- Terrestrial Energy Goes Public with Net of $280 Million

- SMR Developers Get Ready to Submit License Applications to NRC

- DOE Re-Issues $900 Million Solicitation For SMRs

- INL Seeks Industry Sponsors for $5-10 Million to Invest in Nuclear Startups

Terrestrial Energy Goes Public with Net of $280 Million

- Terrestrial Energy merged with a special acquisition company

- The firm expects to net $280 million from the deal

The combined entity of Terrestrial Energy and HCM II Acquisition Corp expects to list on Nasdaq under the symbol ISMR. Proceeds will be used to accelerate commercial deployment of Terrestrial Energy’s IMSR technology and to pay transaction expenses. Prior to the SPAC merger, Terrestrial Energy had raised $94 million, according to PitchBook.

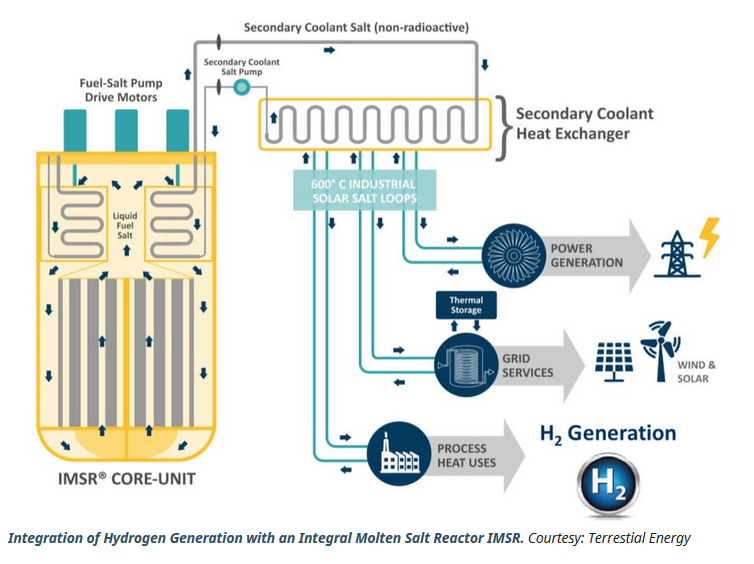

The ticker IMSR is a reference to Terrestrial Energy’s design of small modular reactor (SMR), which it calls an integral molten salt reactor. The startup is targeting a range of markets, including electric power, data centers, and industrial applications that require process heat.

The transaction will provide approximately $280 million in gross proceeds consisting of $50 million in common stock PIPE commitments at $10.00 per share from new non-affiliated fundamental institutional investors, and approximately $230 million of cash held in HCM II Acquisition Corp.’s (HCM II) trust account before potential redemption.

HCM II Acquisition Corp. (HCM II) is a blank check company formed for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. HCM II’s Class A ordinary shares and warrants are listed on the NASDAQ under the ticker symbols “HOND” and “HONDW”, respectively.

HCM II’s management team is led by Shawn Matthews, its Chairman of the Board and Chief Executive Officer, and Steven Bischoff, its President and Chief Financial Officer. HCM II’s Board of Directors includes Andrew Brenner, Michael J. Connor and Jacob Loveless.

Cantor Fitzgerald & Co. is acting as exclusive capital markets advisor and sole PIPE placement agent. King & Spalding LLP is acting as legal advisor to HCM II. Bryan Cave Leighton Paisner LLP is acting as legal advisor to Terrestrial Energy. DLA Piper LLP (US) acted as legal counsel to the placement agent, Cantor Fitzgerald & Co.

Key Markets for the IMSR

Terrestrial Energy’s IMSR plant technology is focused on several growth sectors, including data center power supply, industrial heat and power, grid power, and the production of advanced low-carbon fuels and materials.

The company has multiple partnerships and agreements with Westinghouse Fuels, Energy Solutions, Schneider Electric, the U.S. Department of Energy (DOE), and Argonne National Laboratory, among others.

