energyy

Investment Thesis

United States Steel Corporation (NYSE:X) is cheaply valued at about 5x this year’s EPS.

Rather than spend time going through its balance sheet and discussing its underlying financials as I did recently, I’ll spend more time addressing the demand for steel as part of the great energy transition.

In short, there’s a lot to be excited about with US Steel, as it’s one of the companies with the best balance sheet in its sector.

Future Energy

Future Energy is how we move forward with our energy transition. The energy transition has at its core the decarbonization of energy sources. Everyone has largely agreed on this aspect.

Where the story rapidly gets complicated is with the next part of the equation, transition to what?

I’ll be the first to acknowledge the progress that we continue to make with solar energy. But where I struggle to see much progress at least for now, is wind turbines.

With this in mind, I believe that it’s helpful to put in context the critical role of steel in building wind turbines.

Physics of wind turbines

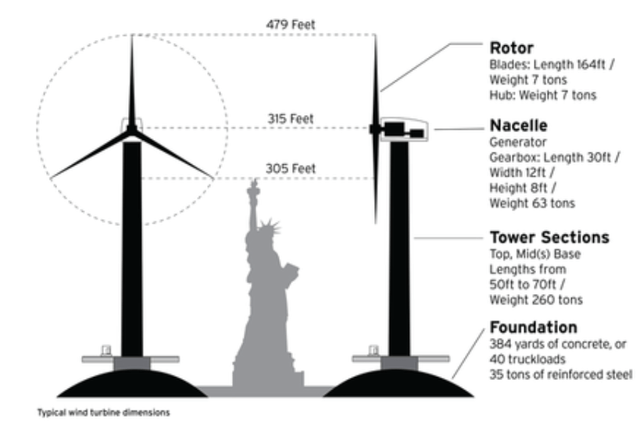

For a 5-megawatt turbine, the steel averages 150 tons for the reinforced concrete foundations, 250 tons for the rotor hubs and nacelles (see above), and 500 tons for the towers (Vaclav Smil)

A 5 MW capacity could support a medium-sized data center for an hour, providing sufficient electricity for AI server racks and cooling systems or about the same as charging 2.5K EVs.

5MW wind turbine is slightly bigger than the Statue of Liberty. Hence, not a small object, but clearly powerful enough to provide power for a medium-sized data center.

Back with Smil, if wind-generated electricity were to supply 25% of global demand by 2030, at 35% aggregate installed win power of about 2.5 terawatts we will require 450 million tons of steel. That’s a massive amount of steel being required.

OK, But What About the Near Term?

Trading Economics

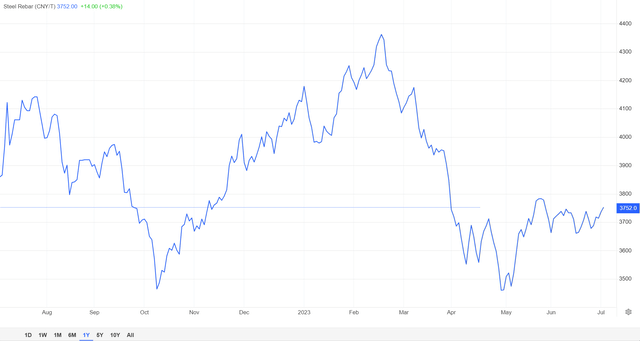

Steel prices have gone nowhere fast in 2023. Steel demand is tied up in the global economic forecasts. If we are expected to move into a global recession, there’s no need to embark on new construction, and as a consequence, demand for steel tails off.

And even though AI and semiconductor stocks have been on a tear in the past few months, commodities have not participated in the upside, as investors reconsider the possibility that we may not be facing a recession after all.

Meanwhile, this uncertainty and lack of visibility is holding back steel demand. However, I passionately assert that even if a recession thesis holds its weight on many other basic materials, I don’t believe this rings true when it comes to the basic metals required for the energy transition. Why not?

The Energy Transition is Not a Choice

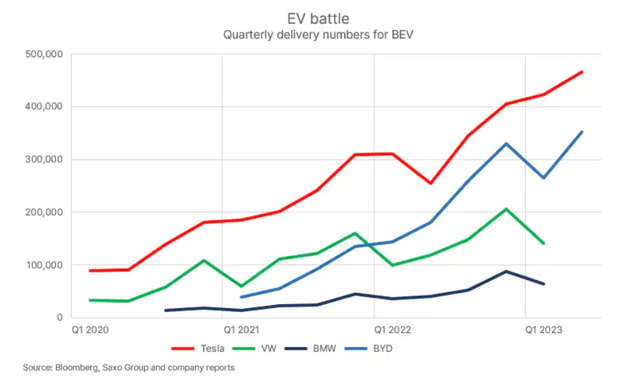

In the U.S., we are slowly seeing a significant uptick in the number of electric vehicles (“EVs”) being delivered.

Saxo Group

This rapid very strong rise in the number of EVs is further confirmation that the need for digitization and electrification is taking market share away from oil.

Now, to be clear, I’m not saying that EVs make up a large amount of the global fleet. My argument is that there’s a very rapid acceleration underway, and this will require a lot of renewable energy.

And that solar energy, nuclear, and natural gas alone will not be enough to displace how aggressively we cut back from coal. And that in order to build wind turbines, we need a lot more steel than investors presently expect.

With this in mind, let’s now discuss US Steel.

Why US Steel? Why Now?

I make the case that US Steel has two catalysts to its underlying fundamentals. The first is what we’ve discussed above, the demand for steel in the medium term.

