Mananya Kaewthawee/iStock via Getty Images

On July 27, before the market opened, Bristol-Myers Squibb (NYSE:BMY) released its Q2 2023 financial results, which, while failing to beat analysts’ expectations, were able to demonstrate that demand for Yervoy, Opdualag, and Breyanzi is growing faster than many on Wall Street expected. On the other hand, sales of mega-blockbusters such as Eliquis and Opdivo showed a quarter-on-quarter decline, making investors nervous as their exclusivity ends in five years.

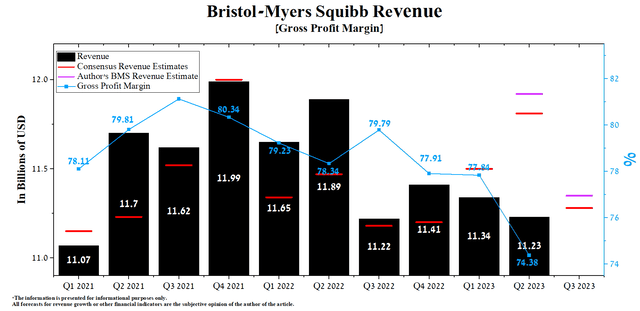

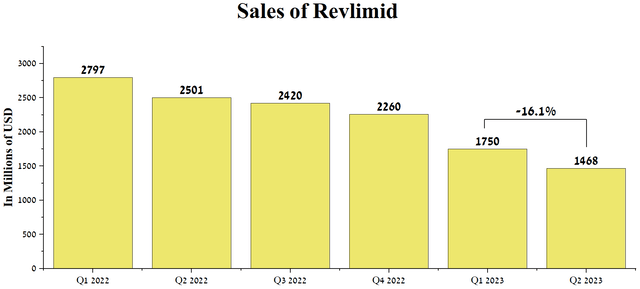

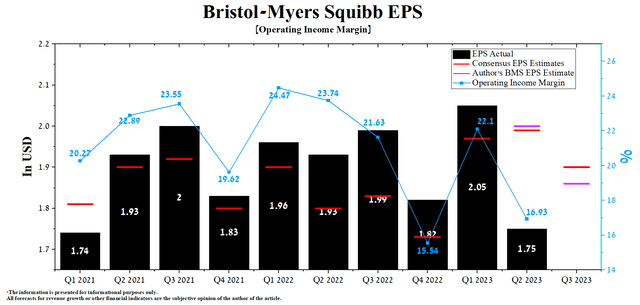

Bristol-Myers Squibb’s revenue was about $11.23 billion, $0.69 billion below our expectations. The company’s non-GAAP net earnings were $3.7 billion or $1.75 per share, which is $0.25 less than we previously forecasted. This was mainly due to the higher rate of decline in sales of Revlimid. The company’s blockbuster sales were $1,468 million, down 41.3% year-over-year as more generics hit the market and lower net selling prices in Europe. As a result, traders and investors negatively assessed the company’s financial report, which was reflected in the fall of its price by 4.2% over the past two days.

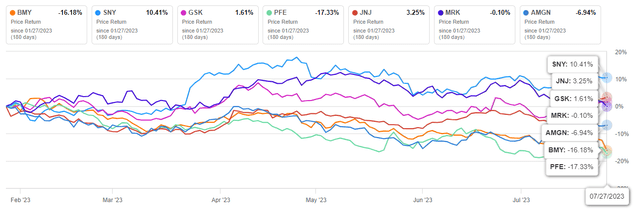

Over the past six months, Bristol-Myers Squibb’s share price has declined by more than 16%, despite the publication of positive clinical trial results and numerous medicine approvals. But at the same time, such leaders of the global cardiovascular and oncology drugs market as Johnson & Johnson (JNJ), GSK (GSK), and Merck (MRK) pleased investors much more over the same period.

Author’s elaboration, based on Seeking Alpha

We continue our analytics coverage of Bristol-Myers Squibb with an “outperform” rating for the next 12 months.

Bristol-Myers Squibb’s Q2 2023 financial results and outlook for the 2H 2023

Bristol-Myers Squibb’s revenue for the second quarter of 2023 was $11.23 billion, down 0.97% from the previous quarter and 5.6% from the second quarter of 2022.

