pidjoe

NextEra Energy, Inc. (NYSE:NEE), the world’s largest utility company, has carved a name for itself due to its ownership of Florida Power & Light Company, the largest electric utility in the U.S., and its significant strides in sustainable energy. The company’s firm commitment to clean energy, exemplified by its leadership in wind and solar electricity generation, coupled with its focus on battery storage, makes it a compelling investment prospect. This article offers an in-depth technical analysis of NextEra Energy, aiming to forecast potential shifts in the company’s stock price, thereby identifying favorable investment possibilities for long-term stakeholders. The long-term projection for NextEra Energy maintains a notably bullish sentiment, albeit currently undergoing a period of price consolidation. Any subsequent decrease in the company’s stock value could potentially present an attractive buying opportunity for long-term investors.

A Look at NextEra Energy’s Sustainable and Profitable Growth

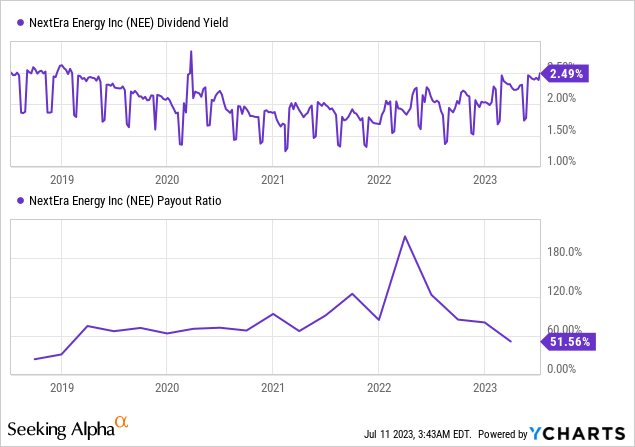

This significant achievement of NextEra Energy, coupled with a strong commitment to sustainable energy, makes it an interesting and potentially rewarding investment. The company’s emphasis on clean energy, as a leading entity in electricity generated from wind and solar, and its investment in battery storage, attest to its innovative approach. The company’s long-term performance is encouraging, particularly in terms of its dividend-paying capacity. The chart below presents the dividend yield and payout ratio of NextEra Energy. With a recent yield of 2.49%, NextEra Energy is not just a regular dividend payer, it has shown consistent growth in its dividend payments, with an average yearly increase of about 11% over the past five years. The payout ratio of 51.56% signifies room for more growth, demonstrating the company’s commitment to sharing profits with its investors. This, coupled with a recent P/S and P/E ratio below the five-year average, marks it as a potential investment opportunity.

However, the price consolidation indicates that investors may need to prepare for some consolidation in the short term. This could potentially bring the stock down to lower levels, creating a compelling buying opportunity for long-term investors. Notwithstanding, the growth projections of NextEra Energy are encouraging. The company’s mix of regulated utility and clean energy operations provides it with a unique advantage, positioning it for sustained growth in the future. This is a significant factor for investors interested in dividend growth, as the company has made known its plans for future growth.

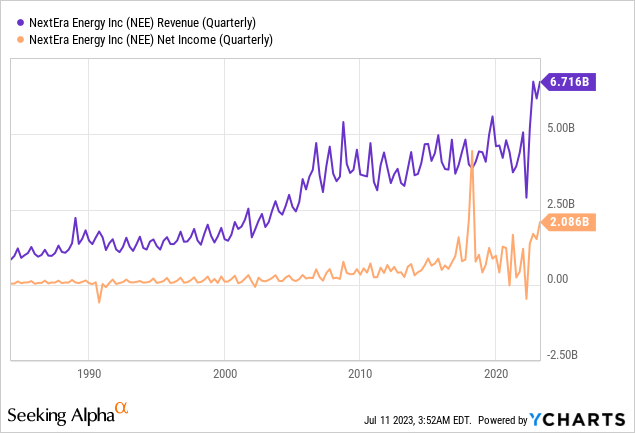

Furthermore, the financial figures for NextEra Energy, as illustrated in the chart below, show robust profitability. The company’s quarterly revenue and net income stand impressively at $6.716 billion and $2.086 billion, respectively. These significant figures not only underline the successful financial performance of NextEra Energy but also demonstrate its potential for continued growth and stability in the energy sector.

