JuSun/iStock via Getty Images

By Derek Deutsch & Mary Jane McQuillen

A Fundamentals-Driven Approach to Proxy

Market Overview

U.S. equities made strong gains in the second quarter, with the benchmark Russell 3000 Index advancing 8.39% on enthusiasm for AI and optimism the Fed could be nearing the end of its cycle of raising interest rates. Inflation continued to cool and the job market remained robust, lending credence to arguments that despite the Fed’s financial tightening the economy would be able to avoid or at least soften the effects of a recession.

The information technology (IT, +16.86%), consumer discretionary (+12.76%) and communication services (+12.25%) sectors again led the market in a growth rally centered on generative AI and AI-driven cloud adoption. Every other sector underperformed, with the defensive utilities (-2.75%) and consumer staples (+0.59%) sectors lagging. The energy sector was the other negative performer (-0.48%), a positive for the Strategy, which has no traditional energy holdings.

Market leadership concentrated in a few perceived AI winners remained challenging for a diversified portfolio of high-quality companies sought for their ability to outperform over the full market cycle. The Strategy nevertheless delivered strong absolute returns helped by several catalysts, including AI, where we have diversified exposure to several growth trends.

Stock selection in the IT sector was a relative headwind despite strong showings from holdings Microsoft (MSFT), Apple (AAPL) and Synopsys (SNPS), a leading provider of electronic design automation software and services to the semiconductor industry. Solar energy companies SolarEdge Technologies (SEDG) and Enphase Energy (ENPH), meanwhile, were lower amid concerns of weaker U.S. residential demand and falling prices compressing margins.

In consumer discretionary, our main detractor was ETSY, the leading e-commerce marketplace for handmade artisan items, which was weaker as concerns grew about the next leg of growth after a period when the pandemic drove strong returns. Athletic footwear and apparel company Nike (NKE), also a beneficiary of pandemic pull-forward demand, lagged primarily around fears about consumer resilience and potential pressure on Nike’s business in a macroeconomic slowdown.

Meanwhile, our cyclical industrials and materials holdings were standouts from a relative perspective. Industrials holdings continued to outperform, with Eaton (ETN) advancing amid enthusiasm for the company’s electrical product lineup, which is critical to both energy saving and long-term electrification of the global economy. Solid execution is also helping the stock perform strongly. TREX is a manufacturer and marketer of wood alternative decking products made from recycled wood fibers and plastic waste for residential and commercial customers. Trex beat sales and earnings estimates in its recent financial report and is benefiting from optimism concerning the housing cycle, which looks set to recover. A testament to Trex’s value proposition, composite decking continues to take share from wood even as lumber prices have declined. A rebound for materials in June was helpful for water and hygiene solution company Ecolab (ECL), where strong pricing and productivity gains are more than offsetting ongoing inflationary pressure, as well as aluminum packaging company BALL, which rose on reports of a possible sale of its aerospace unit.

Portfolio Positioning

In IT, we re-initiated a position in Lam Research (LRCX), a semiconductor capital equipment company with a dominant market share in etch technology and leverage to secular tailwinds from the slowing of Moore’s law and rising capital intensity. Lam should grow faster than the market when memory capital expenditures rebound, and from market share gain opportunities in leading edge logic. Margin opportunities are also evident with visible drivers such as lower-cost manufacturing initiatives. Lam is a high-quality company with a very strong balance sheet and high returns on capital. Semiconductor capital equipment directly improves the energy efficiency of manufacturing, and Lam has best-in-class human capital management programs and a governance structure that is properly aligned with shareholders.

To fund our purchase of Lam Research, we exited ON Semiconductor (ON), preferring Lam at this point in the semiconductor cycle, and as we are also cautious on automotive demand, a key end market for ON Semiconductor. Along the same vein, we exited TE Connectivity (TEL), a leading supplier of connectors and sensors. Due to heavy exposure to the auto end market, the company faces risk from a downturn in the auto cycle as well as the economy overall.

