grynold

Introduction

I have to admit that whenever I discuss energy, I tend to talk about a crisis or a looming crisis. As I mention in most of my articles, I’m not doing that for clickbait reasons but because I’m honestly concerned about the direction of energy prices and the lasting impact this could have on the economy and the market.

Roughly one month ago, I wrote an article titled My Top Energy Crisis Picks: 2 Dividend Powerhouses. In that article, I explained my longer-term bull case based on slowing supply growth and lasting demand growth.

In this article, I’ll update that thesis, using new important developments. In the second half of this article, I’ll give you two no-nonsense energy plays that, I believe, will be perfect for dividend investors.

These aren’t just two picks that I like, but two investments that I’m aggressively buying for myself and the accounts that I advise/manage.

So, let’s get to it!

Oil Prices: Higher For Longer?

I’m a long-term investor. While I do have some minor trades at the moment, I mainly care about the bigger picture.

Hence, since the pandemic of 2020, I’ve been a buyer of energy stocks on weakness.

I’m not just doing that because I like the dividend but because I believe it is important to own energy assets for the sake of income and capital protection.

Essentially, my bull case is based on supply developments. While demand determines cycles, the supply situation is a secular development.

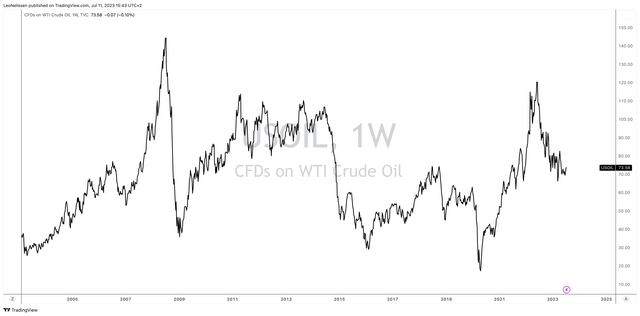

Before the pandemic, the supply situation was the main reason why energy stocks were a horrible place to be. After the global commodity peak of 2011, oil prices entered a very volatile sideways trend with major sell-offs. The worst occurred during the pandemic when WTI crude prices briefly went negative.

TradingView (WTI Crude Oil)

These problems were self-inflicted, at least to a large extent.

