Roman Mykhalchuk/iStock via Getty Images

In my original write-up on the name back in April, I said that Williams Companies (NYSE:WMB) has one of the most valuable assets in the midstream space in Transco and that the stock had solid upside from current levels. Since then, the stock has generated at return of over 16%, outpacing the S&P 500. Let’s catch up on the name.

Company Profile

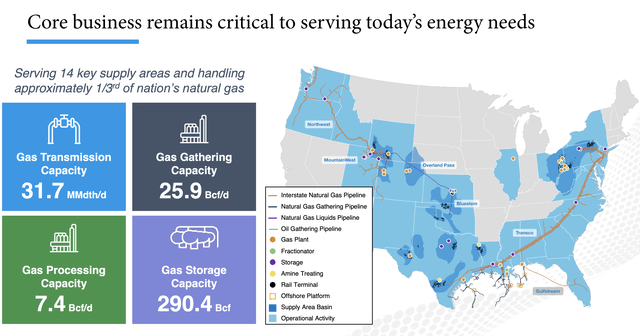

As a refresher, WMB is a midstream operator that owns interstate natural gas pipelines; gathering, processing and treating assets; NGL marketing services; and crude oil transportation and production handling assets.

It owns a number of large interstate natural gas pipelines, including Transco, Northwest Pipeline, and MountainWest, which are part of its Transmission & Gulf of Mexico segment. Natural gas storage and gathering assets as well as crude oil production handling and transportation assets in the Gulf Coast region are also found in the segment.

Its Northeast G&P segment is centered around the Marcellus and Utica shales, where it provides natural gas gathering, processing and fractionization services. Its West segment, meanwhile, consists of its natural gas gathering, processing and fractionization assets in various basins in Texas and other places west of the Mississippi. It also has a Gas & NGL Marketing segment that provides asset management and the wholesale marketing, trading, storage, and transportation of natural gas for clients.

Company Presentation

Natural Gas Isn’t Going Anywhere

Since my initial write-up, WMB has reported solid Q1 results, which I discussed in detail in May. The company has also been very vocal about the importance of natural gas both in the press and at investor conferences in the interim as well.

Perhaps the biggest knock on the midstream space is what the long-term future holds for the companies. Both the U.S. and Europe, as well as many other parts of the world, have goals to greatly reduce their carbon footprints. This is set to be done with things such as increasing electric vehicle adoption and alternative energy use such as solar, wind, and green fuels.

For his part, Williams CEO Alan Armstrong believes that increasing demand for electricity from EVs and heavy industries will actually fuel the need for more natural gas infrastructure. In an article in the Financial Times, Armstrong said that no one will risk not having a back-up to wind and solar, which can be more intermittent.

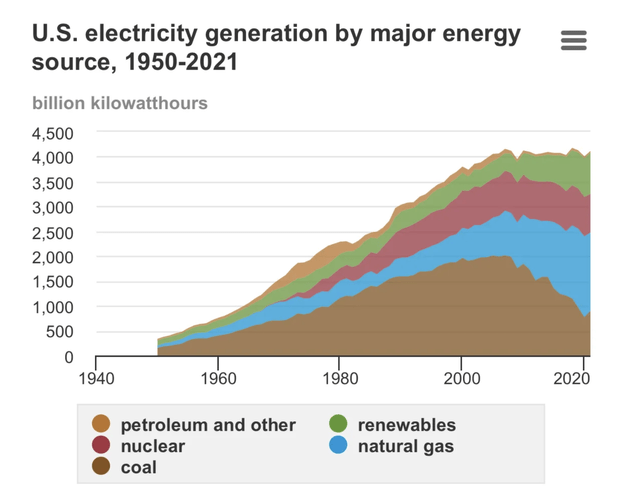

While the article noted a Stanford study that said “a combination of wind, solar and hydropower, coupled with battery storage, new transmission lines, and the management of demand” could help meet all the county’s incremental power needs, but recent history shows that natural gas, not renewables has been the biggest winner of increased electricity needs over the years.

In fact, while the push to EVs has been touted as green, the reality is that it’s mainly just been a shift from crude to natural gas at this point. The graph below shows how much share natural gas has gained in U.S. electric generation, and of course, electricity is what powers electric vehicles.

EIA

Discussing the impact of electrification at a recent JP Morgan conference, Armstrong added:

“So you look at ’19 through ’22, we saw an 85% increase in renewables in both our Northwest pipeline market and our Transco market, but we saw a 9% and a 14% increase in peak days on our systems on those, and that was not on a weather basis. In other words, that was normalized weather. So we’re really continuing to see growth in peak day, and we’re going to continue to see that as renewables come on. And if you really — I have the pleasure of sitting on the National Infrastructure Council, and — that is really looking hard at a lot of electrification studies right now. And it is really shocking if you look at how much electrification is going on in all kinds of places, airports, port authorities and the degree of data centers, AI is going to continue to put a big load on that. So more and more electrification continues to come on. And the amount of load is really getting to be kind of almost to the point where people are shaking their heads and there’s no way we’re actually going to get there in terms of that much electrification, that much transmission that’s going on. But as that happens, I will just tell you, from Williams’ standpoint, this is a very positive thing for our business because we’re going to be there ready to serve these increases in demand capacity.”

