From 1952 to 2023, energy company BP released its benchmark publication detailing trends in energy production and consumption during the previous year, the Statistical Review of World Energy. This summer marks the second edition the production has been maintained by the Energy Institute, which released the 2024 edition this month. The report is backward-looking, so this year’s report includes data on the year 2023. Interested readers can see summaries of past Statistical Reviews for comparison.

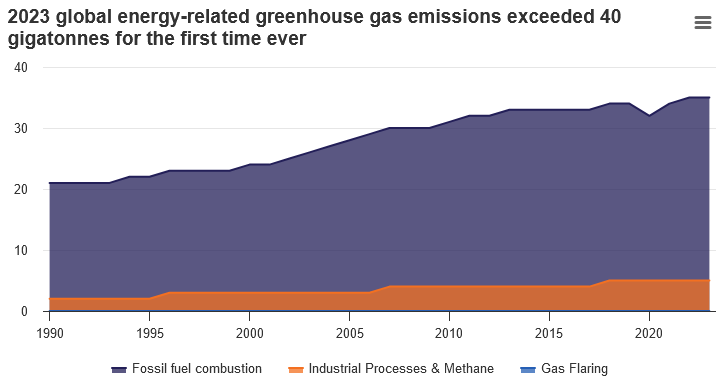

Global primary energy consumption grew by 2% during 2023 to reach a record 620 exajoules (EJ), 5% above its pre-COVID level. Countries outside the OECD, a club of 38 mostly-rich countries, saw the highest energy consumption and fastest consumption growth for the second consecutive year. Fossil fuel consumption declined slightly from 81.9% to 81.5% of primary energy use, but total primary energy use grew faster than fossil fuel use shrank, so fossil fuels still reached their highest-ever level. While natural gas consumption remained relatively flat during the year, more carbon-intensive fuels like oil and coal, which together make up almost 50% of all emissions globally, made up the difference. Consequently, energy-related greenhouse gas emissions reached their highest-ever levels in 2023, surpassing 50 gigatonnes (Gt) for the first time. The energy industry produces greenhouse gases from industrial processes, gas flaring, and fossil fuel combustion, with the latter accounting for around 87.5% of energy-related emissions.

The power sector, the largest single market for primary energy, and the leading source of greenhouse gas emissions in most countries, grew by 2.5% to reach 29,925 terawatt-hours (TWh). This rate is 25% higher than primary energy, suggesting a growing number of uses for electricity throughout the economy. Fossil fuels remained the dominant source of power generation, accounting for 60% of the total. Coal, whose share has barely budged in decades, generated 35% of power globally, while natural gas accounted for about 23%. Renewables (which the Energy Institute counts as biofuels, plus electricity from sources other than coal, natural gas, nuclear, or hydro) grew to 30%, up from 29% in 2022. The growth of renewables in power generation is particularly important because decarbonizing electricity makes it possible to make many other processes low-carbon by electrifying them. Nuclear held steady at 9% of global power generation, and battery storage, which is used to back up intermittent renewables, reached 55.7 gigawatts (GW).

Renewables grew by 13% in 2023, from 7.4% to 8.2% of primary energy use, outpacing all other new power generation. New wind and solar power generation installations totaled 462 GW, surpassing 2022’s record installation by 67%. Approximately 75% came from solar, and the remainder was wind. China, which now boasts as much installed wind capacity as America and Europe together contributed roughly 55% of all new renewables construction. Today renewables generate 30% of electricity globally, but account for a smaller proportion of primary energy consumption since electricity cannot easily substitute for every application that fossil fuels are currently used for. Therefore, achieving net-zero targets still requires continued deployment of renewables, alongside technologies like hydrogen,energy efficiency, and carbon capture. Production of biofuels, one technology meant to address this problem, grew by over 8%, with the largest growth in America and Brazil. Biofuel crops absorb the carbon released by their combustion, but they are controversial because they compete for land with crops grown for food, and may drive the expansion of cropland.