Author’s elaboration, based on Seeking Alpha (Author’s elaboration, based on Seeking Alpha)

The key reasons for the company’s quarterly decline in revenue are increased competition with generic versions of Revlimid (lenalidomide) and an increase in the number of patients receiving this drug from the Bristol Myers Squibb Patient Assistance Foundation in the United States. On a quarterly basis, sales of BMS’s blockbuster were down 16.1% more than we assumed in our model.

Author’s elaboration, based on quarterly securities reports

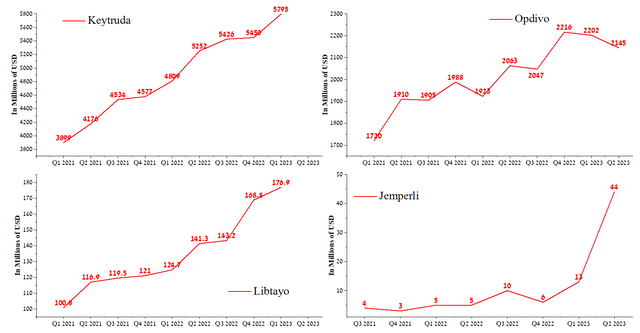

Another medicine whose sales surprised us negatively is Opdivo (nivolumab), whose mechanism of action is based on blocking the PD-1 pathway. Sales of this monoclonal antibody were $2,145 million in Q2 2023, up 4% year-on-year but down 2.6% quarter-on-quarter. The year-on-year increase in sales was driven by its label expansion in the US and Europe and higher demand for it in the treatment of patients with bladder cancer and stomach cancer. At the same time, sales of GSK’s Jemperli amounted to $44 million in the 2nd quarter of 2023, an increase of 238.5% compared to the previous quarter.

Author’s elaboration, based on quarterly securities reports

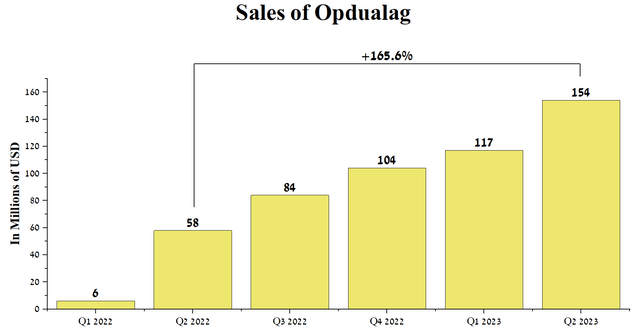

According to Seeking Alpha, Bristol-Myers Squibb’s Q3 2023 revenue is expected to be $10.8-$11.92 billion, down 4.5% from analysts’ expectations for Q2 2023. At the same time, under our model, Bristol-Myers Squibb’s total revenue will be above the median value of this range and will amount to $11.35 billion. This will primarily be due to the continued high demand for innovative medicines such as Yervoy (ipilimumab) and Opdualag (nivolumab and relatlimab-rmbw). Sales of Opdualag, an FDA-approved drug for treating patients with unresectable or metastatic melanoma, totaled $154 million in Q2 2023, up 165.6% from Q2 2022. But what is more remarkable, this medicine was launched only in March 2022. Since then, its high sales rates have been maintained due to the high efficiency demonstrated in numerous clinical trials.

Author’s elaboration, based on quarterly securities reports

Bristol-Myers Squibb’s earnings per share (EPS) for the second quarter of 2023 was $1.75, down 9.3% from the previous year. As a result of its decline and negative trends in sales of certain cancer drugs, the company’s management lowered the guidance for 2023 from $7.95-$8.25 to $7.35-$7.65, which was undoubtedly perceived negatively by market participants.

According to Seeking Alpha, Bristol-Myers Squibb’s Q3 EPS is expected to be $1.69-$2.09, down 6% from the Q2 2023 consensus estimate. While we believe this is slightly overestimated, our model puts Bristol-Myers Squibb’s EPS at $1.86.

