Vanit Janthra

Plug Power (NASDAQ:PLUG) recently had its Analyst Day and also made a few public announcements on the day itself.

This was also only the second time since the Rochester gigafactory was opened to invited guests in its Symposium held last October.

I was able get an update about the company’s opportunities in its Applications and Energy businesses, along with a detailed financial update of the company.

I came out of the Analyst Day event more optimistic about Plug Power’s medium-term plans as the company continues to see accelerating demand across its businesses.

Consistent execution will be required to achieve its long-term goals.

Let’s dive right into it.

Announcements made on Analyst Day

There were multiple announcements made on Analyst Day

Plug Power announced that they signed an agreement with Avina Clean Hydrogen to provide them with containerized proton exchange membrane (PEM) electrolyzer systems for a green hydrogen production facility. This facility will serve the commercial mobility sector in south California. This will be first ever hydrogen production facility for heavy duty trucks in the Southern California. In addition, Plug Power has the right of first refusal to supply electrolyzers for Avina Clean Hydrogen’s next production facility. This provides a surprising upside for Plug Power and demonstrates how the company is making progress in the mobility market, which is a positive sign.

In addition, Plug Power announced a new pedestal customer, Blue EnerFreeze, a subsidiary of STEF in Europe, which is a significant expansion in Europe for the company. Plug Power is expected to provide the company with a complete green hydrogen ecosystem across two distribution centers, before potentially expanding further into their network of over 100 sites.

Also, Plug Power announced what they seek to achieve in 2030, which includes the following:

- Production of more than 2,000 TPD hydrogen per day from its green hydrogen network including its first kiloton-scale plant by 2030.

- Deploy one GW of stationary power products.

- Ship 5 GW of electrolyzers per year.

- Deliver 500,000 fuel cell powered forklift trucks.

- Manufacturing capability to support 10 GW of fuel cells and electrolyzers.

- Through its partnership with Renault, Plug Power expects to have 100,000 HYVIA vans on the road by 2030.

Financial targets

For those unfamiliar with Plug Power, the company has near-term, medium term and long-term financial targets.

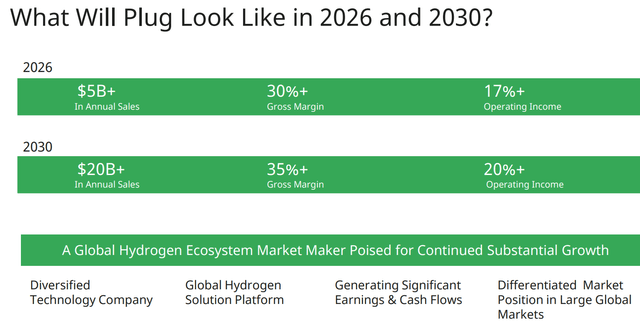

The medium-term target, or the 2026 target includes achieving at least $5 billion in revenues, 30% gross margins and 17% operating margins.

The long-term target, or the 2030 target, includes achieving at least $20 billion in revenue, 35% gross margins and 20% operating income.

Plug Power’s 2026 and 2030 financial goals (Plug Power Analyst Day)

In terms of the near-term guidance, management reiterated that they expected revenues of $1.4 billion, with the lower-case scenario being $1.2 billion. The lower-case scenario will occur if some liquefaction and electrolyzer projects slip into early 2024.

In addition, management reiterated turning gross margin positive as we exit 2023. I also found it useful that management was more transparent about their outlook for 2023 revenues, with 60% coming from non-material handling revenues, and 25% coming from Europe. This transparency is useful to investors, in my view, because it demonstrates how Plug Power is expanding into new and high growth markets.

