Written By Germán & Co, Apr 29

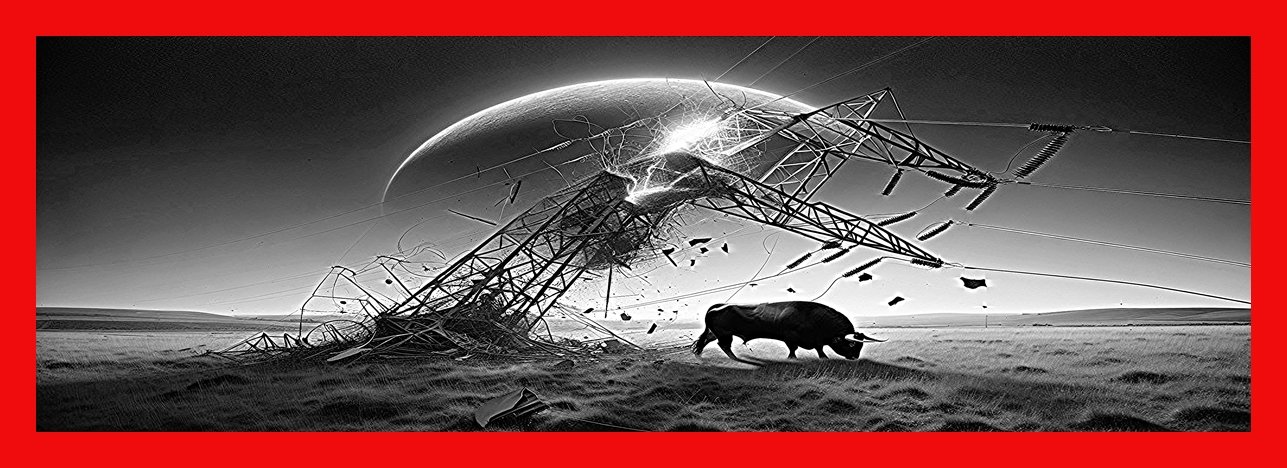

It was a Black Monday that etched itself into the annals of history. Just yesterday, the long-anticipated nightmare of a grid failure became a chilling reality for countless souls in Spain and Portugal. The lights flickered out instantly—not for a fleeting moment, but for agonizing hours that felt like an eternity.

Airports fell into an eerie hush as flights were abruptly halted mid-air. Hospitals raced against time, their life-support systems gasping for breath on dwindling generator fuel. Trains stood frozen in their tracks, while businesses closed their doors, engulfing entire cities in an oppressive darkness.

Authorities were quick to quell fears of a cyberattack. Still, the unsettling truth was far more alarming: the collapse was rooted in a deep-seated instability within the Iberian grid—a structural frailty that no digital fortress could defend against.

This wasn’t a mere regional hiccup but a stark wake-up call to the developed world. No matter how affluent, advanced, or interconnected, nations that overlook the bedrock of their energy infrastructure flirt with disaster.

So, what’s the elusive solution? Battery storage emerges as the holy grail of the electric system. While no single technology holds all the answers, batteries—when deployed with the right power, duration, and location—become the vital link between weather-dependent generation and round-the-clock demand. With Spain and Portugal blessed with abundant sunshine and wind, and now united in a post-blackout political resolve, the pressing question shifts from whether to invest in substantial storage to how swiftly it can be accomplished.

Failing to address this will risk turning yesterday’s darkness into the new normal for tomorrow.

Global Energy News Update – April 29, 2025

Gratitude is our heartbeat.

Inflation bites, platforms shift, and every post now fights for survival. We’re holding the line with premier tools, licensed software, and striking images—but we can’t do it alone.

Help us stay loud:

One click: Like, repost, or share on X, LinkedIn, or Energy Central—free, private, game-changing.

One gift: PayPal gjmtoroghio@germantoroghio.com | IBAN SE18 3000 0000 0058 0511 2611 | Swish 076 423 90 79 | Stripe (donation link).

Each gesture—tiny or titan—powers the words you read.

Thank you for keeping the flame alive.

https://x.com/Germantoroghio/status/1915515888515899541

All rights reserved by Germán & Co. Reproduction is strictly prohibited.

Why Europe’s blackout has turned digital panic into real-world urgency?

By Germán & Co.

