maybefalse

I argue that we are seeing a shift in the risk-reward for Alibaba Group Holding Limited (NYSE:BABA) stock right now.

Sentiment is still poor, but this improved risk. reward brings attractive opportunities for long-term investors.

The business fundamentals of the company is improving, while its risks have also been reduced.

Today, I’ll be sharing several updates about Alibaba, given how we saw in the news headlines about Ant Group, the recent 6.18 festival in China, Jack Ma’s message to business leaders of Taobao and Tmall, and a preview into the June quarter. I also highlight what I think are some of the near-term catalysts of the company.

Key developments

Recently, Ant Group was fined Rmb 7.1 billion, or almost $1 billion, by the authorities.

This is expected to be the end of multiple years regulatory crackdown into the technology sector in China and specifically, positive news and closure for the fintech company of Alibaba.

On top of the fine, Ant Group will be required to stop its crowdfunded medical aid service and compensate user. This business was closed in 2021.

This penalty is one of the largest fines ever given out to an Internet company in China. According to a statement, Ant Group violated laws and regulations in corporate governance, anti-money laundering obligations, and financial consumer protection.

In addition, Ant Group also said that it has already completed its rectification work and will comply with the terms of the penalty and improve governance and compliance in the future.

Who else was fined?

While the major news outlets mostly covered the fine of Ant Group, there were many other financial companies that faced fines by the authorities.

Companies that were fined by the authorities include Ping An Bank, PICC Property and Casualty, Postal Savings Bank and Tencent’s payment platform, Tenpay.

Tenpay was given a penalty of about Rmb 3 billion or $420 million, for similar violations like customer data management,

The authorities ended this investigation stating that the majority of the problems of these financial businesses have been corrected and the regulator’s focus will shift from individual companies to the industry regulation as a whole.

Implications

The fine was seen as a positive sign for the entire Internet sector in China, as it shows that the authorities’ crackdown mode is slowly ending, and the Internet sector will likely see more “normal” business operations and regulatory environment going forward.

Ant Group share repurchase

On top of the news of the fine, Ant Group also announced it will be repurchasing 7.6% of its share capital at a valuation of $78.5 billion.

This is about 75% below the valuation it received before its failed IPO in November 2020 when the firm was valued at $320 billion.

Also, this is 23% higher than the $63.8 billion valuation that Fidelity marked its holding of Ant in January 2023.

This implies that Alibaba’s stake in Ant is $26 billion, or about 12% of Alibaba’s market capitalization.

I do not see the valuation drop in Ant as a bad thing, given so many other tech darlings have seen their valuations correct significantly over the same period.

The reason for the share repurchases of Ant shares is to provide existing investors with the necessary liquidity while also retaining staff through employee incentives.

Potential future catalysts for Alibaba

I think that bulk of the near-term catalysts will be event driven.

This may come firstly from the final completion of the restructuring of the financial holding company.

Secondly, there’s a chance of an announcement of an Ant IPO, although I am of the view that this is probably about 12 to 18 months away.

Lastly, the spinoff of the cloud business in 2024 and the implied valuation that it will be able to achieve on that will be another key event driven catalyst in my view.

These event-driven catalysts provide nice upside drivers in the near-term as the company looks to unlock value through this restructuring of its business segments.

Fundamentals and a preview into the June quarter

The consumption sentiment recovery remains rather slow, but I think that the combined factors of an easier comparable and better-than-expected 6.18 promotional traction will lead to the GMV growth of Taobao and Tmall in the June quarter to be better than what market expects.

In this year’s 6.18 shopping festival, Taobao and Tmall attracted a record number of merchants, while more than 2.6 million SMEs generated a higher GMV than in the prior year’s 6.18 festival. Also, the short-form videos average daily views on Taobao also increased by 113% year-on-year. More than 400 brands that launched flagship stores on Tmall Global saw sales double in the first four hours of the festival.

In addition, international commerce and local consumer services segments are also likely to do better than expected in the June quarter as a result of a rebound in Eleme, AliExpress and Amap services.

The focus for the rest of the financial year will not just be disciplined management of costs and scaling back of newer non-core initiatives to improve margins. The company still looks to increase their investment in innovation, technology and to improve user engagement and experience. This balancing act, in my view, will lead to considerable upward revision in profit expectations for the rest of the year.

