Sergei Dubrovskii

Helix Energy Solutions Group (NYSE:HLX) specializes in well intervention and well abandonment, including deep see robotic operations. The company has enjoyed strong revenues and financial performance during PY2022, but its Q1-2023 performance was weak. Helix Energy Solutions addressed the reasons for the poor performance in its Q1-2023 conference call and gave guidance for the rest of the fiscal year. The company expects stronger performance for the rest of the year, especially during the second half.

Helix Energy Solutions’ stock has been on an extreme uptrend of 225% over the last twelve months. I would recommend the stock as a buy, but it typically undergoes a downtrend in July after its earnings release. One might wait until the market has digested the release before opening a position. The stock may stabilize around $10 channel and beyond in the near future, so long as the company continues its strong financial performance. The stock currently trades at $8.15 per share and seems undervalued. One should watch for the best entry point for an investment.

Operations

Helix Energy Solutions has current operations in Europe (North Sea), West Africa, Asia (Thailand and Australia), South America (Brazil), the Gulf of Mexico, and the US East Coast. The company reports its revenues in four operating segments: Well Intervention, Robotics, Production Facilities, and Shallow Water Abandonment.

Helix Energy Solutions owns a large fleet of technical vessels and equipment for the service of offshore energy operations. Well Intervention concerns the servicing of offshore wells, including enhancement and decommissioning. Robotics concerns trenching, seabed clearance, offshore construction, as well as repair and maintenance. Shallow water abandonment, which the company does in the Gulf Coast, concerns offshore oilfield decommissioning and reclamation, as well as repair, heavy lifts, and commercial diving services. The company’s production facilities include ownership of gas and oil properties in the Gulf of Mexico. The company has current projects which concern trenching for wind farms.

Q1 Results and Q2 Guidance

Investor Presentation

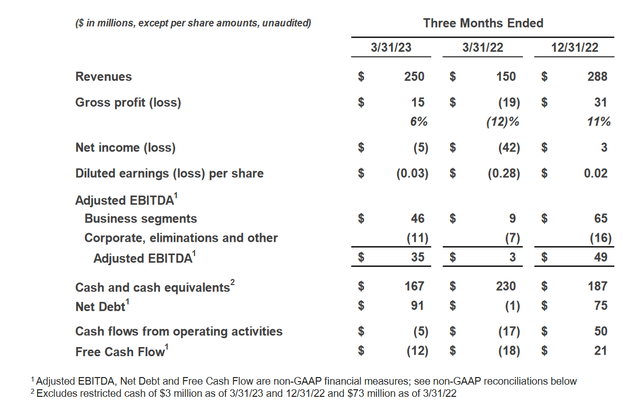

For Q1-2023, Helix Energy Solutions reported revenues of $250 million, a 66% increase YoY. Revenues for Q1 decreased $38 million from Q4-2022. The company showed a net loss of $5 million, compared to a net loss of $42 million in Q1-2022. For Q4-2022, the company reported a net income of $3 million. Adjusted EBITDA was $35 million, compared to $3 million in Q1-2022 and $49 million in Q4-2022. The company’s revenue numbers have increased over 2022 and should continue to increase for 2023. The company has reported a gross profit six times out of the last nine earnings releases.

Operating cash flow for Q1-2023 was a negative $5 million, compared to a positive $21 million for Q4-2022. Over the last nine quarterly reports, or roughly two years, the company has reported positive cash flow six times and negative cash flow three times. Expenses for Q1-2023 included $17 million of dry dock and recertification costs, as well as $7 million in capital expenditures. The company’s fluctuation in cash flow is dependent on the costs of vessel maintenance and certifications.

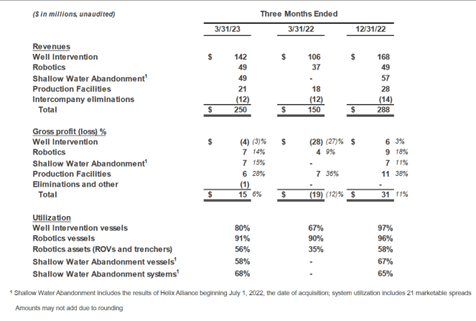

The company’s revenue by segment breakdown is as follows:

Investor Presentation

Although the company had better financial performance YoY and the demand for its services remains robust, its Q1-2023 performance was by the company’s own admission weak. Helix Energy Solutions experiences seasonality in earnings because of weather conditions, maintenance, certification issues, and project mobilization. The company measures its earnings potential based on the percentage of utilization of each vessel and system.

The company explained that its Q1 reports are typically the weakest in terms of performance. The company addressed this seasonality in its Q1-2023 conference call:

Of course, offshore work is always impacted due to the seasonality of the weather. This is also why we historically scheduled dry docks and related CapEx expenditures for Q1. The negative impact to our quarterly free cash flow is just a timing issue resulting from the front-end loading of this CapEx.