Karlstad, Sweden | April 28, 2025

________________________________________

On the morning of April 28, 2025, Iberia went dark. Within minutes, a rival narrative spread faster than the voltage collapse itself:

“The Day the Grid Failed… In five catastrophic seconds, 60% of Spain’s electricity generation vanished. By noon, the collapse had rippled across borders: Portugal’s lights flickered out, Belgium’s nuclear reactors went silent, and Germany’s industrial heartland ground to a halt.”

The quote—taken from a blog post penned by Germán & Co. and published on Energy Central, titled “The Coming Electricity Crisis…”—ricocheted through social media feeds. Yet by early afternoon, the facts on the ground told a more limited story: the outages were confined to Spain, Portugal, and parts of southwest France. In Antwerp and Dortmund, the lights still burned bright. This gap between lived experience and digital hyperbole sets the stage for the following investigation. It poses three urgent questions: What happened? Why were we unprepared? What might come next?

________________________________________

I. A Crisis Foretold

This was not an isolated glitch. It culminated years of ignored warnings, cautious forecasts, and political hesitation.

On March 29, 2024, this publication issued a stark alert in “The Coming Electricity Crisis”, warning of the widening chasm between soaring energy demand and stagnant infrastructure. The warning was clear: global grid systems are under pressure they can no longer bear.

Just weeks later, on April 13, a viral post titled “How Imminent Is a Worldwide Electrical Outage?” exposed the vulnerabilities of the U.S. power grid. The article sparked fierce debate among utilities experts, climate advocates, and market analysts.

As southern Europe plunged into darkness, those debates took on terrifying new urgency. This time, they aren’t theoretical.

It’s happening. Iberia went dark. Within hours, a rival narrative, quoted at length below, spread faster than the voltage collapse itself:

*“The Day the Grid Failed… In five catastrophic seconds, 60 % of Spain’s electricity generation vanished… By noon, the collapse had rippled across borders: Portugal’s lights flickered out, Belgium’s nuclear reactors went silent, and Germany’s industrial heartland ground to a halt.”

This dissonance between lived reality and digital hyperbole is the entry point for the following investigation. It asks three questions:

This was not an isolated incident. It culminated years of warnings—ignored, downplayed, or met with bureaucratic inertia. On April 13, a viral post titled “How Imminent Is a Worldwide Electrical Outage?” laid bare the United States’ vulnerabilities, sparking fierce debate among experts. Today, Europe’s nightmare has given those debates terrifying urgency.

“This is not madness,” said Dr. Elena Marquez, a grid analyst at the European Energy Agency. “It is the predictable result of a system pushed to its limits. We were warned. We did not listen.”

________________________________________

II. Warnings Ignored

Long before today’s blackout, the signs were there. In 2021, the International Energy Agency (IEA) issued its Electricity Market Report, forecasting a 5% annual surge in global demand—a pace unseen since the 1970s. Eight months later, Russia’s gas squeeze exposed Europe’s dependency on volatile imports. Yet the grid remains starved of investment, and regulators cling to outdated models.

“The IEA’s warnings were a fire alarm in a burning house,” said Michael Webber, an energy scholar at the University of Texas. “But policymakers treated them like background noise.”

Last week, The Washington Post echoed the alarm, noting that U.S. grid upgrades lag decades behind China’s. Now, Europe’s crisis has made the theoretical terrifyingly real. (1)

2. The Blog That Lit the Fuse

The April 13 blog post—a 12,000-word manifesto viral post published in Energy Central—was penned by Germán & Co. Carlos Mendez, a former grid operator turned whistleblower, raised significant concerns by revealing how the aging U.S. transmission infrastructure and insufficient maintenance funding could potentially lead to a nationwide blackout.

“We’re playing Russian roulette with the grid,” Mendez wrote. “Every solar panel we add without storage, every wind farm we build without inertia, is another bullet in the chamber.”

The post sparked a firestorm of debate. Seasoned energy executives squared off against renewable idealists, while Wall Street analysts sounded alarms over “stranded assets” tied to fossil-heavy grids. But today’s collapse of Europe’s power system has changed the conversation—from if to when.

________________________________________

III. Anatomy of a Pan-European Collapse

1. Five Seconds to Darkness

Spain’s grid operator, Red Eléctrica de España (REE), reported the unthinkable: a near-total loss of 60% of generation capacity in five seconds. The trigger? A “dramatic loss of tension”—grid jargon for voltage collapse.

Here’s how it unfolded:

-

11:20 a.m.: A sudden drop in wind output off Spain’s Galician coast, compounded by cloud cover slashing solar generation in Andalusia.

-

11:22 a.m.: Frequency oscillations began—wild swings between 48 Hz and 52 Hz—as the grid struggled to balance supply and demand.