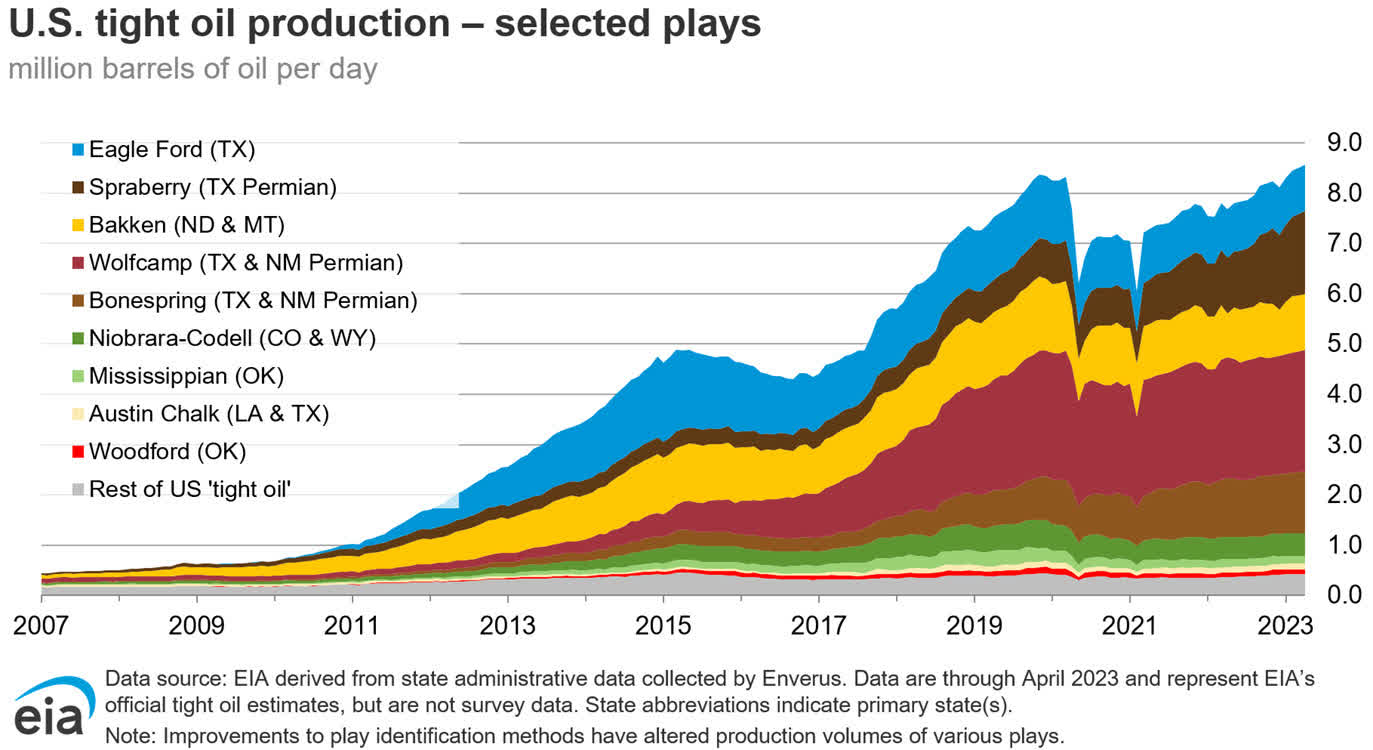

As I discussed in countless articles, the shale revolution in the United States was the biggest engine of supply growth after the Great Financial Crisis.

Tight oil (which is unconventional production) was at roughly 500K barrels per day in 2007. That number is currently 8 million barrels per day higher.

Energy Information Administration

Highly efficient unconventional drilling practices and top-tier inventories in regions like the Texas and New Mexico Permian have resulted in a massive increase in production.

Production rose so fast that any demand hiccups immediately caused oil prices to plummet.

Having said that, WTI crude is currently trading at $74. While this is down from last year’s highs, it’s still elevated, especially considering that we’re likely close to a manufacturing recession and a slowdown in global growth.

If the supply situation were better (meaning more supply growth), I believe that oil prices would easily be $10 to $15 lower.

This brings me to the core of this article.

One of the reasons why supply growth is subdued is political reasons. Energy companies know that if they keep pumping as they did before, they might encounter another steep energy sell-off. Given the current rush for net zero, the chances are they might not get the funding they need if things go south.

Hence, they keep production low to focus on free cash flow. Not only does this enhance internal funding capabilities (no need for outside funding), but it’s also highly rewarding for investors as it often comes with strong dividend growth and buybacks.

The other reason is the inventory quality. While I’m not making the case that the world is running out of oil (it is not), I am making the case for much slower supply growth in the future. Mainly because the US shale, the engine of the most recent supply surge, is running out of steam.