Reinforcing defensive exposure and pushing our consumer staples positioning from underweight to overweight the benchmark, we added Procter & Gamble (PG), a leading consumer products company with leading franchises in a variety of stable categories, including fabric care, baby, beauty and health. It is a high-quality company with a track record of superior growth, market share gains and attractive returns on capital. It also has defensive attributes when economic conditions deteriorate. Procter & Gamble is a sustainability leader with a demonstrated commitment to addressing environmental and social objectives in how it manages the business, and it has above-average corporate governance practices. Many Procter & Gamble products have a positive impact by promoting hygiene, self-care or health.

Outlook

We are seeing some conflicting signs about the direction of the markets: clearly the first half of the year was stronger than many predicted, particularly following the regional banking crisis in March, with many economists calling for a recession, and now the question on many investors’ minds is whether we are experiencing a bear market rally or the beginning of a new bull market. We still believe a recession in the months ahead is more likely than not. However, there is an argument for what some have called a rolling recession in which different areas of the economy are impacted at different times, in part due to post-pandemic normalization. We think, in this scenario, it is possible the overall economy can avoid a full-blown recession, especially if the labor markets remain durable. Notably, market strength has been very narrow, with a small number of large cap growth stocks driving market returns. We are hopeful that market breadth will broaden in the second half, which would be a healthier dynamic for sustainable returns. Against this backdrop, we remain focused on investing in companies we believe can outperform through full market cycles. We remain firmly convinced that high-quality companies with leading sustainability profiles will prove to be rewarding long-term investments.

Portfolio Highlights

The ClearBridge Sustainability Leaders Strategy underperformed its Russell 3000 Index benchmark during the second quarter. On an absolute basis, the Strategy had gains in seven of 10 sectors in which it was invested (out of 11 sectors total). The main contributors were the IT and industrials sectors, while the consumer discretionary, health care and utilities sectors were the detractors.

On a relative basis, overall stock selection detracted. Stock selection in the IT, consumer discretionary, health care and communication services sectors were the main detractors. Conversely, stock selection in the consumer staples and materials sectors was positive.

On an individual stock basis, Microsoft, Apple, Eaton, Trex, and Alphabet (GOOG,GOOGL) were the largest contributors to absolute performance in the quarter. The main detractors from absolute returns were positions in Etsy, Thermo Fisher Scientific (TMO), Walt Disney (DIS), Nike and BioMarin Pharmaceutical (BMRN).

ESG Highlights

Why Is Proxy Voting Important?

The U.S. proxy season, most active between April and June each year, is when the majority of companies hold annual shareholder meetings. These meetings give shareholders a chance to review financial performance and to vote on resolutions made by both management and shareholders that address important issues affecting each company, called proxy votes. Broadly, issues include corporate governance, such as the election of board directors and management pay, as well as social and environmental matters that may be relevant to a company’s operations, products and services.

Shareholder proposals in 2023 have focused on a wide variety of environmental and social topics, with climate change, political spending/lobbying, human rights, diversity, equity and inclusion (DEI) and health/safety foremost among them.1

ClearBridge takes a fundamental-driven approach to proxies on behalf of clients, with portfolio managers bringing company-specific knowledge to bear on these and other issues. In voting proxies, ClearBridge is guided by general fiduciary principles. Our goal is to act prudently, solely in the best interest of the beneficial owners of the accounts we manage. We attempt to provide for the consideration of all factors that could affect the value of the investment and will vote proxies in the manner we believe will be consistent with efforts to maximize shareholder values.

At the same time, along with direct and ongoing company engagement, proxy voting is an important part of our approach to positively influencing companies through active ownership. ClearBridge’s votes on proposals filed by shareholders or by management are an effective way to signal confidence in the companies we own or to suggest the need for a change in policies, disclosures or related aspects of a company’s business.

