Natural gas prices recently soared to their highest levels in two years, driven by a combination of extreme weather, supply constraints, record liquefied natural gas (LNG) exports, and global demand pressures. This surge has significant implications for consumers, industries, and energy markets worldwide.

Severe Weather is Driving Demand Higher

Arctic conditions across North America and Europe have dramatically increased heating demand, leading to higher natural gas consumption. Extreme cold has also triggered production challenges, such as “freeze-offs,” where frigid temperatures disrupt wellhead operations, temporarily halting gas extraction.

At the same time, lower-than-average wind speeds have reduced renewable energy output, increasing reliance on natural gas to compensate for the shortfall.

Supply Constraints Are Tightening the Market

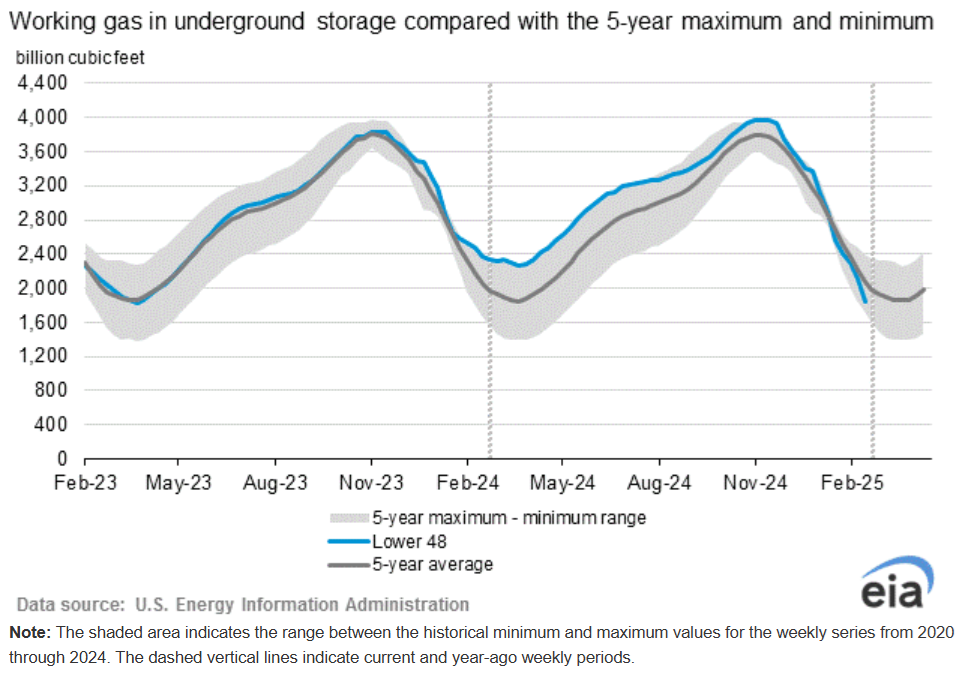

The harsh winter conditions have led to heavier-than-usual withdrawals from underground storage facilities, pushing inventories below the five-year average. Reduced supply levels have fueled price volatility, as traders anticipate potential shortages in the months ahead.

Historically, when underground storage levels fall below the five-year average, prices rise, and vice-versa. Note that inventory levels in the graphic below are 23% below the levels of a year ago, when inventories were at the top of the five-year range and Henry Hub natural gas spot prices were below $2 per million Btu.

Meanwhile, natural gas production has faced additional disruptions. Freeze-offs in key production regions have constrained output, exacerbating concerns about supply tightness. These challenges, combined with heightened demand, have put upward pressure on prices.

Record LNG Exports Are Adding to Domestic Supply Pressures

The U.S. has reached record LNG export levels, with 2024 shipments averaging nearly 12 billion cubic feet per day. The global appetite for LNG continues to grow, as European and Asian buyers compete for available supply in response to geopolitical instability and reduced Russian gas flows to Europe.

As more U.S. natural gas is sent overseas, domestic markets face added pressure, reducing available supply and further supporting price increases. This trend highlights the interconnected nature of global energy markets, where domestic prices are increasingly influenced by international demand.

Global Demand and Geopolitical Uncertainty

Rising demand in Europe and Asia is another key driver of natural gas price volatility. Since the reduction of Russian gas supplies to Europe, many nations have turned to LNG imports to fill the gap, creating intense competition for available cargoes. In Asia, economic recovery and seasonal heating demand have further tightened the market.

Geopolitical tensions also continue to impact global supply chains. Any disruption in LNG shipping routes or export facilities could send prices even higher, making market participants increasingly sensitive to political developments.

Storage Levels and Market Outlook

Higher-than-average withdrawals from storage facilities have depleted inventories in both the U.S. and Europe, reinforcing concerns about supply shortages. With current stockpiles running lower than normal, replenishing inventories could take longer than usual, particularly if winter conditions persist or production remains constrained.

Looking ahead, the combination of strong demand, tight supply, and geopolitical risks suggests continued price support for natural gas. Weather forecasts will play a crucial role in determining short-term price movements, while global LNG trade patterns and geopolitical developments will influence long-term market dynamics.

For investors and market participants, closely monitoring storage data, production trends, and international LNG flows will be critical in navigating the natural gas landscape.

Follow Robert Rapier on LinkedIn or Facebook