Author’s elaboration, based on Seeking Alpha

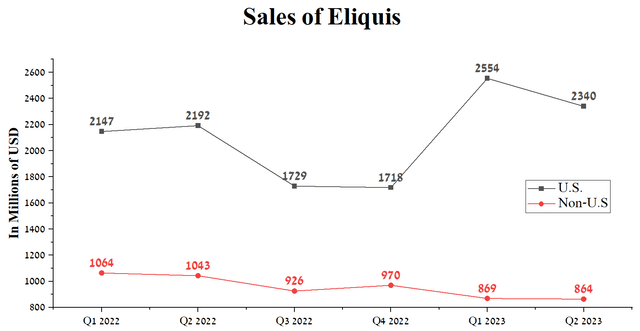

One of the many reasons for Bristol-Myers Squibb’s year-over-year operating income decline is the falling demand for Eliquis (apixaban), a drug to prevent and treat certain types of blood clots and reduce the risk of stroke and systemic embolism.

International sales of Eliquis were $864 million in Q2 2023, down 17.2% year-over-year due to the strengthening of the US dollar against foreign exchange rates and increased competition from generics in Canada and the UK. At the same time, sales of this blockbuster in the US showed slight growth year-on-year due to lower net selling prices and increased competition in the global anticoagulant market.

Author’s elaboration, based on quarterly securities reports

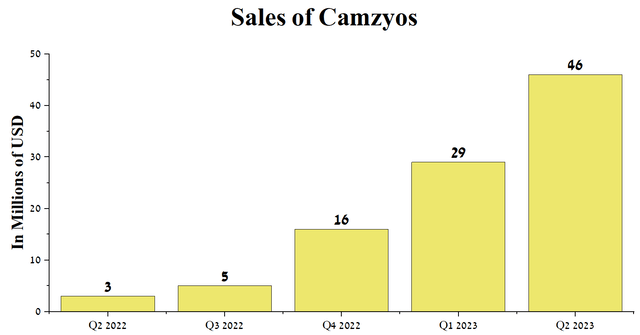

On the other hand, Camzyos (mavacamten), a cardiac myosin inhibitor developed by MyoKardia, which Bristol-Myers Squibb acquired for $13.1 billion in 2020, is seeing strong sales. According to the company’s management, its peak sales are expected to reach over $4 billion. Currently, Camzyos is approved for treating symptomatic obstructive hypertrophic cardiomyopathy in the US and Europe. Moreover, on June 15, 2023, the company announced that the FDA had approved an sNDA to expand the label on Camzyos based on positive data from the Phase 3 VALOR-HCM study. Bristol-Myers Squibb’s upcoming blockbuster hit $46 million in Q2 2023 sales, up 58.6% QoQ.

Author’s elaboration, based on quarterly securities reports

We expect its sales growth to continue in the coming quarters, not only due to its high efficacy shown in clinical trials, which translates into continued market leadership, but also its potential label expansion. The company is currently conducting clinical trials to determine the safety profile and efficacy of Camzyos for treating diseases such as non-obstructive hypertrophic cardiomyopathy and heart failure with preserved ejection fraction (HFpEF).

Conclusion

On July 27, before the market opened, Bristol-Myers Squibb released its Q2 2023 financial results, which, while failing to beat analysts’ expectations, showed that the demand for drugs such as Camzyos, Sotyktu, and Opdualag is growing at a fast pace. These medicines were launched only in 2022, and the company’s management predicts their combined peak sales will be more than $12 billion.

On the other hand, due to a more substantial decline in sales of Revlimid and Sprycel and also a decrease in demand for such blockbusters as Eliquis and Opdivo, Bristol-Myers Squibb management had to lower its guidance for 2023 from $7.95-$8.25 to $7.35-$7.65. Moreover, we are also reducing Bristol-Myers Squibb’s EPS for Q3 2023 and expecting $1.86. At the end of the second quarter of 2023, the company’s remaining share buyback capacity was $6 billion, which will help mitigate some of the negative impact of bearish traders on the company’s price.

However, due to the rapid expansion of the portfolio of product candidates, the high sales of medicines launched in the last two years, and the favorable dividend yield compared to its competitors, we continue our analytics coverage of Bristol-Myers Squibb with an “outperform” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.