jetcityimage

Investment thesis

Our current investment thesis is:

- Honda (NYSE:HMC) has an attractive revenue profile, diversified by region and product. Further, the business has a strong brand and product suite.

- The concern is that Honda is late to the EV transition and we are concerned about how the business will catch up. The Chinese producers in particular are dominating Asia and are positioned perfectly to expand globally. For this reason, the forecast growth for Honda is poor.

- Financially, the business is performing moderately but is underwhelming relative to peers.

- The company looks undervalued slightly but due to our commercial concerns, we consider the stock a hold.

Company description

Honda Motor Co., Ltd. is a leading global manufacturer of cars, motorcycles, and power equipment. The company operates through various segments, including car, Motorcycle, Financial Services, and Power Products, offering a diverse range of products to customers worldwide.

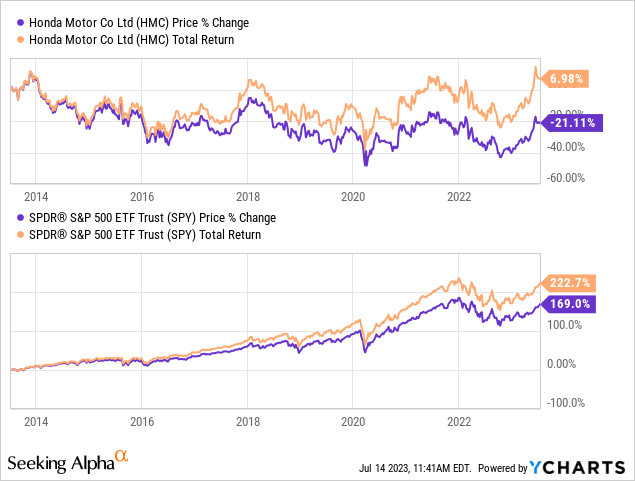

Share price

Honda’s share price has performed poorly in the last decade, during which time the wider market has achieved impressive gains (as has the automotive industry in particular). This is a reflection of its mild performance in conjunction with the impact of the changing industry dynamics.

Financial analysis

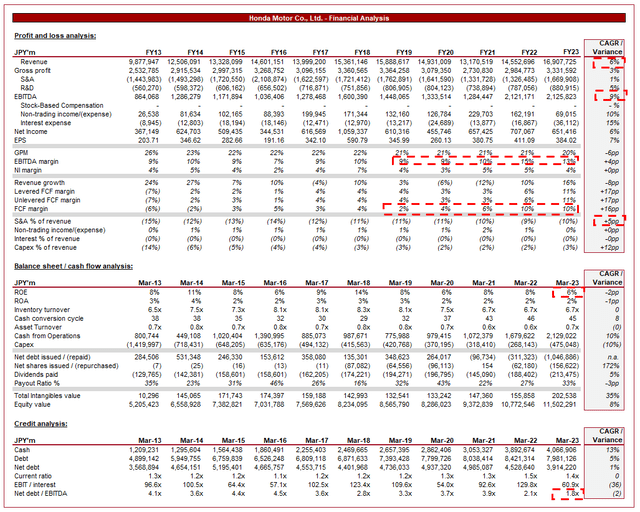

Honda (Capital IQ)

Presented above is Honda’s financial performance for the last decade.

Revenue & Commercial Factors

Honda’s revenue has grown at a CAGR of 6%, with generally consistent growth, although it has experienced the odd period of decline, a concerning occurrence.

Business Model

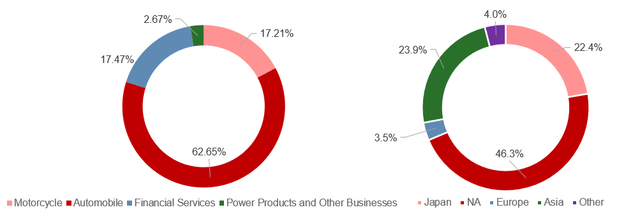

Honda offers a wide range of products, including cars, motorcycles, power equipment (such as generators, lawnmowers, and outboard motors), and even aircraft. This diverse product portfolio allows Honda to cater to different customer segments and geographies, contributing to a diversified revenue profile. This is a strategy that is only really seen in Japan, with most automakers specializing solely in cars.

As the following illustrates, revenue is highly diversified, both by region and Segment, although the business is weighted heavily toward Cars and Asia.

Revenue profile (Honda)

Honda places significant emphasis on R&D to innovate and introduce new products with advanced technologies. With the EV transition well underway (which we will discuss in further detail later), this is an increasing requirement for all businesses. Honda’s R&D efforts have resulted in numerous technological benefits, illustrated by the fact it is the largest engine manufacturer in the world.

