kynny

Axcelis Technologies, Inc. (NASDAQ:ACLS), an influential entity in the semiconductor manufacturing sector, has seen a considerable increase in its stock price over the past year. A substantial part of this gain came to fruition recently, driven primarily by the resilient electric vehicle (EV) sector, which holds its ground amidst economic fluctuations. Axcelis’ crucial role in the development of an innovative chip essential to EVs strengthens its standing in the market. This article provides a comprehensive technical analysis of Axcelis’ stock price, with the objective of pinpointing attractive entry points for prospective investors. The observation reveals a consistent upward trend in Axcelis’ stock price, characterized by a parabolic movement, and currently operating at the peak of its resistance limit. Any market adjustment could potentially present viable investment openings for investors with a long-term perspective.

Capitalizing on the EV Boom and Semiconductor Surge

Witnessing a significant surge in its stock price, Axcelis Technologies, a distinguished player in the semiconductor manufacturing sector, has logged an over 300% increase in its stock value, calculated from the lows of October 2022. This impressive upswing is largely underpinned by the thriving EV sector, which has demonstrated robust resilience amid economic turbulence. Axcelis’ influential role in spearheading the development of a novel type of chip vital to EVs further bolsters its market success.

For the second quarter of 2023, Axcelis Technologies reported solid financial results, with a quarter-on-quarter revenue hike from $254.0 million in Q1 to $274.0 million in Q2. Operating profit leaped from $51.4 million in Q1 to $63.7 million in Q2, and net income rose significantly from $47.7 million in Q1 ($1.43 per diluted share) to $61.6 million in Q2 ($1.86 per diluted share). The company managed to enhance its gross margin from 40.9% in Q1 to 43.7% in Q2. The quarter ended with total bookings of $193 million, leading to a substantial system backlog of $1.23 billion. Axcelis primarily attributes this robust financial performance to the strong demand for its Purion product line, particularly in the silicon carbide (SiC) power market. Given the existing market conditions, Axcelis anticipates achieving revenues of $1.3 billion over the next one or two years.

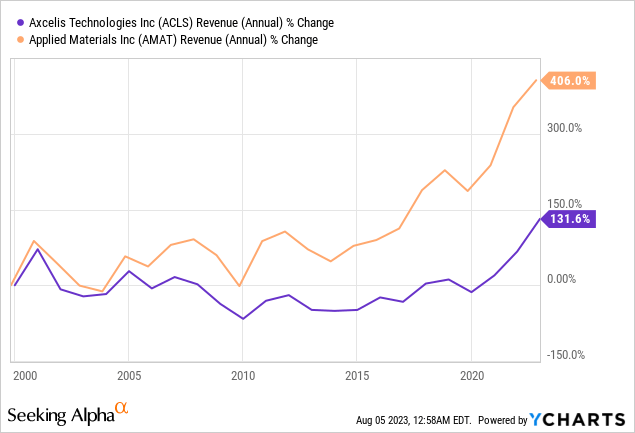

Axcelis, an expert in the specialized field of ion implantation within semiconductor wafer manufacturing, positions itself as a leading entity in this technology, sharing the spotlight with its industry rival, Applied Materials, Inc. (AMAT). The process of ion implantation involves integrating ions from different elements into a silicon wafer, a critical step in the creation of power management chips. The following chart depicts the percentage change in annual revenue, illustrating a more pronounced surge for Axcelis compared to Applied Materials during the past 7 years. This can be attributed to the robust demand in ion implantation, a niche where Axcelis excels. In contrast, Applied Materials, being a vast and diversified corporation, offers more than just ion implantation, and some of its other equipment divisions are currently experiencing a temporary downturn.

