Ales_Utovko

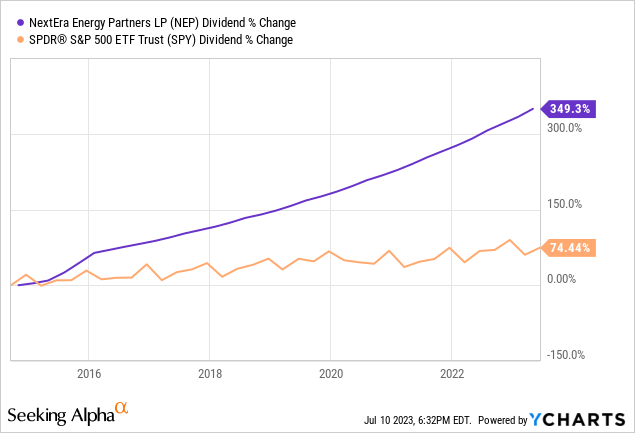

NextEra Energy Partners (NYSE:NEP) has a very impressive distribution growth track record, delivering market-crushing results for investors since going public:

In this article, we will look at NEP in more detail and share three reason why we believe that it is poised to not only continue delivering very attractive distribution growth, but also deliver meaningful total return outperformance over the next few years.

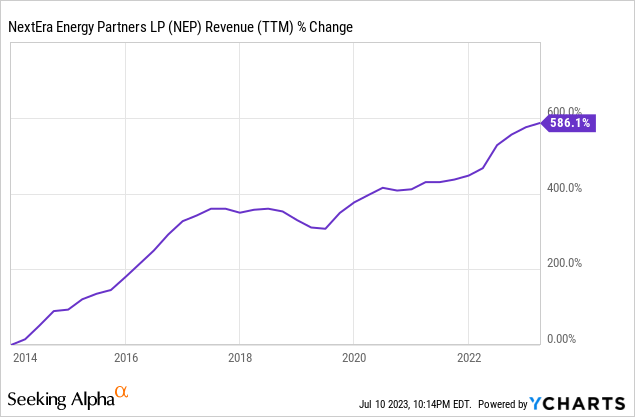

#1. NEP Has A Very Impressive Growth Runway

NEP has an impressive existing portfolio of renewable energy assets spread across the United States, minimizing geopolitical and currency risks while still enjoying meaningful geographic diversification. It owns over 7,500 MW of wind power assets, over 1,500 MW of solar power assets, nearly 250 MW of paired storage assets, and nearly 4.5 Bcf of total natural gas pipeline capacity. These assets nearly all enjoy long-term contracts, creating a very stable cash flow stream.

Moving forward, it has a very robust growth runway, with access to a steady stream of drop-down acquisition assets from Energy Resources across the solar, batter storage, wind, distributed generation, green hydrogen, renewable fuels, and competitive transmission asset categories.

To drive growth along these avenues, NEP has three main pathways: organic growth through contractual rent escalators, repowerings, and operational improvements, third-party M&A, and purchasing drop-downs from Energy Resources. Management believes that the current organic growth embedded in its portfolio along with the pipeline of projects currently underway at Energy Resources give NEP plenty of growth visibility through 2026.

When combined with the general tailwinds that the renewable power sector is enjoying from ESG investing, growing private-sector demand, and support from the so-called “Inflation Reduction Act,” NEP has more than enough opportunity to continue its highly impressive growth momentum in the coming years.

#2. NEP Has Access To Enough Capital To Take Advantage Of Its Growth Runway

While its underlying cash flows are well diversified and quite stable in nature and the growth runway is very attractive, the main risk to the investment thesis is whether or not NEP can access enough attractively priced capital to achieve its growth aims while also delivering the sort of double-digit distribution CAGR that it has promised investors.

