baona

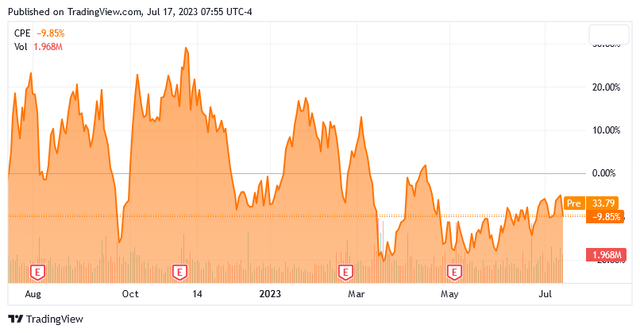

Callon Petroleum Company (NYSE:CPE) is an independent exploration and production company that primarily operates in the Permian Basin of West Texas. This is a very popular place to operate, and there are several independent exploration and production companies in this area. Unfortunately, Callon Petroleum Company has not performed very well in the market recently, as the stock is down 9.85% over the past year:

Seeking Alpha

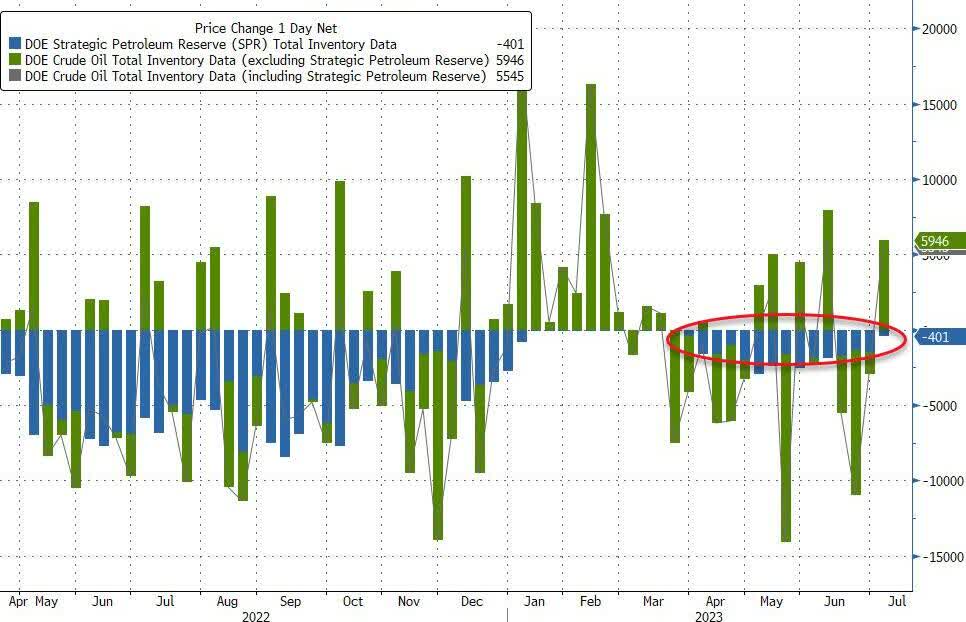

This is almost certainly being driven by energy prices, as both crude oil and natural gas are down over the same period. However, there are some reasons to believe that crude oil will rise in the near future, as production growth in the Permian Basin appears to be showing signs of slowing down and OPEC+ is actively cutting production in an effort to drive up energy prices. This is balanced against the fact that the United States government will eventually have to refill the Strategic Petroleum Reserve, as the Biden Administration has now been drawing from it for fifteen straight weeks, which is on top of the sales that occurred last year:

Zero Hedge

Once the Administration starts buying oil to replenish the SPR, this will represent a large new buyer entering the market. This will almost certainly push up prices given the relatively tight balance between supply and demand. That should serve as a positive catalyst for Callon Petroleum’s catalyst, especially if the Administration begins buying in the fourth quarter of this year, as it recently hinted at. The overall fundamentals for the oil bull case are still positive even without the refilling of the Strategic Petroleum Reserve, and Callon Petroleum is currently trading at a remarkably cheap valuation, so entering a position today could make sense even if you doubt the government’s statements about refilling the nation’s stockpile.

