Elijah-Lovkoff

Investment thesis

I think that Canadian Solar’s (NASDAQ:CSIQ) stock is unique. I think so because the company is one of the leaders in the global solar energy market with solid revenue growth and stable profitability metrics. At the same time, the stock is trading ridiculously cheaply. I understand that investing in the solar energy industry is highly risky due to many uncertainties related to the further adoption of the technology. At the same time, my valuation analysis suggests that the stock is multiple times undervalued, even under very conservative assumptions. The near-term outlook looks bright despite the challenging macro environment. Revenue growth demonstrates solid momentum, and profitability metrics are slightly improving. Overall, I think that CSIQ stock looks like a compelling investment opportunity.

Company information

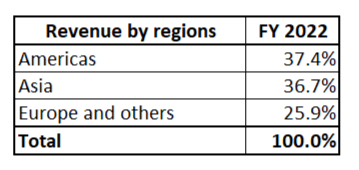

Canadian Solar is one of the world’s most significant solar technology and renewable energy companies manufacturing solar photovoltaic modules, providing solar energy and battery storage solutions. CSIQ generates global revenue, with Americas and Asia sharing about the same weight of the total.

Compiled by the author

The company’s fiscal year ends on December 31. CSIQ operates in two segments: CSI Solar and Global Energy. CSI Solar provides solar module manufacturing, total system solutions, battery storage integration, and long-term service agreements for various applications. Global Energy engages in global project development for solar and battery storage. In FY 2022, revenues generated by SCI solar segment represented 89% of the total, according to the latest annual SEC filing of the company.

Financials

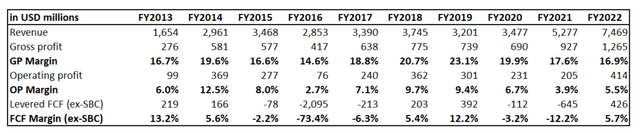

I have mixed feelings about the company’s financial performance over the past decade. On the one hand, revenue grew at a stellar 16.3% CAGR. On the other hand, almost a five-fold topline increase did not help to improve either profitability ratios or the free cash flow [FCF] margin.

Author’s calculations

Profitability metrics peaked in FY 2018 and FY 2019 and stagnated since then. Looking at the SG&A to revenue ratio, we can see that it is relatively low, meaning that the company has little room to improve its operating margin without expansion of the gross margin. But the cost of revenue is substantial and, on average, is about 80%. That said, the FCF margin is poised to be at single digits over the long term, in my opinion. Scaling up the business does not contribute much to the margin expansion.

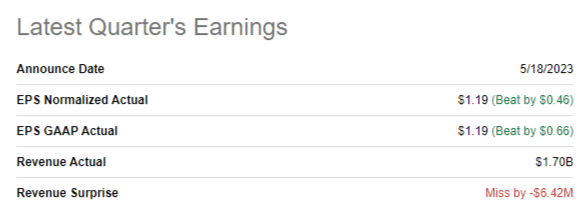

Let me proceed with my financial analysis by looking at quarterly earnings dynamics. The latest quarterly earnings were released on May 18, and the company slightly missed on revenue but delivered better-than-expected EPS. Revenue demonstrated a stellar 36% YoY growth, and the adjusted EPS also improved significantly from $0.14 to $1.19.

Seeking Alpha

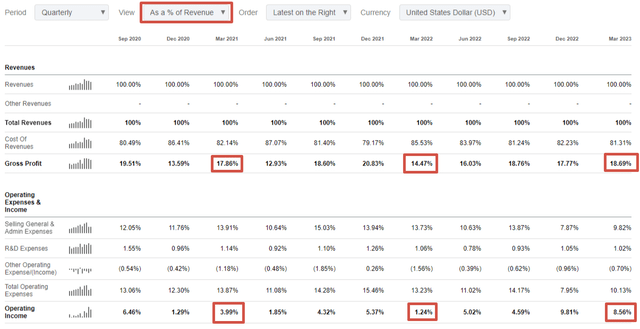

Profitability metrics demonstrated a solid improvement on a YoY basis. The strength in the operating margin was mainly due to the revenue increase since, in absolute terms, SG&A expenses did not change much YoY. During the latest earnings call, the management reiterated its commitment to profitability improvement, which is a solid bullish signal for me. I think so because the company already reached a solid scale, and the profitability matters the most at the current stage of the business lifecycle.

