supermimicry

Background

Did you know that Monster Energy (MNST) was the best-performing stock in the past 25 years (1998-2023)? It annualized 37.1% growth each year, turning $10 invested on New Year’s Eve 1998 into $26,888.24, a cumulative return of 26,888%! However, a new player has entered the game: Celsius Holdings (NASDAQ:CELH), which is now the third-largest U.S. energy drink maker with a 7.5% market share. They trail only Red Bull and Monster Energy. The market is also vastly growing, with reports stating that “In 2021, energy drinks hauled in $159 billion worldwide, according to Statista. It estimates that sales globally will climb to $233 billion by 2027.”

Investment Thesis

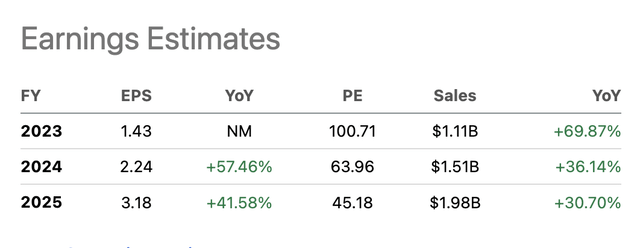

Celsius Holdings has seen sales grow at an average compound annual growth rate (CAGR) of 79% over the past 5 years. Sales grew 107% last year, and analysts expect sales growth of 150% in 2023. This has resulted in a lofty multiple of 100x price-to-earnings (P/E), which is significantly higher than the sector median of just above 20x. However, rapid growth and analyst expectations that it will continue to help to justify the extended multiple. Over the next three years, analysts expect sales to continue to grow at an average CAGR of 45.5%, reaching $1.98 billion in 2025. I believe Analyst are underestimating the potential international growth that will come.

Sales & Earnings Expected Growth (Seeking Alpha)

In my opinion, Celsius has the potential to continue to move higher. Celsius saw record sales in Q1 2023, and its current market capitalization is $11 billion. The company expects full-year sales to be $1.1 billion. In comparison, Monster Energy has a market capitalization of $60.2 billion and expects sales of $7.1 billion for the year. The energy drink industry is growing at a 5% rate, and Celsius is gaining market share with sales growing well above 5%. Therefore, I believe there is even more room for Celsius to grow as it enters an untapped market.

Celsius’ new partnership with Pepsi (PEP) has created a powerhouse duo. Pepsi now accounts for 60% of Celsius’ revenue, based on the company’s Q1 earnings report. Pepsi sells products in over 200 countries, and Celsius now has access to all of the same resources. This leads me to be extremely optimistic about Celsius’ future, and I continue to see it as a long-term hold.

The Future is Bright

In 2022, Pepsi Co. Invested $550 million in Celsius Holdings, Inc. (CELH), acquiring 8.5% of the company and becoming its most valuable partner. Celsius instantly gained access to Pepsi Co.’s distribution centers, transportation systems, and most importantly, shelf space. As a result, Celsius products were available in every gas station, grocery store, and commercial, thanks to Pepsi’s existing partnerships. Analysts had no choice but to upgrade the stock.

Pepsi initiated the position in CELH at $75, which is now up 90%. Although the stock continues to rise (up 37% YTD), which lowers our risk-to-reward ratio, I can’t help but still love the upside potential. Morningstar investment research platform gives the stock a base fair value of $150, but has a bullish $214 upside scenario. With analysts expecting high sales growth, profitability growth on the horizon, and a declining forward P/E ratio, the stock looks appealing over the next 5-10 years.