About Callon Petroleum Company

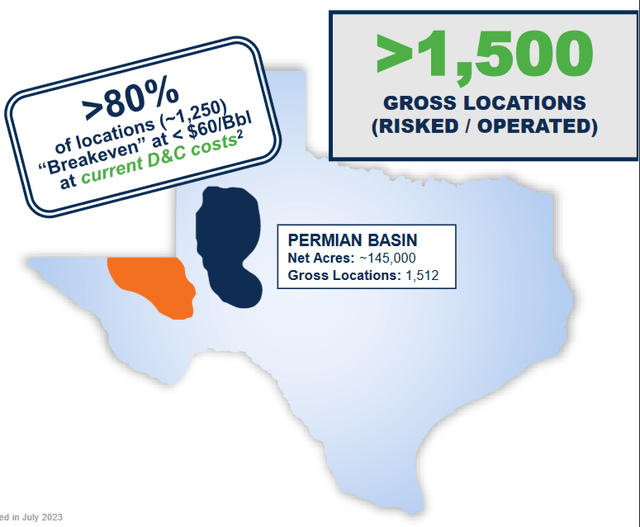

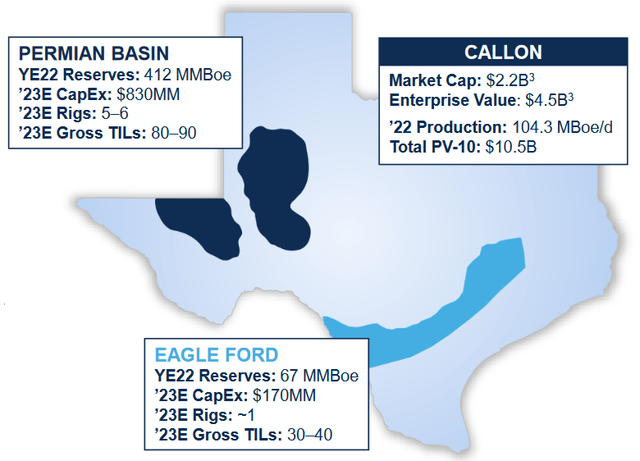

As stated in the introduction, Callon Petroleum Company is an independent exploration and production company that primarily operates in the Permian Basin of West Texas. The company owns approximately 145,000 net acres throughout the region:

Callon Petroleum

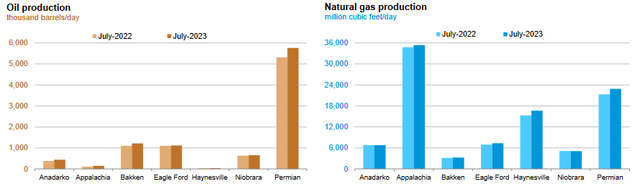

The Permian Basin will almost certainly be a very familiar name to anyone that has followed the American energy industry for any length of time. After all, this is the region that has been the focal point of the American energy renaissance that led to the nation briefly becoming a net exporter of fossil fuels prior to the COVID-19 pandemic. While the nation may or may not hold that status today (reports are conflicted), the Permian Basin is still a very important region of the United States as it is the largest producer of crude oil and the second-largest producer of natural gas in the nation:

U.S. Energy Information Administration

This makes a great deal of sense as the region is one of the wealthiest in the world in terms of hydrocarbon deposits. According to the U.S. Energy Information Administration, the Permian Basin still contains approximately five billion barrels of crude oil and nineteen trillion cubic feet of natural gas despite the fact that it has been exploited since the 1920s. As such, we can probably expect that Callon Petroleum will have considerable amounts of resources located on and under its land in the region.