-

11:23 a.m.: Protections failed. Automated circuit breakers, designed to isolate troubled zones, reacted too slowly, causing cascading failures that raced through interconnectors to France and Portugal.

“The system’s inertia—its ability to absorb shocks—was gone,” said REE engineer Ana Torres. “Renewables don’t provide that inertia. When the crash came, there was nothing to cushion the blow.”

2. The Domino Effect

Spain’s collapse triggered a continent-wide crisis:

-

Portugal: Dependent on Spanish imports, its grid collapsed within minutes.

-

Belgium: The Doel nuclear plant, supplying 15% of the country’s power, automatically shut down to avoid damage.

-

Germany: Wind farms in the North Sea disconnected, overloading coal plants in the south.

“Europe’s grid is a house of cards,” said Dr. Klaus Schmidt of Germany’s Fraunhofer Institute. “One nation’s failure becomes everyone’s emergency.”

________________________________________

IV. What We Know—and What We Don’t

1. The Government’s Silence

Spain’s Socialist-led coalition has refused to speculate on the causes, citing an ongoing investigation. But leaked REE documents reveal glaring vulnerabilities:

-

Underinvestment: Spain’s grid expenditure fell 18% between 2020 and 2023, even as renewable capacity surged by 34%.

-

Storage Deficit: Battery capacity is 5 GW, less than half the 12 GW needed to buffer renewable dips.

“They prioritized megawatts over resilience,” said opposition leader Alberto Núñez Feijóo. “Now Spaniards are paying the price.”

2. The Oscillation Hypothesis

The leading theory is system oscillation—a destabilizing fluctuation in voltage or frequency. Renewable-heavy systems use complex algorithms to mimic inertia, unlike traditional grids, where coal and nuclear plants provide inherent stability. When those digital safeguards falter, collapse follows.

“It’s like replacing a symphony orchestra with a synthesizer,” said Dr. Lucia Ferrara, a grid dynamics expert. “If the synthesizer glitches, the music stops.”

________________________________________

V. Global Lessons, Local Failures

1. Chile 2019: The Perils of Centralization

Chile’s nationwide blackout—triggered by a single transmission line failure—offers a cautionary tale. “Centralized grids are brittle,” said Andrés Gómez-Lobo, a Chilean economist. “But Europe made the same mistake with renewables, building hubs without redundancy.”

2. U.S.-Canada 2003: Ghosts of Human Error

The 2003 blackout, which cut power to 50 million, began with a tree branch in Ohio and a software bug. Today, Europe’s crisis blends old and new risks: analog infrastructure meets digital complexity.

“We’re repeating history,” said John Moura of NERC. “Systems fail when humans and machines miscommunicate.”

V. The Path Forward: Reinvention or Ruin?

1. The Storage Imperative

“Batteries are the missing link,” said REE CEO Beatriz Corredor. Spain plans to triple storage capacity by 2026, but critics call this “too little, too late.”

2. Synthetic Inertia: A Digital Lifeline

Startups like Spain’s Ingeteam are racing to deploy AI-driven systems that stabilize grids by mimicking traditional inertia. Pilot projects in Catalonia show promise—but scaling remains a hurdle.

3. Decentralization: Power to the People

Barcelona’s citizen-led microgrids, which kept lights on in 15 neighborhoods during the blackout, offer a blueprint. “We can’t trust national grids,” said activist Clara Ramos. “We’re building our own future.”

________________________________________

Epilogue: A Continent at a Crossroads

Europe’s blackout is a harbinger, not an anomaly. The WSJ editorial board noted today: “The crisis is a referendum on modernity itself—can we power our future without destroying our present?”

The answer lies in humility. The renewable transition demands more than solar panels and wind turbines; it requires grids that bend but don’t break, regulators who adapt faster than disasters strike, and citizens trusted with the truth.

In the darkness of April 25, one lesson shines clear: The lights won’t stay on unless we open our eyes. He had yet to witness the seventeen artificial roses blossoming from his blood in the plaza. The gypsy Melquíades had not yet returned with his parchments of miracles.

Now we wander like blind men through a labyrinth of our own design, our fingertips raw from brushing against walls that shift by the hour. We yearn for the certainty that once guided letters from lover to beloved across impossible distances, yet the compass needle spins madly, mocking our desperation. The boundary between right and left has dissolved like sugar in the bitter coffee of existence—a minor tragedy beside the greater dissolution that follows.

