Josie Elias/iStock via Getty Images

It’s here. It’s make-or-break time for the oil bulls. And I’m not saying that to be dramatic, but it’s time for the rubber to meet the road.

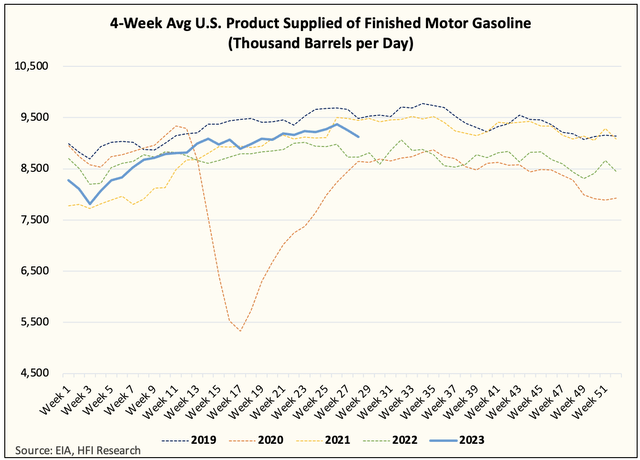

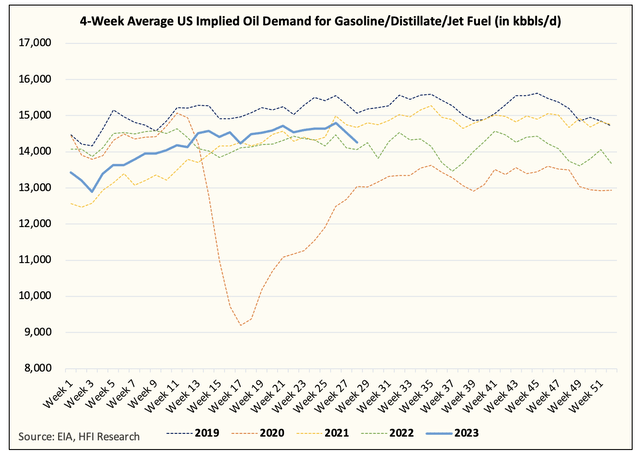

With the funky holiday data behind us, U.S. weekly implied oil demand popped, but there are still signs of weakness we are seeing. While implied gasoline demand in the U.S. is well above 2022 levels, we will need to see continued strength for this inflection point to be real.

EIA, HFIR

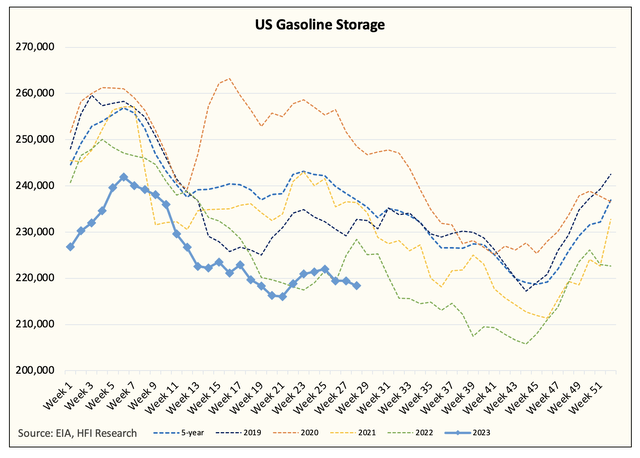

We believe that U.S. gasoline demand should continue to improve. If so, then we should continue to see gasoline lead the way for the oil complex. This has also been reflected in the very low gasoline storage we are seeing.

EIA, HFIR

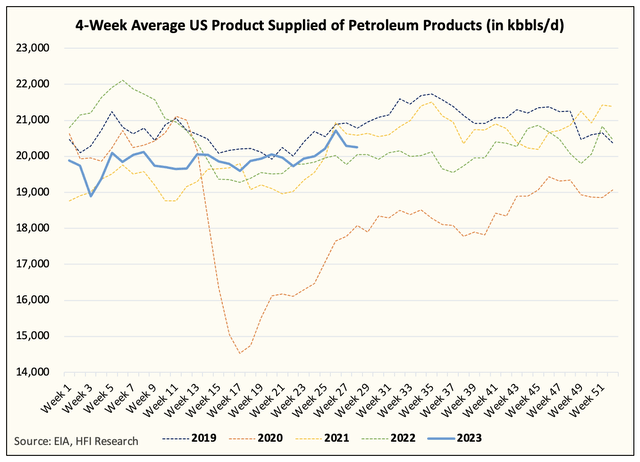

And while implied total U.S. oil demand is better than last year, we are still seeing pockets of weakness in areas like distillate.

Total U.S. implied oil demand

EIA, HFIR

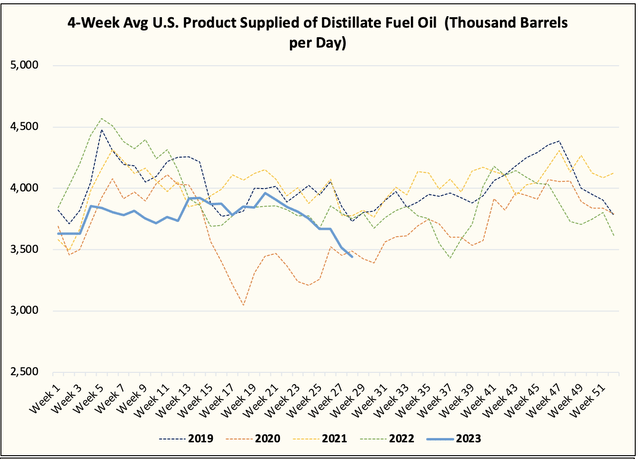

Distillate

EIA, HFIR

As we wrote in our write-up last week, distillate is an economically sensitive fuel, so persistent weakness in this figure implies that we are already in a recession on the manufacturing front. Consumers, on the other hand, appear to be doing better with better gasoline and jet fuel figures.

EIA, HFIR

The end result, however, is that the big 3 implied oil demand is barely just above 2022. You can thank weak distillate demand for that.

So this is what needs to happen for us to be right about this being the inflection point.

- We need to see higher implied gasoline demand over the next few reports. Gasoline is currently leading the oil complex and should continue to do so. This should be reflected in the crack spreads.

- Total liquids in the U.S. need to start drawing meaningfully. On average, we should see draws averaging over 6 million bbls over the next few weeks.

- Crude inventories should continue to draw. Our preliminary estimate shows next week’s draw is around 4 to 5 million bbls.

- We need to see signs of distillate demand bottoming. If not, then you can confirm that the recession is already here.

From an oil market perspective, the voluntary cuts from Saudi and Russia are starting to meaningfully drain oil-on-water, which will translate to lower onshore crude inventories. This combined with skewed oil speculator positioning will put upward pressure on oil prices. But the market will only buy the bullishness if global oil inventories trend lower. So this is why we need to be right about the most visible inventory data (U.S. market) in order for oil to keep trending higher.

If we are right, then we see WTI reaching $80 in the next few weeks.

It’s time for the rubber to meet the road.

HFI Research, #1 Energy Service

For energy investors, the 2014-2020 bear market has been incredibly brutal. But as the old adage goes, “Low commodity prices cure low commodity prices.” Our deep understanding of US shale and other oil market fundamentals leads us to believe that we are finally entering a multi-year bull market. Investors should take advantage of the incoming trend and be positioned in real assets like precious metals and energy stocks. If you are interested, we can help! Come and see for yourself!