Marat Musabirov

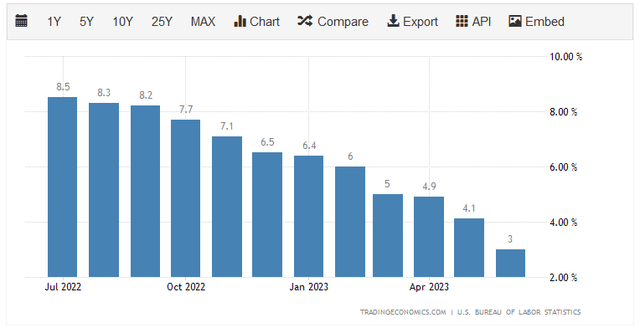

There can be little doubt that one of the biggest problems facing the average American today is the incredibly high rate of inflation that has dominated the economy. This high inflation rate has pushed up the prices of everything we consume in our daily lives, which is quite evident by looking at the consumer price index. This index claims to measure the price of a basket of goods that is regularly purchased by the average person. As we can see here, the consumer price index has increased by more than the 2% year-over-year rate that is considered healthy during each of the past twelve months:

Trading Economics

We can see that the year-over-year growth has been slowing, which is a good sign. However, it is misleading because the improvements have been entirely caused by the fact that energy prices are lower than they were a year ago. The core consumer price index, which excludes volatile food and energy prices, shows much higher year-over-year growth than the above numbers suggest. As such, an increase in energy prices would very quickly undo all of the so-called improvements in inflation that have been seen thus far. The important thing though is that wages have not risen as rapidly as inflation, so the budget of the average person is growing increasingly strained. In a recent blog post, I discussed how many consumers have resorted to things such as pawning possessions or dumpster diving for food in an attempt to support themselves.

Synchrony Financial (SYF) reports that Americans had been depending on borrowing money to maintain their standard of living over the past two years and are now beginning to default in large numbers. We are also seeing people trade down on their vacations and start traveling by bus instead of by plane. In short, the average person is desperate to maintain their standard of living in the current environment, as their previous standard of living is no longer affordable.

As investors, we are certainly not immune to this. After all, we have bills to pay and require food for sustenance just like anyone else. Many of us would also like to enjoy a few of the luxuries available in life. Naturally, these things all require money and in most cases more money than they did last year or the year before that. Fortunately, we do not have to resort to the extreme measures that some others do in order to get the extra income that we require to satisfy our needs and wants. After all, we have the ability to put our money to work for us to earn an income.

One of the best ways to do this is by purchasing shares of a closed-end fund, or CEF, that specializes in the generation of income. These funds are unfortunately not very well-followed by the investment media and many financial advisors are unfamiliar with them. As such, it can be difficult to obtain the information that we would like to have in order to make an informed investment decision. This is a shame because these funds offer a number of advantages over familiar open-ended and exchange-traded funds. In particular, a closed-end fund can employ certain strategies that have the effect of boosting their yields well beyond that of any of the underlying assets or indeed pretty much anything else in the market.

In this article, we will discuss the Eaton Vance Enhanced Equity Income Fund (NYSE:EOI), which is one CEF that income-seeking investors can use for their needs. The fund yields an impressive 7.80% at the current price, so it is certainly boasting a high enough yield to satisfy most peoples’ needs. I have discussed this fund before, but a few months have passed since then so naturally a few things have changed. This article will, therefore, focus specifically on these changes as well as provide an updated analysis of the fund’s finances. Let us investigate and see if this high-yielding fund could deserve a place in your portfolio today.