Independent Voting, Informed by Company Fundamentals

A key part of ClearBridge’s approach to voting proxies is how portfolio managers take an active role. Some models of voting treat proxies as a largely administrative responsibility, so committees may be staffed with generalists with no investment experience. Other models simply hire a third-party proxy adviser. We would consider that an abdication of our fiduciary responsibility: we believe as fiduciaries the investment teams should have informed opinions on the proxies we vote, similar to the informed opinions we require to invest in or exit a given security. At ClearBridge, proxy voting forms an essential part of the fundamental investment and ownership process.

Pushing for Pay Equity

In some cases, our votes signal the need for companies to improve sustainability practices such as pay equity. These cases often involve voting against management, as we did in the case of Netflix’s (NFLX) proposal to ratify named executive officers’ compensation, a so-called “say on pay” vote. This was also a case where we took into consideration other stakeholder views; the Writers Guild of America reached out to us directly to share its perspective, given its current contract negotiations with major studios.

While this input did not sway our vote directly, we ultimately voted against this proposal due to 1) the magnitude of compensation, which for co-CEOs amounted to over $74 million including salary, stock and eligible bonus (the Writers Guild of America asked for $68 million for ~12,000 people), 2) the need to better tie bonuses and equity compensation to performance criteria, and 3) the ability for Netflix executives to receive an unusually high portion of their compensation in cash, instead of equity stakes, which we believe is a form of compensation more aligned with long-term value creation. Consistent with our active approach to ownership, we shared detailed feedback with Netflix on this proposal following the annual general meeting.

Supporting Biodiversity

Plastic pollution is ubiquitous, threatening ecosystems and biodiversity, a term that, in the context of sustainable investing, refers to the way ecosystems, which provide humans basic needs like food, fuel, shelter and medicine, may be positively or negatively affected by industry. This year Amazon.com (AMZN) received a shareholder proposal requesting it to issue a report on pollution from plastic packaging, including an assessment of its efforts to reduce the impacts on the environment.

In weighing our vote on this proposal, while we acknowledge that the company has made progress in reducing its packaging materials, we noted Amazon does not provide an overall baseline amount of plastic used throughout its supply chain. Although it disputes the filer’s claims regarding its plastic use, it does not provide competing data that allows investors to assess its progress. Meanwhile, several of Amazon’s peers have announced goals specifically around single-use plastic reduction. Although Walmart’s (WMT) and Target’s (TGT) sustainable packaging goals focus on private label products, we believe Amazon should be able to monitor third-party seller plastic use, given its knowledge of every item sold on its site. Amazon’s third-party marketplace has been growing faster than its first-party sales for the past several quarters, making it all the more important for the company to work with third-party sellers on surfacing their plastic usage data, even if not all of them are measuring that information today.

Concern over the environmental damage caused by plastics is rising and regulations are likely to go into force in many jurisdictions that would limit the amount of single-use plastic packaging that can be used. Additional disclosure would help shareholders gauge whether Amazon is appropriately managing risks related to the creation of plastic waste. We believed a vote for this proposal and against management was warranted in this case.

