andresr/E+ via Getty Images

Investment Thesis

EQT Corporation (NYSE:EQT) is one of my favorite natural gas plays. The only minor blemish to EQT’s investment thesis is that it has hedged a meaningful portion of its 2024 natural gas production at approximately $5 MMBtu.

But asides from that aspect, there’s a lot to be bullish about here.

Why Invest in Natural Gas Producers?

There are 3 critical dynamics that underpin the demand for U.S.-based natural gas. I refer to natural gas as being positioned at the confluence of 3Ds:

- Deglobalization concerns (here think energy security as well as reshoring of manufacturing driving up demand for natural gas).

- Decarbonization.

- Digitalization.

The U.S. government is intent on ensuring that the energy crisis that took place in Europe in the past 2 years doesn’t surface in the U.S.

For this, the U.S. is doing everything in its power to ensure that energy prices remain low. Indeed, one of the main criteria for any government is to make sure that its country has access to cheap, scalable, and reliable energy.

Similarly, the U.S. government has been outspoken in its need to progress towards cleaner energy with lower-carbon sources. The easiest path here is the most obvious. Displacing coal with the ”greenest” fossil fuel, natural gas.

And finally, digitalization is the electrification of everything. From AI data servers to smart homes to charging electric vehicles (“EVs”) from one’s place of work or home.

Simply put, none of these 3 secular tailwinds can take place without natural gas. Natural gas from U.S. producers fulfills all these facets.

But there’s more to this story, that goes beyond the U.S. shores.

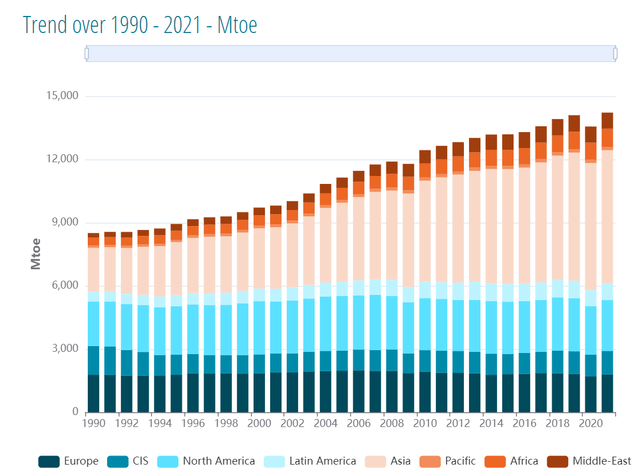

Future Energy Demand Will be Led by Emerging Countries

Yearbook

My key contention is that with time, emerging countries will seek to use similar levels of energy as developed countries. Naturally, this is common sense.

What I believe that too many investors haven’t sufficiently reflected upon is that developed countries will not be plateauing in their energy demand.

And on that front, I argue that the low natural gas prices in the U.S. relative to Asia and Europe are not likely to remain this low. Why?

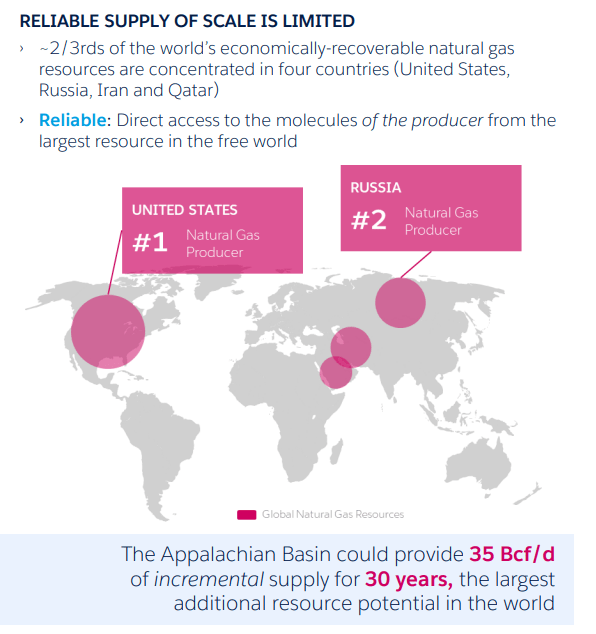

Because Asia and Europe also want access to ”green” fossil fuels. In the same way as the U.S. is leading the pack in the 3Ds, the rest of the world too aspires to have access to reliable, secure, cheap natural gas. And the U.S. is well-positioned to supply it, see below.

EQT presentation

A Discussion of EQT’s Hedges

As Deep Value Returns members know I am heavily invested in Antero Resources Corporation (AR). But if I wasn’t investing in AR, I believe that EQT would be my number 2 choice. Why am not invested in EQT?

Because if I’m bullish on natural gas, I don’t want to be positioned in a company that is 50% hedged to the upside. This doesn’t make too much sense to me to be hedged, considering everything we have discussed regarding natural gas demand.

What’s more, the price of natural gas today is hovering around $2.7 MMBtu which is towards the low end of a multi-year low. And what’s the cure for low commodity prices? You got it, low commodity prices!

Because if natural gas falls below the cost of production, as it inevitably has for many producers outside of the Appalachian region in the U.S., those producers have been forced to cut back on production.

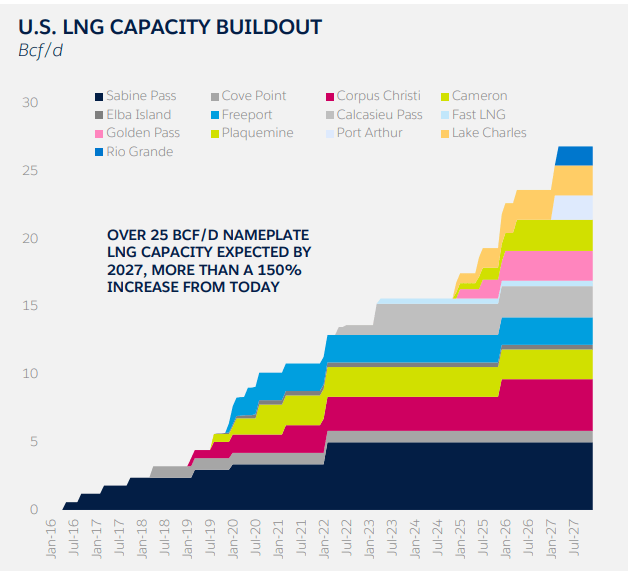

EQT Investor Presentation

Finally, I’ve left the best for last. The graphic above is a reminder of LNG capacity that is expected to come online starting late 2024. This will see substantial LNG volumes being carried away from the U.S. And suddenly, within 12 months, we’ll have gone from having an oversupply of natural gas to a very tight natural gas market.

The Bottom Line

In my view, EQT is a natural gas investment that excites me due to its strong potential. Although there’s one small concern about the hedged 2024 natural gas production at around $5 MMBtu, the overall bullish case for EQT remains compelling.

The three critical dynamics – deglobalization concerns, decarbonization, and digitalization – driving the demand for U.S.-based natural gas are key factors supporting EQT’s growth.

The U.S. government’s focus on energy security and cleaner energy sources further enhances the market for natural gas. Moreover, I strongly believe that emerging countries’ increasing energy demands will lead to a rise in natural gas prices globally, benefiting EQT.

The company’s position to supply LNG to international markets in the coming years creates an excellent long-term opportunity, especially as the natural gas market tightens. Despite some hedging concerns, EQT holds immense potential for substantial upside in the future. In conclusion, there’s a lot to be bullish on EQT.