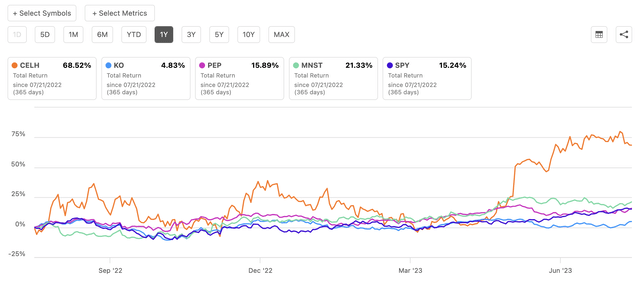

Celsius 3 yr. Performance Comparison (Seeking Alpha)

Celsius now has the pieces in place to focus on profitability. The company currently has 42% gross profit margins, and in Q1 2023, it saw a net income margin of 15.8%, the highest it has been since 2019. Its main competitors, Pepsi, Coke, and Monster, all have gross profit margins in the 50% range and net income margins ranging from 8-22%. With sales expected to increase rapidly and the company focusing on cost-cutting, I believe shares can continue to rise.

Potential Growth

Celsius’s potential for exponential growth hinges on its international growth. The company now has access to Pepsi’s distribution network, which sells products in over 200 countries. In Q1, international sales grew 15% year-over-year to $11.4 million, but they still only accounted for 4.3% of total sales. The company’s North American (specifically US) business is huge and dominant, so international growth and expansion is still a work in progress. Sweden was responsible for the largest foreign portion of international sales at $5.5 million.

I believe that with Pepsi’s help, international growth will continue to steadily grow in the double digits for the next 5-7 years. Monster Beverages had international sales of $622.9 million in Q1 2023, which is 54 times larger than Celsius’s international exposure in Q1. However, I believe that with Celsius’s continuous flavor innovation and shelf space exposure through the Pepsi network, international growth will be a key driver for the company over the long term. With profitability turning around, I see the company consistently growing total sales and earnings year in and out for the next few years.

Estimates

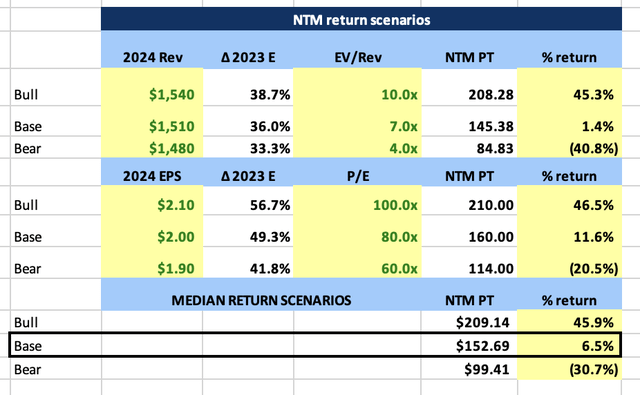

Based on analyst consensus, earnings per share (EPS) are expected to increase 1,250% from $0.10 to $1.34 in 2023. EPS is then expected to continue to grow by analysts at 50% growth rates in 2024 and 2025. If we use 2024 sales and earnings estimates along with forward sales multiples, we can get a price range scenario for the next twelve months (NTM). The stock trades at $143 and currently has a 1.5x risk-to-reward (R:R) ratio based on my calculations.

2024 Price Target Scenarios (Author Calculations based on data from Koyfin)

The return scenario table above creates different price targets based on current estimates, historical valuations, and current company information.

To start, we take the base case average analyst estimate for 2024 sales and EPS, which is $1.51 billion and $2.00, respectively. We then put in a hypothetical bull and bear case scenario to measure what the price could be if the company beats or misses estimates. Using the estimated earnings results and historical valuations of the company over the last few years, we can calculate these scenarios.

For example, to calculate the price target based on EPS, we look at the last three years’ average P/E ratio range of 60x to 100x. We then create our bullish/bearish return scenario by multiplying expected EPS by historical P/E valuations. To calculate the price target based on sales, we take the projected revenue multiplied by the expected EV/S minus net debt, all divided by the shares outstanding. This calculation results in the base price target of $145.38:

As you can see above, the stock is close to fairly valued, trading at only 6.5% off our base case. Our bull and base case scenarios create our risk-to-reward ratio (R:R), and a 1.5x R:R is what makes me rate CELH a hold at this price. If the stock drops below $130, specifically $127 and under, R:R becomes 3x, which is what we look for. A 3x R:R would mean that your upside reward from your cost basis would be three times your risk, in our case 60% upside to 20% downside based on our scenarios. Overall, if you hold this one, continue to hold, but if you are looking to get in, wait for a pullback to pull the trigger.

