PhonlamaiPhoto

Investment Rundown

Not long ago, FuelCell Energy Inc (NASDAQ:FCEL) posted its Q2 FY2023 results and I think there have been some good improvements that investors were hoping for. The revenues have been increasing at a very fast rate, over 100% YoY. But operating margins seem to be difficult to improve. With a history dating back to 1969 which was its founding year, FCEL has grown into a significant company in the fuel cell industry.

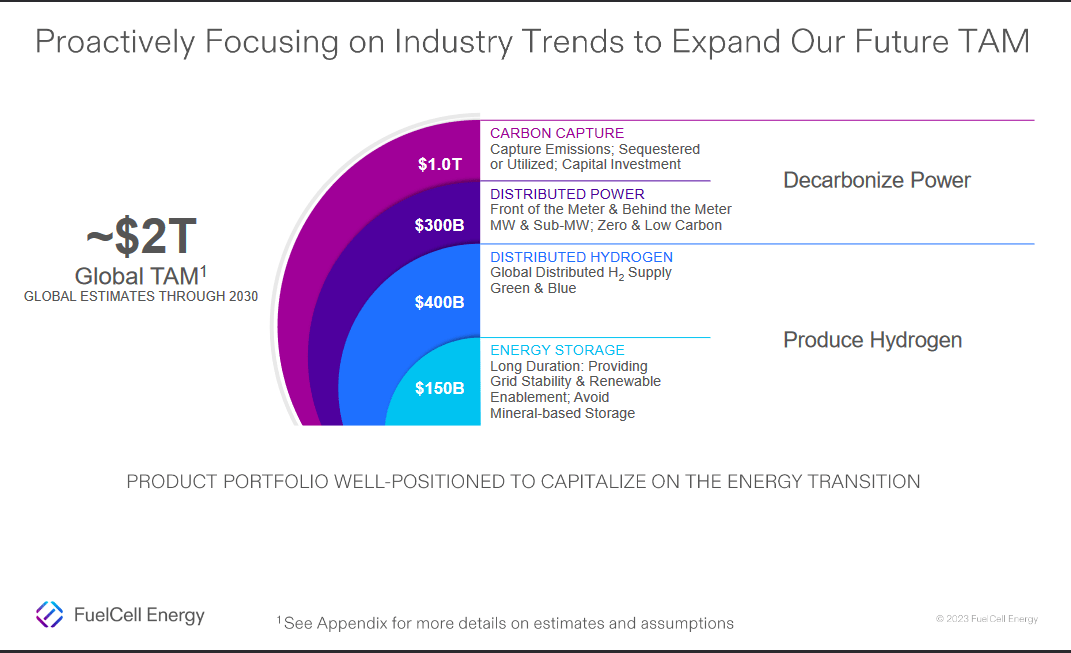

They primarily manufacture and also sell stationary fuel cell energy platforms that are meant to decarbonize power supplies and produce hydrogen as a result. The product line the company has is called “SureSource” with the largest one being SureSource 3000, capable of producing up to 1,200 kilograms of hydrogen each day. The market opportunity that FCEL is extremely large at $2 trillion. I think however that there needs to be some sort of fundamentals with the company until a buy case can be made. The industry does seem to lack basic positive margins but that will hopefully improve with time though. For the moment, I view FCEL as a hold.

Company Segments

The revenue streams of FCEL can be divided into three individual parts. The first one is Service Agreements, the second is Generation, and lastly Advanced Technologies. The first one is responsible for the largest amount of revenues, $26.2 million in Q2 2023, up from $2.6 million a year prior. The results seem to have been that a new module change was a result of the strong increase and the management noted they don’t expect higher module changes for the remainder of the year.