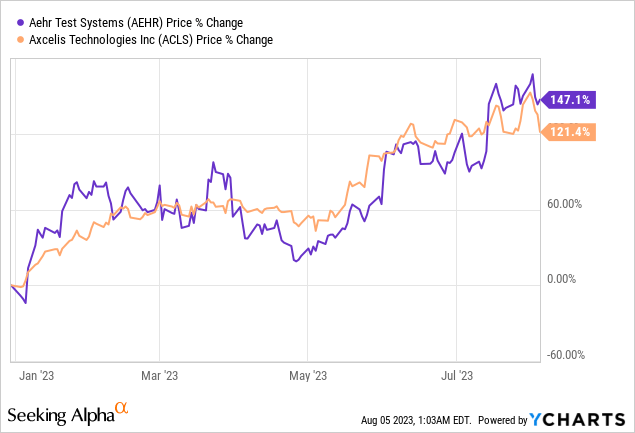

Closely intertwined with the burgeoning EV market, Axcelis’ trajectory of growth hinges on the production of power management chips, particularly SiC chips, indispensable for high-voltage applications integral to EVs and swift charging infrastructures. Demand for Axcelis’ equipment has seen a substantial upsurge, with SiC chip producers in Europe and Asia becoming regular buyers. Axcelis’ growth trajectory mirrors that of Aehr Test Systems (AEHR), another company leveraging the SiC chip boom through the manufacture of chip testing equipment, as shown in the chart below.

Exploring Dynamics of its Dramatic Market Advance

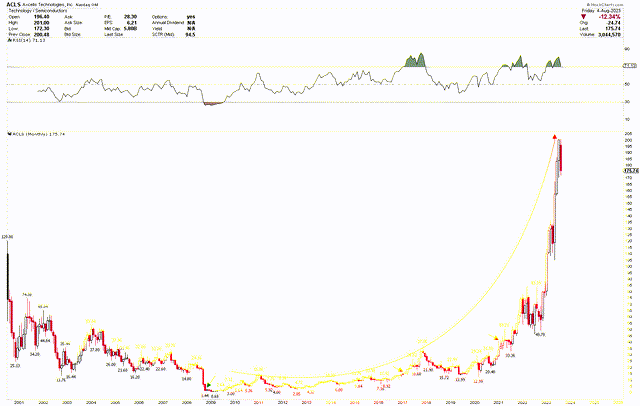

The technical perspective on Axcelis paints a robustly optimistic scenario, as indicated by the accompanying monthly chart. Axcelis stock price demonstrates a parabolic trend from the 2009 low of $0.68, as illustrated by the green arrow, soaring to record-breaking highs. This parabolic pattern can occur due to a sudden escalation in investor demand, often fueled by impressive company results, positive news, or industry trends that elevate the stock’s perceived value. The demand outweighs supply, leading to an increase in price. As the price swells, the fear of missing out motivates more investors to purchase the stock, further driving the upward trajectory. Currently, Axcelis stock price maintains a potent momentum, as indicated by the robust monthly candle for July 2023, suggesting more room for future price escalation. Yet, the RSI signals an overbought stock price due for adjustment. Regardless, as pointed out by the red arrows in the monthly chart, parabolic trends often disregard such overbought conditions, allowing the stock price to continue rising.

ACLS Monthly Chart (StockCharts.com)

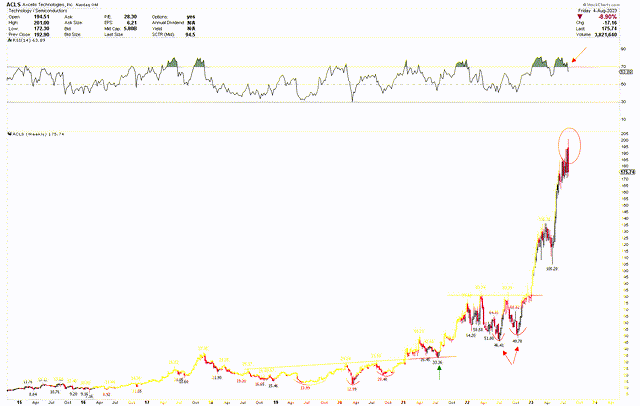

Expanding on this discussion, the weekly chart below highlights the strong upward momentum demonstrated by Axcelis. The stock price went through a consolidation phase between 2018 and 2020, resulting in an inverted head and shoulders pattern, with the head at $12.99 and the shoulders at $13.99 and $20.40. These patterns indicated a bottom formation and were disrupted in 2021 when the stock price hit $32, sparking a vigorous rally to all-time highs. After shattering these substantial patterns, the stock price dipped to reach the red neckline at $33, a strong buy signal in the market as depicted by the green arrow on the chart. While the Axcelis stock price did dip in 2022 due to a broader market correction, it formed a double bottom at $46.41 and $49.78, the breakout of which ignited another rally in 2023. This robust surge gained 303.78% from a low of $49.78 to a high of $201, bringing the price into overbought territory as per the RSI, although the trend remains decidedly bullish. The key reversal at $201 might indicate a potential correction, though the correction might be restricted due to the parabolic price patterns and the strong 2023 momentum. Market corrections will likely present lucrative bullish opportunities for long-term investors.

