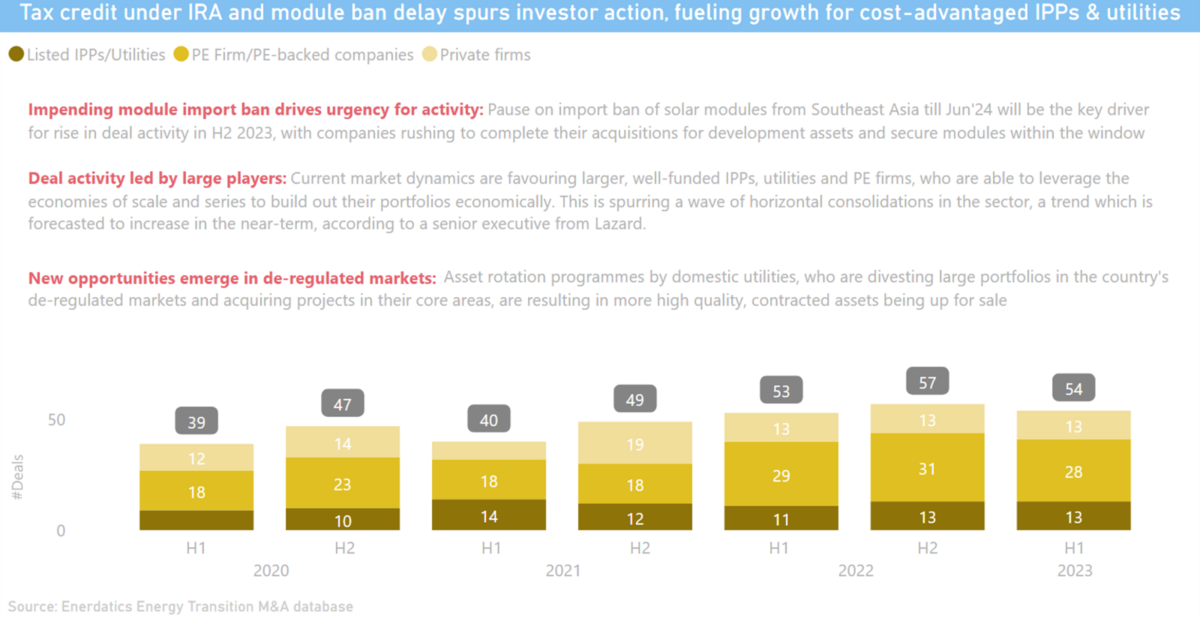

Tax credit under IRA and module ban delay spurs investor action, fueling growth for cost-advantaged IPPs & utilities.

Impending module import ban drives urgency for activity: Pause on import ban of solar modules from Southeast Asia till Jun’24 will be the key driver for rise in deal activity in H2 2023, with companies rushing to complete their acquisitions for development assets and secure modules within the window.

Deal activity led by large players: Current market dynamics are favoring larger, well-funded IPPs, utilities and PE firms, who are able to leverage the economies of scale and series to build out their portfolios economically. This is spurring a wave of horizontal consolidations in the sector, a trend which is forecasted to increase in the near-term, according to a senior executive from Lazard.

New opportunities emerge in de-regulated markets: Asset rotation programmes by domestic utilities, who are divesting large portfolios in the country’s de-regulated markets and acquiring projects in their core areas, are resulting in more high quality, contracted assets being up for sale.