Risk

There are three main risks to consider when investing in Celsius Holdings. The first is intense competition. The energy drink market is incredibly crowded, with multiple brands vying for market share. For example, Pepsi’s investment and partnership with Celsius is similar to Coca-Cola’s. Coke is the Largest shareholder of Monster Energy, owning 16.7% of the company, which benefits both parties’ sales and reach. Red bull continues to dominate the energy drink industry with a 44% market share, followed by Monster with 34%.

While Celsius could steal market share as it gains popularity, specifically with younger generations, a more competitive industry typically drives margins and profits down. This is because companies are forced to lower prices to compete, which leads to lower earnings across the industry.

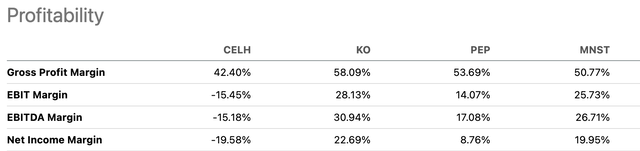

2022 Profitability Comparisons (Seeking Alpha)

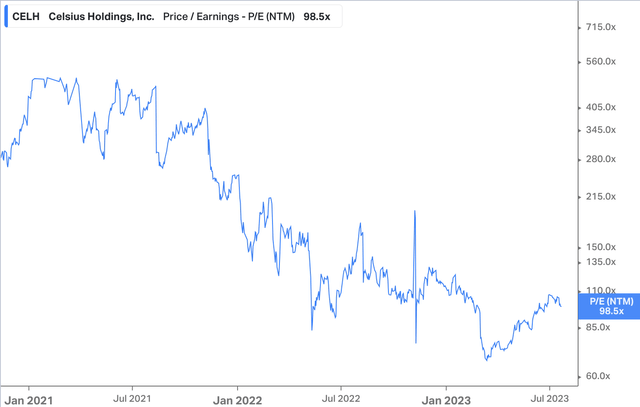

The second risk to consider is that the valuation will have to contract eventually. Celsius Holdings is not a Tesla or Nvidia, where innovation and the addressable market are continuously growing. Eventually, sales growth will slow and fall below 50%, and eventually 30%. A 90x or 100x P/E multiple will no longer be viable at that point.

Monster Energy never grew sales as quickly as Celsius is, but it consistently saw double-digit sales growth year after year. At Monster’s peak, its P/E ratio reached 45x. It currently trades at 36x and has a five-year average of 28x. If we take Celsius’s analyst EPS estimate for 2025 of $3.04, that puts the stock’s forward 2025 P/E ratio at 47x, just above the 45x mark. It will be crucial to monitor whether EPS growth can keep up with the stock’s price action, or if investors could see a correction as sales growth slows in a few years.

CELH P/E Chart (Data from Koyfin)

The third and final risk is legislative and financial risk. The company has already faced multiple lawsuits in its short time as a public company. Most recently, it was fined $7.8 million for allegedly having misleading labels. This was weeks after it was found guilty of breaching a partnership contract with Flo Rida and having to pay $82.6 million. These self-inflicted problems have caused the company bad publicity and unnecessary expenses, lowering cash for reinvestment.

Conclusion

I continue to believe that Celsius Holdings is a safe stock to hold. If you are not invested yet, I recommend waiting for a pullback. However, the potential sales growth and untapped international markets lead me to believe that the company’s sales and size could double or even triple. Earnings will be the main thing to watch going forward. If management can continue to raise earnings year after year, I believe shareholders will be rewarded, even if they have to tolerate some volatility. Energy drinks, and even more importantly, caffeine, is a huge part of society and in millions daily routine. This gives me reason to believe that Celsius Holdings can build a steady cash flow and a reliable customer base. Keep an eye on this company and look out for Q2 earnings, which may tell us the future direction of the stock.