Deciphering Long-term Market Trajectories

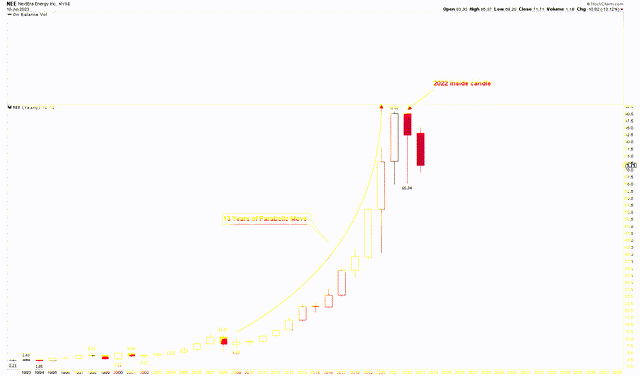

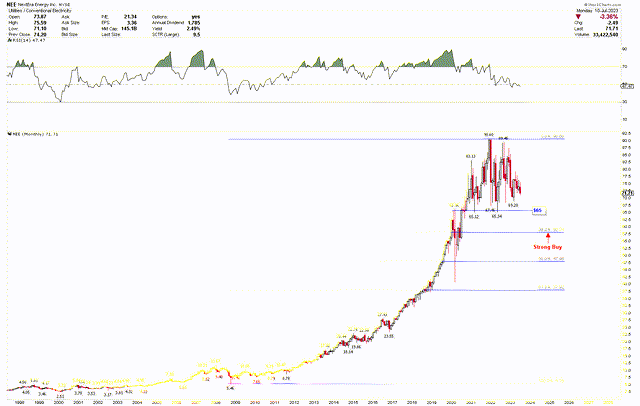

The following chart provides a long-term perspective of NextEra Energy, featuring the company’s yearly chart. From a low of $6.83 in 2009 to a high of $90.60 in 2021, the chart paints a decisively bullish picture, characterized by a significant price increase of 1226.5% over a span of 13 years. During this phase, the price exhibited persistent upward movement without a single yearly decline. As time passed, price volatility also heightened, indicating a promising potential for future growth. This potential is further evidenced by the ‘inside candle’ of 2022, with highs and lows contained within the previous year’s range. This pattern points to considerable price consolidation and suggests that surpassing the highs or lows of 2021 could determine the next market move. However, a market breach of 2021 lows would present an excellent buying opportunity for investors.

NextEra Energy Yearly Chart (stockcharts.com)

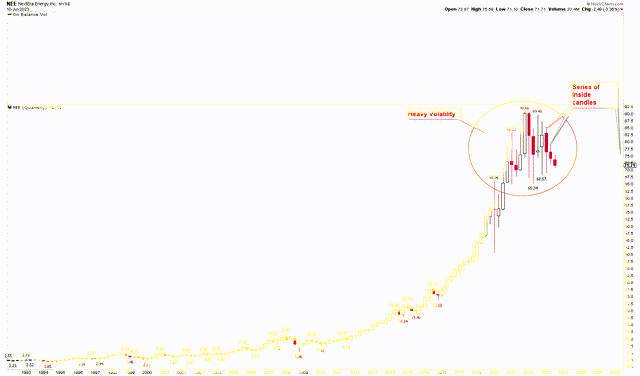

To gain deeper insights into the long-term trajectory of NextEra Energy, the quarterly chart analysis is shown below. The chart demonstrates a series of ‘inside candles’ for each quarter, identifying the $65 to $90 price zone as an area of high volatility due to large price swings. The chart maintains a strong bullish trend in line with market behavior, making it clear that the consolidation range is between $65 and $90. Any breach of these levels could propel the market in the next direction. However, given the strong bullish long-term patterns, any market pullback would represent a lucrative buying opportunity for NextEra.

