zhengzaishuru/iStock via Getty Images

Investment Summary

Just looking at the last report from Magnolia Oil & Gas Corporation (NYSE:MGY) would make you think there are facing incredible challenges. The net income dropped like a rock $106 million, a 49% decline from results 12 months earlier. The EPS ended at $0.5 which means MGY is currently trading at a p/e of 5 on a TTM basis, but 9 on a FWD basis. I find it likely we see similar low results for both Q2 and Q3 in 2023.

But we need to look beyond that and realize that MGY is taking measures right now to set itself better up for coming demand rather than growing margins just for the short term. Measures taken like working more closely with top suppliers of materials and services suppliers should ensure a tighter margin range for MGY to operate within. In the long run, this should yield better results in the ups and downs of the industry. MGY is however staying proactive and ensuring shareholders are getting some value still through dividends and buybacks. That makes me optimistic about the current situation and I am rating MGY a buy now.

Strong Outlook For Oil And Gas Still

With its operations in the United, States MGY has grown into a strong position fueled by market expansion and strategic acquisitions. MGY focuses on the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States, with properties and sites located around the Southern part of Texas.

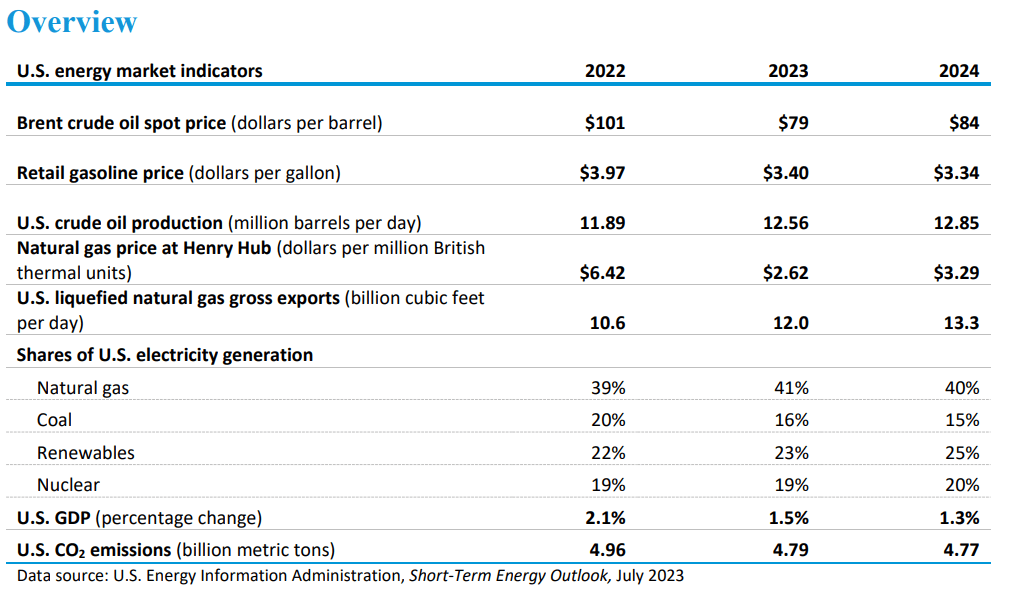

Some might say that the outlook for oil and gas is very negative as the rise of renewables is beginning and will make “traditional” energy sources take a back seat. But the fact of the matter is that both oil and natural gas will still be a very large part of our energy generation, even in 2050 when a lot of emission targets are set for.

Company Overview (Earnings Report)

Looking at where the price of oil is heading, the estimates suggest that between 2023 and 2027 the price will average out at $90. In Q1 of 2023, the average price of oil was $74.24 for MGY. That leaves an upside of 21%, which would significantly increase the revenues for MGY. In Q1 of 2022, the price of oil was around that $90 mark, which made them generate $208 million in net income, translating to an EPS of $0.9.

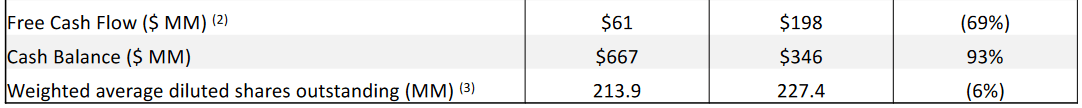

FCF Result (Q1 Report)

If we estimate the MGY will reach that then the full-year EPS would be around $3.6 if we assume that all quarters generate the same and the is no seasonality impact, which of course is unlikely. But their reference highlights that the long-term valuation of MGY looks quite cheap. With the EPS of $3.6 then MGY is trading at a p/e of 5.8. But as I have mentioned, MGY is taking measures to ensure investors are getting some value still, like buybacks. Reducing outstanding shares by 6%. This will fuel further EPS growth and make the valuation even cheaper.

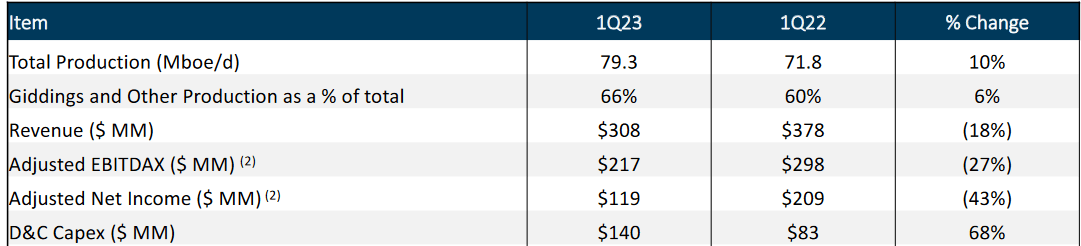

Quarterly Result

What made MGY drop its net income so much is the fact that market prices were far less favorable this year in comparison to Q1 of 2022. The production levels however were up 10%, which helped offset some of the losses but also showed that demand is still very much there.