In fact, this is the case, which we can clearly see by looking at the company’s reserves. An energy company’s reserves are something that are frequently overlooked by investors but they are critically important. This is because the production of crude oil and natural gas is by its nature an extractive process. Companies like Callon Petroleum literally obtain the products that they sell by pulling them out of reservoirs that are located in the ground. As these reservoirs contain a finite quantity of resources, a company must continually discover or otherwise acquire new sources of resources or it will eventually run out of products to sell. A company’s success at accomplishing this task is by no means guaranteed, so its reserves dictate how long it can continue to operate without success in this endeavor. As of December 31, 2023 (the most recent date for which data is currently available), Callon Petroleum had total proved reserves of 412 million barrels of oil equivalent in the Permian Basin and 67 million barrels of oil equivalent in the Eagle Ford Shale:

Callon Petroleum

Things look a little bit different today as Callon Petroleum sold all of its assets in the Eagle Ford Shale to Ridgemar Energy back in May. The company received $655 million for this transaction, which it used to acquire all of the Permian-based assets of Percussion Petroleum. The acquired assets comprise about 18,000 net acres producing an average of 16,300 barrels of oil equivalent per day. However, the company has not stated what the reserves of this acquired acreage are. Prior to this acquisition, Callon Petroleum’s assets in the Permian Basin were producing an average of 93,000 barrels of oil equivalent per day. Its reserves, therefore, were sufficient to produce for a bit more than twelve years in that area. If we assume that the newly acquired acreage has a similar ratio of reserves to production, then Callon Petroleum probably has sufficient reserves to produce for somewhere between ten and thirteen years even if it fails to acquire any more sources of crude oil in the future. That is a reasonable reserve life that is in line with the rest of the industry, including the supermajors.

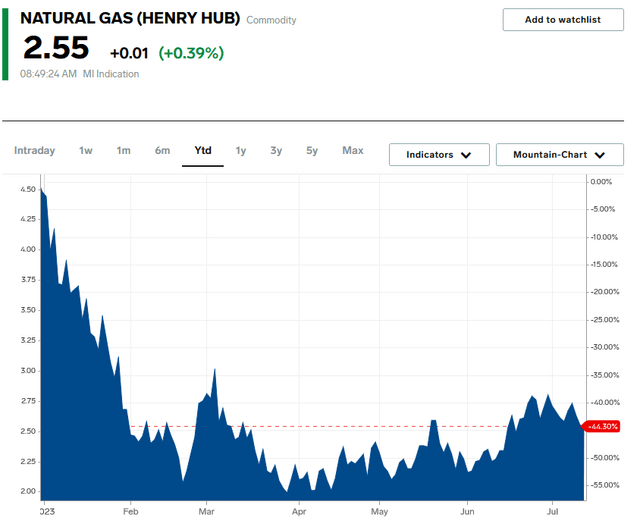

One thing that we frequently see across producers in the Permian Basin is that their production is more weighted to oil than natural gas. Callon Petroleum is no exception to this as its production is about 60% crude oil. The company’s guidance is for average production of 103,000 to 106,000 barrels of oil equivalent per day, 62,000 to 64,000 barrels of which is crude oil. This is something that investors loved to see about ten years ago due to natural gas prices being so low that it was not even worth attempting to transport that natural gas to the market to sell it. Things have changed somewhat, as natural gas has become profitable and infrastructure in the Permian Basin has been built up. In fact, some would argue that natural gas is preferable to crude oil considering that natural gas demand is almost certainly going to grow much more rapidly than crude oil demand going forward. This is partly due to the use of natural gas as a supplement to unreliable renewable energy sources. I have discussed this in various previous articles. However, natural gas prices have plunged recently and in fact, the price of natural gas at Henry Hub is down 44.30% year-to-date:

Business Insider

This compares quite poorly to West Texas Intermediate crude oil, which is only down 3.80% year-to-date. Thus, crude oil prices have held up much better than natural gas. This may begin to reverse, considering that Freeport LNG has restarted and is thus removing some of the oversupply from the market along with various natural gas producers working to cut back on production. This illustrates the advantageous position that Callon Petroleum has right now as its exposure to both commodities provides it with the potential upside of either of them while protecting it from the worst-case scenario that it would encounter if it was entirely a producer of only crude oil or natural gas. This is something that investors should appreciate right now.