Company Product (Investor Presentation)

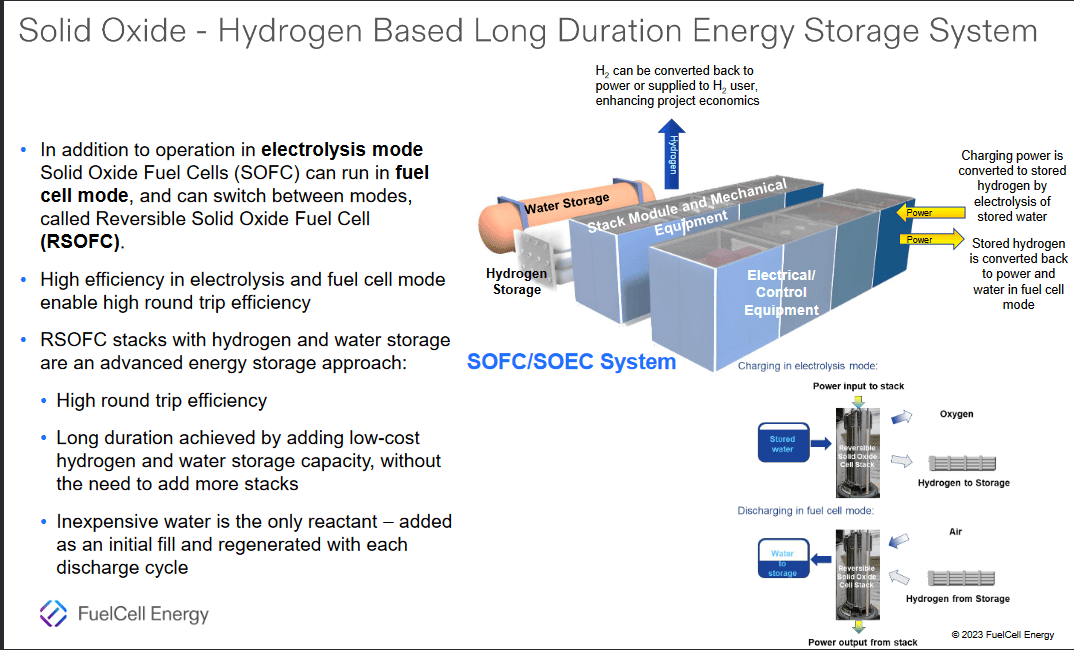

Besides the fuel cell energy platforms the company is producing, they are also involved in hydrogen-based long-duration energy storage systems. I find energy storage to be a very interesting market to get exposure to. For the coming 5 years there seems to be an over 14% CAGR expected for the industry, something that I think FCEL can capture in terms of revenue growth. Fueling this growth is the need to make renewable energy and hydrogen more profitable and not waste any of the energy that is produced. Being able to have mobile energy storage systems will also be a major technological step forward.

Markets They Are In

Being a part of the fuel cell industry, FCEL has a lot of pressure on themselves to deliver and satisfy the demand which has recently grown. The demand for hydrogen seems to not be slowing down and many seem to see it as a very reliable source of significant amounts of energy.

TAM (Investor Presentation)

FCEL themselves sees the TAM here to be worth around $2 trillion in total through 2030. With around $1 trillion of this coming from carbon capture. In terms of hydrogen, the distributed hydrogen market is expected to be $400 billion and act as a supply of green energy for the world.

Earnings Highlights

Looking at the last report from FCEL, a lot of growth was seen. The revenues landed at $38.3 million, up over 100% from Q2 FY2022 results of $16.4 million. The gross margins improved over the year and gross loss was $6.1 million, up from $7.3 million.