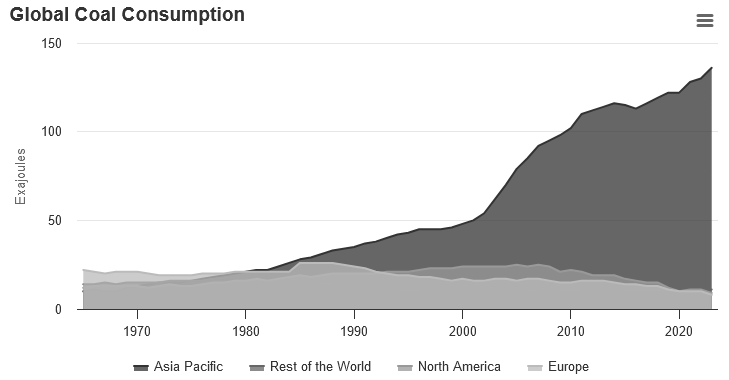

Coal production and consumption both reached their highest-ever levels in 2023, at 179 EJ and 164 EJ respectively. Production was concentrated in the Asia Pacific region, with 80% of global production coming from Australia, China, India, and Indonesia, with China alone producing almost half. Consumption in America and Europe fell to 1965 levels, even coming to an end in the country that launched the Industrial Revolution. However, strong consumption elsewhere meant that global coal use rose 1.6%, seven times higher than the ten-year annual growth. Despite declining to finance coal generation abroad, China accounted for a staggering 56% of coal use globally. India accounted for 13%, surpassing the combined consumption of America and Europe. The vast majority of coal consumed is “thermal coal,” which gets burned for power generation. A smaller fraction is “metallurgical coal,” which is harder, blacker, and more carbon-rich than thermal coal, and is used to make coke for steel production.

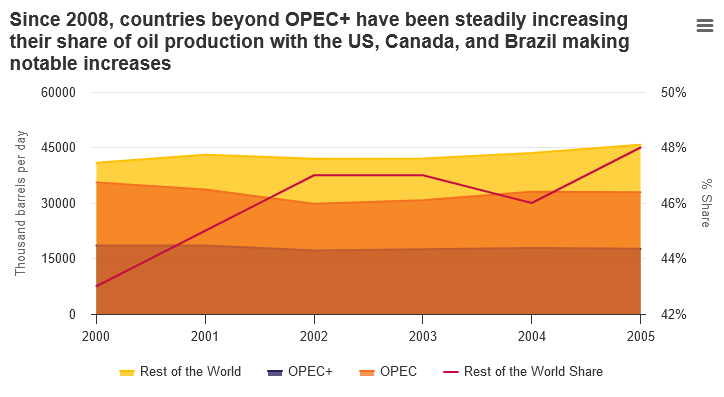

Oil production and consumption both reached their highest-ever levels, reaching 96m barrels per day (b/d) and 100m b/d respectively. America increased its output by 8%, maintaining its position as the world’s largest producer. A significant portion of production came from outside OPEC+ countries, the 13 OPEC members and an informal group of other large producers, with non-OPEC+ exceeding the year’s incremental demand growth by 20%. Like coal, oil consumption showed regional contrasts – North America saw a small increase under 1% and European consumption fell almost 1%, while the Asia Pacific region increased production by roughly 5%. Crude oil is removed from the ground and refined into a range of petroleum products, including fuels and industrial feedstocks for chemicals, plastics, and asphalt. China surpassed America to become the world’s largest refiner. Among products, gasoline consumption slightly surpassed 2019 levels, while kerosene consumption has yet to reach its 2019 levels.

Global natural gas production was nearly flat in 2023 compared to 2022. America remained the largest producer, accounting for about one-quarter of global output, while Russian output fell by 5%. A gas at ambient conditions, natural gas is most easily transported via pipeline. Russian pipeline exports to Europe shrank 15% from 2023, and are down 45% since the beginning of its ongoing war against Ukraine. Natural gas can also be moved between continents in liquid form via ships, which requires the energy-intensive processes of liquefaction and regasification. America passed Qatar and Australia to become the world’s largest LNG exporter in 2023, reaching 114 bcm compared to 0.2 bcm in 2013. The largest LNG importers were China, Japan, and South Korea, together accounting for 45% of the global trade. Natural gas is used in combustion turbines to generate electricity, burned for space heating, and provides high-temperature heat in industrial applications. It produces roughly half the carbon emissions compared to coal, and coal-to-gas switching has driven America’s recent emissions reductions. However, natural gas remains contentious because it often adds rather than replaces fossil fuels on the grid.

