We Are

Main Thesis & Background

The purpose of this article is to evaluate the iShares Global Energy ETF (NYSEARCA:IXC) as an investment option at its current market price. This is a passively managed sector fund with an objective “to track the investment results of an index composed of global equities in the energy sector.”

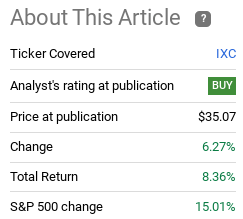

This is an Energy fund I owned for a while and will continue to do so going forward. However, with Energy being a volatile sector, I tend to be a bit more active with this holding when compared to the rest of my portfolio. Case in point, when Energy was selling off back in Q1, I saw this as an opportune time to build to my position in IXC. I’m happy I did, as it has returned a pretty sizable gain since that time (albeit less than the S&P 500):

Fund Performance (Seeking Alpha)

With this in mind, I am starting to see a more clouded horizon for Energy at the moment, and IXC by extension. I think further gains will be difficult to come by. I see merit in reducing my exposure a bit, locking in some of these profits, and waiting for a better (cheaper) entry point to come along. For this reason, I am downgrading my rating on IXC to “hold” and I will explain why in this review.

Major Economies Showing Signs Of Slowing

One of the primary concerns is that Energy – and other cyclical sectors – are very reliant on economic signals. Unlike funds that track more stable sectors, IXC will see increased volatility when headlines/economic metrics paint contrasting pictures. This is certainly true at the moment, with the fund seeing some decent swings over the past few quarters. As my prior paragraph shows, the gains have been fairly strong in the short term, but my concerns stem from weakening economic signals that could push Energy lower as a whole.

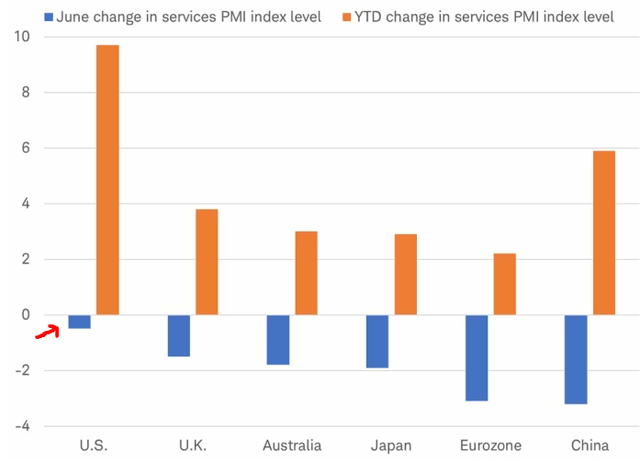

Chief among these signals is the Purchasing Managers’ Index, which tracks the expansion or contraction of the manufacturing sector in the U.S. and other economies worldwide. This was actually a saving grace for the market for most of the year in 2023 so far. As worries of a recession dominated headlines last year and this year, the PMI index across the developed world showed strong growth and put some of those concerns at ease. However, after rising for much of the first half of the year, the PMI has fallen for multiple countries in June:

Services PMI Change (By Nation) (Charles Schwab)

This can be seen a precursor to a recession or at least a weaker economy in the second half of the year. While I do not want to be alarmist (and I still plan to hold plenty of IXC in my portfolio) this definitely seems like a sign to reduce some of my exposure. If this is the start of a reversal in economic growth then Energy is probably going to come under pressure. With that understanding, I would be surprised if investors don’t get a better to pick up these shares in the coming months.

Oil Is At A Key Resistance Level

Another point of concern is that oil may have peaked in the short term. The recent rise in crude prices has been a boon for the sector, helping drive the gains in IXC that I already mentioned. But WTI crude is now hitting its 200-day moving average, a key resistance level:

WTI Futures (Bloomberg)

Of course, if crude can break this resistance, more gains could come. But I don’t see this as the likely course of action given the slowing in key economic metrics like the PMI.

The takeaway here is that oil’s price action drives the Energy sector. It isn’t the only attribute we need to concern ourselves with, but it probably is the most important. We have seen the sector rising over the past month on the backdrop of WTI’s rise. Now I expect oil prices to take a bit of a breather and that means IXC is likely to follow them lower. That is central to why I am downgrading my rating.

British/European Exposure May Hurt, Not Help

Another cautionary sign is IXC’s foreign exposure. This is generally something I view positively for the fund. It helps to diversify my US-centric portfolio and gives me additional exposure to oil majors that I don’t get from my other holding – the Vanguard Energy ETF (VDE). However, at this juncture, I am concerned about inflation across the pond more so than domestically. If central banks in Britain and Europe tighten (put in place restrictive policies) at a faster rate than here at home, economic growth could be weaker there than here. This would mean cyclical areas like Energy could actually perform worse outside US borders than in them.