Texas A&M University recently selected Terrestrial Energy to partner on the construction of a commercial IMSR plant at the Texas A&M RELLIS campus, contributing to the university’s goal of achieving 1 GW of generating capacity at the site by the mid-2030s.

Progress with Canadian and US Nuclear Regulatory Agencies

In 2023 the Canadian Nuclear Safety Commission (CNSC) completed its programmatic Vendor Design Review of the IMSR plant design, the first Generation IV reactor design to complete Canada’s CNSC Vendor Design Review, and a historic industry first for a nuclear plant powered with molten salt reactor technology.

The company’s Nuclear Regulatory Commission (NRC) engagement commenced in 2016 and includes a successful inter-agency joint review of the IMSR technology under a CNSC-U.S. NRC Memorandum of Cooperation and concurrent with the CNSC’s completion of the Vendor Design Review.

About Terrestrial Energy’s IMSR

Terrestrial Energy’s reactor core is designed to be entirely replaced every seven years, in part to head off some of the problems earlier molten salt reactors experienced like corrosion. The reactor core includes not only the fuel and graphite modulators that regulate the speed of the fission reactions, but also the heat exchangers and pumps that keep the salt cool and flowing.

The company’s IMSR plant design, consisting of two operating IMSRs, has an 822 MWth / 390 MWe capacity. Terrestrial Energy’s IMSR technology is differentiated from legacy nuclear technology through its use of molten salt reactor technology, which offers high efficiency and inherently safe operation.

Terrestrial Energy’s IMSR plants are designed to make use of low-cost, readily available Standard-Assay Low Enriched Uranium (LEU enriched to under 5% U235) fuel, enabling secure and scalable fuel supply chains necessary for widespread fleet deployment.

Terrestrial Energy believes the use of LEU fuel is a key competitive advantage given significant challenges to the commercial supply of High-Assay Low- Enriched Uranium (HALEU is enriched to between 15% and 20% U235) due to geopolitical tensions.

There are many proposals to build commercial-scale molten salt reactors, but to date, none has been built. The basic technology was invented in the 1950s at Oak Ridge National Laboratory. However, these designs did not proceed to commercial implementation.

Terrestrial Energy isn’t the first SMR startup to use a SPAC — Sam Altmans Oklo completed its deal in 2024. However, X-Energy exited a SPAC deal shortly after the termination of NuScale’s project in Idaho and reverted to being a privately held company.

& & &

SMR Developers Get Ready to Submit License Applications to NRC

(WNN) Oklo Inc and Deep Atomic Inc are preparing pre-application engagements with with the Nuclear Regulatory Commission (NRC) for their respective projects: Oklo Inc is engaging with the regulator ahead of an application to construct and operate an Aurora Powerhouse at Idaho National Laboratory, while Deep Atomic is planning to apply for design certification of its MK60 small modular reactor.

NRC pre-application activities mainly occur through three processes: white papers/technical reports, topical reports, and readiness assessments. These documents request NRC feedback on technical, programmatic, regulatory, or administrative topics that may involve challenging issues, describe new/novel approaches, involve policy issues that require Commission involvement, or are technical areas that applicant/vendors have little experience.

SMR Developers Engage With US Regulators

NRC policy regulating advanced nuclear reactors encourages potential applicants to engage with its staff “early and often” in the design process to help minimize complexity and add stability and predictability in the licensing and regulation process.

Oklo is engaging with the NRC through a Pre-Application Readiness Assessment for the combined license application (COLA) it intends to submit later this year. The readiness assessment allows NRC staff to review and familiarize themselves with Oklo’s licensing materials ahead of the full application so that both sides can prepare for an efficient and cost-effective review

The Readiness Assessment will begin later this month, and will address the content of the first phase of Oklo’s COLA submission, which will include information on the siting and environmental portions of the application. Oklo plans to submit a formal COLA later this year, with plans for follow on-applications for an order pipeline of 14 GW.