In this perpetual twilight, white no longer stands apart from black, nor light from shadow. The grey mist that descended upon Macondo during those five years of unrelenting rain has settled permanently in our souls. We peer at moral questions through their haze, unable to discern their accurate outline, while ancestral ghosts whisper counsel that fades before we can grasp it.

And here lies the most terrible revelation—an heirloom of despair passed down through generations: we have forfeited even the sacred right to choose. Our freedom languishes in the same distant chamber where undeliverable letters are heaped, forgotten in dusty corners where lamps never glimmer. The illusion of choice gleams before us like the golden fish Úrsula once dreamed of, always visible yet forever beyond reach, condemned to circle in waters too deep for our understanding.

If we remember when we complained about the postal service, we did so because we did not know what the future would bring; it was impossible to imagine that ZIP codes would impose order on chaos and that envelopes—sealed with a quick lick and a spark of hope—would carry our faith across continents.

The postal network, conceived by visionary officials and traced daily by letter carriers who mapped the world with every route, served as an invisible compass: a shared spell through which nations unable to understand one another knew precisely how to be found. Indeed, in every odd-numbered address lay a promise, in every even number, a certainty.

________________________________________

References:

(1) The Washington Post has highlighted that the U.S. is significantly behind China in upgrading its power grid. The issue has become increasingly urgent as Europe’s energy crisis has underscored the vulnerabilities of outdated infrastructure. The U.S. grid was never designed to handle the current demand for renewable energy, and regulatory roadblocks have further hindered progress. For instance, the interconnection queue, which allows new solar, wind, or fossil fuel projects to connect to the larger electricity grid, has experienced significant delays. Integrating new renewable energy sources into the grid has made it challenging.

Moreover, the U.S. offshore wind industry is still in its early stages compared to Europe and China. Recent political decisions, such as a new permitting pause, have further slowed progress in this sector. Experts agree that a better-designed grid could significantly increase the penetration of renewable energy, potentially reaching 60 to 70 per cent of total energy production. However, without substantial upgrades and policy changes, the U.S. may continue to lag behind other nations in this critical area.

China’s wind and solar energy capacity has surpassed thermal power for the first time, marking a significant milestone in its renewable energy development. In the first quarter of 2025, China added 74.33 million kilowatts of new wind and photovoltaic power capacity, bringing the total installed capacity to 1.482 billion. This surpasses the installed capacity of thermal power, which stands at 1.451 billion kilowatts. Despite this achievement, coal remains a significant part of China’s energy mix, with the country beginning construction on 94.5 gigawatts of coal power projects in 2024, accounting for 93 per cent of the global total. China’s coal production has steadily increased, reaching 4.8 billion tons in 2024, up from 3.9 billion tons in 20202.

You can’t possibly deny me…

Have a wonderful day filled with good health, happiness, and love…

In December 2023, Energy Central recognized outstanding contributors within the Energy & Sustainability Network during the ‘Top Voices’ event. The recipients of this honor were highlighted in six articles, showcasing the acknowledgment from the community. The platform facilitates professionals in disseminating their work, engaging with peers, and collaborating with industry influencers. Congratulations are extended to the 2023 Top Voices: David Hunt, Germán Toro Ghio, Schalk Cloete, and Dan Yurman for their exemplary demonstration of expertise. – Matt Chester, Energy Central

Gratitude is our heartbeat.

Inflation bites, platforms shift, and every post now fights for survival. We’re holding the line with premier tools, licensed software, and striking images—but we can’t do it alone.

Help us stay loud:

One click: Like, repost, or share on X, LinkedIn, or Energy Central—free, private, game-changing.

One gift: PayPal gjmtoroghio@germantoroghio.com | IBAN SE18 3000 0000 0058 0511 2611 | Swish 076 423 90 79 | Stripe (donation link).

Each gesture—tiny or titan—powers the words you read.

Thank you for keeping the flame alive.

https://x.com/Germantoroghio/status/1915515888515899541

You can’t possibly deny me…

Have a wonderful day filled with good health, happiness, and love…

All rights reserved by Germán & Co. Reproduction is strictly prohibited.

Global Energy News Update – April 29, 2025

📌 U.S. Climate & Energy Policy: Empire Wind and Wider Offshore Review

-

Apr 26 – 29: New York’s federal district court set an expedited schedule, with a May 10 hearing on Attorney General Letitia James’ motion for a preliminary injunction against the Interior Department’s suspension of Equinor’s Empire Wind 1 permit.