A range of minerals are crucial to the energy transition. Copper has been mined for the longest of these, giving it the most advanced supply chain and largest absolute production, but also making it difficult to expand production rapidly. Over the past decade, production of minerals crucial to the energy transition has grown by 4% on average, while copper production has grown around 2%. Prices for key metals and minerals fell by 26% in 2023. Copper saw a price decline of 4%, while cobalt fell 47%. Asia produced nearly 70% of the minerals required for Li-ion batteries, with China alone responsible for 20% of global lithium production and 74% of global graphite production. Cobalt production is dominated by the Democratic Republic of Congo, which was responsible for roughly 96% of the global supply. Resource extraction will remain geopolitically important in a world that consumes less fossil fuels. America and China are building competing rail networks to link resource-rich African countries with coastal ports, while newly discovered lithium deposits in America threaten to disrupt the market for that mineral.

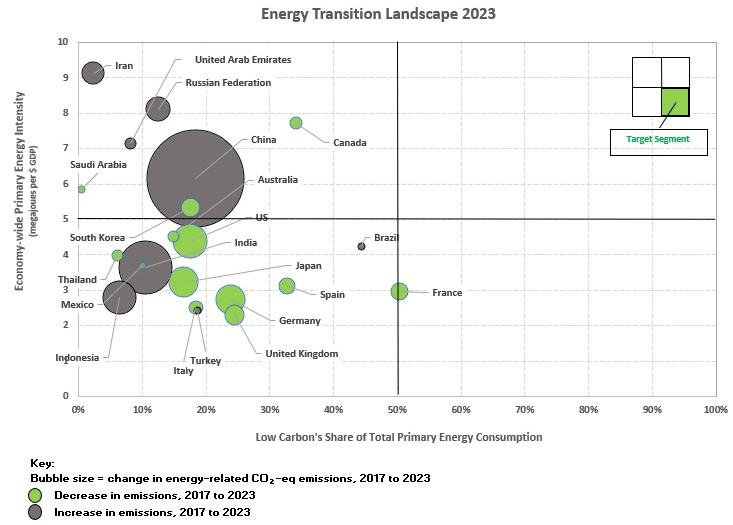

With respect to the term “energy transition,” there are valid questions about from what, to what, and how fast. Poor countries are experiencing catch-up economic growth, where firms adopt existing technologies. This usually involves a shift from rural agricultural work toward industrial work in cities, and a marked increase in energy intensity of the economies. These countries are transitioning from low-energy sources with significant negative health impacts like charcoal, wood, and dung to modern energy infrastructure. While this usually involves increased use of fossil fuels, it should be celebrated – higher energy consumption is clearly associated with higher incomes. Meanwhile, wealthier countries are experiencing frontier economic growth, which requires innovating new technologies to drive productivity improvements. This involves slower economic growth as well as slower energy consumption growth. These nations are transitioning away from coal generation as solar, wind, and batteries continue to fall in price. As they do so, they are showing signs of peaking fossil fuel use, demonstrating that it is possible to simultaneously reduce emissions while growing economically.

Historically, energy transitions have moved slowly and consisted of adding additional resources to the energy mix, rather than replacing existing ones. In many respects, the current energy transition is panning out similarly. Fossil fuels accounted for 85% of global primary energy consumption 20 years ago but are just a few percentage points lower today, and carbon dioxide emissions have never been higher. While coal use is declining in wealthy countries, natural gas and oil consumption remain stubbornly persistent, and carbon emissions per person within the OECD dwarf those of poorer countries. All of this suggests a world that is making improvements toward increased well-being and falling carbon emissions, but one which remains far off track to reach net-zero emissions by 2050. While such a world will involve more frequent natural disasters and more spending on climate adaptation, there remain ample reasons to accelerate renewable energy construction and reduce fossil fuel consumption.