Minnesota clean energy and economic development officials say a Canadian solar manufacturer’s planned expansion in the state shows the impact of federal climate incentives for domestic production.

Pete Wyckoff, assistant commissioner of federal and state initiatives for the Minnesota Department of Commerce, said Heliene’s announcement that it plans to onshore solar cell manufacturing in partnership with an Indian supplier shows the Inflation Reduction Act “is doing what it is designed to do, which is to provide incentives to encourage every step in the solar manufacturing process to occur domestically.”

In late July, Heliene said it had reached a joint venture agreement with Premier Energies, India’s second-largest solar cell manufacturing company, to build a solar cell manufacturing facility somewhere in the Twin Cities. Heliene also has a plant in northern Minnesota, where it assembles solar panel modules using imported cells from Premier Energies.

Several U.S. factories assemble solar panel modules — think of the rectangular boxes you’d see installed on a rooftop. Almost all of these domestic manufacturers, though, depend on imported solar cells — the half-foot square slices of silicon that actually do the work of converting sunlight to electricity.

The Inflation Reduction Act prompted a flurry of announcements related to domestic solar cell production, but its viability here remains unclear, Renewable Energy World recently reported. Multiple companies have already retracted plans for U.S. solar cell factories, citing market challenges.

Meeting installer demands

Heliene CEO Martin Pochtaruk said its planned solar cell plant is meant to meet clients’ demand for modules with higher levels of domestic content, which allow project developers to claim more lucrative incentives. After solar owners receive a standard 30% tax credit for projects, they can add another 10% by using modules with equipment made in the United States.

“Strong solar cell manufacturing offers solar developers a higher percentage of U.S.-made domestic content components for their projects, reduces reliance on imports, and releases stress on our supply chain,” Pochtaruk said.

He said working with Premier on establishing an American beachhead that could employ more than 200 workers makes sense because the Inflation Reduction Act rewards solar panels made primarily with parts made in the U.S. solar cells.

Solar developers must use panels with a domestic content of 40% or more for the bonus, and the threshold will increase to 55% in 2026.

In August, Heliene agreed to a multi-year contract with NorSun to supply low-carbon wafers — one of the building blocks of solar cells — for all the company’s solar panels starting in 2026.

Heliene has also announced a partnership with UGE, a community and commercial solar and battery storage developer, to provide panels that meet the requirements of the Domestic Content Investment Tax Credit (ITC) Bonus.

Heliene said in a press release that it would manage construction, finances, supply chain logistics, regulatory oversight, and human resources. Premier will provide cell technology engineering, manufacturing expertise, supply-side agreements, and raw material vendor relationships.

Pochtaruk said Heliene’s commitment to buy material from Premier Energies and NorSun was instrumental in their ability to finance the new factories. He asked both to try to open in 2026 when the content bonus requires more American-made content.

Jeremy Kalin, a Minneapolis attorney who works with several solar developers, said his clients are seeking panel suppliers with enough content to take the additional 10% tax credit. Manufacturers must provide a guarantee that the panels reach the threshold of having at least 55% of the panels’ components American-made.

“Once they meet that requirement, they will see a flood of business,” Kalin said.

Could Minnesota be a solar manufacturing center?

Minnesota Solar Energy Industries Association business development and communications director Abbi Morgan said the company’s presence “is huge and something we’re excited about because Minnesota is often overlooked when it comes to clean energy.”

So far, though, Heliene’s Minnesota operations have yet to attract other solar manufacturers. Morgan said one of the association’s members, a German firm, opened a factory in Arizona. At least among the association’s more than 170 members, plenty have expressed interest in buying panels from Heliene.

“There are a lot of members who ask about Heliene, but we’ve heard they have a long waiting list even though they expanded their factory in Mountain Iron,” Morgan said.

After securing a $3.5 million state loan package in 2018, Heliene began manufacturing and assembling panels in a once-shuttered solar module plant in Mountain Iron. The former plant, Silicon Energy, failed despite state investments of millions of dollars.

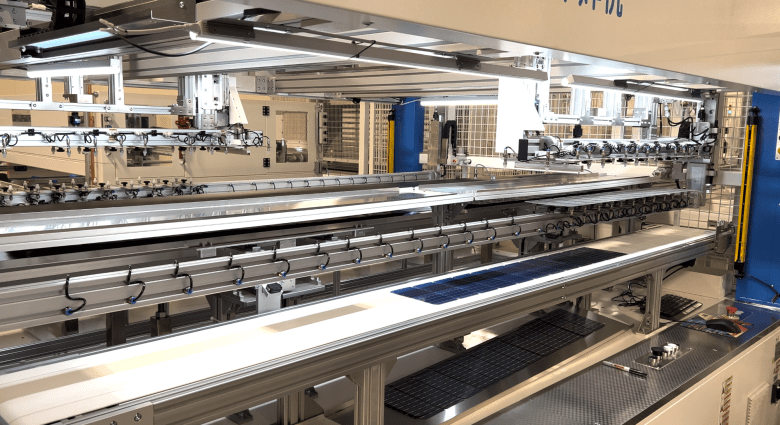

The plant is in a business park created to attract green energy companies across the street from a taconite mine. Two years ago, the company spent $21 million to triple the production space through an addition to the plant. Heliene spent $9.5 million to pay for the expansion and received most of the rest through state loans and a county grant.

Now, the company has shifted attention to adding capacity in central Minnesota, where it will begin developing two solar module manufacturing lines in an existing 227,000-square-foot warehouse in Rogers, a burgeoning exurb northwest of Minneapolis.

Before preparing the warehouse for solar production, Heliene is waiting to hear whether the project will receive money from the Minnesota Investment Fund (MIF) and Job Creation Fund (JCF). State officials were expected to make an announcement in September.

Rogers Community Development Director Brett Angell said Heliene will fit into the city’s growing reputation as a hub for sustainable enterprises. The company plans to employ at least 180 people and spend $16 million on building improvements and equipment.

“Additionally, (Heliene) would continue to add to the growing segment of sustainable manufacturers within the community as the city currently is home to multiple plastic recycling companies,” Angell said.

Heliene has not selected a site for the solar cell manufacturing plant or provided details on how much investment and employment it will create. Pochtaruk said the building will be significantly larger than the solar module plant.