One thing that we have been seeing recently among exploration and production companies is that they have generally abandoned the “growth at all costs” mentality that was prevalent prior to the pandemic. In its place is an increasing focus on generating free cash flow. Callon Petroleum is no exception to this as the company has been generating positive free cash flow during most of the past eight quarters:

| Q1 2023 | Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | Q4 2021 | Q3 2021 | Q2 2021 | |

| Levered Free Cash Flow | $39.6 | $21.0 | -$66.7 | $85.9 | $46.6 | -$224.9 | -$48.1 | $49.1 |

(all figures in millions of U.S. dollars.)

We do see a few quarters in which the company’s free cash flow was negative, but the generally positive trend here is hard to ignore. This is a sharp departure from prior to the pandemic when nearly all independent exploration and production companies had negative cash flow and were forced to rely on the issuance of junk debt to stay afloat (see here). It is also something that should be appealing to investors since free cash flow is ultimately the money that the company can use to reward the shareholders. This is the money that can be used for things such as paying down debt, buying back stock, or paying a dividend.

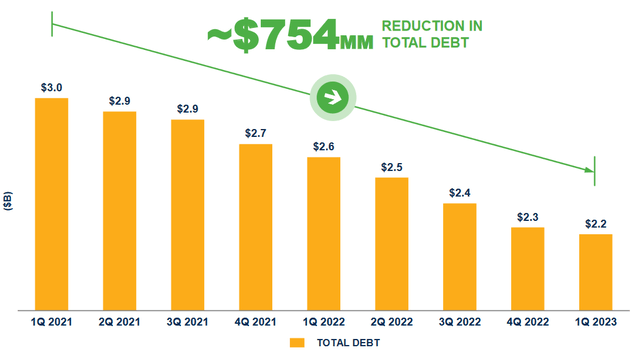

Callon Petroleum has been doing the first two, but it has yet to pay a dividend. As we can see here, the company has reduced its debt by a whopping $754 million since the first quarter of 2021:

Callon Petroleum

Obviously, this was not all done solely with free cash flow. The company also used other methods, such as asset sales. For example, the aforementioned sale of its Eagle Ford assets netted it $655 million in cash, but it only paid $265 million in cash (along with some common stock) to Percussion for the Permian assets that replaced them. This netted the company a few hundred million in cash that could be used for debt reduction. The company has also announced a $300 million stock repurchase program valid until the second quarter of 2025. That represents approximately 12% of the company’s total outstanding equity as of the time of writing, which obviously rewards shareholders because the equity reduction should theoretically drive up the share price. With that said, I would prefer to see that money used for a dividend instead of a share repurchase.

Financial Considerations

It is always important that we analyze the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by issuing new debt and using the proceeds to repay the existing debt since very few companies have the ability to completely pay off their debt as it matures. That can cause a company’s interest expenses to go up following the rollover in certain market conditions. As interest rates are currently at the highest levels that we have seen since 2007, it seems certain that any rollover today will result in a company’s interest costs going up.

In addition to interest-rate risk, a company must make regular payments on its debt if it is to remain solvent. As such, an event that causes a company’s cash flows to decline could push it into financial distress if it has too much debt. As Callon Petroleum’s revenues are highly dependent on commodity prices, which can be volatile, this second point is a risk that we should certainly not ignore.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio basically tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity will cover its debt obligations in the event of bankruptcy or liquidation, which is arguably more important.