The Aurora powerhouse is a fast neutron reactor capable of producing electricity – up to 50 MWe – or heat. Oklo received a site use permit from the US Department of Energy in 2019 to build and operate a prototype reactor at Idaho National Laboratory and is working towards site characterization for the first-of-a-kind plant.

The firm plans to submit its combined license application after 10/01/25 which is the date at which the NRC’s planned 55% hourly reduction in fees takes place for applications by developers of advanced reactors.

Oklo’s first reactor, which is to be built at a site on the Idaho National Laboratory, will use HALEU fuel derived from the EBR II project. While there is enough for a first fuel loading, like other advanced reactors developers, the firm is facing a challenge to secure enough fuel for future new builds especially at multi-unit sites supporting data centers.

It will be 2030 or later before production of HALEU fuel by US suppliers is up to speed. Oklo noted in the investor briefing that it is also building a fuel recycling plant at the Idaho lab which will provide the fuel for its commercial installations.

Oklo said in an investor briefing last week that it has expanded the power rating of its advanced reactor to 75 MW to meet requirements for power by large data center customers. The firm said in the briefing the change will take place, “without any notable technical, design, or regulatory complexities.”

The firm’s ambitions to build out 14 GW of power for multiple customers translates into about 190 of the 75 MW units. The firm’s business model is one of build, own, and operate the reactors at customer sites. Each reactor the firm builds and operates becomes a continuous revenue stream for the firm. The firm said in its briefing that the larger reactor design is more fuel efficient and allows its customers to achieve needed electrical generation with fewer reactors.

Deep Atomic Design certification

Deep Atomic formally notified the NRC in a letter dated 03/01/25 of its intent to begin the Pre-Application Process for the Design Certification of its MK60 SMR. The MK60 SMR uses pressurized light water reactor technology, and is designed to produce 60 MW of electricity. It is specifically intended to cater for data centers. The Zurich, Switzerland-headquartered company says its target date for the project (series manufacturing) is the fourth quarter of 2029.

“We are looking forward to working collaboratively with the NRC to ensure a transparent, efficient, and thorough review process throughout all stages of the licensing process,” Deep Atomic CEO William Theron said in the letter to the NRC.

Deep Atomic initiated the consultation with the NRC in October last year. It aims to submit its regulatory engagement plan this coming July and the design certification application by the fourth quarter of 2027. It told the NRC that it also intends to submit an application for an Early Site Permit – which certifies that a site is suitable for the construction of a nuclear power plant from the point of view of site safety, environmental impact and emergency planning – by the fourth quarter of 2027, but without naming a proposed site. Eventually, the firm will have to select a location for the ESP.

Deep Atomic recently issued a white paper on its vision for co-location of SMRs at data centers to provide a fully integrated, optimized power and cooling generation solution. The company says it views the data center and the SMR as parts of one integrated system rather than two separate entities.

& & &

DOE Re-Issues $900 Million Solicitation For Generation III+ SMRs

(NucNet) The US Department of Energy (DOE) on 03/24/25 re-issued a $900m (€831m) solicitation to support the deployment of Generation III+ small modular reactors (SMRs). The re-issued solicitation specifies light-water reactor (LWR) technologies.

Among the changes, “all community benefits requirements, and related elements, have been removed from the solicitation.” The previous solicitation required a community benefit plan that considered four factors: local engagement, alignment of community benefits with community priorities, quality local jobs, and support for underrepresented groups. The previous solicitation put 20% of the evaluation for a funding award on these factors.

The original solicitation was issued in October 2024. The new solicitation has the objective of achieving “grid-scale deployment of “domestic Gen III+ SMR technologies that are reliable, able to be licensed, commercially viable, and have a demonstrated path towards a multi-reactor order book.”

Three Applicants Likely Among Others

While the solicitation is open to all comers, three applicants to the previous RFP are likely submit bids for this one. They include;

Constellation had teamed with the New York State Energy Research and Development Authority to support an early site permit from the Nuclear Regulatory Commission for one or more advanced nuclear reactors at the Nine Mile Point site in upstate New York.