Honda has built a strong brand image and reputation for manufacturing high-quality, reliable, and innovative products. The company is known for its engineering excellence, durability, and performance. This looks to be synonymous with its Japanese heritage, with Toyota (TM) perceived in a similar vein.

Honda has a global presence and operates in various markets worldwide. Importantly, the company has a strong market presence in all of the key markets, including Asia for Motorbikes and NA/Europe for Cars. This has been achieved through a strategy of localization, adapting its products and operations to cater to the specific needs and preferences of each market. By establishing local production facilities and developing strong distribution networks, Honda strengthens its market position and responsiveness to regional market dynamics. This strategy has been wound back somewhat to cut costs, with its UK manufacturing facility closed in 2021, ending Honda production in Europe (replaced with Japan, NA, and China).

Automotive Industry

Companies differentiate themselves within this industry through reputation, fuel efficiency, design, brand, and pricing. Honda competes with other global automotive/motorcycle manufacturers such as Toyota, Volkswagen (OTCPK:VWAGY), Stellantis (STLA), General Motors (GM), Hyundai (OTCPK:HYMTF), Renault (OTCPK:RNSDF), Suzuki (OTCPK:SZKMY), Kia (OTCPK:KIMTF), Yamaha (OTCPK:YAMHF), and Ford (F).

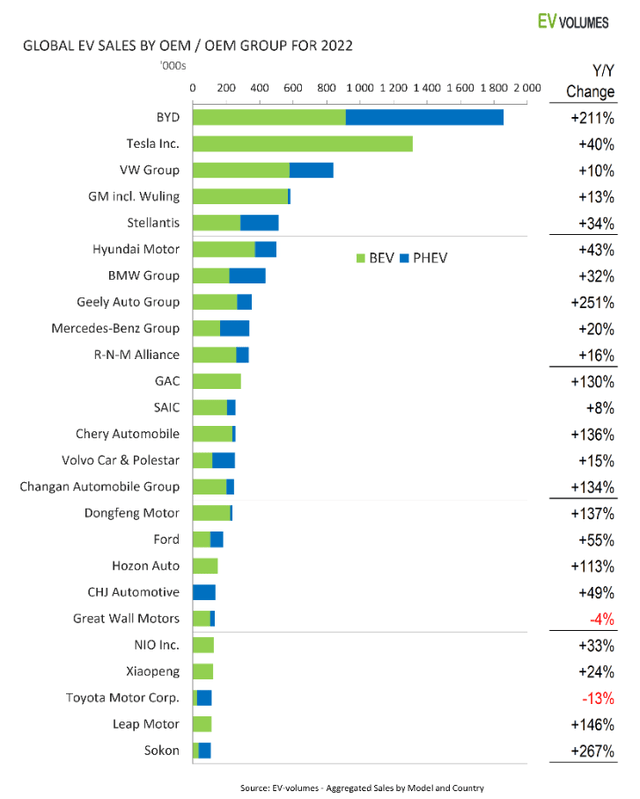

The increasing demand for electric vehicles (EVs) presents both opportunities and challenges for Honda, requiring investments in EV technologies and charging infrastructure. This has become a transition Honda must conduct, as global regulation and changing consumer behaviors are encouraging rapid adoption of this technology. EV sales were up 60% in 2023, with 1 in 7 cars sold being EVs. Currently, Honda is nowhere to be seen, relying on its traditional ICE-powered vehicles. As the following sales breakdown illustrates, Honda does not even make the list.

EV Volumes

The reason most of the traditional manufacturers have struggled with the transition is due to the need to fund both the legacy segment and the EV development, requiring significant cash (and debt). This is why EV specialists such as Tesla (TSLA) and BYD (OTCPK:BYDDF) have dominated. For a business like Honda, this is compounded by the fact it is the largest engine manufacturer, essentially seeing a large part of its market being eroded.

Honda has rightly acknowledged the impending transition and has committed to a production of 2m vehicles by 2030. Unfortunately, its peers will likely be significantly ahead by this point. Further, it places significant pressure for innovate and develop a leading proposition to customers. Its first all-electric SUV (due in 2024) will utilize GM’s battery platform. The business is essentially riding on the hope of extending the life of the traditional-ICE segment for as long as possible, hoping its brand and designs will support an easier transition in the future.