About The Fund

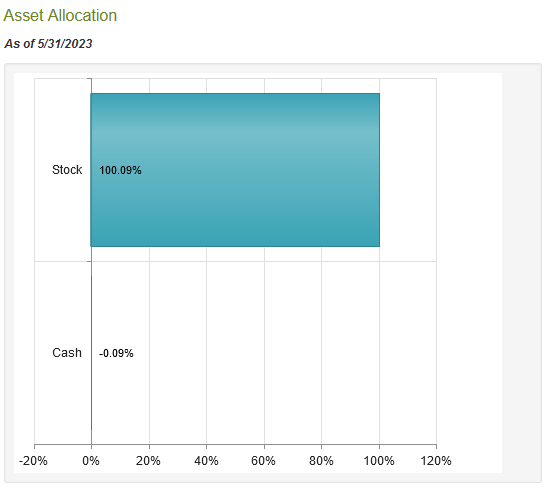

According to the fund’s webpage, the Eaton Vance Enhanced Equity Income Fund has the stated objective of providing its investors with a high level of current income. This is somewhat surprising at first glance, as the fund is an equity closed-end fund. Its portfolio is currently entirely invested in common stock:

CEF Connect

This is the reason why the fund’s objective is surprising. With the exception of the fossil fuel sector, common stocks do not provide income. As of the time of writing, the S&P 500 Index (SP500) yields 1.43% and even the traditionally high-yielding utility sector (IDU) only yields 2.55%. With those yields, even a $1 million portfolio will not provide a suitable level of income to cover someone’s retirement expenses.

This fund is not exactly a pure common stock portfolio though, as is indicated by the “enhanced” descriptor in the fund’s name. Generally, that descriptor means that the fund is using some sort of options strategy to boost the effective yield of the portfolio. This is the case with the Eaton Vance Enhanced Equity Income Fund. The fund’s fact sheet describes its strategy thusly,

The fund invests in a portfolio of primarily large- and midcap securities that the investment advisor believes have above-average growth and financial strength and writes call options on individual securities to generate current earnings from the option premium.

In other words, this fund is employing a covered call writing strategy. The fact that this fund uses any options strategy may concern some investors as we have all heard horror stories about the risks of options. However, the covered call writing strategy is reasonably safe due to the fact that the fund already owns the stock that it would have to sell if the option is exercised against it. This differs from a short naked call position that may require the writer to pay any price to purchase the stock in the event of an option exercise.

As this fund owns the stock that the options are written against, all it has to do in the event of an exercise is sell the stock it already owns to the owner of the option. Thus, all that the fund loses is the upside on the stock above the option’s strike price. If the strike price on the option is higher than the price that the fund paid for the shares, it will even make a gain if the option is exercised against it. Thus, the risks of the fund’s options strategy are quite minimal.

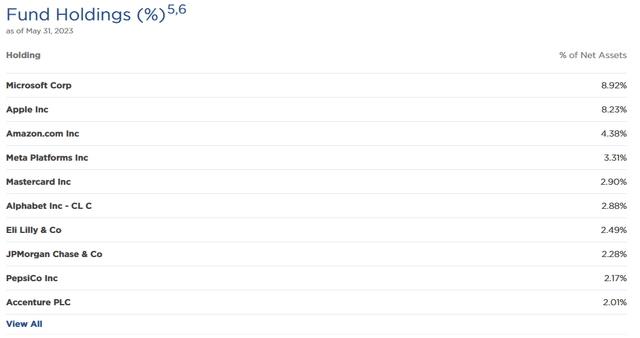

One thing that I have noted in previous articles on Eaton Vance funds is that they tend to have sizable exposure to the mega-cap technology companies. The Eaton Vance Enhanced Equity Income Fund is no exception, as we can clearly see by looking at the largest positions in the fund. Here they are:

Eaton Vance

We quickly see here that five of the fund’s ten largest positions are the major American technology firms. Ordinarily, this would make no sense for an equity fund seeking income because of the fact that all of these companies have either no dividend or such a low yield that they may as well have no dividend:

| Company | Current Dividend Yield |

| Microsoft (MSFT) | 0.77% |

| Apple (AAPL) | 0.49% |

| Amazon.com (AMZN) | N/A |

| Meta Platforms (META) | N/A |

| Mastercard (MA) | 0.57% |

| Alphabet (GOOG) | N/A |

| Eli Lilly & Co (LLY) | 1.00% |

| JPMorgan Chase & Co (JPM) | 2.59% |

| PepsiCo (PEP) | 2.72% |

| Accenture (ACN) | 1.41% |

Of these companies, only JPMorgan Chase and PepsiCo have a yield above that of an S&P 500 index fund, and not one of them manages to beat the current yield on an ordinary money market fund or even a savings account at most online banks. Thus, this is certainly not what would be expected of any fund that has the objective of providing its investors with a high level of current income.