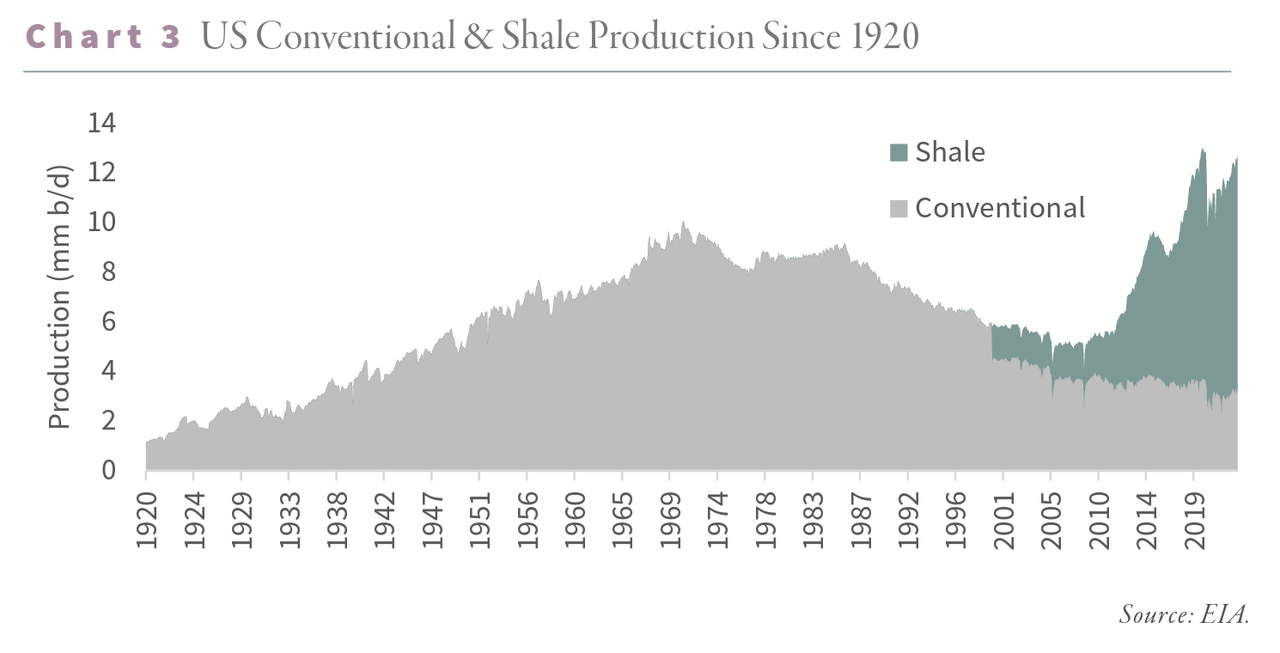

At this point, it is important to keep in mind that the US witnessed declining oil production between the 1960s and the Great Financial Crisis. The shale revolution made the US energy independent and the engine of global supply growth (OPEC didn’t like that).

The chart below visualizes this.

Goehring & Rozencwajg

Now, shale is running out of steam.

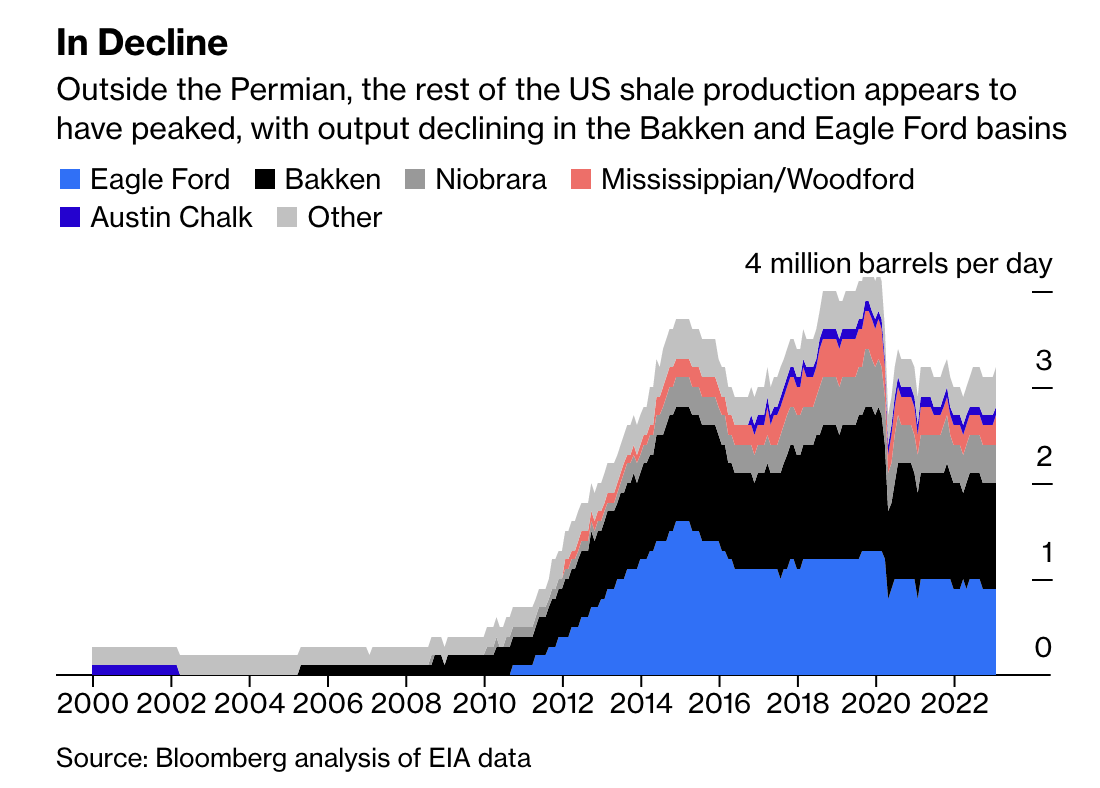

Looking at the chart below, we see that major basins (excluding the Permian) peaked prior to the pandemic. Production in these areas has not improved, as a decline in legacy production is offsetting new production.