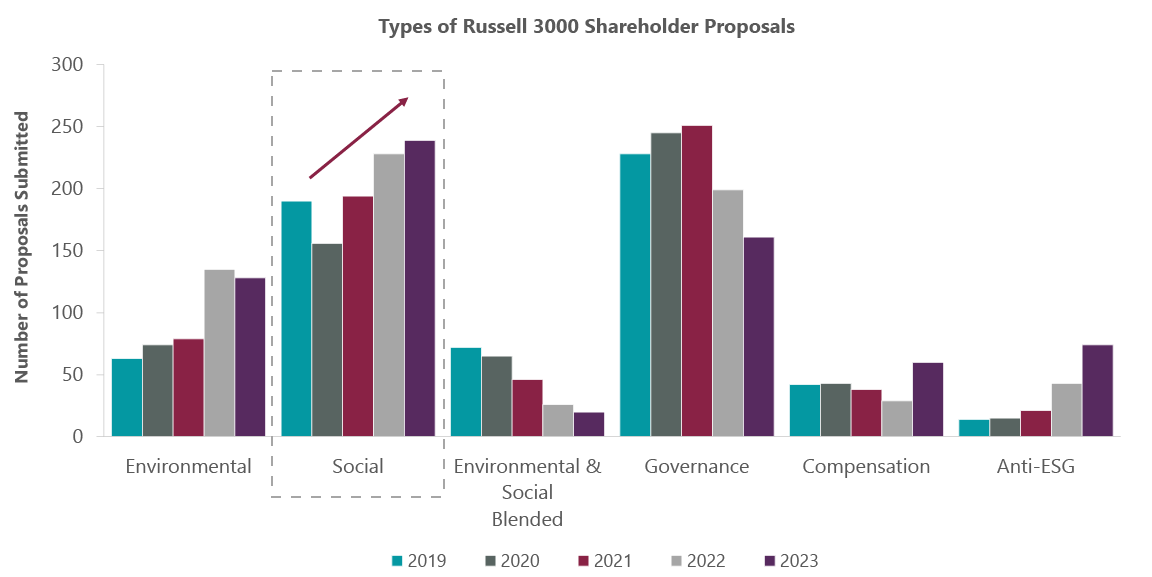

Companies Are Making Progress on Topics of Social Proposals

Proposals on pressing social topics saw less support in 2023 than in previous years, with median support for social proposals falling from 32.5% in 2021 to 24.1% in 2022 and 18.2% in 2023. However, this is not necessarily a sign of waning interest in these topics — indeed, the number of social proposals has been steadily increasing (Exhibit 1) — but can reflect a higher number of proposals submitted and the effect of company engagements on behalf of active owners like ClearBridge helping companies make progress on several fronts. In social topics as diverse as facial recognition, animal welfare and child labor, ClearBridge holdings have been making progress, and our votes signal our confidence in the companies we own.

In 2023, a filer requested that Amazon disclose a third-party report on the company’s Rekognition facial recognition system. We found, however, Amazon’s oversight and guidelines for the technology to be sufficiently robust. Its Nominating and Corporate Governance Committee has oversight over corporate social responsibility practices, including risks related to human rights and ethical business practices, as well as risks related to operations and engagements with customers, suppliers and communities. In its Acceptable Use Policy, Amazon clearly prohibits using its services in an unlawful manner. Amazon states that it supports and has suggested guidelines for developing governmental regulations around these technologies.

Exhibit 1: Social and Environmental Proposals Continue to Increase

As of May 31, 2023. Source: ISS Corporate Solutions.

Amazon has also established guidelines for customer use of facial recognition technology, specifically with reference to law enforcement agencies, including human review; a 99% confidence score; reliance on the technology as a starting point and not the sole determinant in taking action; transparent use of the technology and safeguards in place; and trained personnel using the technology. It has also published additional resources for guidelines on using facial recognition for public safety cases, and in June 2020 announced a one-year moratorium on selling the use of Rekognition to law enforcement to give Congress time to develop regulations around the technology. The company has now indefinitely extended this moratorium. In addition, Rekognition is an image analysis service, not a surveillance system, and similar tools are available from many other vendors. We believed a vote against this proposal was warranted.

Prioritizing Shareholder Benefit

Sometimes we may deem proposals to have little to no benefit for shareholders, even while we agree with the spirit of the proposal. For example, this year global snack food and beverage company Mondelez International (MDLZ), which operates under brands such as Oreo, Ritz, Toblerone and Cadbury, received a proposal requesting that it disclose updated cage-free egg benchmarks. The company outlines its animal welfare policies and goals, and it states its commitment to the Five Freedoms of animal welfare. It has a goal for 100% of its egg supply globally to be cage-free by 2025, excluding Ukraine and Russia. As of the end of 2021, it reports that 39% of eggs supplied globally were cage-free and 100% of the egg ingredients purchased in the U.S. and Canada were cage-free.