This is where the options strategy comes in, as the option premium on some of these companies can be fairly large due to their share price volatility. For example, as of the time of writing, August 04 197.50 calls ($0.40 per share above the current stock price) on Apple are currently trading for $3.60 each. That is the equivalent of a 47.49% annualized yield ($3.60 per share over a two-week period) and the fund would still be able to keep the $0.40 per share gain if the stock does go up a bit from today’s level.

While the fund is not writing call options against every stock that it holds in its portfolio and not every trade will result in a synthetic yield as attractive as Apple, we can still easily see that the fund can generate a fairly high level of current income through its call option writing strategy. Thus, the portfolio does actually work as a source of income despite it being pretty terrible for a dividend-focused investor.

There have been quite a few changes to this fund’s portfolio over the past four months since we last discussed it. In particular, UnitedHealth Group (UNH), Procter & Gamble (PG), and Wells Fargo & Co (WFC) were removed and replaced with Eli Lilly, JPMorgan Chase, and Accenture. There were also a few weighting changes, but those could easily be explained by one stock outperforming another in the market and are not necessarily indicative of the fund’s management actively changing its portfolio. Still, the fact that we saw three major changes in just four months could lead one to expect that this fund has a fairly high turnover. This is not really the case, though, as the Eaton Vance Enhanced Equity Income Fund had an annual turnover of 50.00% last year, which is right around the median for a common equity fund.

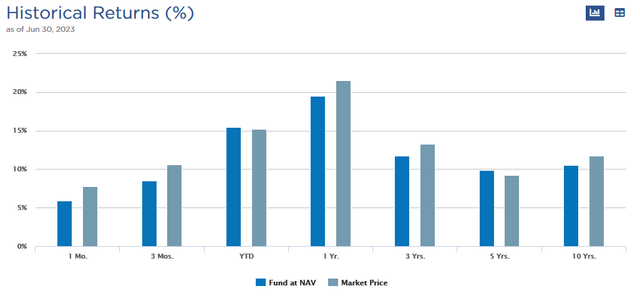

The reason a fund’s turnover is important is that it costs money to trade stocks or other assets. These expenses are billed directly to the fund’s shareholders, which creates a drag on the portfolio’s performance. It also makes management’s job more difficult, since the fund’s managers need to earn sufficient extra returns to cover these added expenses and have enough left over to satisfy the shareholders. This is a very difficult task that few management teams are able to accomplish on a consistent basis. As a result, most actively-managed funds end up underperforming comparable index funds. This fund does not really have a comparable index fund by virtue of its somewhat unique strategy, but it has generally performed reasonably well over time:

Eaton Vance

The nice thing here is that this fund has generally delivered positive returns over any historical period. This is not unusual for a fund that uses an options strategy, as the options premiums offset some of the market losses during a bear market. However, they do cap the fund’s performance during a strong bull market. We can see this in the fact that the Eaton Vance Enhanced Equity Income Fund only delivered a 10.52% average annual total return compared to 12.86% for the S&P 500 Index. Thus, with this fund, we are trading the total return for consistency and income. That is a very reasonable trade for most retirees or other people that are depending on their portfolios to pay their bills or finance their lifestyles.

