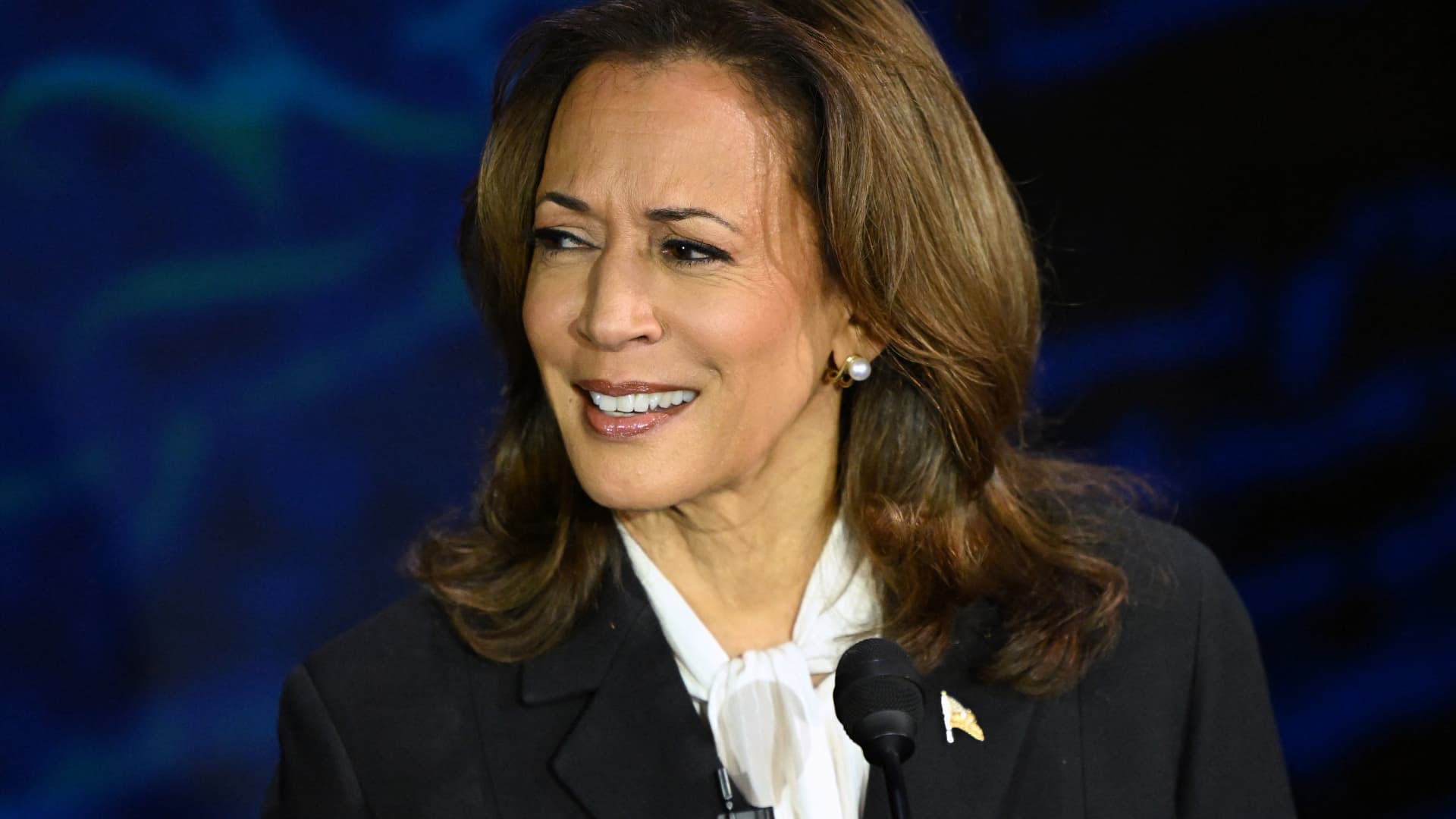

With the broad equity markets selling off after the latest inflation data on Wednesday, one industry group bucked the trend and surged higher. Solar stocks jumped to the top of the leaderboard in reaction to the presidential debate on Tuesday evening, fueled by renewed optimism for renewable energy in the result of a victory by Vice President Kamala Harris in November. The technical configuration for solar has not been particularly bullish in 2024, with the Invesco Solar ETF (TAN) down over 25% year-to-date compared to the S & P 500’s +14% and the Nasdaq 100’s +11%. Let’s take a closer look at two of the strongest charts in the group, First Solar Inc. (FSLR) and Sunrun Inc. (RUN) , and see how the recent upswing fits into the larger technical picture. Earlier this year, FSLR had an impressive run of outperforming the S & P 500, pushing to a high just above $300 in mid-June. But the stock quickly dropped to find new support around $210, eventually settling into a trading range between $200 and $240. This price range lines up well with previous resistance from 2023, adding further conviction to the importance of these levels. When a stock is in a consolidation phase, with clear support and resistance levels, it’s often best to wait for a confirmed move outside of that price range. For First Solar, that would mean a break above established resistance around $240 would complete the upside rotation and signal a likely retest of the 2024 high around $300. A buy emerging Sunrun is in perhaps a more attractive technical configuration at this point as it is already in a confirmed uptrend phase. After finding support around $9 in late 2023, and retesting that support level in early 2024, the stock has now established a clear pattern of higher highs and higher lows. When a stock is in an uptrend phase, pullbacks to the 50-day moving average often provide ideal entry points to ride the next leg higher. This week, RUN actually pulled back to an ascending 50-day moving average, suggesting a potential higher low to continue the uptrend. Similar to FSLR, Sunrun does have some overhead resistance to be concerned about. Over the last two years, the stock has often topped out in the $20-24 range, suggesting a short-term upside target in that congestion area. But if RUN can finally break above the $24 level, that would mean clear skies ahead from a technical perspective. When the markets go into a risk-off mode, it can be quite helpful to identify stocks and themes that are moving counter to that downside market thrust. While solar stocks still have much to prove, their technical configurations suggest investors should watch this space closely leading into the November elections. -David Keller, CMT Chief Market Strategist, StockCharts.com President, Sierra Alpha Research LLC marketmisbehavior.com DISCLOSURES: (None) All opinions expressed by the CNBC Pro contributors are solely their opinions and do not reflect the opinions of CNBC, NBC UNIVERSAL, their parent company or affiliates, and may have been previously disseminated by them on television, radio, internet or another medium. THE ABOVE CONTENT IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY . THIS CONTENT IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSITUTE FINANCIAL, INVESTMENT, TAX OR LEGAL ADVICE OR A RECOMMENDATION TO BUY ANY SECURITY OR OTHER FINANCIAL ASSET. THE CONTENT IS GENERAL IN NATURE AND DOES NOT REFLECT ANY INDIVIDUAL’S UNIQUE PERSONAL CIRCUMSTANCES. THE ABOVE CONTENT MIGHT NOT BE SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES. BEFORE MAKING ANY FINANCIAL DECISIONS, YOU SHOULD STRONGLY CONSIDER SEEKING ADVICE FROM YOUR OWN FINANCIAL OR INVESTMENT ADVISOR. Click here for the full disclaimer.

Solar stocks get a Harris bump. What the charts say about whether the rally is for real