Based on midstream valuation as a whole, investors clearly doubt the role these companies may play in the future. In my view, natural gas isn’t going away anytime soon and demand should continue to grow around the globe. However, changing the narrative may be more difficult despite what the statistics currently show.

One sign of the importance of natural gas, however, is that as part of the debt-ceiling deal, there was a pipeline permitting reform and the Biden administration also approved a permit for the much maligned and delayed Mountain Valley natural gas pipeline.

While MVP is a competing pipeline out of the Northeast, WMB actually said it has been it has been in favor of the project and will benefit from it once it comes online. The company noted that it has 500,000 acres of gathering dedication for EQT (EQT) when it bought acreage from Chevron (CVX), so it will be able to gather a lot of the gas that will run through the pipeline. It also said supplies to the North Carolina, Virginia and South Carolina markets were low and that it didn’t have any low-cost expansion opportunities, but with MVP it will have “very high margin, very high return expansion opportunities.” Of course, the legal battle over MVP seems never-ending and a court once again halted the pipeline even after a law moved the jurisdiction of the pipeline.

Valuation

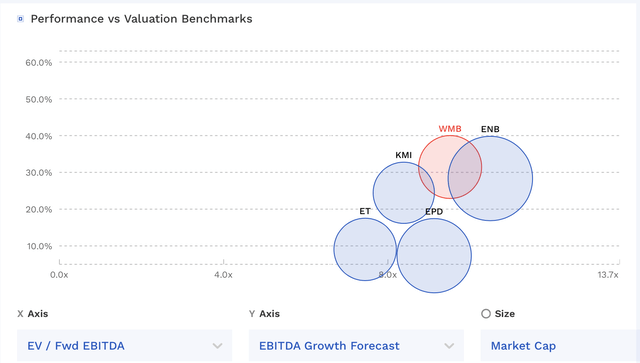

Turning to valuation, WMB trades at 9.6x the 2023 EBITDA consensus of $6.61 billion. Based on the 2024 EBITDA consensus of $6.71 billion, it is valued at 9.4x.

The stock has an attractive free cash flow yield of about 10.2% based on my 2023 projections calling for $4.25 billion in FCF. The stock has a yield of about 5.3%. As such, the dividend is very well covered and has plenty of room to grow.

WMB trades towards the higher end of where other large midstream operates are currently trading. Its status as a c-corp, as well as its ties to demand-pull natural gas customers are likely reasons for this. MLPs like Energy Transfer (ET) and Enterprise Products Partners (EPD) tend to trade at discounts due to their issuance of K-1s, while Kinder Morgan (KMI) has more ties to refined products. I recently wrote about KMI here.

WMB Valuation Vs Peers (FinBox)

Conclusion

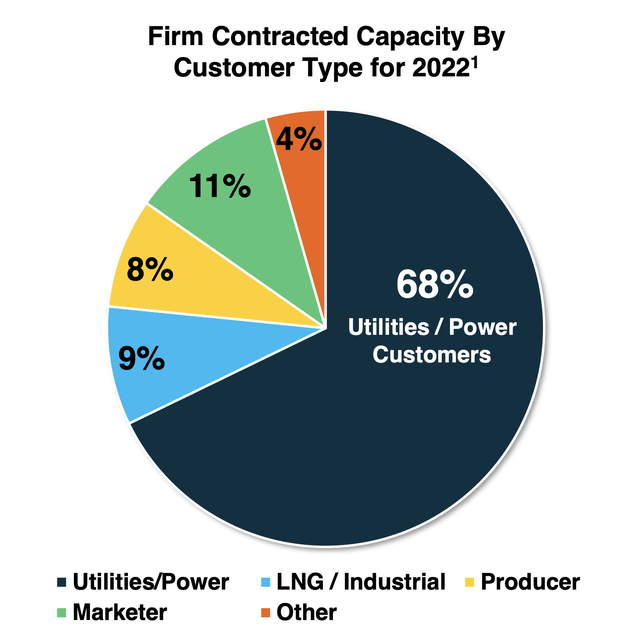

WMB owns arguably the most important and valuable natural gas pipeline system in the U.S. in Transco. If you believe natural gas is here to stay and will be an important part of the U.S. and world’s energy solution, then WMB is a good stock to own. The company offers solid growth, as it has some big projects that will come online later this year and next that will fuel both 2024 and 2025 results. Given its largely demand-pull customer base and fee-based contracts, the company is also defensive in nature in the medium term. Throw in a solid balance sheet and growing dividend, and WMB is a solid stock to own.

WMB Demand-Pull Customers (Company Presentation)

I continue to rate the stock a “Buy” with a target of $42. If it hits my target, that would be about an 11x multiple on the 2024 consensus.