TebNad

Offshore oilfield services stocks have become the hottest part of the energy sector. The latest bullish news was Equinor’s (EQNR) decision to exercise a 370-day option for the Transocean Encourage at $465 per day. The news caused Citi analysts to upgrade Transocean Ltd. (RIG) stock and raise its price target from $6.50 to $9.50.

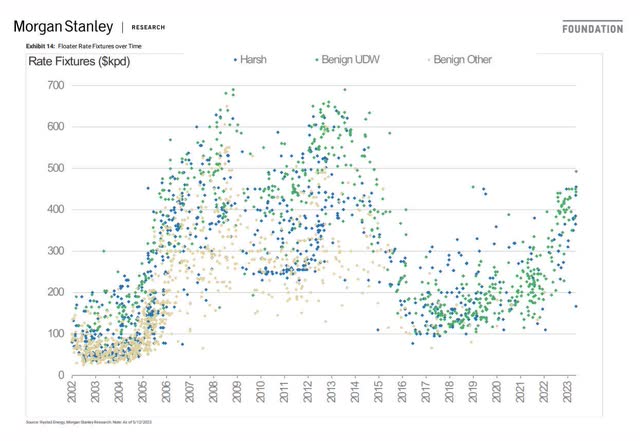

The deal further tightens the harsh environment floater market. Dayrates have been on an upswing but have room to run before approaching cyclical highs. The chart below shows a clear trend higher.

Morgan Stanley

Source: Morgan Stanley, May 25, 2023.

In light of today’s tight market for offshore rigs, we expect dayrates to climb above $500 over the next year.

Genesis Energy Has Been Left Out of the Party

Higher dayrates spurred a rally in offshore oilfield service stocks. Over the past three weeks alone, Transocean shares have jumped 27%. We discussed our bullish outlook for Transocean shares in an article published on June 21.

Increasing dayrates and the resulting higher equity values assigned to these companies imply that E&P capex will flow to the sector in increasing amounts over the next few years.

We agree. Today’s favored destination for the marginal capex dollar, the Permian Basin, may have years of production growth left, but consolidation among the basin’s major operators and concerns about inventory depletion have created an operating environment where producers aim to maintain flat to low-growth production profiles. By all appearances, the days of rapid U.S. shale growth rates are gone.

As U.S. onshore production enters maturity, deepwater offshore production will become the logical destination for oil majors’ capex. Within the U.S., that means heightened interest in the Gulf of Mexico.

Our newest holding, Genesis Energy, L.P. (NYSE:GEL), derives roughly half of its EBITDA from its Gulf of Mexico operations. It will therefore benefit when exploration and production activity in the Gulf increases its assets’ throughput volumes.

Despite its exposure to offshore drilling activity, GEL units have failed to participate in the sector’s recent rally. We believe its units are poised to outperform and that their current price represents an attractive buying opportunity.

GEL Will Benefit from Higher Offshore Drilling Capex

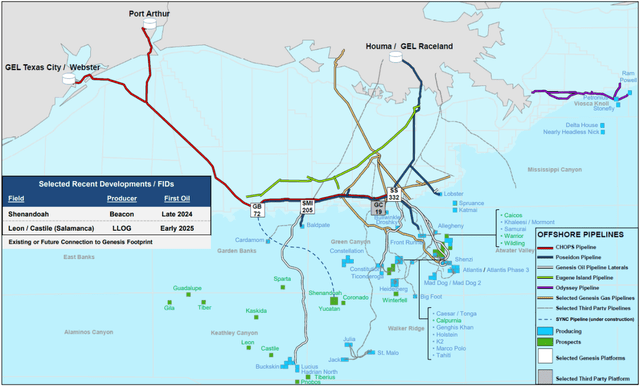

GEL operates more than 2,400 miles of pipelines and infrastructure that connect the central part of the Gulf with demand centers in Louisiana and Texas. The map below shows the company’s assets, as well as their proximity to producing and prospective acreage.

Genesis Energy

Source: Genesis Energy, June 2023 Investor Presentation.

Leasing activity among Gulf of Mexico producers has been robust, in line with pre-pandemic levels. The most recent lease sale, held on March 29, generated more than $263 million in high bids for 313 tracts covering 1.6 million acres of federal waters in the Gulf. A full 40% of these tracts were located in the central part of the Gulf, in proximity to GEL’s assets.

While Gulf of Mexico production growth has been modest over the past decade, GEL’s throughput volume growth rate has outpaced the region’s overall growth rate due to improved drilling efficiency and lower service costs among producers on its dedicated acreage, as well as the startup of 39 new fields since 2015, 27 of which tie back to existing infrastructure such as GEL’s.