Quarter Results (Q1 Report)

MGY remained active in passing down the $61 million of FCF they generated to shareholders. In total $76 million was returned to shareholders, where the majority came through share buybacks.

CEO Chris Stavros commented on the performance of the sites that MGY has, “Strong well performance in both the Karnes and Giddings areas and continued operating efficiencies at Giddings helped support year-over-year production growth of 10 percent during the first quarter”. Seeing solid operational performance makes me optimistic about MGY results when oil prices are higher and MGY should be able to yield solid returns then, just like in 2022.

Risks

In the context of an oil cycle, the ability of an oil and gas producer to sustain profitability in the later stages relies on two key factors: the characteristics of its producing fields and the adeptness of its management in efficiency and financial management.

One critical risk that impacts the profitability of oil and gas producers is volatile oil prices. Fluctuations in oil prices can have a significant impact on a company’s revenue and cash flow. During periods of low oil prices, the profitability of oil producers may decline, and their ability to cover production costs could be challenged. On the other hand, surges in oil prices can lead to increased profits for producers, but they may also face challenges in managing cost inflation and maintaining sustainable long-term growth.

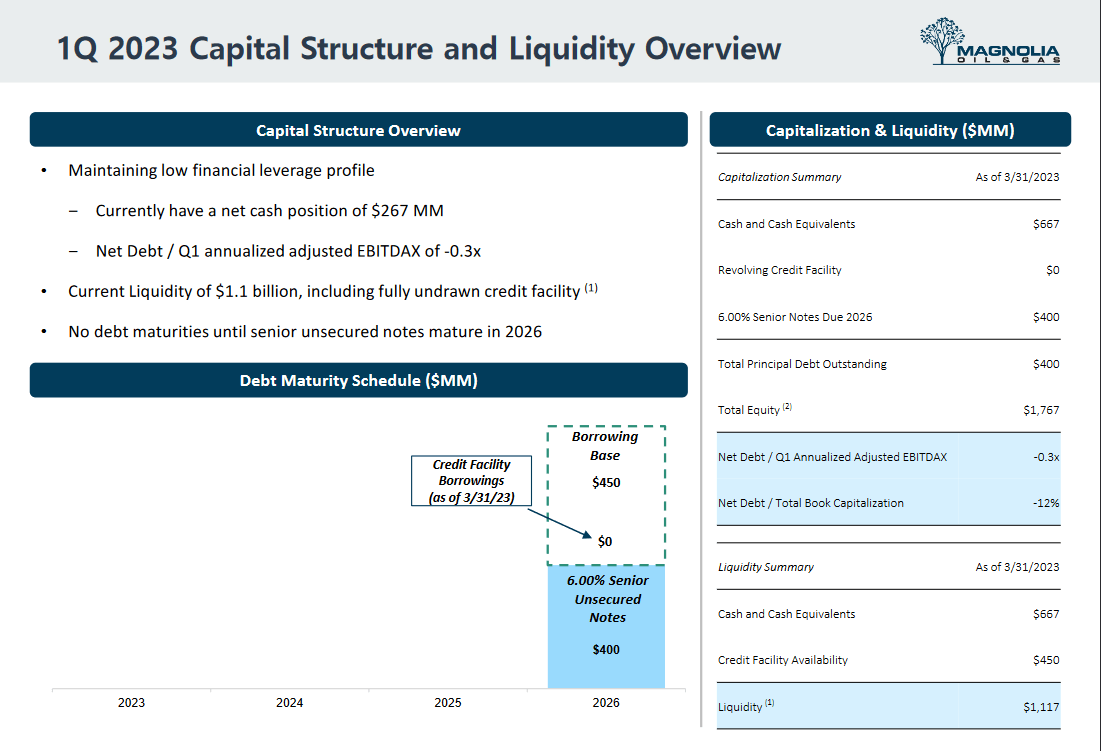

Capital Structure (Seeking Alpha)

As I have talked about though, MGY is taking measures to ensure that though times of lower prices they are still producing strong results, and when times change, they are ready to follow the momentum. But MGY is also keeping a very strong liquidity level right now, with a cash position of $220 million and total liquidities of $1.1 billion. This deleverage MGY and makes investments rather safe even though downturns in my opinion.

Valuation & Wrap Up

As I have highlighted previously, the p/e of MGY is rising on a forward basis to 9.7. This is far above the TTM of 5. With prices being lower than in 2022 investors should be prepared for a significant YoY decrease in both Q2 and Q3 of 2023. But as has also been highlighted is the fact that MGY still looks very appealing when evaluating the long-term price outlook for oil. If it averages at $90 between 2023 and 2027, just like in Q1 of 2022 a p/e of around 5.8 would be the average throughout that timeline, if MGY stays at around $20 – $21 per share.

Stock Chart (Seeking Alpha)

Comparing it to the sector is difficult because it also reflects these price differences, But in the TTM MGY has been trading around 25% lower than the p/e for the sector. That points out to me that MGY might offer less downside risk when prices become less favorable.

All in all, though, MGY has shown that it wants to pass down earnings to shareholders and ensure a solid return in times like Q1 of 2023. Buying back shares at a 6% rate YoY underscores that MGY has solid potential returns for the long term. Rating MGY a buy now.