pidjoe

Renewable energy has become a very popular investment theme in recent years due to the rapid rise of the ESG investing movement and the mass adoption of the goal to move the world towards a zero-carbon footprint. While this goal may not be realistically achievable for many decades – if ever – and even the merits of the goal itself remain debatable, the fact of the matter is that there is very likely going to be trillions of dollars invested in renewable energy production in the coming decade and beyond. As a result, quality renewable power production companies have a very robust growth runway and could potentially deliver attractive returns to shareholders.

While the valuations of these stocks became bloated in the wake of the Democrats’ sweeping victories in the 2020 U.S. elections, alongside historically low interest rates making the cost of capital for investing in these projects extremely cheap, reality has since come crashing down. Soaring inflation forced interest rates to move higher at a rapid pace, pushing the cost of capital significantly higher for growth-oriented renewable energy companies. As a result, their stock prices have plummeted.

In this article, we will look at two of these companies – Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE:HASI) and NextEra Energy Partners, LP (NYSE:NEP) – and share our view on which is the more attractive buy at the moment.

HASI Stock Vs. NEP Stock: Business Model

Structured as a real estate investment trust, or REIT, HASI is essentially a business development company (“BDC,” BIZD) and mortgage REIT (MORT) hybrid that focuses on the renewable energy sector.

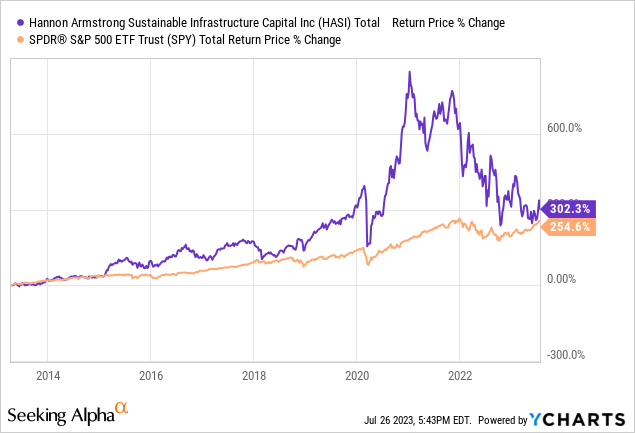

Despite paying out a generous dividend to shareholders, HASI has managed to grow its distributable earnings per share at an 11% CAGR through 2022, leading to total return outperformance even after including its recent steep selloff:

HASI invests across a number of businesses and asset classes in the renewable energy sector, with over 320 total investments. Its cash flows have a lengthy lifespan with an 18-year weighted average life on its current investments, and its $3.7 billion investment portfolio is invested across tax equity, senior debt, subordinated debt, structured equity, and common equity, with the vast majority of its capital being deployed in preferred equity and senior debt.

NEP, meanwhile, is pretty much exclusively an owner and operator of renewable power generation assets, particularly wind and solar. It owns over 7,500 MW of wind power assets, over 1,500 MW of solar power assets, and nearly 250 MW of paired storage assets. While it also owns nearly 4.5 Bcf of total natural gas pipeline capacity, NEP is actively shopping some of these and expects to sell a large amount of its pipeline capacity by the end of 2023, with the remainder of its pipeline assets likely to be sold in the near future as well.

Both businesses enjoy very robust growth pipelines and feel confident in their ability to source plenty of accretive investments for years to come that will deliver attractive risk-adjusted returns on investments for shareholders.

Overall, we do not see one business model as being necessarily better than the other. While HASI’s focus on debt and preferred equity gives it an element of reduced risk, NEP’s active approach to managing and optimizing its own portfolio, large scale, and operating competitive advantages (demonstrated superior performance in repowering, proprietary data analytics for development optimization, dropdowns from Energy Resources, and support from its parent NextEra Energy (NEE)) help to mitigate some of its higher risk that comes from being an asset owner rather than a lender/preferred equity investor.

HASI Stock Vs. NEP Stock: Balance Sheet

Both businesses lack investment grade credit ratings, though both still have solid balance sheets. HASI has plenty of liquidity (~$490 million of cash and undrawn revolver capacity), has limited exposure to floating interest rates, and has demonstrated an ability to raise capital from a diverse set of sources. With a BB+ credit rating, it has access to reasonably attractively priced capital.

NEP, meanwhile, enjoys support from its A-rated parent NEE and has a fairly flexible balance sheet in its own right. While there were considerably concerns about how it would navigate its upcoming convertible equity portfolio financings without diluting shareholders, NEP recently released a balance sheet and corporate simplification plan that takes care of these.

Management plans to do the following:

- Fully fund all convertible equity portfolio financings through 2025 by selling NEP’s pipeline assets.

- Use excess proceeds from the pipeline sales to eliminate new equity issuance needs through 2024.

- Suspend IDRs to NEE through 2026 in order to offset the cash flow lost from the pipeline sales.

