JamesBrey

Note: All amounts discussed are in Canadian Dollars

We have previously covered Cenovus Energy Inc. (NYSE:CVE) and it remains one of our favorite energy plays. While the common shares retain upside and are undervalued relative to the broader market and its peers, we want to talk about another investment opportunity in the company.

The Company

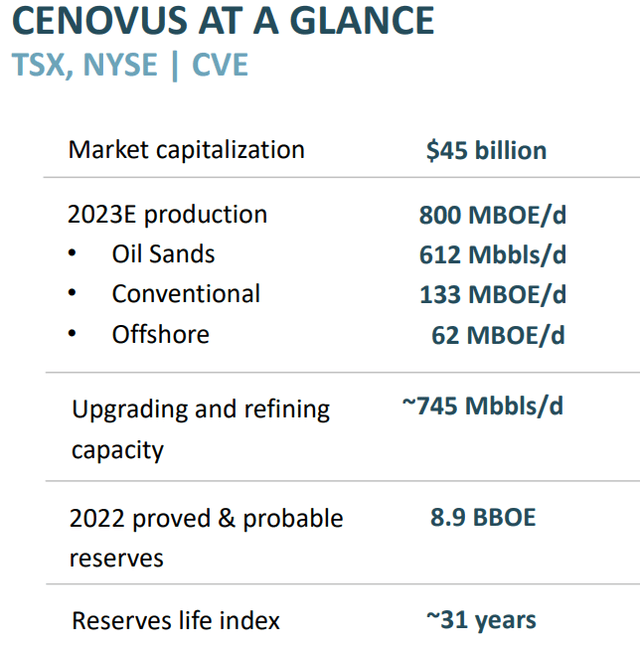

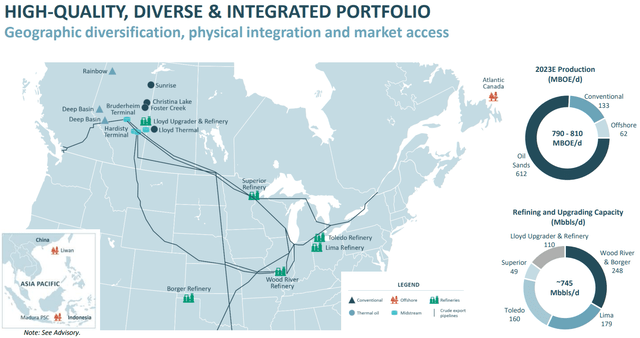

Cenovus has substantial scale and size with a market capitalization of $45 billion and over 800,000 barrels of oil production a day. It has almost the same amount of upgrading and refining capacity, making it an integrated producer able to capture value from the entire chain.

CVE Presentation

As is common with the oil sands producers like Suncor Energy (SU) and Imperial Oil Limited (IMO), CVE has a huge reserve life index. Unlike the shale oil plays which need a vast amount of drilling to even keep production flat, CVE has all the oil it can use right under its feet. The trade-off is that this production comes with a higher operating cost and tends to have a higher break-even price.

CVE has had woes in the past due to a lack of takeaway capacity. In 2018, the price of heavy oil collapsed to single digits a barrel. That risk has now been completely mitigated by a few different factors. The first being that pipeline capacity out of Alberta has really increased. Enbridge Inc. (ENB) expanded its Mainline capacity and TC Energy’s Corporation (TRP) new project will be operational in 2024.

But Enbridge – which reported a first-quarter profit of $1.7 billion on Friday, down from $1.9 billion a year ago – will also soon be facing increased competition when the Trans Mountain pipeline expansion comes online. That project, which is under construction and expected to be in-service in the first quarter of 2024, will increase the Trans Mountain pipeline’s capacity from 590,000 barrels per day to a total of 890,000 barrels per day.

Source: CBC

Sturgeon refinery also came into play in the last few years and created an additional local buffer in the system.

CVE Presentation

So what was a producer problem has now become an overcapacity issue for the midstream names.