Seeking Alpha

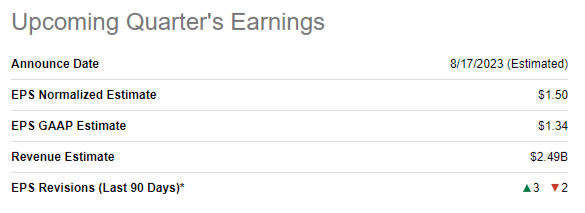

The management is very optimistic and looking forward to the upcoming quarter. Revenue for Q2 is expected at $2.5 billion at the midpoint, which is about 8% higher YoY. It is essential to mention that the management guided a 20% gross margin at midpoint, which is a significant improvement compared to June 2022 quarter. The upcoming quarter’s earnings announcement is scheduled on August 17.

Seeking Alpha

The company’s financial strength is medium, in my opinion. Liquidity ratios look average, while financial leverage is high. The covered ratio at about 7 looks decent, but we all remember that the company’s FCF margin is razor-thin. The company’s net debt position is slightly above $2 billion.

Another bullish signal is that on July 7, UBS Group analysts recently upgraded Canadian Solar’s rating from “Neutral” to “Buy”.

Valuation

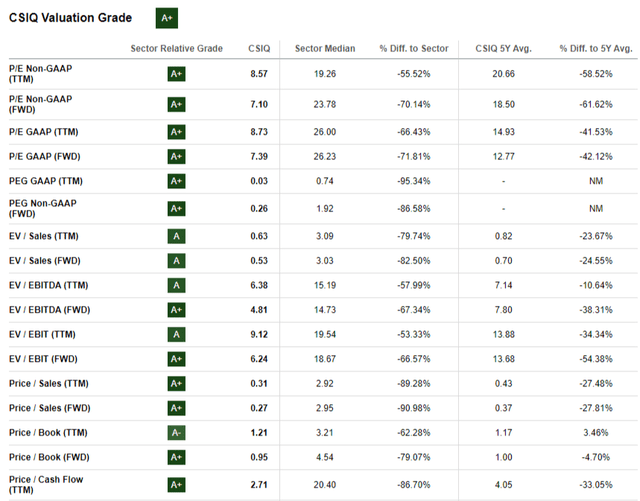

CSIQ demonstrated a solid stock price appreciation year-to-date, with a 26% rally since the start of the year. This is an outperformance of a broad U.S. market. The stock has the highest possible “A+” valuation grade from Seeking Alpha Quant. Current multiples are significantly lower than the sector median and historical averages. That said, the stock is massively undervalued based on the multiples analysis.

Seeking Alpha

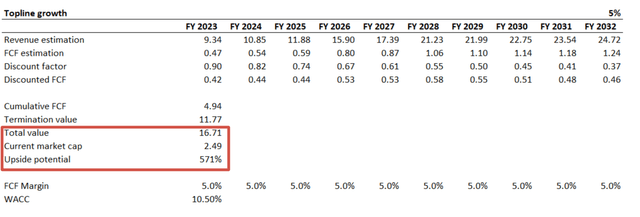

The company does not pay dividends, so I use discounted cash flow [DCF] approach to proceed with my valuation analysis. CSIQ is a Canadian company, so I use a slightly higher WACC of 10.5% as a discount rate. I have revenue consensus estimates available up to FY 2031, and for the years beyond, I have implemented a 5% CAGR. Overall, for the next decade, revenue CAGR is projected at 11.4%, which looks fair for a company from the solar equipment industry. I will use the same conservative 5% for the FCF margin during the next ten years.

Author’s calculations

As you can see from the above spreadsheet, the current market cap is multiple times lower than the business’s fair value. Simulating multiple scenarios here would be just a waste of readers’ time because, with such a massive upside potential, it will still be massive even under very conservative assumptions.

Risks to consider

Although the solar energy industry can no longer be described as very young, there are still some risks and uncertainties for industry players. Future demand for solar energy products and services is uncertain, and various factors such as cost efficiency, government incentives, capital availability, competition from alternative energy technologies, economic conditions, and favorable regulation can affect the CSIQ’s earnings.

It is also apparent that general global economic conditions may negatively impact the operating performance and financial results of Canada Solar. The developed world is experiencing turbulent times nowadays, with the Eurozone being in a recession and the U.S. and Canada having the highest interest rates since the Global Financial Crisis. All these factors have adverse effects on the company’s near-term growth prospects.

Bottom line

Overall, the stock is a “Strong Buy”. The upside potential looks like a fairy tale, and my analysis suggests that the momentum for the company’s financial performance is solid. Risks and uncertainties related to investing in solar energy stocks are very high, but I think CSIQ is an excellent “high risk-high reward” play.