-

Apr 28: The “Wind Works” coalition staged rallies in more than 40 U.S. cities; organizers claimed over 120 000 participants.

-

Apr 29: Interior Secretary Doug Burgum opened a 30-day public-comment docket covering all 14 pending Outer Continental Shelf wind leases, citing “economic resilience and grid stability” as review criteria.

📌 Renewables & Nuclear: Companies Re-position, Finland Leads on SMRs

-

Ørsted (Apr 26) temporarily halted on-water construction at its South Fork project and began a formal “pause-and-re-scope” process for its entire U.S. pipeline.

-

Finland (Apr 28): Parliament passed a fast-track licensing act for small-modular reactors (SMRs); first commercial SMR now targeted for 2032 instead of 2035. Sweden’s government announced SEK 4 billion in credit guarantees for domestic SMR developers the same day, while Italy’s ENEL unveiled a public-private SMR venture.

-

IEA (Apr 29) cut its 2025 global-renewables deployment forecast by 3 % versus the April 20 outlook, blaming U.S. policy uncertainty and rising bond yields.

📌 Fossil-Fuel Markets & Investment: Oil Rises, LNG Deals Multiply

-

Brent crude settled at $74.15 / bbl on Apr 29, up nearly $2 since Friday, after a Houthi drone strike briefly threatened Saudi Arabia’s Ras Tanura terminal.

-

ExxonMobil (Apr 26) won six new deep-water leases in the central Gulf of Mexico auction; Chevron (Apr 27) told investors it will double Permian cap-ex in H2 2025.

-

QatarEnergy & ConocoPhillips (Apr 29) signed a 20-year LNG supply pact with Germany’s Hanseatic Energy Hub, first cargos due 2029.

📌 Electric-Vehicle Market Dynamics: Incentive Uncertainty Spreads

-

Ford (Apr 26) began a voluntary-layoff program for 900 staff tied to the delayed Tennessee “BlueOval City” battery campus.

-

GM–Honda (Apr 27) agreed to broaden their Ultium partnership to share U.S. assembly lines if federal EV credits remain curtailed.

-

Tesla (Apr 28) paused site work on its planned Oregon cathode refinery; the company offered vendors the option to shift supply contracts to its Austin facility.

-

BYD (Apr 29) completed foundational work at its Szeged, Hungary plant less than eight months after breaking ground; Volkswagen confirmed it will “slow the ramp” of its Chattanooga EV expansion until at least Q4 2026.

📌 Geopolitical Energy Developments: Brazil & India Under Pressure

-

Brazil (Apr 28): The Supreme Federal Court agreed to hear an injunction request from environmental NGOs seeking to re-suspend Petrobras’ Amazon-mouth drilling. Petrobras has mobilised the drillship Onyx Star but cannot spud until the court rules.

-

India (Apr 29): Record-early heat-wave demand drove an 8 GW shortfall across northern states; the Power Ministry authorised emergency LNG imports and extended grid-code exemptions for captive coal plants through July.

📌 Economic & Market Trends: Diverging Indexes, Gas Prices Climb

Week-to-date change (Apr 19-29) NotesS&P Global Clean Energy Index-1.8 %Falls to a two-year low as investors re-price U.S. renewables riskS&P 500 Energy Sector Index+1.3 %Buoyed by higher oil prices and upstream cap-ex announcementsHenry Hub Nat Gas$3.45 / MMBtuHighest since Oct 2024 on hotter U.S. summer forecastsDutch TTF Gas€26 / MWhStable-to-soft; EU storage ~65 % full, well above 5-year average

Traders are watching the May 1-2 Federal Reserve meeting; futures now price one 25 bp cut in September, far less than the four cuts expected at the start of 2025, a shift that weighs on capital-intensive clean-tech projects.

Sources:

-

Reuters – various energy & policy dispatches, Apr 26-29, 2025

-

Bloomberg – market closes & Fed-watch, Apr 29, 2025

-

Financial Times – Ørsted pause; Finnish SMR law, Apr 26 & 28, 2025

-

IEA – “Renewable Energy Market Update: Addendum,” Apr 29, 2025

-

Wall Street Journal – U.S. oil-company capital-ex moves, Apr 26-29, 2025

-

Automotive News – Ford, GM-Honda, Tesla developments, Apr 26-28, 2025

-

Estado de São Paulo / Reuters Brazil – Petrobras Amazon legal fight, Apr 28-29, 2025

-

Economic Times (India) – Grid stress & LNG imports, Apr 29, 2025