GEL intends to continue growing its Gulf of Mexico volumes. Beginning in 2022, it launched a $550 million capex program to expand its existing 64%-owned Cameron Highway oil pipeline system and to construct its new 100%-owned SYNC pipeline. These midstream investments are intended to accommodate Gulf of Mexico producers’ sub-sea tie-backs, secondary recovery operations, and stand-alone developments. Both projects are expected to enter service by mid-2024. At that point, throughput volumes will ramp higher through 2025.

The company has already signed contracts representing 160,000 barrels per day of crude oil on a take-or-pay basis for the new assets. The deal implies an attractive 5-time EBITDA build multiple for the new assets.

Management is also pursuing separate deals that represent an additional 150,000 to 200,000 bpd of new volumes. Higher throughput from these deals will boost EBITDA and cash flow beginning next year.

In total, an additional 310,000 to 360,000 bpd of incremental throughput volumes would represent an increase of more than 50% for GEL’s current Gulf of Mexico throughput. Moreover, the company will have several hundred thousand barrels per day of unused capacity that can be contracted with minimal additional capex.

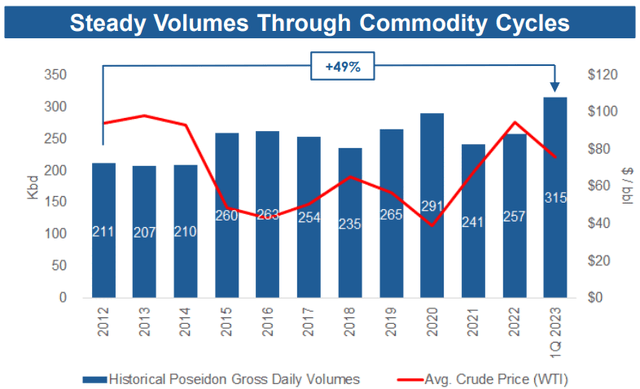

GEL’s Gulf of Mexico assets are high quality relative to most midstream assets. They are low-maintenance, feature take-or-pay contracts, and are subject to less competition than most onshore pipelines. Their production tends to be stable over many years, irrespective of oil price swings, due to the long-cycle nature of Gulf of Mexico production. Throughput volumes on GEL’s Poseidon system, shown below, offer an instructive example.

Genesis Energy

Source: Genesis Energy presentation at the 20th Annual Energy Infrastructure CEO & Investor Conference, May 23-24, 2023.

Assuming management can allocate capital for the benefit of equity owners over the coming years, we believe GEL units should trade at a higher multiple than the midstream sector average due in large part to the attractive returns and stable cash flow produced by its Gulf of Mexico assets.

Soda Ash Business Growth Will Add to Cash Flow

While GEL stands to benefit from higher capex directed toward offshore drilling, it also owns a growing and attractive alkali business. GEL operates the largest leasehold of trona ore reserves in the Green River, Wyoming, the region that holds the majority of the world’s accessible trona reserves. It mines the trona ore to produce low-cost soda ash.

GEL recently invested more than $350 million to expand its soda ash facilities, and the expansion is set to come online over the next few months. This operation accounts for one-third of GEL’s EBITDA. Like the company’s Gulf of Mexico segment, it is well-positioned for growth over the next few years.

GEL’s soda ash business generates an attractive 25% EBITDA margin as a percent of revenues. Like the company’s Gulf of Mexico transportation system, it should garner a higher multiple than the typical midstream operator.

Recent Cash Flow Deficit Causes Undervaluation

GEL’s cash flow has been strained in recent quarters. The company’s regular outspending of organic cash flow has increased the risk to its equity and has no doubt contributed to its units’ persistent undervaluation versus their long-term prospects.

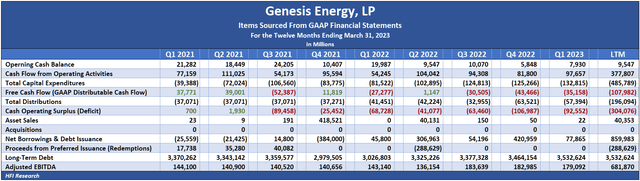

The table below shows that large capex commitments were the culprit behind GEL’s cash flow deficit, which has been in place since the third quarter of 2021. It has funded its cash flow deficit from organic cash flow and by taking on additional debt.

HFI Research

Despite the sustained cash flow deficit, EBITDA gains achieved since the period of higher capex began have reduced leverage to a comfortable 3.99-times. Management expects to end 2023 with a leverage ratio below 4.0-times.