Recent Results and Debt Reduction

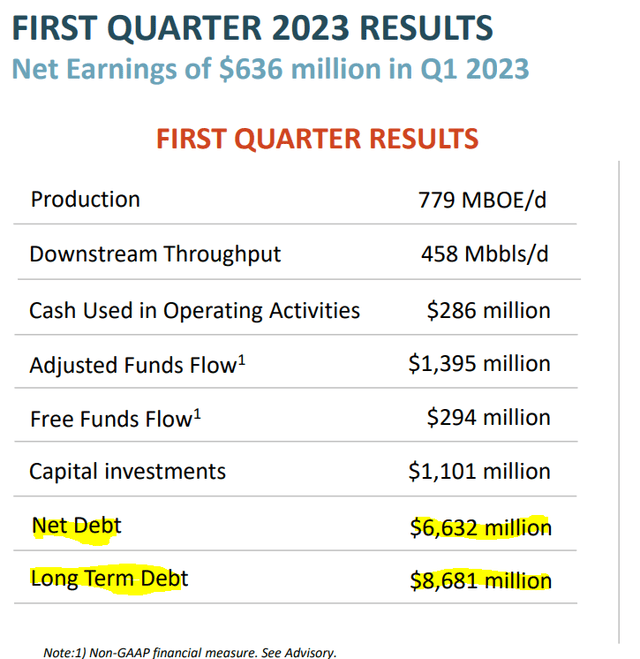

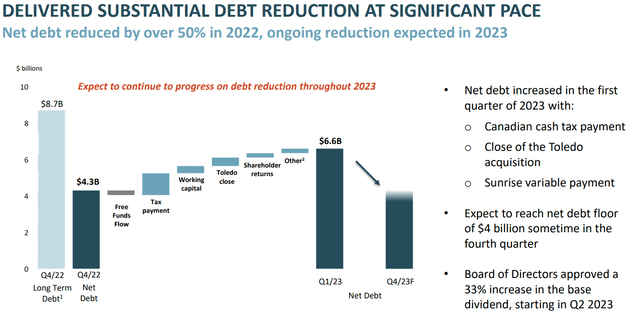

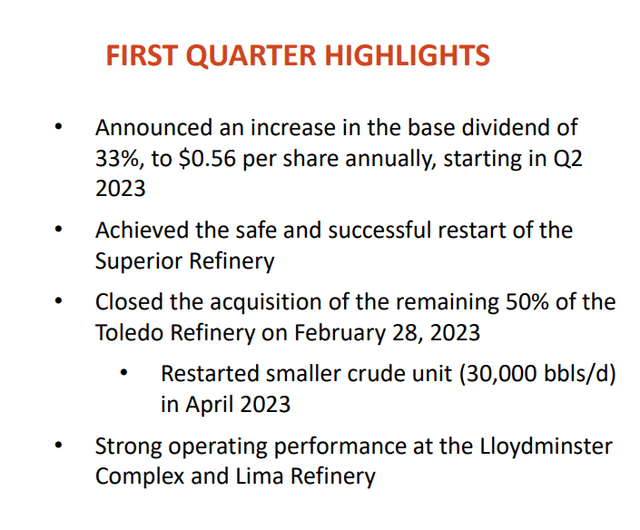

CVE delivered solid Q1-2023 numbers, although the net debt levels went up substantially.

CVE Presentation

CVE did the walk-through explaining the delta. The company guided for net debt to reach $4 billion by the end of the year.

CVE Presentation

We think it will achieve this in Q1-2024, but the exact point is rather irrelevant. CVE is already accelerating shareholder returns via dividends.

CVE Presentation

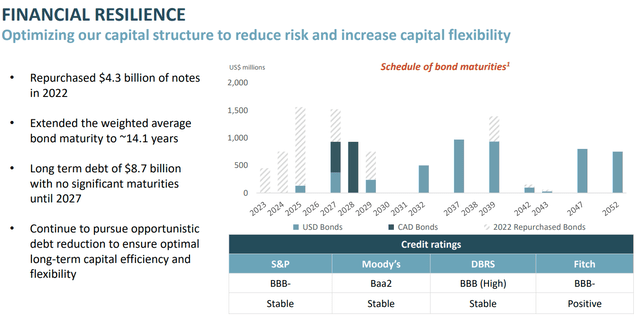

The weighted average debt maturity is a joy to behold with over 14 years as of Q1-2023.