Management also continues to entertain significant interest from institutional investors to potentially sell structured equity stakes in some of their growth projects to further accelerate their growth rate while minimizing their own common equity investment needs.

While this plan hinges on the successful sale of their pipeline assets, management recently emphasized that this process is progressing well, stating on the Q2 earnings call:

in May, we launched the sales process for the Texas natural gas pipeline portfolio and are pleased with our progress as we remain on track to sell the assets by later this year… the Texas pipelines provide 25% of the natural gas supply to Mexico through contracts with PEMEX and the other pipeline assets that support the Texas pipeline are fully integrated with that pipe… And if you look around that area, these are very, very strategic for a number of players… we remain pleased with the progress that we continue to make on the sales transaction.

HASI Stock Vs. NEP Stock: Dividend

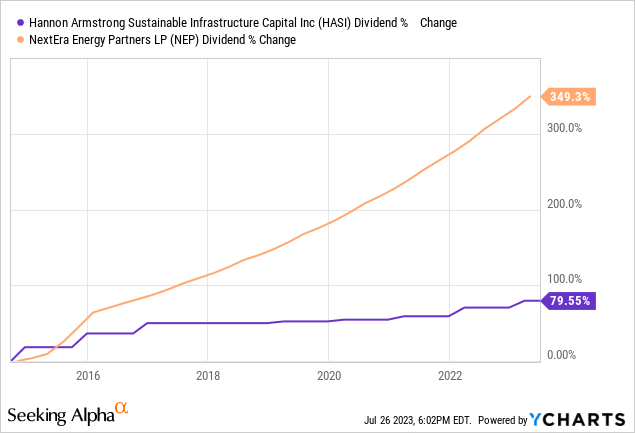

Both HASI and NEP have grown their dividends at strong clips since going public, though NEP has clearly grown theirs at a much faster pace:

Moving forward, HASI thinks that they can grow their dividend at a 5-8% CAGR while NEP is guiding for a ~12% dividend CAGR.

The difference in expected growth rates stems from three factors:

- HASI is planning to grow its distributable EPS at a faster pace than its dividend per share as it is trying to retain more capital to take advantage of its robust growth pipeline. In contrast, NEP plans to grow its dividend roughly in-line with its CAFD per unit growth rate moving forward.

- HASI is primarily a debt and preferred equity investors whereas NEP is primarily an equity investor. NEP’s higher returns on invested capital and the organic growth that come from being an equity investor enable it to grow faster.

- NEP has more levers to pull to raise capital to fuel its growth pipeline than HASI does given the support it is receiving from its parent (i.e., NEE waiving its IDRs) and its ability to sell structured equity stakes in some of its projects to institutional investors.

While NEP clearly wins this comparison, both businesses have attractive dividend growth profiles.

HASI Stock Vs. NEP Stock: Valuation

When it comes to valuation, NEP wins once again. Its 6.5% NTM dividend yield is higher than HASI’s 6.0% NTM dividend yield, their P/AFFO multiples are virtually identical, and NEP’s expected growth rate is meaningfully higher than HASI’s. As a result, it appears that NEP is positioned to deliver higher total returns than HASI is.

HASI Stock Vs. NEP Stock: Investor Takeaway

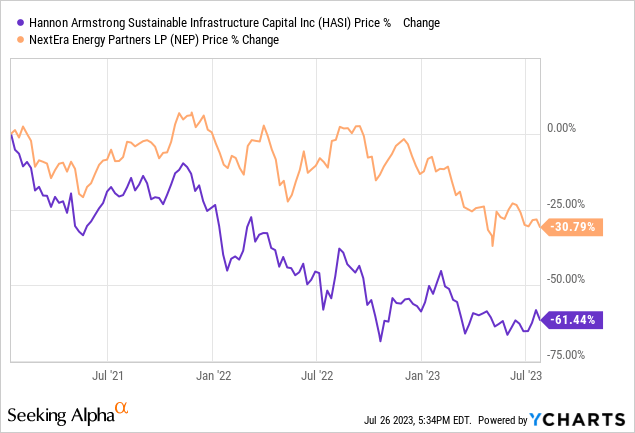

Both HASI and NEP have impressive track records of growing dividends for shareholders. However, both have also seen their stock prices crash down to earth since the jubilant days of early 2021:

While HASI has seen its stock price collapse at twice the rate of NEP’s over that period, NEP appears to be the better buy at the moment given its stronger growth profile. That said, both appear to be attractive buys at the moment. We are buying high yielding, high growth renewable power businesses like NEP and several others right now. We expect the long-term growth tailwind to drive sustained attractive dividend growth for years to come, making the current sell-off a very attractive opportunity to lock in high current yields as well. High yielding stocks that are also growing rapidly is a very rare combination, and we believe that Mr. Market is currently giving investors a golden opportunity.