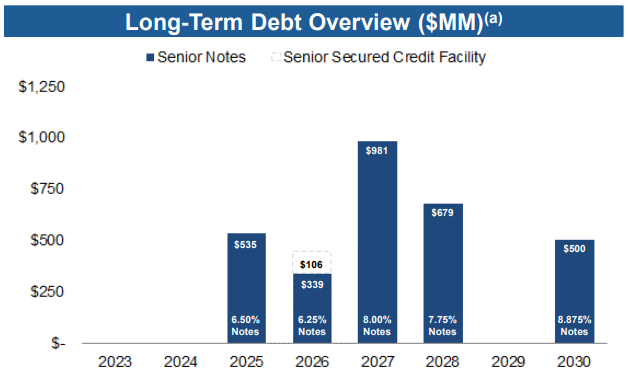

GEL has more than enough liquidity to see its growth projects through to completion. At the end of the first quarter, it had $725.6 million available on its $850 million revolving credit facility. Meanwhile, its debt maturities are manageable, as shown below.

Genesis Energy

Source: Genesis Energy, June 2023 Investor Presentation.

The company’s common distribution is currently covered 3.8-times by operating cash flow after preferred distributions. While the company’s capex has eliminated free cash flow for the time being, growth expenditures are set to trail off in the second half of 2024. At the same time, new projects will begin contributing to free cash flow. Management can then allocate excess free cash flow for the benefit of its common unitholders. The surging free cash flow will result in high distribution coverage, making the units more attractive to conservative MLP investors.

EBITDA, Cash Flow, and Intrinsic Value are Set to Increase

For 2023, management is guiding to EBITDA of $780 to $810 million. In the first quarter, GEL’s offshore segment operated at a full-year EBITDA run rate approaching $400 million. The new expansions should conservatively add $100 million of incremental EBITDA.

The rest of the business also operated at an approximately $400 million full-year EBITDA run rate. Management expects the soda ash expansion to add approximately $70 million to EBITDA on a full-year basis.

In total, these investments stand to increase GEL’s EBITDA to around $965 billion in 2025, the first year GEL’s asset expansions will contribute a full year to results.

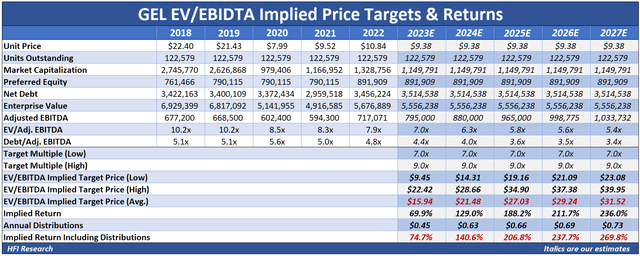

Our EV/EBITDA valuation assumes no debt is paid down and all preferred units remain outstanding. Assuming further that the company increases its distribution by 5% each year over the next five years, our EV/EBITDA valuation implies 74.7% total return upside from their current price of $9.38. Total return upside increases to 269.8% by 2027.

HFI Research

From a cash-flow-multiple perspective, if we start with the $965 million of EBITDA in 2025, then subtract interest expense of $240 million, preferred distributions of $100 million, and ongoing annual capex of $150 million, GEL should be able to generate $475 million of free cash flow in 2025 that can be allocated at management’s discretion. A 9-times free cash flow multiple yields an equity price per share of $34.88.

These valuations point to the huge appreciation potential for GEL units. Assuming management can reduce senior obligations and their associated cash outflows, value per share can go significantly higher.

Once GEL’s new Gulf of Mexico expansion is placed into service in 2024, management can allocate free cash flow toward paying down debt. Doing so will add to equity value, reduce equity risk, and enhance the company’s credit profile.

Alternatively, management can allocate free cash flow toward redeeming the company’s Class A Convertible Preferred units, which became convertible in 2022 after preferred unitholders elected to reset the preferred distribution rate from 8.75% to 11.24%.

The Class A Preferred units are redeemable at 110% of par value before September 1, 2024, and at 105% of par value thereafter. GEL recently amended its revolving credit facility to allow it to purchase the preferreds. Given the preferreds’ high cost, their redemption will add to cash flow and increase the intrinsic value of GEL common units.

Despite GEL’s dramatic upside potential, we’ve set our price target at our 2023 valuation of $16, implying 70.6% upside from the current price. However, our price target is conservative. We believe conservatism is called for in this case because management has a rather spotty capital allocation track record, at least until recent years. But after GEL’s growth projects are placed into service, risk to GEL’s equity will decrease and free cash flow will increase. At that point, we’ll revisit our price target for an upgrade.

Conclusion

At their current price, GEL units fail to reflect the bullish prospects for offshore drilling, GEL’s attractive economics, and its long-term growth prospects. The units trade at a 6.4% distribution yield, not far below the midstream sector average. The yield is particularly attractive given the likelihood of significant increases over the coming years.

In light of their income growth and appreciation potential, investors should buy Genesis Energy, L.P. units before growth investments start generating cash flow. Once they do, the equity’s prospects will be better appreciated by investors and the units are likely to trade at a significantly higher price.