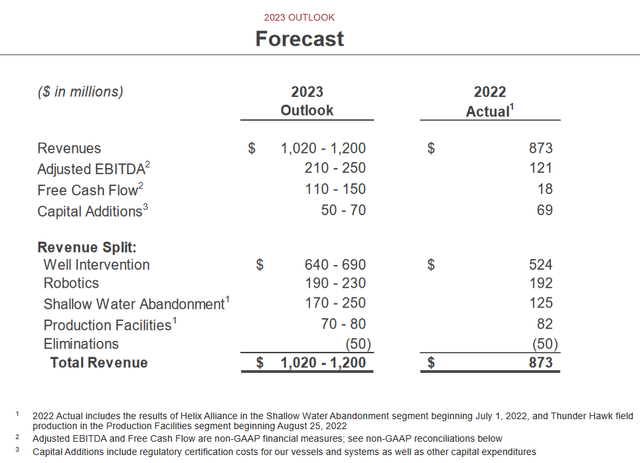

The company said that Q2-2023 performance would be better than Q1. It expects Q3 and Q4 to be the stronger reports. The following is the outlook for 2023 from the company’s investor presentation.

investor presentation

The company expects PY2023 revenues to be between $1 billion and $1.2 billion and EBITDA to be between $210 million and $250 million. The company should report free cash flow between $110 million and $150 million. It plans capital expenditures between $50 million and $70 million. As of its Q1-2023 earnings transcript, the company said that it is on track to end the year on the high end of its guidance.

According to market estimates, the company is expected to report $273 million in revenue and an EPS of $0.07. For the next earnings report, one will want to see whether the company shows a net income and free cash flow. These indicators should foretell whether the stock will rally on the report. The company has not given any update of its 2023 expectations besides its forecast in its Q1-2023 investor presentation and conference call.

Stock Price Gains 225% Over the Last Year

www.stockcharts.com

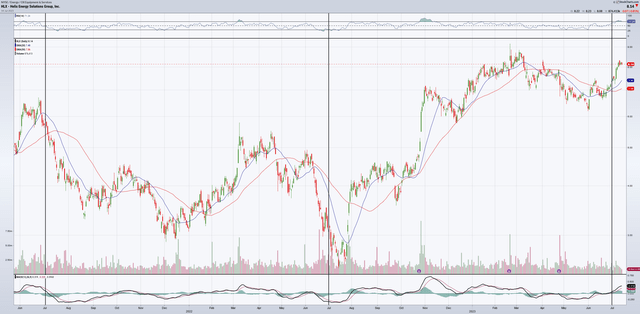

Helix Energy Solutions’ stock price has increased 225% over the last twelve months. Before its earnings report last July, the stock dropped to an extreme low. The next two quarterly reports (July and November) brought the stock to higher price channels. The next release may decide whether it goes higher or lower. Currently, the stock price is on the uptrend. It is up 18% over the last thirty days. It is currently trading over its 20/50/200 moving day averages.

The graph covers two years of price performance. You can see that July is a choppy month for the stock price, regardless of its direction. I added vertical black lines for each month of July, so one may see the trend better. The company’s stock is owned by large institutions (over 90%) and it has a large number of outstanding shares float (93%). Sometimes these metrics indicate a short squeeze and another reason to be cautious about a July strategy.

Risk and Investment Strategy

I believe the company’s financials are sound and there is no risk of liquidity. Helix Energy Solutions has sufficiently explained why its cash flow fluctuates from quarter to quarter. Overall, the company does not operate at a loss and rather enjoys robust revenue growth and gross profits. The company describes its services as technical and in high demand. The risk seems low for a long-term strategy.

The company’s stock price trades at 1.28x (NTM) Total Enterprise Value / Revenues. Helix’s Total EV is $1.53 billion. Its book value per share is $10.00. The stock currently trades at $8.15-$8.20 per share. Street targets on the price range between $10 and $13 per share.

The larger stock market conditions remain volatile, although there has been improvement. The market is slowly entering bullish territory, but new risks are emerging. The energy market has been bullish, but also undergoing volatility. Helix Energy Solutions’ business is not dependent on the price or demand for energy. It rather depends on the needs of offshore rig maintenance and the need for shutting down well sites.

One should watch the July earnings release and the stock price trend afterward. Any news of negative cash flow or net loss will likely drop the stock. Even if the report is positive, short squeeze conditions might ultimately drop the stock price. Once the price seems to stabilize, one should consider a long-term position and possibly a covered call strategy.

Conclusion

Helix Energy Solutions offers technical services to the offshore energy sector. The company’s strong financial performance indicates the high demand of its services. The company has consistently showed net profits and free cash flow over the last two years of reports. The company’s Q1-2023 report was weak, but it promised better results for the rest of the fiscal year, while citing seasonality for Q1 performance. The company’s stock has been up 225% over the last twelve months and up 18% over the last thirty days. Helix Energy Solutions is set to release its Q2-2023 earnings report after market on July 26th. I rate the stock as a hold for now, but recommend a long-term strategy after the price stabilizes post earnings.