NextEra Energy Quarterly Chart (stockcharts.com)

Key Levels and Investor Considerations

The key levels for NextEra are discerned by examining the monthly chart using the Fibonacci retracement, which ranges from the low of $5.46 to the high of $90.60. The 38.6% retracement of this move lands at $58, a level that could potentially be viewed as a strong buying point by investors. In the event the price hits this level during a consolidation or correction phase, compelling buying opportunities could be presented for investors. The $65 level has so far posed a challenge, with the price showing hesitation to dip below this mark. The RSI currently hovers around the mid-level 50, albeit with a slight downward tilt below 50.

NextEra Energy (stockcharts.com)

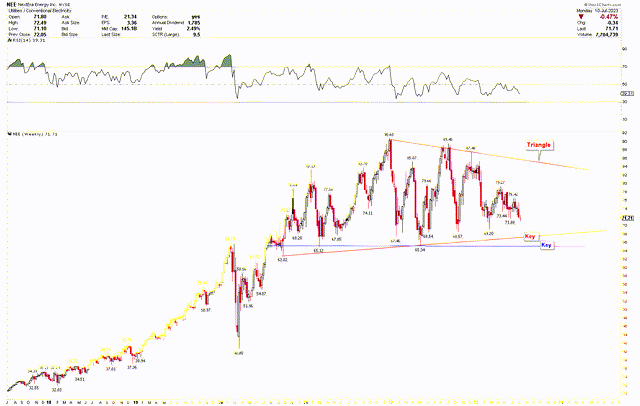

For further understanding of the key levels for NextEra Energy, the weekly chart below illustrates a triangle formation, indicative of the market’s recent consolidation. The triangle’s lower support trend line and blue support line serve as the first and second keys, respectively. A weekly close below $65 could pave the way for a dip to $58, where investors may consider adding long positions in anticipation of significantly higher prices. The RSI on the weekly chart also suggests further consolidations in the market.

NextEra Energy Weekly Chart (stockcharts.com)

Risk Factors

The successful growth plans and dividend growth strategy of NextEra Energy has led to a higher valuation compared to its peers, driven mainly by aggressive expansion into renewable energy and promising growth forecasts. High valuations pose a risk as the company must consistently meet high investor expectations. Moreover, the stock price has shown considerable volatility, as evidenced by the monthly chart and the inside candle patterns. Such volatility may bring short-term risks and might even push the stock down to lower levels.

As a major player in the utility sector and clean energy initiatives, NextEra Energy faces regulatory risk. Changes in environmental policies or regulations can significantly impact the company’s operations and profitability. Additionally, the future of the utility sector as a whole can impact NextEra Energy. Shifts in energy consumption, technological advancements, changes in market dynamics, and competitor actions could affect the company’s performance. NextEra Energy’s commitment to renewable energy is commendable, but the sustainability of these initiatives depends on technological progress, consumer acceptance, and economic feasibility. Any negative development in these areas can impact the performance of NextEra Energy.

Bottom Line

In conclusion, NextEra Energy presents a compelling investment opportunity, characterized by its unique position as the world’s largest utility company and a strong commitment to sustainable energy initiatives. The company has demonstrated a healthy dividend payment history, backed by an innovative approach to the energy sector through its focus on renewable sources and battery storage.

Although technical analysis suggests possible short-term consolidation, the company’s prospects for growth, underpinned by its mix of regulated utility and clean energy operations, appear robust. However, potential investors must consider the company’s high valuation, market volatility, and regulatory risks inherent in the utility and renewable energy sectors. Despite these challenges, the promise of solid growth potential, an unyielding commitment to renewable energy, and a track record of rewarding shareholders make NextEra Energy a promising prospect for long-term, growth-oriented utility stock. At present, the stock price is oscillating between $65 and $90, and any breach of these levels could drive the market to the next stage. Given the bullish price trends, should the price dip below $65, robust support is expected at $58, a point where investors might consider accumulating long positions.