If you’re a retiree collecting Social Security, you probably know that one of the most important days of the year is just around the corner.

The Social Security Administration (SSA) announces the cost-of-living adjustment (COLA) every year in mid-October. The COLA is the amount by which your Social Security checks will increase next year, and the size of the increase is based on a specific inflation rate, the CPI-W, or the Consumer Price Index for Urban Wage Earners and Clerical Workers. The SSA uses the third-quarter inflation rate of the CPI-W, or the average of the July, August, and September numbers, to determine the COLA for the following year.

With August’s inflation report just in last week, Social Security beneficiaries got some potentially good news, courtesy of a surprising source, OPEC (Organization of Petroleum Exporting Countries). Let me explain.

Image source: Getty Images.

Inflation is getting hotter

We found out last week that the main inflation gauge, the Consumer Price Index for All Urban Consumers (CPI-U), rose at its fastest monthly clip all year in August, up 0.6%, or 3.7% from a year ago. The primary reason for the acceleration in the inflation rate was higher gas prices, which rose 10.6% from July to August, and the Bureau of Labor Statistics said that the largest contributor to the overall increase in monthly consumer prices.

Oil prices rose through August and have continued to increase in September, largely because OPEC has cut back on production in order to boost prices. The cartel has been curtailing production for several months now, and gas prices in the U.S. are now at the highest levels they’ve been all year. Saudi Arabia, the biggest producer in OPEC, said at the beginning of August that it would extend its voluntary cut of 1 million barrels per day through September, and Russia also said it would cut exports by 300,000 barrels per day.

Production cuts are now expected to continue through the end of the year, as the International Energy Agency (IEA) predicted that the oil market would continue to tighten in the fourth quarter.

Why it’s good news for Social Security beneficiaries

The timing of the jump in oil prices is well suited to retirees, since the third quarter is the only period that matters for calculating the COLA. Additionally, oil prices are likely the most volatile major component of the inflation rate, and retirees tend to spend less on gas than working Americans, since they don’t have to commute to work.

The CPI-W has slightly different weights than the CPI-U and covers a smaller percentage of the population, but the numbers tend to be similar. In August, the CPI-W rose 3.4% on a year-over-year basis, compared to 3.7% for the CPI-U, while the CPI-W ticked up 2.6% in July, below the 3.2% the CPI-U recorded.

With oil prices remaining high in September, the annual CPI should be similar to August, meaning the Social Security COLA is likely to be between 3% and 3.5% in 2024. Without the recent spike in oil prices, the increase seems as if it would have been headed for under 3%.

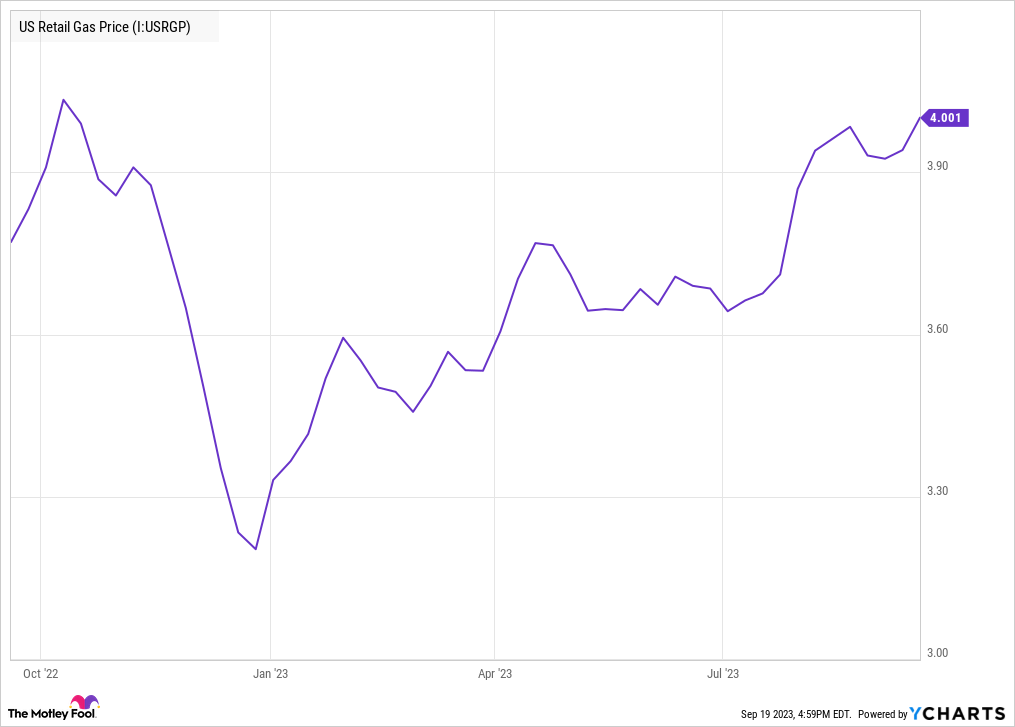

While nobody likes to pay higher prices at the pump, gas prices are volatile, and today’s prices are a poor predictor of where they’ll be in, say, three months. The chart shows how retail gasoline prices have fluctuated over the last year, ranging by roughly a dollar during that time.

US Retail Gas Price data by YCharts

There’s another reason to be optimistic about gas prices coming back down soon as well. Gas stations will soon switch to a cheaper winter blend of gasoline, and gas prices typically fall in the colder months as demand slows with the summer travel season over.

With the average Social Security monthly benefit now around $1,800, Social Security recipients should get a COLA of around $60 on average next year, with the recent spike in gas prices contributing a significant bump to that.

We’ll know the official number in just a few weeks after the September CPI comes out in mid-October, but if gas prices moderate in the winter, the spike over the last few months looks like a win-win for retirees, who would reap the benefits of an increased cost-of-living adjustment for their Social Security checks in 2024 without necessarily suffering a long-term impact from energy costs.