As such, I am cautiously optimistic that the low expectations along with better-than-expected business momentum and continued solid execution from management will lead to a positive June quarter for Alibaba.

A message from Jack Ma

It was reported by multiple news outlets that the founder of Alibaba, Jack Ma, met with the business leaders of Taobao and Tmall Group.

The news source claimed that Jack Ma thought that Taobao and Tmall are in a highly challenging situation today, with strong competition coming from multiple competitors and multiple formats.

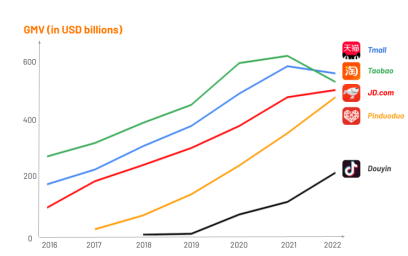

As can be seen below, competitors like Pinduoduo, now PDD Holdings (PDD), and ByteDance’s Douyin are taking up increasing share in the e-commerce market in China.

Competition continues to heat up as China market saturates (Momentum Works)

Jack Ma encouraged the management of Taobao and Tmall to be proactive and innovate, as the past ways in which the business used to succeed are no longer relevant in today’s market.

As a result, Jack Ma said the business should focus on Taobao, users and the internet and to flatten the organization structure of the business.

With more focus on product innovation like the use of AI to bring value add to SMEs, the company needs to ensure that they continue to evolve with the environment to maximize its opportunities.

I think with Jack Ma coming out to speak to these business leaders of Taobao and Tmall, this highlights the start of the company’s increased focus on the business segment to ensure that it maintains its market share from here on and is able to defend its competitive position from other competitors. At the end of the day, Jack Ma knows the ingredients necessary to make Taobao and Tmall great again.

Retail sales data updates

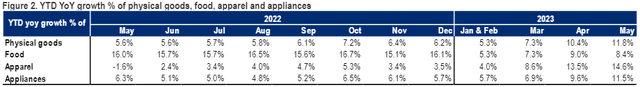

In May 2023, online physical goods sales were up 17% year-on-year and 17% month-on-month. On a year-to-date basis, as of May 2023, the online physical sales were up 12%, as shown below, which shows an improvement in the trend from January through to May, 2023.

NBS data updates (NBS )

The online physical sales numbers were likely in line, as the market was expecting a recovery in the numbers from the prior year and that demonstrates the improving trend of consumer spend in China.

This bodes well for Alibaba, as it implies that the consumer recovery in the online goods space is in progress and on track, leading to greater confidence in the June quarter’s numbers.

Valuation

Alibaba currently trades at 10x NTM P/E.

From a relative valuation perspective, I am of the opinion that Alibaba’s valuation remains cheap given how the opportunities have improved while the risk on the stock and the industry has also declined. This means that Alibaba has a strong risk-reward opportunity from here.

I’ll be looking to the near-term event driven catalysts and the June quarter for near-term upside to bring its depressed valuation to more normalized terms.

Concluding thoughts

I think the recent fines on the financial platform companies were seen as a closure for Ant Group and other financial platform companies in terms of the regulatory crackdown that started in 2021.

In addition, the near-term catalysts remain to be event-driven, including the completion of the restructuring of the financial holding company, the announcement of an Ant IPO, or the spinoff of the cloud business and other businesses.

The retail sales data shows that online physical goods sales are recovering in line with expectations, and the recent 6.18 festival had better than expected momentum, which will likely result in the June quarter performing better than expected.

I think Jack Ma’s recent message to the business leaders of Taobao and Tmall shows that we will see greater focus on revitalizing and regenerating the growth in this business segment for the business to be able to compete against future and current competitors. Product innovation and investment in technology will bring better user experience and improved customer loyalty over time.

I think that the Alibaba investment case looks way better today than it did earlier in the year. We are starting to see the company come out of the woods in terms of the regulators and authorities ending their probes and investigations into the company and the company having corrected their ways after these probes and investigations.

In my opinion, valuation remains depressed, and the risk reward opportunity is attractive given how the fundamentals have improved while the risk level has fallen since the height of the crackdown.

At the end of the day, I think that the weakness in the sentiment of Alibaba stock will improve only when the regulatory cloud has cleared up. In my view, we are nearly at the end of the tunnel in this regard.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.