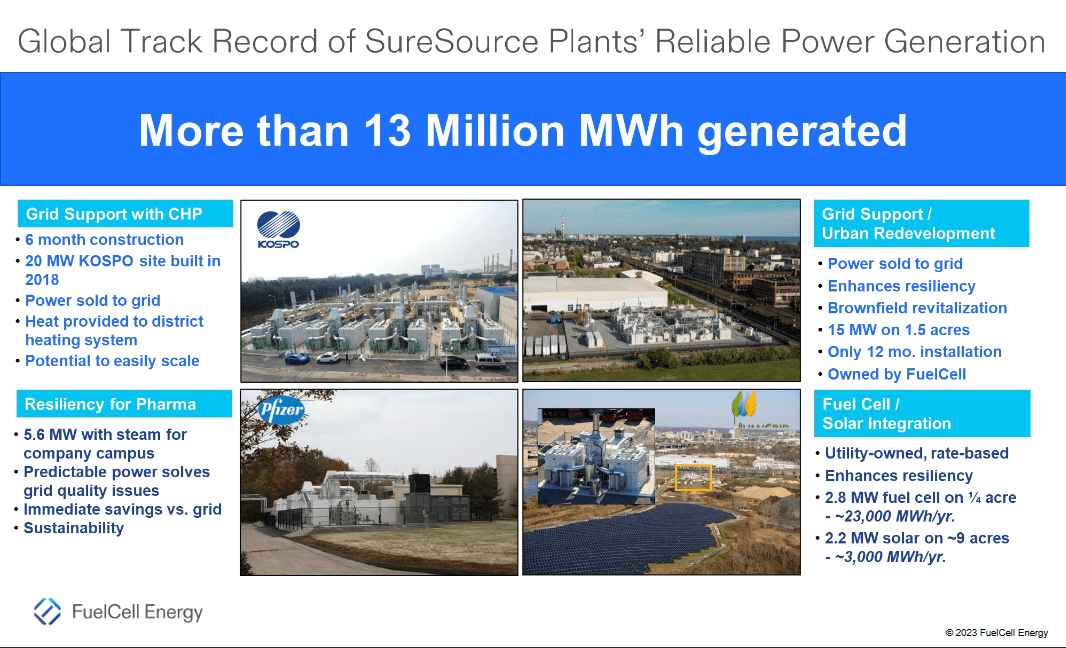

Company Growth (Investor Presentation)

So far FCEL has achieved some impressive goals like reaching 13 million MWh generated since the start of the company. But momentum is only starting and during Q2 FCEL made strong progress on some of the major projects it has, like the Toyota Project and the “Derby” project. Together these are valued at 16.8 MWh in total and bring FCEL closer to taking even more market share in the industry.

Risks

What I find to be a little risky with FCEL is first and foremost the fact that it’s yet to have a positive bottom line. This makes the share price trade loosely on optimism about when FCEL might be able to achieve a positive net margin.

The outlook for the industry does remain very positive but I think we might have to wait some time until FCEL posts its first positive EPS. In the meantime, there will be a lot of volatility in the share price I think but for investors staying for the long term, holding onto shares should pay off.

Besides the negative EPS, the decreasing backlog the company noted they had in Q2 2023 is worrying. It sits at just over $1 billion, down from $1.3 billion a year prior. That was a decrease of $300 million and FCEL didn’t generate that much in 2022, it was $130 million. To me, that seems like they have gotten cancellations, which could be caused by the economic environment being more constrained this time around. Interest rates are making an investment into what FCEL has more difficult for customers.

Final Words

I think that having exposure to green energy companies will be a priority for many investors in the coming years. Sometimes getting in early pays off exponentially in the long run, but for FCEL I am not quite convinced yet that it offers a strong entry point right now. The backlog dropped 30% YoY but the revenues did increase significantly.

My worry with FCEL is that EPS will remain negative for longer than what investors are comfortable with and that will result in a share price that trades volatile but also slowly downwards. For investors looking for a fuel cell company that at least has the financial position to keep on growing then I think FCEL is a good option. A negative net debt puts them ahead of companies like Bloom Energy Corporation (BE), a company also operating with fuel cells, but rather solid-oxide fuel cell systems instead. In conclusion, to FCEL, I think currently they are a hold. The future market prospects seem too good to not have exposure to and I feel it’s inevitable that FCEL will grow with it. But without positive EPS it’s very difficult to make a buy case now too.