As of March 31, 2023, Callon Petroleum had a net debt of $2.2011 billion compared to $3.6498 billion worth of shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.60 today. This is quite a bit less than the 0.84 ratio that the company had the last time that we discussed it. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity Ratio |

| Callon Petroleum | 0.60 |

| Matador Resources (MTDR) | 0.21 |

| Diamondback Energy (FANG) | 0.44 |

| Pioneer Natural Resources (PXD) | 0.23 |

| Coterra Energy (CTRA) | 0.13 |

As we can see, Callon Petroleum is more heavily levered than most of its peers, despite its improvements over the past two years. This may be concerning at first, but it is important to remember that all of these companies have also been working to improve their financial structure. Prior to the pandemic, a net debt-to-equity ratio above 1.0 was very common in the sector so all of these companies are much stronger than they used to be. As such, we probably do not really need to worry about Callon Petroleum’s leverage despite the fact that it is higher than its peers.

Another important thing to analyze is a company’s ability to carry its debt. This is normally done by looking at its leverage ratio, which is also known as the net debt-to-adjusted EBITDAX ratio. This ratio basically tells us how long it would take the company (in years) to completely repay its debt if it were to devote all of its pre-tax cash flow to this task. In the first quarter of 2023, Callon Petroleum reported an adjusted EBITDAX of $326.280 million, which works out to $1.30512 billion on an annualized basis. This compares to net debt of $2.2011 billion and gives the company a leverage ratio of 1.69x.

That is quite a bit higher than we want to see, as most of the strongest companies in the industry have a ratio of less than 1.0x today. With that said, the first quarter of 2023 did come in weaker than previous ones due to the fact that energy prices have been broadly declining since the second half of last year. We can still clearly see though that the company has a long way to go in reducing its leverage, although it has made considerable progress already.

Valuation

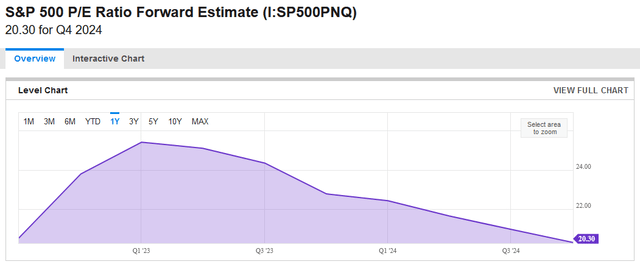

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of an independent exploration and production company like Callon Petroleum, we can value it by looking at the forward price-to-earnings ratio. This ratio basically tells us how much we have to pay today for each dollar of earnings that the company is expected to generate over the next twelve months.

According to Zacks Investment Research, Callon Petroleum currently has a forward price-to-earnings ratio of 4.10. That is incredibly low for today’s market as indicated by the fact that the S&P 500 Index (SP500) currently trades at a forward price-to-earnings ratio of 20.30:

YCharts

Thus, we can already see that Callon Petroleum appears remarkably cheap relative to its forward earnings. However, in various past articles and blog posts, I remarked that the entire energy sector is quite cheap relative to just about everything else in the market. Thus, let us compare Callon Petroleum to its peers and see how attractive it is relative to the rest of the sector:

| Company | Forward P/E Ratio |

| Callon Petroleum | 4.10 |

| Matador Resources | 7.96 |

| Diamondback Energy |

7.38 |

| Pioneer Natural Resources | 10.14 |

| Coterra Energy | 10.28 |

This certainly looks good for Callon Petroleum as the company is considerably cheaper than just about anything else in the energy sector. Thus, the company may represent a good value today and is worth considering for a portfolio.

Conclusion

In conclusion, Callon Petroleum is an independent exploration and production company that recently adjusted its portfolio to focus exclusively on the wealthy Permian Basin. This is not a bad choice, as the company boasts massive reserves across its acreage and relatively affordable production costs that allow it to generate a significant amount of free cash flow. It has been making significant progress at reducing its debt and is now ready to begin rewarding shareholders with a brand-new $300 million buyback. When we combine all of this with the company’s very attractive valuation, we can certainly see a lot to like. Overall, Callon Petroleum Company stock might be worth considering for investment today.