) taxonomy considers certain types of coal phase-out activities to be aligned.

What does this mean for investors and issuers?

Quality issuance is the best strategy against uncertainty. As the sustainable finance market moves from the initial period of rapid growth to a maturing phase with more ESG disclosure mandates and scrutiny, it has become important for issuers to navigate through greenwashing risks by actively leveling up their sustainability credibility. Investors have started to and will increasingly favor quality issuers with ambitious long-term ESG targets, clear interim targets, rigorous progress reporting, as well as detailed disclosure of capital allocation from their sustainable finance products.

Environmental, Social, and Governance aspects will all progress, but the urgency to reduce emissions and mitigate climate risks will remain a strong source of demand for sustainable financing. This can help promote innovation and facilitate the commercialization of nascent decarbonization technologies.

We are in an era of adjustment and normalisation, but sustainable finance remains a crucial tool to provide financial support for sustainable activities. Therefore, we do see the market continuing to grow in the future.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.