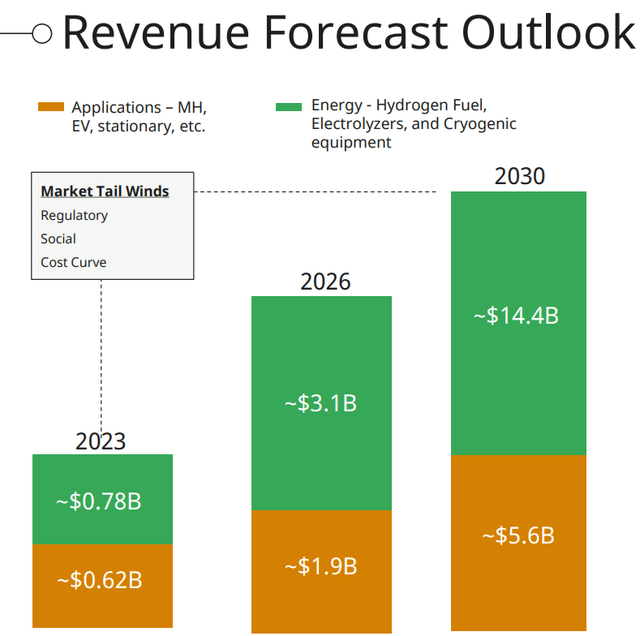

As we move towards the medium-term, the revenue mix will transition towards the Energy segment as the Applications become a smaller part of the total revenue contribution. By 2030, management expects that the Energy segment will grow to about two-thirds of total revenue, contributed by fuel, liquefaction, tanker and related sales, while the Applications segment will take up a third of total revenue.

How will Plug Power get to its 2030 revenue targets?

This will require multiple efforts on several fronts. Plug Power needs to first expand its market channels, by growing its customer base and partnerships. This will form the base of initial customers from which it will grow from, and these customers and partners will be the early adopters of green hydrogen. Second, Plug Power will need to grow into new markets, as it is currently doing. These new markets can include stationary power, EVs and aerospace, amongst others. Third, the company needs to leverage and market on the global market for its electrolyzers to gain scale, and to generate the numbers needed for the business to grow significantly and continue to build its cryogenic platform to ensure that it is able to provide an end-to-end solution for its customers. At the end of the day, Plug Power needs to continue to innovate and develop new hydrogen products and solutions that the market needs and over time, cross sell to existing customers its comprehensive hydrogen solutions. From the business front, Plug Power needs to ensure that its capabilities are scaled up and investments are made to lower costs and improve performance.

Revenue forecast mix outlook (Plug Power Analyst Day)

The company is making the investments needed to accelerate revenues over the period.

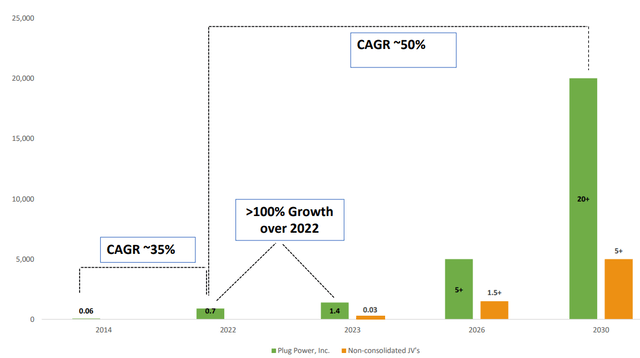

Historically, hydrogen investments made by Plug Power from 2014 to 2022 grew at 35% CAGR.

From 2022 to 2023, the expected hydrogen investments grew more than 100%.

From 2022 to 2030, hydrogen investments will grow at 50% CAGR, an acceleration from the earlier time period.

Hydrogen investments made by Plug Power (Plug Power Analyst Day)

How will Plug Power achieve their margin targets?

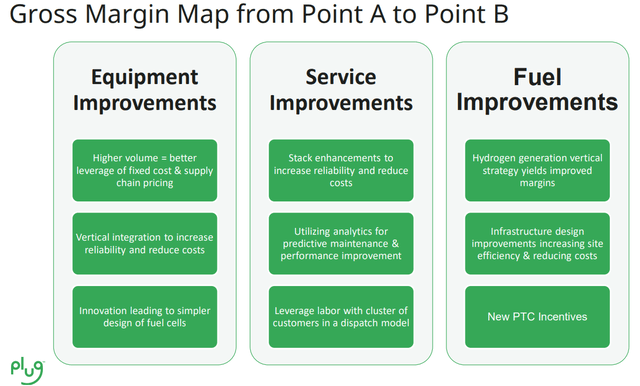

To achieve its gross margin targets, Plug Power has highlighted clear improvements it’s needed to make to achieve its targets. For the equipment side of the business, vertical integration, scale and innovation will bring gross margin improvements, while on the service side of the business, stack enhancements, use of analytics and using a dispatch model will drive improvements in gross margins. Finally, for the fuel side of the business, vertical integration will yield better margins, while the company continues to strive for improving site efficiencies and infrastructure design, and last but not least, the new PTC incentives should help drive gross margins home.

Gross Margin Map (Plug Power)

In terms of driving operating margins to its target levels, this will be achieved through operating expenses leverage, supply chain leverage, vertical integration and continued innovation.

