pegasophoto

Dear readers/followers,

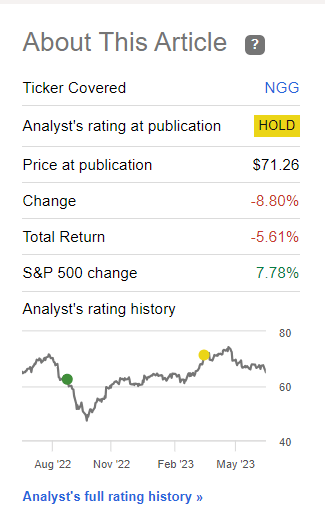

National Grid (NYSE:NGG) remains a qualitative utility with interesting exposures and a good and attractive future. My last article on the company was published in early April of this year, and I would say objectively that I’ve been able to pinpoint, for 2023, good points to “BUY” and good points to stop buying and go “HOLD”. I went “HOLD” in April, and the relevant returns since that time speak for themselves.

Seeking Alpha NGG RoR (Seeking Alpha)

It shows you once again why valuation is such a crucial consideration during times such as these, and why you want to make sure that you never really buy anything too expensively relative to what else you can get on the market in the same sector.

This article serves as an update – and a rating change for the company, which once again is in a position to be attractive here.

National Grid – Attractive again after a small drop, but only barely

Now, I don’t want to give you the impression that NGG is some sort of screaming, must-“BUY” rating here just because it’s down a few percent. That’s not the case. The company teeters between a slight premium and sometimes trading at a discount. The last time we had a real opportunity here, which is also when I loaded up on the business, was during last fall of 2022 when the company briefly went below 13x normalized P/E.

That’s not where we are today – but more on that later when we look at valuation.

I’m at about half a percent in terms of portfolio allocation for this company. That’s not a trivial position for me, and it makes NGG one of my larger utility stakes, though not comparable to my significant 4.8% stake in Italian Enel (OTCPK:ENLAY), which is currently by far my largest utility holding. That one is still “percolating” though – meaning it’s up significantly (over 43%), but it’s still not anywhere near I consider it meeting its full potential.

Utilities are very appealing plays, though the changes in interest rates have made investing in them a bit more complex. Why would you invest in a 3-4%-yielding utility no-growth play when you can get almost the same from bonds? Utilities don’t have massive growth. The best you can hope for, if you buy the “right” utility at the “right time” is a combination of reversal in valuation and attractive dividends, maybe some dividend growth, to really land you in the green and see some good returns on your investment.

This is how I view companies like NGG.

And NGG is certainly a “good business”. Fundamentals and history for the company go back to well before the 2000s, and before its founding, the operations that are now NGG, generation, and transmission of electricity in England and Wales were under the Central Electricity Generating Board, a public entity that was broken up in 1990 into different companies. It’s not only a rich heritage, they are core assets that make up part of the backbone of the British energy infrastructure.

This is attractive to own.

Organic growth for a business like this is usually nil. It’s growth strategies are related to inorganic growth and tack-on M&A’s, not any sort of organic growth beyond the low single-digit percentages.

A good way to view a utility is a relatively safe income investment, a bond-type investment. What NGG has done is become US-heavy. The US market is now over 40% of the company’s assets, and it’s strictly in regulated markets in the US.

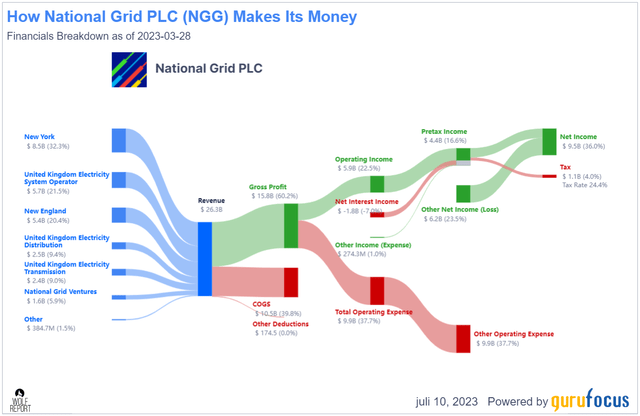

The company is one of the more attractive utilities out there in terms of profitability, which I view as key for a good investment. 60%+ gross margin and a 36% net margin make the company a 90th-percentile and above operator with a COGS of below 40% and below 40% OpEx. It’s a very streamlined and efficient operation, with an attractive asset and income mix, as you can see below.

