Sundry Photography

This is my fourth article on Enphase Energy (NASDAQ:ENPH). In this one I go into great detail about the 2Q23 quarter results and then I end with why I remain a buyer of the company.

Enphase’s fundamentals remain intact and are in fact improving. However, the share price weakness are a result of the commentary around the US and a lighter than expected guidance. The reason for this is due to the macro backdrop and high interest rates, factors that are outside of Enphase’s control and experienced by the broader US solar market.

You can find my previous articles on Enphase here.

2Q23 review

The 2Q23 financials were all largely in-line with expectations, but the main disappointment for the results came from the guidance and commentary around weakness seen in the US business, which I will explain in greater detail in the next section.

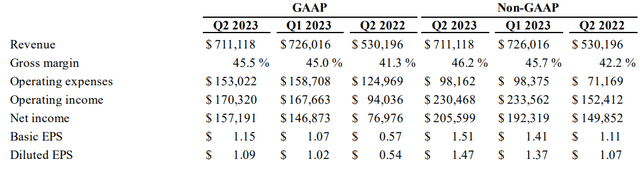

Financials (Enphase Energy)

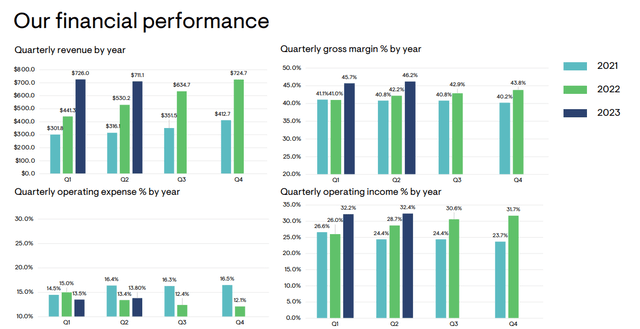

Enphase 2Q23 revenue was up 34% from the prior year to $711 million. This includes 82 megawatt hours of IQ batteries and 2121 megawatts DC of microinverters. The company saw a record revenue quarter for its international segment as a result of strength in Europe and Australia, while the US was rather weak as revenues declined 1% from the prior year. Europe revenue more than tripled from the prior year while sell-through of microinverters in Europe was 13% higher than the prior quarter.

Gross margin was 46% in the quarter, an improvement from the prior year as a result of improved logistics and increased mix in IQ8. This led to a corresponding increase in operating income margin to 32% in the 2Q23 quarter.

Diluted EPS for 2Q23 was $1.47 and free cash flows were at $225 million, up 37% and 17% from the prior year respectively.

Enphase financial performance (Enphase Energy presentation)

In terms of the production credits from the IRA, Enphase accounts for them as a reduction in cost of goods sold. The company expects the production credit to be between $24 to $28 per microinverter sold in 3Q23 and they expect to ship about 600,000 microinverters in the quarter from its US contract manufacturing facilities.

Enphase currently has two contract manufacturers in the US making microinverters, Flex in South Carolina and Foxconn in Wisconsin, and are on track to start production with a third in 3Q23.

By the end of 2024, Enphase expects to have 4.5 million microinverter US capacity per quarter by the end of 2024.

US business continues to struggle with high interest rates

In the quarter, management provided additional color on the business in the US. The overall sentiment around the US business now is rather negative, and this was further impacted by what management mentioned in the quarter.

As a reminder, Enphase ships its products to large installers and distributors. Thus, they recognize revenue when the products are shipped to them. It is also important to note that Enphase has a large market share in the US and thus, the industry dynamics that it highlights reflects the broader industry dynamic for the US microinverter space.

In the second quarter of 2023, Enphase saw weaker than expected sell-through in its microinverters in the US, with the sell-through increasing only 2% compared to the first quarter and increasing 2% from the prior year.

This would typically be seen as somewhat stable numbers, but the second quarter is typically a stronger quarter than the first quarter and this is a result of the weaker market environment seen in the US.

The main reason for the weak sell-through in the US market is due to a “broad-based slowdown due to high interest rates”.

Enphase saw some divergence in the market trends in the US. In California, the sell-through for microinverters in the second quarter was actually up 20% from the first quarter and 34% higher from the prior year. This higher sell-through in California was a result of the strong backlog in NEM 2.0 installation, which the company expects to continue in the near-term. NEM 3.0 will have a greater impact on results after the third quarter, which I will talk about later. In the non-California states, the sell-through of microinverters in the second quarter was down 6% from the first quarter and down 11% from the prior year. In particular, in Texas, Florida and Arizona, the sell-through was disproportionately worse as a result of worsened economics of loan financing due to higher interest rates and lower utility rates.

I’ll provide some introduction to NEM 3.0 but I have already discussed this in an earlier article. In California, NEM 3.0 will replace NEM 2.0 after April 15 2023. Under NEM 3.0 billing, residential solar customers will earn 75% less for the excess electricity that they push to the grid. This is to encourage homeowners to pair their solar panels with battery storage to become more self-sufficient. According to Enphase, with NEM 3.0, the payback for pure solar is between 7-8 years and when you add a battery storage, the payback comes down to 5-6 years.

With these economics, its clear that we will see a higher battery attach rates as a result of NEM 3.0. According to some anecdotes from Enphase’s large installers, they have seen higher than 50% battery attach rates for NEM 3.0. Enphase has a comprehensive NEM 3.0 solution, which includes a smart battery, a power control system to avoid main panel upgrades and an energy management system to maximize ROI for homeowners.

