franckreporter

Las Vegas Sands Corp. (NYSE:LVS), a large-cap casino stock which owns and operates integrated resorts in Macao and Singapore, plans to publish its Q2 results on July 19, post market hours. Here are some important considerations ahead of the big event.

Earnings-Related Considerations

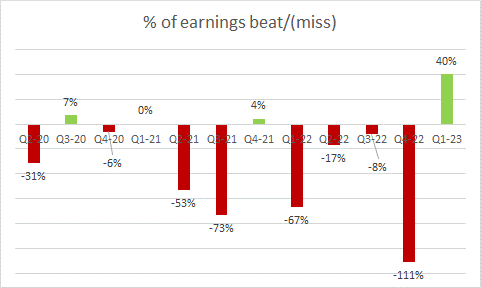

Given LVS’s troubling track record during earnings season, investors may likely be facing this event with plenty of trepidation. For context, over the last 12 quarters, it has missed bottom-line street estimates on eight separate occasions. Crucially, it’s not as though the variance has been marginal; in fact, the average performance over the last 12 quarters has amounted to a miss of over 26%.

Seeking Alpha

In Q2-23, the two key headline numbers to watch out for are a) an EPS of $0.44, and b) a revenue estimate of $2.38bn

If one looks beyond street expectations for the headline metrics and delves into other nuances, it looks like Q2 could be a strong quarter for LVS. We are taking our cue from some of the recent macro and industry reports, which suggest that the recovery in Macau has been coasting along very well. Average daily gross gaming revenue in Macau had been trending at the $62-63m mark for the last two months of Q2-23, which would put it at the highest point since the COVID outbreak in February 2020.

Revenues in May in particular would likely have benefitted from the 5-day break for Labor Day, which reportedly saw a 2x spike in the number of Chinese visitors compared to what was seen last year. We’d be curious to see if there was a pick-up in visitations from the non-Guangdong Chinese provinces as well, which was leaving a mark on overall visitations (as of March 2023, non-Guangdong Chinese visitations were only at 32% of 2019 levels).

For LVS to garner even more favorable positioning from the investment community, it’s vital that we see some pickup in the mass-market visitation trends (as opposed to just VIP trends) as LVS is a market leader in this segment (approximately 30% over the past five years).

LVS management will be expected to shed some insight into how effectively they’ve been able to ramp up their room inventory at Sands China, Macao. In Q1, out of their 12,000-odd room capacity, only 69% were put to use, as the rest were hampered by labor shortages in Macau. In Q2, another 3,000 rooms are expected to come back into the system, but it still won’t be at full tilt until Q3 or Q4.

LVS Management noted how the Macau government was doing its bit to ameliorate the employee gaps for operators like LVS, but investors need to recognize that unless there’s an easing of restrictions with non-local work permits, non-gaming revenue expansion could remain stunted (just for some perspective, LVS has big plans for their non-gaming verticals and invested over $2bn towards this during the pandemic). Just for some context, at the end of Q1, the number of non-local staff in Macau’s recreational, cultural, and gaming sectors was still down by 50% relative to the pre-pandemic levels.

Closing Thoughts – Valuation and Technical Narratives

While gauging the valuation and technical quotients of LVS, we’re left with mixed feelings overall.

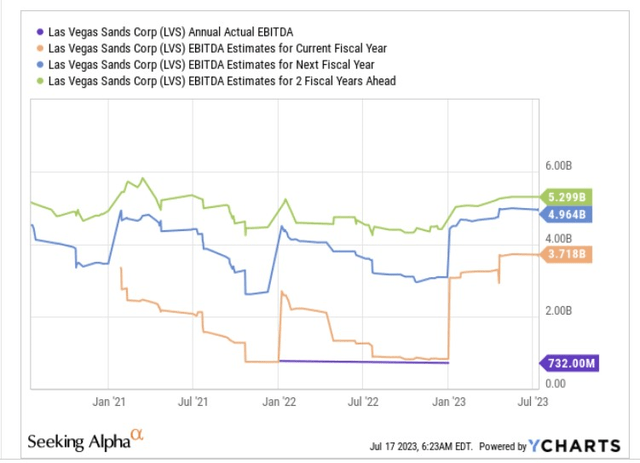

After a fairly long period of underwhelming EBITDA readings, LVS’s forward EBITDA profile is now brimming with promise, particularly as LVS is poised to extract superior operating leverage from a more normalized environment in Macau (in Q1, market-wide mass gaming revenue was only 68% of the Q1-19 levels). For context, based on consensus estimates for the next three years, you’re basically staring at a business that is poised to offer you exceptional EBITDA CAGR growth of 93% through FY25!

YCharts

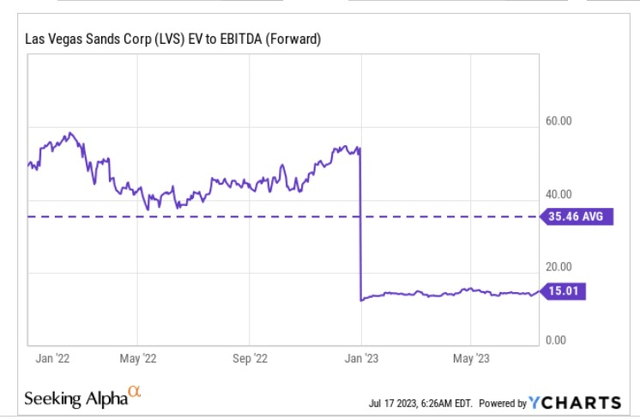

In light of such a tremendous EBITDA runaway, the LVS stock comes across as a real bargain, priced at just 15x forward EV/EBITDA, a 60% discount over its long-term average of 35x.

YCharts

Then, on LVS’s weekly chart, we are certainly enthused to discover the build-up of a bullish flag pattern over the last nine months or so. After completing a two-legged pullback, it looks like the stock is now making an attempt to break past the $65 level, a region that has previously served as a wall during 2019, 2021, and May 2023. Needless to say, a stellar Q2 report could help the stock breach this boundary but yet still, we feel that the more prudent point to have considered LVS is around the sub-$55 level which represents the lower-end of the broad pullback range. Whilst we are not ruling out a breakout, we don’t feel an entry at the current price offers the most optimal risk reward.

Investing.com

Finally, it’s also worth considering how LVS is positioned relative to its peers from the gaming space. As you can see from the image below, quite unlike late 2021, when the relative strength ratio was trading below the mid-point of the range, LVS now looks slightly overbought versus a portfolio of stocks involved in the world of casinos, sports betting, gaming, etc. Thus, as a rotational play within this broad universe, LVS is unlikely to serve as the most opportune bet.

StockCharts