NGG IR (NGG IR)

While overall profitability is now lower than it was years ago, this is a natural consequence of higher funding costs. Not even utilities are in any way safe or shielded from these. However, the company’s current valuation means that in terms of fundamentals and dividends, we now have a 5.15%+ yield for the NYSE-native NGG ticker. The company is BBB+ rated and has a market cap of close to $50B, being neither small nor in any way insignificant company.

The 22/23 full-year results were presented in May. Most analysts that have recently covered NGG are viewing the company as a “HOLD”, as did I previously. However, now the time has come to change my rating on this company, in part because of excellent results.

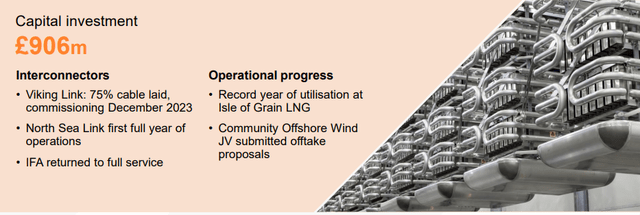

The company continues to invest heavily in infrastructure. In the last fiscal, more than £7.5B was invested in a mix of interconnector cables, gas pipeline replacement, smart connect projects, rewiring power tunnels in London, expanding EV connections, and energizing the world’s first T-pylons.

The company’s high-level strategic pivot is completed. The National Grid Electricity Distribution, formerly WPD was acquired in 2021, it sold Rhode Island businesses, and it’s almost done with the UK Gas transmission and metering sales – currently a 40% consortium option. The remaining business is positioned for good delivery, bringing now a 70/30 Gas/electricity mix.

NGG IR (NGG IR)

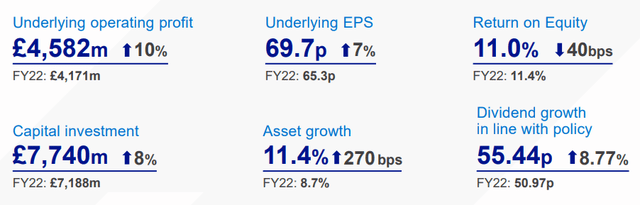

Financial performance, from a high level, was excellent, and also saw a near-double-digit increase of the company’s dividend.

NGG IR (NGG IR)

The company has good RoE, and also saw several milestones in its New York segment, with approval for investments to enable renewable transitions, and allowing for a rate base growth of just south of 10% on a $3B CapEx. UK Electricity saw its own positives, improving RoE by over 120 bips, and rewards of over 17 major transmission projects by Ofgem. The company is part of the “Powering up Britain package”, which views network players like NGG as key enablers of the energy transition in order to speed things up. It’ll be expensive for sure, with £1.3B CapEx in UK electricity alone for this year, but it’s moving forward. In the UK, the company has seen an allowance of 5.23% real allowed return at a £5.9B forward expenditures. The company’s gas ventures also went well, with nearly £1B of investments.

NGG IR (NGG IR)

The company has seen an attractive asset growth of 11.5%, which is up 2.7% compared to the 2022 asset growth, while also investing 8% more than the previous year. The company’s investments are very well allocated amongst its various segments, still with a heavier US focus than the mix might represent – but the infrastructure here is in need of heavier investments than the infrastructure in the UK.