This reliance on demand for its current fleet cannot necessarily be relied on, however. The Chinese manufacturers, led by BYD, are currently dominating the global market. They are producing and selling vehicles at a fraction of the cost, with many suggesting they are ahead of their non-Chinese peers. Charlie Munger famously stated, “Tesla last year reduced its prices in China twice. BYD increased its prices. We are direct competitors. BYD is so much ahead of Tesla in China… it’s almost ridiculous”. If the Chinese manufacturers can successfully gain traction in the Western market, there is a real concern, not just for Honda. As an example, BYD is beginning to launch cars in the UK and Polestar (PSNY) is already quite successful.

Economic & External Consideration

The automotive industry was significantly impacted by the pandemic, as supply chain issues (namely in sourcing semiconductors) contributed to the inability to meet demand. These pressures have begun to subside, although continue to remain an issue. Honda attributes this as a key reason for its weak near-term performance. In the most recent quarter, growth has improved but the YTD remains down YoY.

The company is also impacted by the removal of tax reductions in China, contributing to softer demand. This will likely impact the coming quarters, as demand normalizes to a new level.

Finally, the wider economic weakness, especially in the West, represents the potential for near-term weakness. High inflation and elevated rates do not encourage large purchases.

Margins

Honda’s margins have improved in the last decade, reaching an EBITDA-M of 13% and a NIM of 4%. This improvement has been driven by operational improvement as the business has focused on cost-cutting, as well as commercial improvement to maximize pricing.

Balance sheet & Cash Flows

Honda has successfully deleveraged in recent years, with its ND/EBITDA ratio declining to 1.8x. This looks to be funded through the margin improvement, but also a reduction in Capex spending, allowing for FCF to noticeably expand.

This has allowed distributions to improve, as well as the company to accumulate a larger cash balance.

Outlook

Honda’s revenue is forecast to grow at a mild 2% in the next 5 years (Source: Capital IQ), reflecting the continued transition toward EVs, with Honda continuing to lag behind. This is a reasonable estimate given the issues thus far.

Industry analysis

Automotive industry (Seeking Alpha)

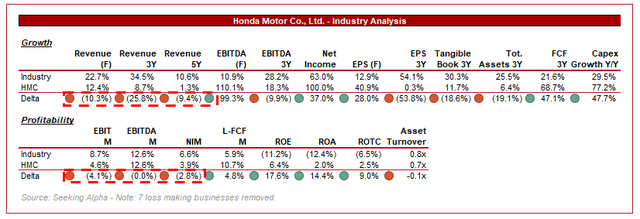

Presented above is a comparison of Honda’s growth and profitability to the average of its industry, as defined by Seeking Alpha (25 companies).

Honda performs poorly relative to the peer group in our view. The lack of growth is a reflection of its disappointing EV transition, with businesses such as Tesla driving this impressive performance. Even if we compare Honda to the traditional players on a 5Y basis, Toyota and Volkswagen grew by 5%.

On a profitability basis, however, Honda performs far better. It is about average relative to the market while performing better than Toyota, Volkswagen, and GM.

Valuation

Valuation (Capital IQ)

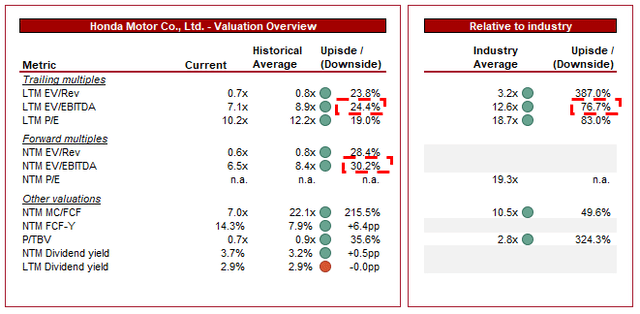

Honda is currently trading at 7x LTM EBITDA and 6.5x NTM EBITDA. This is a discount to its historical average.

A discount to its historical average is likely warranted given the commercial weakness the business is facing. Its growth trajectory is expected to materially slow following the end of this year and we currently have little visibility as to how the business will look in the coming years with the EV transition.

Relative to its peers, a discount is undeniably warranted. The company is underperforming financially, and unlike the majority of them, its wider EV development is still in its infancy.

Given the discount mature Japanese stocks trade at relative to Western / Growth stocks, we believe the historical analysis is likely more useful. If we assumed a c.20% discount, Honda would be marginally undervalued.

Final thoughts

Honda is a solid business. The company has good designs, a strong brand, and a quality approach to the segment of the market it targets. We believe the business will continue to remain important, however, it is facing a difficult few years. The business has a big catch-up ahead and we are unsure how compelling the company will be once this is done.

By the time it is able to mass produce its affordable vehicles, the Chinese may already be dominating the global industry.

The company is undervalued currently but we believe the commercial concerns mean the upside potential is limited.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.