A big cause for concern was NEP’s large number of convertible equity portfolio financings that risked diluting unitholders considerably, combining with IDR fees to NEP’s parent NextEra Energy (NEE) to tax cash flows sufficiently to prevent NEP from achieving sustained strong distribution growth in the coming years. As management put it in a recent conference call with investors:

we believe NextEra Energy Partners’ future growth potential is not reflected in its current valuation due to a few factors adversely affecting its performance.

First, convertible equity portfolio financings have complicated NextEra Energy Partners’ capital structure with the related buyouts resulting in near-term equity needs in a difficult capital markets environment. Second, incentive distribution rights, or IDRs, while helpful in aligning interest between NextEra Energy and NextEra Energy Partners, have been viewed as a cost of capital that consumes NextEra Energy Partners’ share of cash flow that could otherwise be available to drive LP distribution growth.

However, management has announced bold steps – with support from its parent NEE – to address these challenges, announcing the following plan to supply it with sufficiently attractive capital to achieve its growth ambitions:

- Sell their pipeline assets to fully fund all convertible equity portfolio financings through 2025 and make them a 100% pureplay renewable energy business.

- They also plan to reinvest the excess proceeds from the pipeline sales to fund their growth investments alongside opportunistically issued debt (including their current $2.5 billion credit facility), eliminating any need to issue new equity through 2024

- Suspend IDRs to NEE through 2026, effectively offsetting the lost cash flow from the pipeline sales and enabling them to target a mid-80% payout ratio in 2023.

Management has also repeatedly emphasized that they are receiving considerable interest from large institutional infrastructure investors who may want to invest alongside them in some of their growth projects by providing various forms of equity capital, further reducing their need to raise dilutive equity through CEPFs or common unit issuance at unattractive valuations.

Putting this all together, NEP has a pretty clear line of site to raise a considerable amount of equity at accretive values which should enable them to generate attractive levels of distribution growth.

#3. NEP Trades At A Very Attractive Valuation

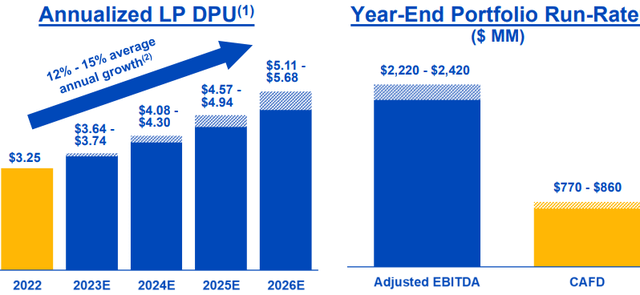

Given its aforementioned capital raising plans, management remains very confident in its ability to continue delivering massive dividend growth, guiding for at least a 12% distribution per unit CAGR through 2026:

NEP Distribution Growth Guidance (Investor Presentation)

If management can merely meet the bottom of its guidance range, its forward yield on current cost in two and a half years from now will be a whopping 8.82%. For a business that generates pretty stable cash flows and is backed by an A-rated parent blue chip utility in NEE while also operating in a high growth industry like renewable energy, that is a very attractive potential yield on cost in just a quarter of a decade.

Wall Street analysts themselves seem to buy management’s narrative, guiding for a 13.6% DPU CAGR through 2027. With a NTM distribution yield of 6.2%, NEP appears to have a very clear path to deliver mouthwatering total returns for common equity investors from these levels.

Investor Takeaway

There is still considerable execution risk that management will fail to sell its pipeline assets in a timely and/or accretive manner. Moreover, there is the risk that interest rates remaining higher for longer could weigh heavily on NEP’s ability to earn attractive enough spreads on acquisitions and growth investments to grow CAFD per unit at a fast enough rate to support its distribution growth guidance.

However, given NEP’s impressive track record, strong support from its parent NEE, and the quality nature of its natural gas pipeline assets and the revived strength in the natural gas sector, we think the odds lie heavily in favor of NEP accomplishing its plan. Even if it fails to achieve its DPU CAGR, an 8-10% DPU CAGR over the next several years alongside the current attractive yield will still very likely deliver considerable outperformance for unitholders at current prices. As a result, we rate it a Strong Buy.