NGG’s investment proposition remains strong. It’s one of the world’s largest public utilities, and its focus on the transmission and distribution of primary electricity makes it generation-independent. It owns one of the world’s most attractive asset bases, and it’s continual investments in the base means that these assets are of high quality. It’s a 49/40/11 UK/US/NGV and other-split, and from its asset portfolio, the company has the ability to generate upwards of £4.5B+ pre-tax profit per year, with the ability to pay an attractive 5%+ dividend yield despite record-level CapEx.

Let’s look at how this translates into valuation appeal and my new “BUY” rating.

NGG – The valuation is appealing due to yield, slight growth, and the market

When it comes to NGG, you really want to buy it at 15x P/E, or as far below 15x P/E as you possibly can. If you can do this, you’re “golden”, as they say.

Why?

Because at a 15x P/E given that the company justifies at least 16-16.5x on the basis of its asset quality if not its growth rate, that means you’re getting a normalized upside of 9-10% per year.

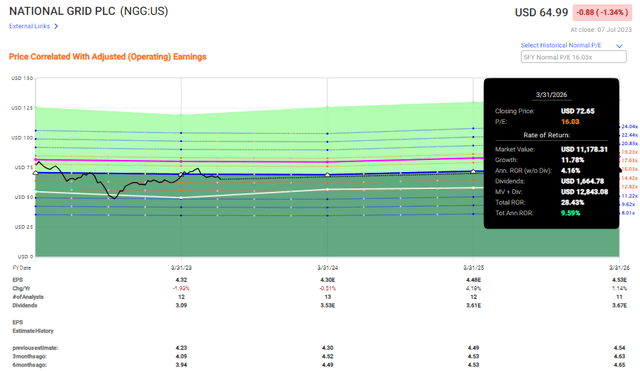

F.A.S.T graphs NGG Upside (F.A.S.T graphs)

Is it the best upside on the market?

It most certainly is not. It’s not even great enough to where I would consider this to be a “top 10 BUY” here. But the company is at a level where I consider the upside to, without a doubt, be “good enough” for a positive longer-term RoR. Given that some income investors want that 3-6% safety in yield, combined with a decent amount of potential capital appreciation, this is a potential I see for such investors.

Not the best, but “good enough”.

There really is very little to no risk that NGG is going anywhere in the short term. It’s likely, as I see it, to provide ample dividends for the foreseeable future. I’m not touching my 0.5% position in the business. my rotation target for the company is at around $75-$78, but I’m not trigger-happy when it comes to this stake.

The company also can’t really be called “cheap” here. My previous PT was $70/share. I see no reason whatsoever to deviate from this either positively or negatively at this time – so $70/share is where I remain.

Remember, I’m a relatively prolific utility investor. Those other investments have seen far better returns so far. This includes companies like Enel (OTCPK:ENLAY), which is currently up 43% or Fortum (OTCPK:FOJCF), which was up almost 70% before I sold a significant part of my position in the company. This means that other of my utility investments have clearly outperformed my RoR in NGG by quite a bit.

Still, I continue to claim that not even Enel can be said to be as conservatively safe as NGG is, given its asset base.

If you view NGG as an investment that’s indexed for inflation and primarily will grant you a good deal of income, then I believe the purchase of shares can be viewed favorably next to a bond, a savings account, or CD. And for that, the company offers investors some appeal here.

With that in mind, here is my current working thesis for the company.

Thesis

- While an excellent company with an appealing portfolio, NGG is about to take on copious amounts of leverage to improve its assets while doing very little to its dividend – though inflation will now do something to offset that.

- After an excellent 2023, the company is in a good position to continue to grow going forward. I don’t expect massive outperformance, but I do expect a solid yield and a good overall amount of continued investment that continues to improve its asset quality and its portfolio.

- With a normalized valuation, I now consider NGG to be a “BUY”.

- I would now be interested in buying the company, and I’m sticking to my price target of $70/share. That makes this one a positive.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- The company is currently cheap

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company cannot rightly be called cheap, and for that reason, I do consider it a “BUY” here, but with the addition that it may go cheaper in the near future.