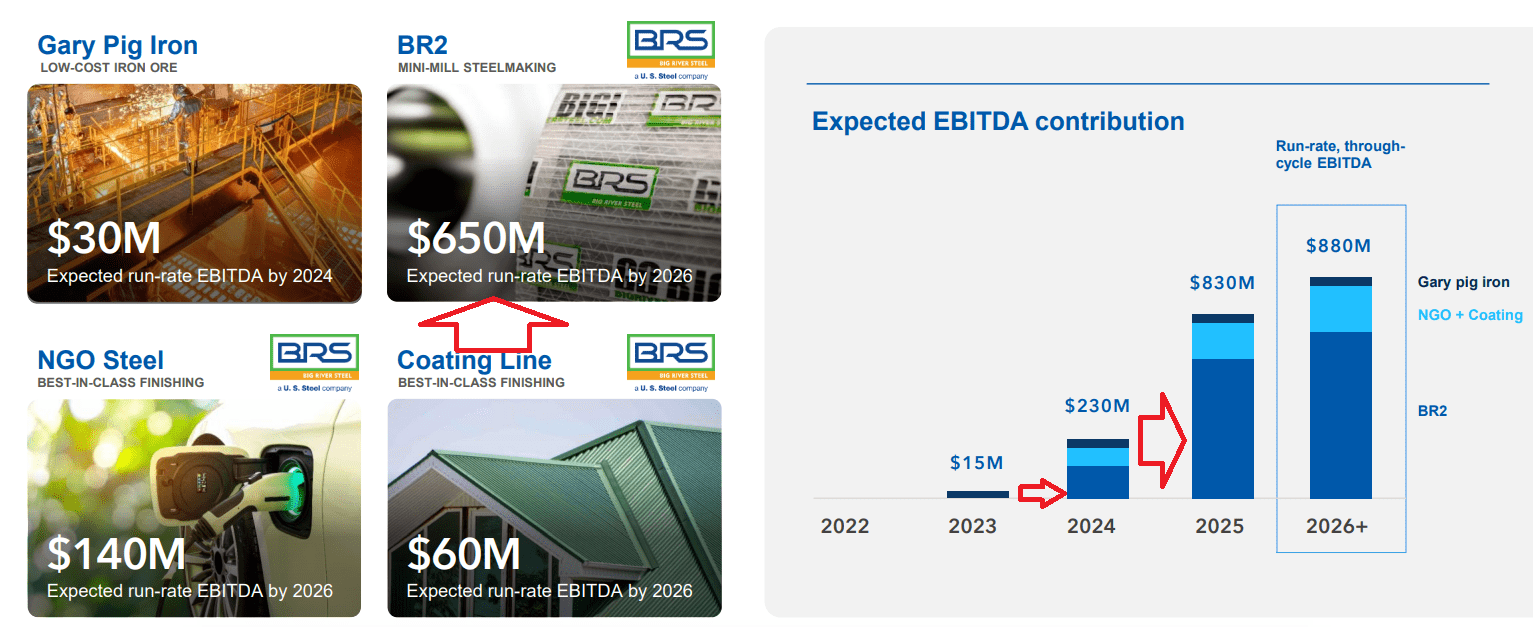

The second catalyst is that starting in 2024, US Steel will start to cut back on its capex cycle with its Big River 2.

X Investor Presentation

What you see above is that starting in 2024, US Steel’s Big River 2 (”BR2”) will start to become a significant EBITDA contributor.

This means that even if steel prices don’t move higher, which I fully expect them to over the next 12 months, as businesses start to understand that the fear of an economic recession has been overblown, irrespective of steel prices, US Steel will see stronger underlying profitability starting 2024.

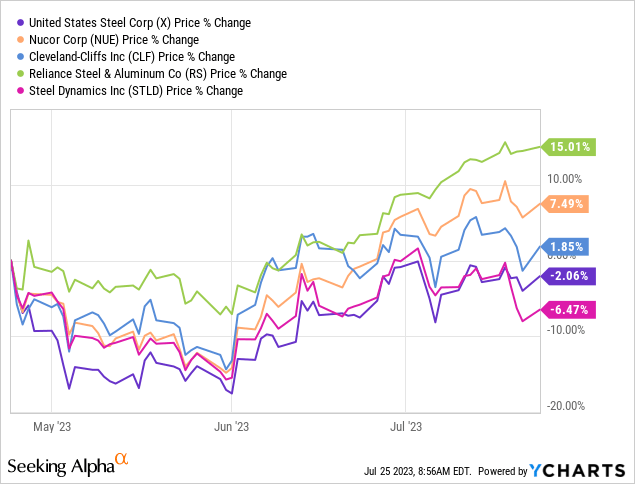

The point I’m making is that steel equities are finally starting to wake up, and in the month of June we have seen them move higher.

Furthermore, I argue that these very cheap stocks are getting finally catching a bid because investors are starting to believe that perhaps we are not going into a recession after all in 2023. And the further pushed back a recession appears to be, the softer it is likely to be, too.

The Bottom Line

Let me put everything in perspective, US Steel already preannounced that it’s going to make around $1.86 of EPS in Q2. This means that if steel prices remain around this price, or better, it could be possible for US Steel to make around $5 of EPS this year.

This would put US Steel priced at 5x this year’s EPS. That’s not expensive, particularly given that the demand for steel is very likely to increase in the coming couple of years.

I’m very hopeful that US Steel could eventually get to around $40 or $45 per share.