Energy Information Administration

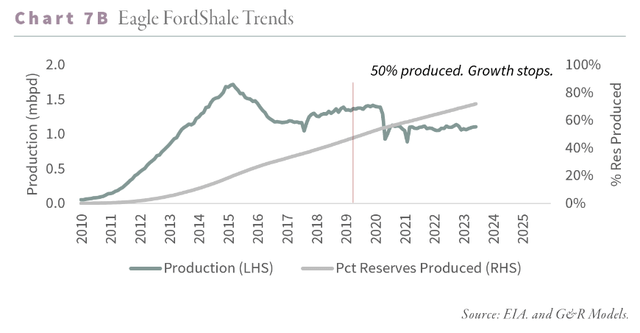

Goehring & Rozencwajg wrote that this is no coincidence, as two major basins (Eagle Ford and Bakken) have followed the Hubbert Curve in production (emphasis added):

We count 7 and 9 billion barrels of recoverable oil in the Eagle Ford and Bakken, respectively, of which 65% and 55% have been produced. Consistent with Hubbert’s theories, both basins have been unable to grow after crossing the 50% mark. The Eagle Ford produced half its recoverable reserves in August 2019; production has fallen 18% since. The Bakken produced half of its reserves in 2022, and production has since been flat.

Goehring & Rozencwajg

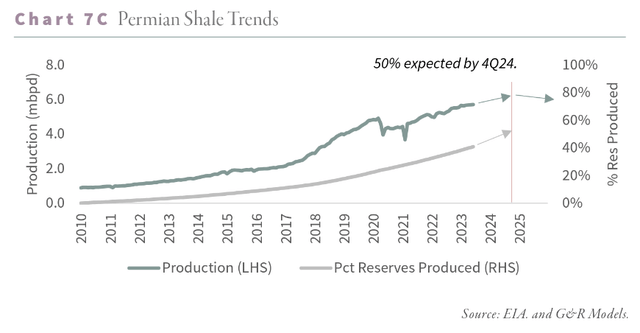

Now, it seems that the same fate is looming for the Permian basin, the only major basin still experiencing growth.

Estimates are that the Permian has produced 14 billion barrels of oil, which is roughly 41% of its reserves. This would indicate peak production in the second half of 2024.

Goehring & Rozencwajg

It’s fair to assume that the average publicly traded driller in the Permian will run out of Tier 1 drilling inventory within four years. This is important to keep in mind when deciding which oil companies to buy, mainly to avoid risky M&A moves that will eventually be required to maintain stable production levels.

For now, the US is still able to provide the necessary supply. For example, the Wall Street Journal wrote an article earlier this month mentioning that US production growth is helpful at a time when OPEC is cutting its output.

Wall Street Journal

According to the paper, efforts to enhance efficiency have provided oil companies with greater profitability even in the face of falling oil prices.

- Production improvements in the US shale since 2014 have reduced drilling and fracking costs by 36%, according to JPMorgan (JPM).

- Essentially, companies have found ways to increase oil production by injecting more water and sand into rocks, creating more fissures. Longer wells and deeper drilling have also contributed to improved productivity.

Unfortunately, this is now ending.

I’m saying, unfortunately, because I believe that the era of cheap energy before the pandemic is over.

While we’re currently seeing that slow economic growth is keeping a lid on energy prices, I believe that every upswing in economic demand will cause energy to rally, creating higher inflation and new challenges for the Fed.

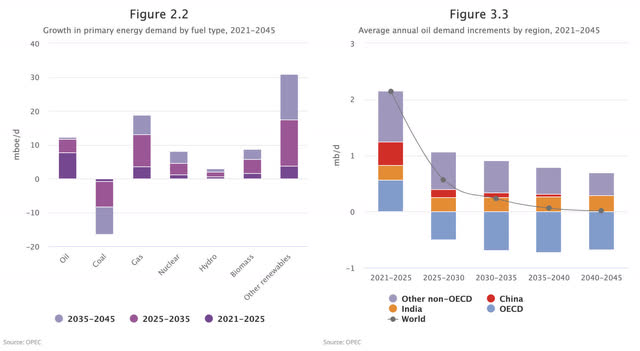

Even in a base-case scenario, we won’t likely see a peak in oil demand until at least 2045.