CVE Presentation

Who would have thought that oil sands would be the place to find such financial prudence while some Canadian REITs have a weighted average debt maturity of under two years. We will add here that those rating absolutely understate the financial resilience of CVE. The company could be debt free by the end of 2024 if it chose not to enhance shareholder returns further. We think that is worth an “A” rating at least.

Preferred Shares

We don’t want to dissuade anyone from buying the common shares. In fact, we recently did a covered call trade ourselves with a 19% yield and a 24% price buffer. But we want to focus on the preferred shares today. Cenovus has 5 different preferred shares listed on the TSX with four of them tied to the 5-Year Government of Canada (GOC-5) bond yields.

1) Cenovus Energy Inc. CUM RED FIRST PFD Series 1 (TSX:CVE.PRA:CA), GOC-5+1.73%.

2) Cenovus Energy Inc. RSET PFD-Series 3 (TSX:CVE.PRC:CA), GOC-5+3.13%.

3) Cenovus Energy Inc. CUM PFD Series 5 (TSX:CVE.PRE:CA), GOC-5+3.57%.

4) Cenovus Energy Inc. 4.6 CUM PFD Series 7 (TSX:CVE.PRG:CA), GOC-5+3.52%.

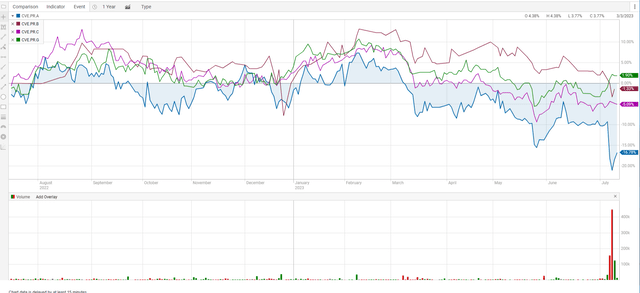

We want to draw attention to the fact that CVE.PRA has underperformed the rest heavily and that culminated with some pretty relentless selling in the last week. Note the volume in the chart below which is for this class only.

CIBC

Yes, CVE.PRA has the weakest spread to GOC-5. But the price discounts this and more. CVE.PRA is trading at $12.15 and at current GOC-5 yields, it will reset in March 2026 to 5.50% on par. That works out to 11.32% on the current price. As a very large portion of the total yield comes from GOC-5 yield itself (as opposed to the spread), this remains one of the most sensitive preferred shares to the GOC-5 yields.

Verdict

We see CVE as a proxy “A” rated company and hence think the preferred shares should offer a relatively low spread vs. GOC-5 yields. CVE.PRA came with a spread of 1.73% (which we think is fair) but thanks to a price that is now 50% below par, the effective spread vs. GOC-5 is more than double to near 3.5%. This is a very high quality dividend stream (current yield 5.31%) that offers a good source of variable dividends. It’s suited best for those who believe in the “higher for longer” outlook. Keep in mind that if interest rates do stay this high and move even higher over time, there’s a non-zero possibility that CVE might redeem these, at par. CVE redeemed a lot of debt recently and some of those coupons were incredibly low. So preferred share redemption or repurchase in the market at a huge discount, certainly makes sense if interest rates stay firm. We bought some of these as we think interest rates will stay firmer than what most expect and the tax-advantaged dividend stream is well worth it.

A Quick Tax Note

The dividends qualify for the dividend tax credit in Canada and generally investors will prefer having these in regular (non-RRSP or TFSA) accounts. For US Citizens, the dividend is treated as a qualified dividend, but there will be 15% tax withheld for which you receive a tax credit. That tax withholding can be avoided by using IRAs.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.