Distribution Analysis

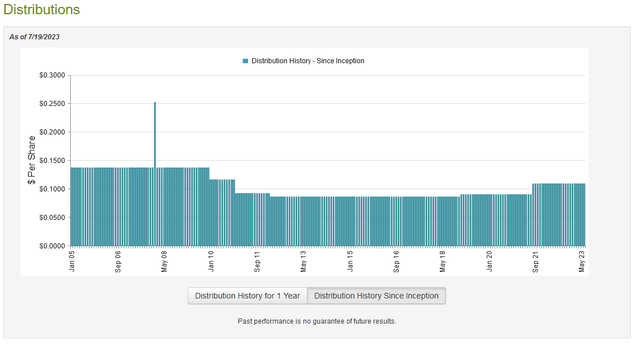

As mentioned earlier in this article, the primary objective of the Eaton Vance Enhanced Equity Income Fund is to provide its shareholders with a high level of current income. In order to achieve this objective, it employs a covered call writing strategy, which can provide remarkably high synthetic dividend yields as we already discussed. The fund then pays out its total returns to the shareholders through distributions. This can be expected to result in the fund having a very high yield, which is certainly the case. The fund currently pays a monthly distribution of $0.1095 per share ($1.3140 per share annually), which gives it a 7.80% yield at the current share price. The fund has generally been consistent about its distribution, as it has been climbing over the past decade:

CEF Connect

We can see that the fund cut its distributions a few times during the period following the Great Recession, but that caused so many changes to the market environment that most people will not be too bothered by that today. The fund has been remarkably consistent for more than a decade, which is a reliable enough history for most people. As such, this fund certainly looks appealing to anyone that is seeking a safe and secure source of income to use to pay their bills or finance their lifestyles.

As is always the case though, it is important that we ensure that the fund can actually afford the distributions that it pays out. After all, we do not want to be the victims of a distribution cut that reduces our incomes and probably causes the share price to decline. Let us investigate this.

Fortunately, we have a fairly recent document that we can consult for this purpose. The fund’s most recent financial report corresponds to the six-month period that ended on March 31, 2023. This is a newer report than the one that we had available to us the last time that we discussed this fund, which is nice as it will give us some idea of how well the fund managed to profit in the market upswing year-to-date. During the six-month period, the Eaton Vance Enhanced Equity Income Fund received $4,799,344 in dividends and surprisingly no interest income. The received dividends thus comprised the entirety of its investment income over the period.

The fund paid its expenses out of this amount, which left it with $1,393,061 available for shareholders. As might be expected, this was nowhere close to enough to cover the $26,423,024 that the fund paid out over the same period. At first glance, this will likely be quite concerning as the fund did not have enough net investment income to cover its distributions.

However, the fund does have other methods that it can employ to obtain the money that it needs to cover its distributions. For example, it might have capital gains that can be paid out to the investors. In addition, it receives premiums from the covered call writing options strategy, which are considered capital gains or return of capital depending on the situation. All of these things result in money coming into the fund but are not considered net investment income. Fortunately, the market during the first few months of this year was strong enough for the fund to have some success here.

It reported net realized capital gains of $16,771,560 and had another $57,374,475 in net unrealized capital gains. Overall, the fund’s assets went up by $52,266,887 after accounting for all inflows and outflows, which is enough to cover the distribution for almost another twelve months. Thus, unless we get a market reversal comparable to 2022 that wipes out the fund’s assets again, the distribution is probably sustainable going forward. I am not particularly worried here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the Eaton Vance Enhanced Equity Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of the fund’s assets minus any outstanding debt. This is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can obtain them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing a fund’s assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of July 19, 2023 (the most recent date for which data is available as of the time of writing), the Eaton Vance Enhanced Equity Income Fund had a net asset value of $16.93 compared to a share price of $16.87 each. This gives the fund a very small 0.35% discount to the net asset value at the current price. This is in line with the 0.42% discount that the shares have averaged over the past month. This is not a very large discount, but it is still a discount and so represents an acceptable price to pay for this fund.

Conclusion

In conclusion, the Eaton Vance Enhanced Equity Income Fund looks like a very reasonable choice for anyone that is seeking to earn income from their portfolios. The fund’s portfolio is not exactly what we would expect from an income-focused fund, but the covered call writing strategy allows it to earn a very high synthetic yield from stocks that are poor income plays themselves. The fund’s 7.80% yield is not as high as some funds, but it does appear to be sustainable and the valuation is very reasonable. The biggest concern here is that anyone buying this fund will end up with substantial exposure to a handful of mega-cap technology companies so it is important to have other things in your portfolio to achieve sufficient diversification.