OPEC (Long-Term Supply Estimates)

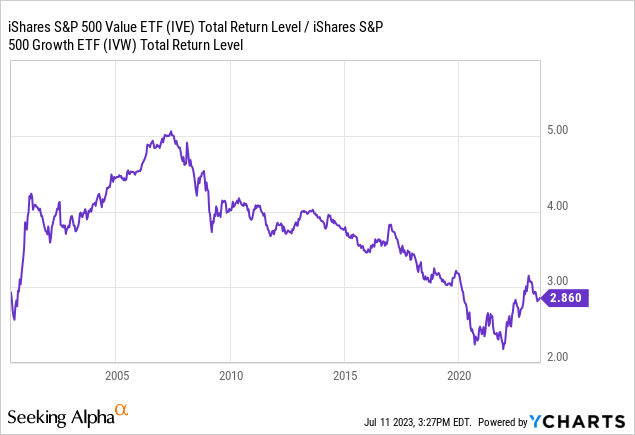

Hence, I also believe that we get a rotation from growth to value stocks. Periods of sticky inflation are much more beneficial for value stocks.

This is because rising inflation makes discounting future cash flows less attractive.

The chart below shows the ratio between value (IVE) and growth (IVW).

Having said all of this, I decided to buy more energy.

I currently have 13.5% energy. I expect to increase that number in the next few weeks.

What Am I Buying?

As the age of shale growth comes to an end, finding attractive investment opportunities in shale exploration and production companies becomes increasingly challenging.

Hence, I focus on a few key issues.

- I want companies with deep, high-quality reserves. This prevents these companies from engaging in risky M&A to maintain production. Also, it gives them a competitive edge in a scenario where competitors are running out of high-quality reserves.

- I want efficient producers with healthy balance sheets. This means that even at subdued prices, they can generate strong free cash flow. The healthy balance sheets allow these companies to distribute most of their cash to shareholders.

- Based on point 2, I want companies that prioritize dividends over buybacks. My personal opinion is that buybacks do make sense. However, I’m buying energy because of their ability to generate loads of cash. I want to benefit from that through regular and special dividends. There’s nothing wrong with buying buyback-focused companies like Marathon Oil (MRO). It’s just not my strategy.

The Picks I’m Betting On

On a side note, I just now noticed that both end with Natural Resources.

While I am writing this, I own Pioneer. It’s my largest energy investment, as I wrote in this article. I currently do not own CNQ. However, I have bought it in an account I manage. I’m also in the process of buying it myself.

Pioneer Natural Resources

With a market cap of $50 billion, PXD is one of the largest onshore drillers in the United States.

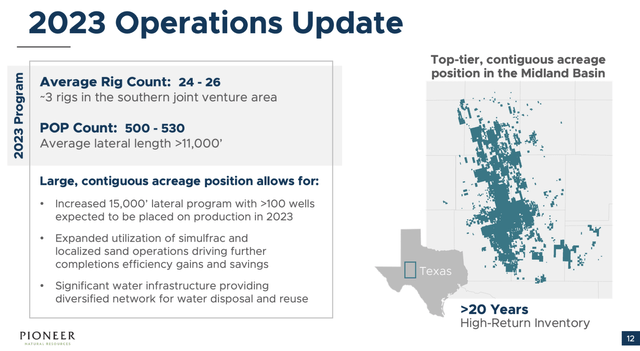

The company solely produces in the Permian, where it produces close to 700 thousand barrels of oil equivalent per day. Roughly 370 thousand barrels of this are crude oil.

Pioneer Natural Resources

Furthermore, in this area, the company has more than 20 years’ worth of high-quality inventory, which is a very important part of my thesis.

This inventory is breakeven at oil prices below $50 WTI.