TVA applied to “accelerate construction of an SMR at TVA’s Clinch River Project, in Oak Ridge, TN,, by two years—with commercial operation planned for 2033.” The selected SMR is the GE-Hitachi BWRX-300.

TVA’s partners include Bechtel, BWX Technologies, Duke Energy, the Electric Power Research Institute, GE Hitachi Nuclear Energy, Indiana Michigan Power, Oak Ridge Associated Universities, Sargent & Lundy, Scot Forge, and North American Forgemasters.

Arizona Public Service had partnered with the Salt River Project and Tucson Electric Power. It focused on site selection efforts with a site picked by the end of the decade and having an SMR in revenue service in the early 2040s.

DOE’s Risk Reduction Strategy

The DOE said the re-issued solicitation offers funding to de-risk the deployment of Generation III+ light-water small modular reactors through two tiers.

Tier 1 will provide up to $800 million to support up to two “first mover” teams of utility, reactor vendor, constructor, and end-users or off-takers committed to deploying a first plant and developing a multi-reactor, Generation III+ SMR order book.

Tier 2 will provide approximately $100 million to spur additional Generation III+ SMR deployments by addressing key gaps that have hindered the domestic nuclear industry in areas such as design, licensing, supply chain, and site preparation.

Why DOE Wants SMRs

The DOE said US electricity demand is forecast to soar in the coming years driven by consumer needs, data center growth, increased AI use, and the industrial sector’s need for constant power.

SMRs could provide reliable power for these energy-intensive sectors, with the added benefit of flexible deployment thanks to their compact size and modular design.

Light-water SMRs could also make use of the existing service and supply chain, including LEU fuel, e.g., less than 5% U235, supporting the country’s current fleet of LWRs. This would help speed up the near-term deployment of new nuclear reactors, the DOE said.

Generation III+ plants incorporate passive safety features which require no active controls. They can shut down safely in an emergency without the need for operator action or electronic feedback. There is no precise definition of Generation III+, but full size plants already in operation that include Generation III+ features include the Westinghouse AP1000, Areva’s EPR and Russia’s VVER 1200. Many generation III+ SMR plants, e.g, less than 300 MW, are under development by multiple developers, but none are yet in operation.

& & &

Idaho National Laboratory Seeks Industry Sponsors for $5-10 Million to Invest in Nuclear Startups

The Idaho National Laboratory (INL) is seeking an industry sponsor to invest $5 million to $10 million in a privately funded innovation incubator. This program will combine the power of a national laboratory with private sector commercialization knowledge to unleash breakthrough innovations by finding and supporting promising startups in the areas of nuclear energy, integrated energy systems, cybersecurity and advanced materials.

The innovation incubator seeks to provide seed-stage startups aligned with the private sector sponsor’s strategic investment priorities with access to INL’s world-class facilities and technical expertise, which can de-risk and advance their innovations. This is a unique opportunity to support promising startups and be at the forefront of innovation.

INL and the private sector sponsor will jointly issue nationwide calls for entrepreneurs and startups to identify American technologies and talent. This effort will develop and narrow into a small cohort of top candidates who will be selected for investment. The incubator provides the private sector sponsor with direct access to a pipeline of innovation at a fraction of the cost of conventional acquisition. Sponsor benefits include:

Pipeline to innovation: The incubator delivers a turnkey source of cutting-edge American innovation in the private sector sponsor’s areas of strategic interest, providing valuable new growth opportunities.

Technology de-risking: National laboratory scientists and laboratory capabilities that provide unparalleled technical due diligence for identified opportunities and subsequent acceleration of technology advancement, resulting in opportunities that are substantially de-risked.

Publicity for advancing American innovation: Partnering with INL adds credibility, goodwill and visibility to the private sector sponsor’s investments, demonstrating viable leadership in technical innovation.

Interested industry sponsors can contact Jim.Keating@inl.gov for more information.

# # #