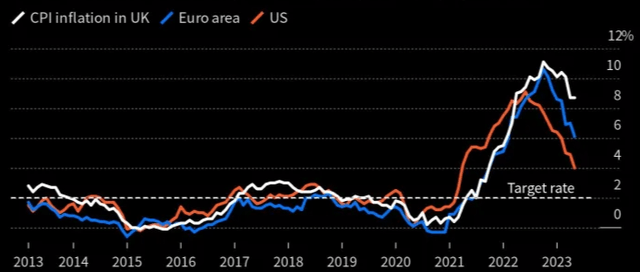

The reason for my worry at the moment is that inflation levels remain much higher in both the UK and in mainland Europe than in America:

CPI Figures (Yahoo Finance)

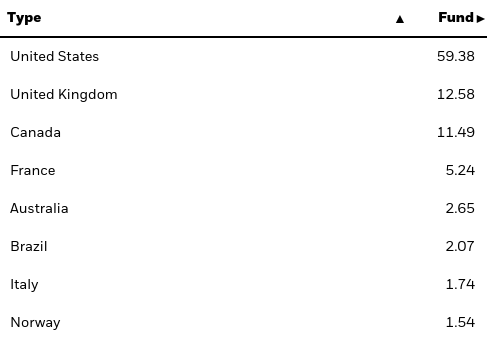

This is relevant to IXC in isolation because the fund has almost 40% non-US exposure, with a good chunk of that coming in the UK and Europe:

IXC’s Geography (iShares)

What I draw from this is to be careful with European and British exposure right now. Consumers and businesses there will continue to be pressured by high prices and at a rate higher than here at home. This makes me like American companies more by comparison and suggests a less bullish outlook on European and British stocks overall has some merit.

Supply Disruptions Can Be Fleeting

For those who watch the oil market closely, they may be aware that some of the gains in recent weeks is due to supply disruptions. These have been due to a number of reasons, such as protests in Libya, the Russian-Ukraine conflict which impacts the Black Sea, fires in Mexico, and leaks in Nigeria, among others. All of these factors have been the focus on recent news articles and headlines such as the one shown below as an example:

Recent Industry Headline (Reuters)

The message here is not that supply disruptions do not matter. They absolutely do – and in a big way when it comes to short-term oil prices. But “short-term” is the key element here. These disruptions tend to ease and re-emerge over time, making tactical entry and exit points crucial to alpha generation. In my view, these disruptions have occurred, oil has bounced, and now is the time to take some profit before these factors even out (as they usually do).

It’s Not Just Oil That Is Seeing Lower Demand

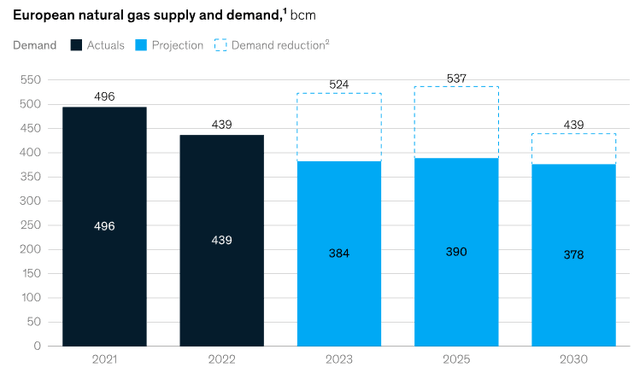

My final thought moves out of the oil market and into natural gas. This is important because “energy” is not just crude oil. This global commodity is probably the biggest drive in IXC’s price action, but natural gas (and other energy inputs) are also relevant and deserve some attention. In this light, the forecast for lower natural gas demand across Europe in the years to come has caught my attention:

Natural Gas Supply/Demand (Euro-zone) (McKinsey)

The logic here is that as demand slows, prices will fall lower. Natural gas has also benefited from supply disruptions and that could absolutely continue in the second half of the year – especially on the backdrop of Russia-Ukrainian escalations. But forecasts for lower demand in the years to come should also be factored in. This is key to why I like selling into strength in this volatile sector.

Bottom Line

IXC has seen a nice gain in the past four months and there is merit to holding on to this ETF. I continue to like the broader Energy theme for diversification purposes and as a hedge against the rising concentration within the S&P 500. Further, IXC’s European exposure makes it a nice compliment to other domestic-focused Energy ETFs that I own.

However, I have concerns about the short-term forward return. Supply challenges in both the oil and natural gas markets have ways of evening out over time. This tells me that it can be prudent to sell into rising prices on those headwinds, and buy back in when those headwinds subside (and prices similarly fall). There are also broader economic challenges across the developed world. A consistent decline in PMI figures can often signal economic weakness and/or a recessionary environment. If that turns out to the case then Energy ETFs, and IXC by extension, are probably due for some pressure. Therefore, I believe a downgrade to “hold” is the right call at this time.