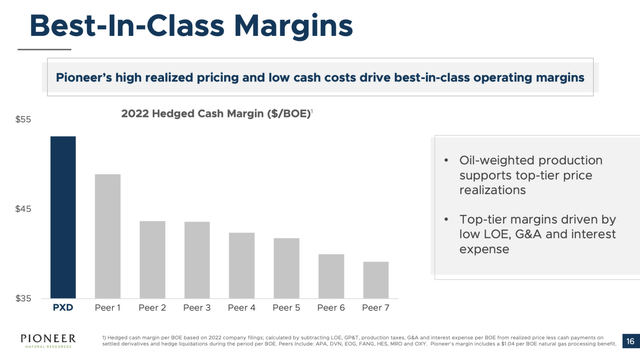

In general, it can be said that PXD is highly efficient. In 2022, it had the highest hedged cash margin among its major peers. It also refrains from hedging to capture more upside.

Pioneer Natural Resources

In light of these favorable margins, the company is confident in its ability to generate a substantial amount of cumulative free cash flow over the next five years, as it is projecting $27 billion at an assumed price of $80 per barrel of WTI crude oil.

This impressive figure would account for 54% of the company’s current market capitalization, equivalent to an annual growth rate of 11%.

Even with a slightly lower WTI price of $70 per barrel, the projected free cash flow would still reach $13 billion, which amounts to 26% of the company’s market cap.

This is terrific news for shareholders.

Under its modified capital framework, Pioneer allocates 75% of its quarterly free cash flow for capital returns, while the remaining 25% is dedicated to enhancing financial flexibility and strengthening the balance sheet.

The company is expected to end the current year with a net debt ratio of just 0.5x EBITDAX, enabling it to prioritize shareholder distributions over debt reduction.

While these are just my estimates, I believe that investors might benefit from a yield close to 10% if oil prices average $80 in any given quarter.

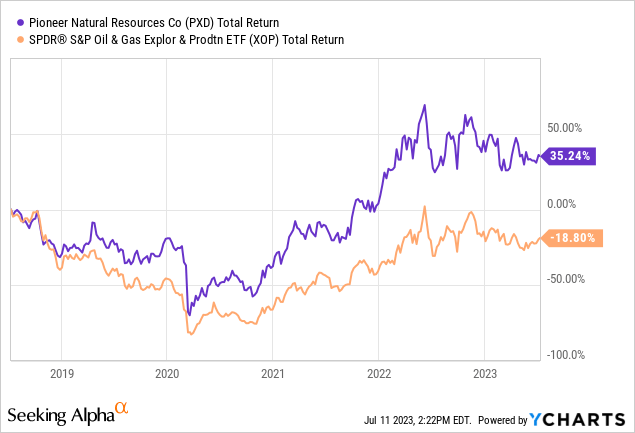

Hence, from PXD, I expect both high income and consistent outperformance versus its peers.

This brings me to pick number two.

Canadian Natural Resources

I fell in love with this company the first time I covered it. In April, I started covering this Canadian gem.

I honestly believe that CNQ is one of the best oil stocks money can buy.

Founded in 1973 as AEX Minerals Corporation, we’re dealing with a company that produces 1.3 million barrels of oil equivalent per day. More than 900 thousand barrels per day are crude oil and natural gas liquids.

Even more impressive is the fact that this company has 42 years’ worth of inventory. Last year, the company added more to this inventory than it drilled, giving it a net inventory addition.