Overall, Mondelez appears to be making progress on its cage-free egg goal and discloses adequate information about its animal welfare policies. Although it makes interim goals for some of its other commitments, such as its climate targets, those targets tend to stretch over a longer time period, making interim goals more useful. Shareholders are unlikely to benefit from the requested update to such short-term goals, especially as Mondelez annually reports its progress toward its goal, which is set to be completed in 2025. For these reasons, we voted against this proposal.

Similarly, we voted against a proposal at Mondelez that asked the company to adopt and report on targets to eradicate child labor in its cocoa supply chain. Cocoa is a key ingredient in Mondelez’s chocolate products. ClearBridge has engaged Mondelez for several years on responsible sourcing in its cocoa supply chain, and believe it to be a leader with its Cocoa Life program, which launched in 2012 to improve sustainability in its cocoa supply chain in areas such as deforestation, improving cocoa farmer incomes and enhancing child protections. In a 2019 company engagement, we discussed its new commitment to source 100% of cocoa for its chocolate brands sustainably through Cocoa Life by 2025, up from 43% at the time. As of the end of 2022, this number is 80%.

The company also has goals for its Child Labor Monitoring and Remediation Systems (CLMRS) to cover 100% of Cocoa Life communities in West Africa; this number was at 74% in May 2022. In a late 2022 engagement we discussed Mondelez’s expanding its Cocoa Life spending by $600 million, up from $400 million. It noted farmer net incomes had increased by 15% in Ghana and 33% in Ivory Coast over the past decade, but there were still systemic challenges for cocoa farmers.

Overall, in-depth knowledge of the company and years of engagement on the topic leads us to believe Mondelez has set and progressed on meaningful targets which are not substantially different than those asked for in this proposal; for this reason we voted against it.

Proxy and Engagements Form Part of Active Ownership

ClearBridge proxy voting and company engagement go hand in hand as part of an active ownership strategy; our engagements can continue conversations with companies on sustainability topics raised by past shareholder proposals.

While engaging Mondelez on its 2023 proxy items, for example, we also caught up on topics from past proxy discussions, such as 2019’s proposal to report on deforestation in Mondelez’s supply chain. Large-scale deforestation results in reduced biodiversity (forests contain the vast majority of Earth’s amphibian, bird and mammal species) and destroys valuable carbon sinks able to help combat climate change.

ClearBridge voted against that proposal, finding the company had a comprehensive set of initiatives in place to reduce the deforestation impact of its cocoa supply chain. In 2023 the company found that, based on satellite images, there had been minimal deforestation since 2018 when it started working on pro-environmental community investments and education initiatives. It is also seeing positive progress on reforestation, growing local incomes from non-cocoa sources.

A Comprehensive Proxy Voting Policy Supports Consistent Voting

The ClearBridge Proxy Voting Committee, comprising mainly portfolio managers, analysts and legal/compliance personnel, meets at the beginning of each year to review the upcoming proxy season and to make amendments to ClearBridge’s Proxy Voting Policy to reflect our latest views on corporate governance, environmental and social proposals. The committee also meets after the proxy season to review and reflect on the proposals and votes that took place that year. Moreover, the investment teams will engage with the investee companies (and shareholder proposal proponents) throughout the year on proxy matters and vote rationales, and to ask questions.

While investor support for environmental and social proposals overall went down from 2022 to 2023, one of the more common reasons for certain votes against shareholder proposals was due to the “language” in them: proposals were poorly worded, overly prescriptive or deteriorative to shareholder value. This underscores the value of the Proxy Voting Policy to ClearBridge’s investment teams, as well as the direct involvement by the portfolio managers in voting on proposals that fall outside the policy. ClearBridge maintains a 100% vote record.

Derek Deutsch, CFA, Managing Director, Portfolio Manager

Mary Jane McQuillen. Head of ESG, Portfolio Manager

Footnotes1 ISS Governance, 2023 Global Proxy Season Recap Note, June 30, 2023. 2 Pensions and Investments, citing ISS. Past performance is no guarantee of future results. Copyright © 2023 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.