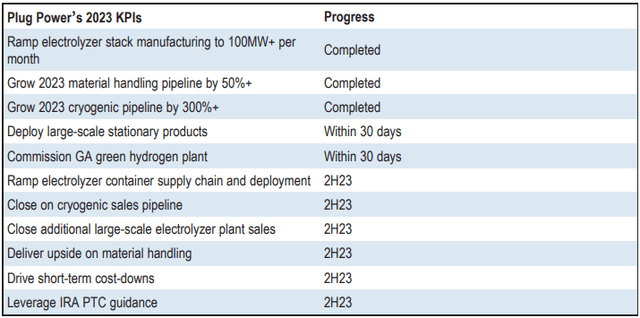

KPIs for 2023

Management is showing increasing focused on execution and with the Analyst Day, the team showed that they are laser focused on their goals for 2023.

As shown below, there are about 11 KPIs for 2023 and the first five KPIs are meant to be near-term KPIs for 2023 and the remaining six are meant to be KPIs for the second half of 2023. As can be seen below, the company has completed or almost completed all the first five KPIs for 2023, with the rest expected to be completed in the second half of 2023.

Plug Power 2023 KPIs (Plug Power Analyst Day)

Significant manufacturing progress

Since the October Plug Symposium, there has been significant progress in manufacturing that has been made.

The focus is to use automation to improve output and as with increasing scale, this should drive equipment margin improvements along with it.

As we met with the manufacturing team at Plug Power that are in charge of areas like assembly, materials, coating and other areas, many of which came from senior manufacturing roles at Tesla (TSLA), we also got a chance to tour the Gigafactory. There has been significant progress made with equipment installation and scaling.

Since the Plug Symposium in October 2022, Plug Power is now able to provide more than 100 MW of capacity each month and by the end of the year, there should be a capacity for 2 GW of electrolyzer stacks. Also, there is also room to continue to increase the company’s output at Rochester, somewhere between two times to three times without needing to increase the physical footprint. The company has been driving cost downs through automation, vertical integration, innovation and improving efficiencies in other areas.

As an example, through automation of the traditionally manual process of MEA, Plug Power was able to improve output by 40% and also have more floor space for other equipment.

Replicable green hydrogen model

With the ambition to produce more than 2,000 TPD of green hydrogen, including the first kiloton scale plant and goal to ship 5 GW electrolyzers annually by 2030, there’s much that needs to be done and decided today.

The Plug Power team is looking to have a replicable green hydrogen plant blueprint across the United States and Europe. The focus is to improve the vertical integration of the electrolyzer supply chain so that green hydrogen plants can be brought online more quickly and to leverage on their engineering experience and knowledge into other projects across the United States, in California, Southwest, Midwest, Gulf Coast and more for after 2025.

In Europe, the team’s goal is to ramp up production of green hydrogen production from 50 TPD in 2025 to 1,500 TPD in 2030, with plans for gigawatt scale sites in the Nordics where renewable capacity is stronger.

Applications momentum continues, especially for stationary power

Plug Power has been leveraging on its core PEM fuel cell technology to secure material handling, stationary power and mobility contracts.

The material handling business showed resilient and strong momentum, with upside from the mid-size solution, while the mobility business continues to show good progress with the ongoing or starting pilots.

Stationary power is showing solid momentum as it generated more than $30 million in revenues after the first year since it was introduced into the market. For example, Energy Vault (NRGV) chose Plug Power to supply 8 MW of hydrogen fuel cells as art of the hybrid microgrid backup system for PG&E (PCG) and the city of Calistoga, which demonstrated the possibility of using stationary power for microgrids.

As highlighted earlier, by 2030, Plug Power is targeting to deliver 500,000 fuel cell forklift trucks, deploy 1 GW of stationary power and have 100,000 HYVIA trucks operational.

Conclusion

For me, management attempted to show concrete steps which it will take to reach their near-term, medium-term and long-term financial targets.

No doubt, the long-term targets are not just far away but look almost unattainable today, but I think that the team is taking the right steps and investments today to make that a reality and I am not sure if the market believes the management team is able to pull this one off.

However, in the near-term, we are starting to see management demonstrate clear steps they are taking towards their near-term targets like setting and disclosing progress on KPIs.

At the end of the day, Plug Power needs a team that is capable of consistent execution, and I think the company is on its way to its ambitious goals.