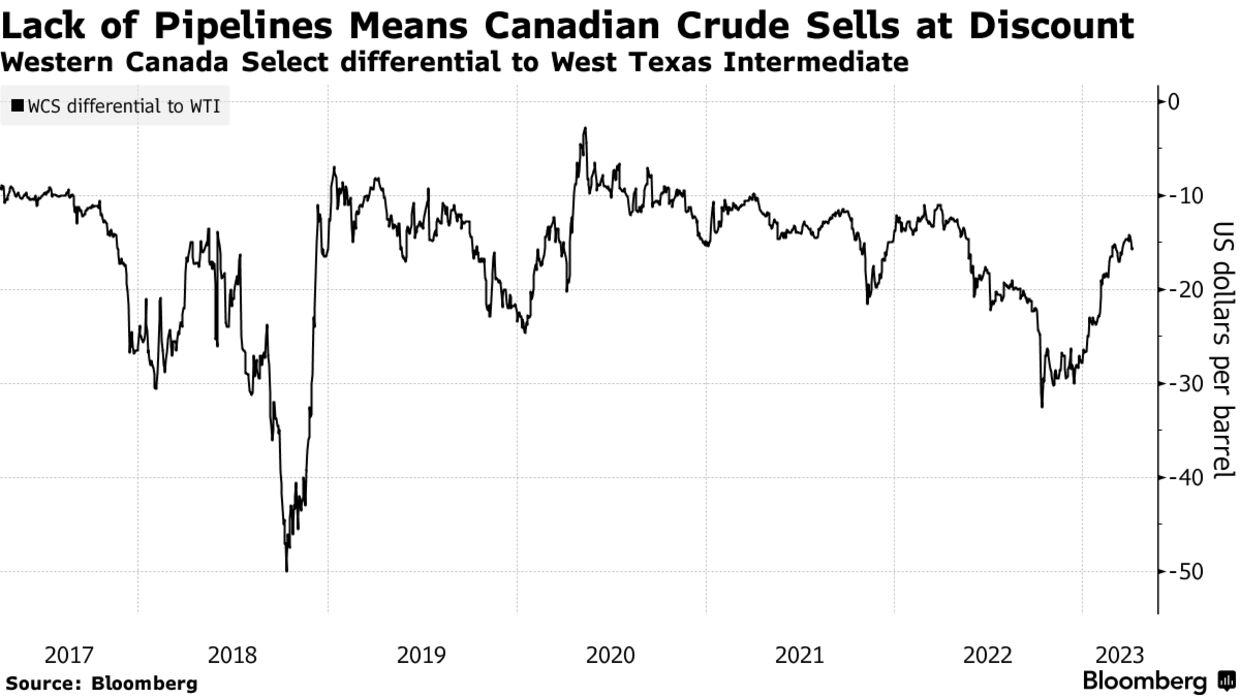

Furthermore, the company benefits from the Trans Mountain pipeline and other expansions.

Canadian crude producers are becoming more competitive thanks to better access to export facilities and customers in the US (and abroad). This enhances margins. Looking at the chart below (from April), Western Canadian oil has already started to benefit from a decrease in the discount versus WTI.

Bloomberg

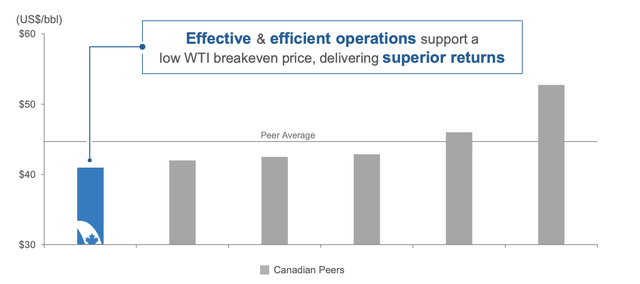

Adding to that, CNQ is highly efficient. The company is breakeven close to $40 WTI, which beats its Canadian peers.

Canadian Natural Resources

CNQ has also taken advantage of higher energy prices to reduce its debt and shift its focus toward shareholder distributions, including dividends and buybacks.

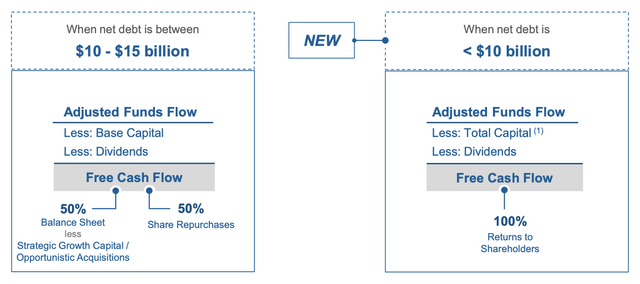

The company aims to allocate half of its post-dividend free cash flow to buybacks if net debt falls to the C$10 billion to C$15 billion range.

If net debt drops below C$10 billion, 100% of the excess free cash flow will be returned to shareholders.

Canadian Natural Resources

So far, CNQ has made significant progress in improving its financial position, reducing net debt by approximately C$10.7 billion since the beginning of 2021.

The company aims to reach a net debt level of $10 billion later this year, considering strip prices, capital profile, and its shareholder return framework.

This brings me to the dividend.