ACLS Weekly Chart (StockCharts.com)

Strategic Moves for Investors

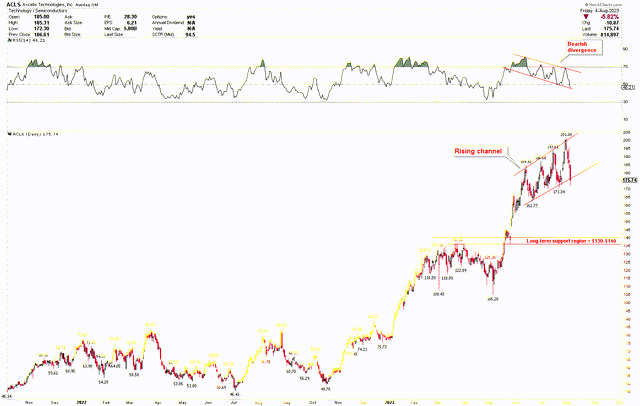

The above analysis indicates that while Axcelis remains within a strongly bullish trend, the stock price is hinting at possible corrections at the top. This can be interpreted from the short-term chart below, showing a rising channel at a higher level. The presence of a bearish divergence indicated by the RSI hints at a potential substantial pullback to the $130-$140 range before the next uptrend ensues. In the event of a correction, the stock price is likely to establish another bottom for a subsequent robust rally, given that the long-term chart shows the price within a parabolic move. To capitalize on this situation, investors might consider buying Axcelis stocks at the current level and increasing their positions if the stock price retreats to the $130 to $140 range.

ACLS Daily Chart (StockCharts.com)

Market Risk

Axcelis Technologies’ commendable growth trajectory hinges primarily on the thriving EV sector. However, the fate of the company is uncertain if this sector encounters a slump or doesn’t evolve as projected, leading to a potential derailment of Axcelis’ growth. Additionally, the company’s forte lies in ion implantation, an indispensable process in semiconductor wafer manufacturing. Thus, the advent of any innovative technology that might make this process either obsolete or less essential could negatively impinge on Axcelis’ stature and revenue streams.

Operating in a fiercely competitive arena, Axcelis shares the market with formidable competitors like Applied Materials, which holds a significant market share. This poses a risk, as outperforming these competitors or their introduction of more advanced, cost-effective technologies could jeopardize Axcelis’ market standing. Furthermore, Axcelis’ performance is vulnerable to global economic conditions, which could sway the demand for its products. Factors like exchange rate fluctuations, alterations in tax policies, trade restrictions, or even a broad global economic downturn could exert pressure on its revenues.

From a technical analysis standpoint, Axcelis’ stock price currently signals an overbought condition, a situation that often precedes a price correction. Since the stock has witnessed a parabolic upswing, any correction within such a trend tends to be steeper than usual. Consequently, investors may be exposed to potential losses if a pronounced price correction ensues. Parabolic trends, by their very nature, are fraught with instability, as Axcelis’ stock price movement demonstrates, adding another layer of complexity for potential investors.

Conclusion

In wrapping up, it’s evident that Axcelis holds a formidable position in the expanding EV market. Its robust performance, marked by a substantial rise in stock price and its pioneering role in crafting new chips for EVs, illustrates a trajectory of growth and promise. Axcelis Technologies, though attractive, carries investment risk. Aspiring investors should cautiously balance the high growth prospects with inherent market uncertainties, ensuring they possess a comprehensive understanding of the industry dynamics and the competitive arena prior to making investment commitments. Regardless of the inherent uncertainties, Axcelis’ fundamental prowess and its solid position in the market may serve as an enticing opportunity for investors willing to grapple with the complexities of this rapidly evolving industry.

From a technical perspective, while the company’s stock has demonstrated a strong bullish trend, potential corrections could be on the horizon. Investors are advised to keep a close eye on these developments and be prepared for possible fluctuations. The approach of purchasing shares at the current price and increasing long positions, if the value dips towards the $130 to $140 range, seems advantageous, providing investors an opportunity to benefit from the long-term bullish outlook.