With that, I think Enphase’s storage business will see an inflection in the fourth quarter of 2023 when we start seeing the effects of NEM 3.0. The company has shipped about one gigawatt of battery systems by the end of the second quarter of 2023, on a cumulative basis. The storage channel inventory continues to be managed well and Enphase introduced their third generation IQ Battery 5P in the US and reduced the selling price of the second generation battery and improved the warranty to 15 years for both batteries.

Elevated microinverter inventory

Enphase Energy’s sell-through of microinverters peaked in the US in the fourth quarter of 2022. In the first quarter of 2023 and second quarter of 2023, the sell-through was about 20% below the fourth quarter of 2022.

However, given that the second quarter is typically a seasonally good quarter for Enphase, the management team decided to only reduce sell-in by 10% in the first quarter of 2023 with the expectation of that seasonally better second quarter.

However, on the earnings call, management shared that that was not the case given that they saw the sell-through in the second quarter being similar to that of the first quarter of 2023. As a result, the company currently has excess inventory in the channel.

The necessary action going forward is to correct that excess inventory and to reduce the inventory in the channel. Enphase intends to aggressively reduce inventory by not shipping as much and they expect the channel inventory to return to normal levels, which is around 8-10 weeks, by the end of the third quarter of 2023.

Guidance

As a result of the commentary regarding the US mentioned above, while management was expecting a seasonally stronger second quarter, the weaker second quarter than expected in terms of sell-through for microinverters in the US results in elevated inventory in the channel. Along with the uncertainty as a result of the macroeconomic environment and the high interest rate environment, this led to weaker revenue guidance for its third quarter as management assumes this continues moving forward and looks to reduce channel inventory in the near-term.

Revenue guidance for the third quarter of 2023 was between $550 million to $600 million, which includes shipping 80 to 100 megawatt hours of IQ batteries. This is 23% lower than the market consensus of $749 million for the third quarter.

Adjusted gross margins were expected to be between 42-45%, which does not include net IRA benefits of between $14.5 million to $16.5 million on the expected shipment of 600,000 units of US manufactured microinverters. Operating expenses are expected to come in between $101 million and $105 million as Enphase continues to invest in innovation in its product, international growth and improvements in customer service.

Market share

To me, the commentary from management about Enphase market share is key.

While the broad market slowdown is, as the name suggests, affecting the whole industry, Enphase reassured investors that its microinverter market share remains high and stable, based on both third party and internal data.

Competition has always been around and in my opinion, Enphase has been able to meaningfully compete and maintain market share through its differentiated technology with distributed architecture, product quality and customer service.

Europe and other regions

The Europe part of Enphase’s business continued to deliver strong results in the second quarter of 2023. The company’s growth trend in Europe remains robust and Enphase will continue to introduce IQ8 microinverters and batteries into more European countries like Sweden, Greece, the UK, Italy and Denmark in the second half of 2023.

For the countries where Enphase is currently operating in in Europe, they stated that there is strong broad based demand and growth seen on the continent. In particular, France and Netherlands are very strong countries for Enphase.

In addition, Enphase is also gaining momentum in Germany with residential solar and batteries. The company is optimistic about the solar market in Germany given that it is that largest in Europe with three gigawatts and the attach rates for batteries are about 80%. Enphase saw strong sequential growth in installer count, sell-through and activations for solar and batteries in Germany in the second quarter of 2023.

In 2Q23, Enphase launched its IQ Router family of devices, part of its HomeEnergy Management System in Germany and Austria. This will enable customers to integrate third party EV chargers and heat pumps into the Enphase solar and battery system. In terms of the European market, management sees its home energy management solution as another part of its differentiation factor in the market.

Enphase launched its third generation IQ Battery 5P in Australia, US and Puerto Rico in 2Q23, with the launch in Europe expected by end 2023. This new generation battery delivers two times the continuous power and three times the peak power for the same kilowatt hour when compared against the previous generation.

The company’s revenue in Australia more than doubled from the prior year as they started shipping IQ Battery 5P in Australia in the second quarter.

Share repurchase program

In the second quarter of 2023, Enphase repurchased 1.25 million shares at an average price of $159.43. This resulted in the completion of the $500 million share repurchase authorization.

As a result, the board has authorized a new share repurchase program for another $1 billion. I think this highlight’s the board’s confidence in Enphase’s future growth, free cash flow generation and the under-valuation of the company’s stock.

Valuation

Enphase is currently trading at 20x 2024 P/E after its post earnings share price decline.

I am reiterating my 1-year and 3-year price targets for Enphase of $230 and $320.

The reason for this is that I think my assumptions for the price targets were intentionally conservative so there is room for upside revision should the fundamentals of the company improve as the macro backdrop improves.

Conclusion

I think of the 2Q23 results as such:

Enphase has seen three very strong years of growth, and now we are experiencing somewhat of a correction in the US solar market. During the past three years, the residential solar market in the US doubled and Enphase sales tripled.

However, it is important to realize that the fundamentals of Enphase and the industry remain stronger than before despite the weakness in the solar market as a result of high interest rates.

The residential solar penetration rate is only between 4% to 5% so clearly, there is still a long runway for growth in the future. The tailwinds for long-term growth will include increasing adoption of EV, the 30% ITC tax credit, rising utility rates and increased stability in the grid. As a result, I remain confident in the long-term prospects for solar and battery.

I remain convicted and invested in Enphase and given that the stock is trading close to 20x P/E while growing rapidly in the next few years, I am looking to buy Enphase below $168.

While I cannot control the length and the severity of the US solar market cycle, I know that when interest rates normalize, when NEM 3.0 takes off and when the market backdrop improves, I think that we will see the US segment inflect to growth once again. In addition, I expect Enphase to remain a leader in the solar market and continue to invest in production innovation and improve its capabilities, service and quality.

Till then, I am more than happy to be a buyer of Enphase.