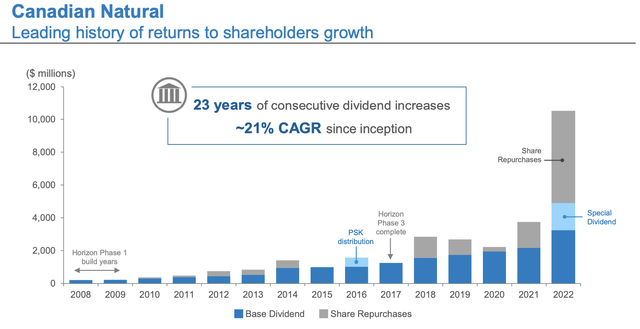

CNQ is a reliable source of dividends, having increased its dividend for 23 consecutive years. In 2022, the company raised its dividend twice, resulting in a total growth rate of 45% to $3.40 per share per year.

Canadian Natural Resources

Additionally, CNQ paid a special dividend of C$1.50 per share last year. The company seeks to maintain a sustainable base dividend to avoid potential cuts during periods of lower oil prices.

While dividend growth is expected to remain high, it is likely that more special dividends will be distributed to manage cash without increasing the base dividend excessively.

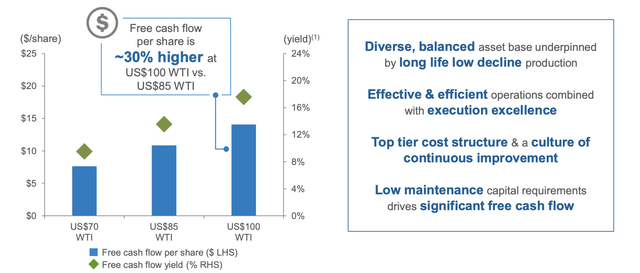

With favorable oil prices, CNQ is well-positioned to sustain aggressive dividend hikes, and if oil prices reach $100, the company’s free cash flow could increase by 30% (versus $85 WTI).

Canadian Natural Resources

In such a scenario, CNQ has the potential to generate close to C$15 in free cash flow per share, implying a 20% free cash flow yield.

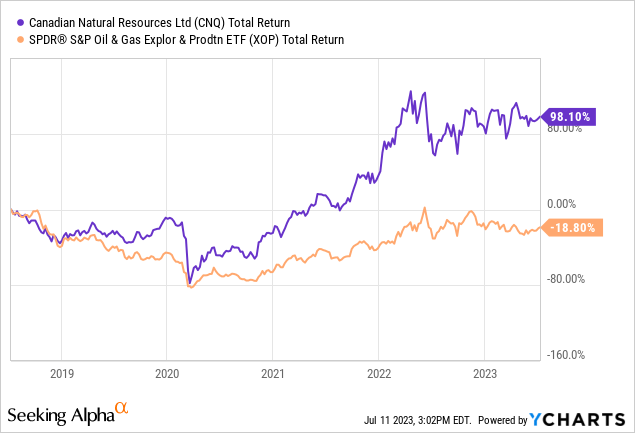

Just like Pioneer, CNQ has the ability to generate a load of free cash flow used to handsomely reward its shareholders. It also has a history of outperformance that I expect to continue.

Furthermore, I believe that buying more than 40 years’ worth of high-quality reserves is a no-brainer, especially given that the rest of the world is slowly running out of top-tier reserves.

Takeaway

In my quest to address the energy crisis and its impact on the economy and market, I am aggressively investing in oil equities. I see the potential for a longer period of higher oil prices due to a combination of slowing supply growth and sustained demand growth.

To make a successful energy investment, I focus on certain key factors.

- Firstly, I look for companies with deep, high-quality reserves to avoid risky M&A moves and gain a competitive edge.

- Secondly, I prioritize efficient producers with healthy balance sheets that can generate strong free cash flow even at subdued prices.

- Lastly, I prefer companies that prioritize dividends over buybacks, aiming to benefit from their cash-generating ability.

Based on these criteria, my two top picks are Pioneer Natural Resources and Canadian Natural Resources.

These companies offer the potential for high income and consistent outperformance in the energy sector with the benefit of massive reserves and efficient production.

I expect to end up owning both very soon and will add them to most accounts that I manage/advise.

Needless to say, going forward, we’ll continue to discuss these developments, as I believe they are crucial to the macroeconomic environment of the next years, maybe (read: probably) decades.