This is the first article in a series exploring the Inflation Reduction Act’s impact after two years. The second details historic industry investment, third details auto manufacturing job growth, and the fourth tracks a clean manufacturing boom.

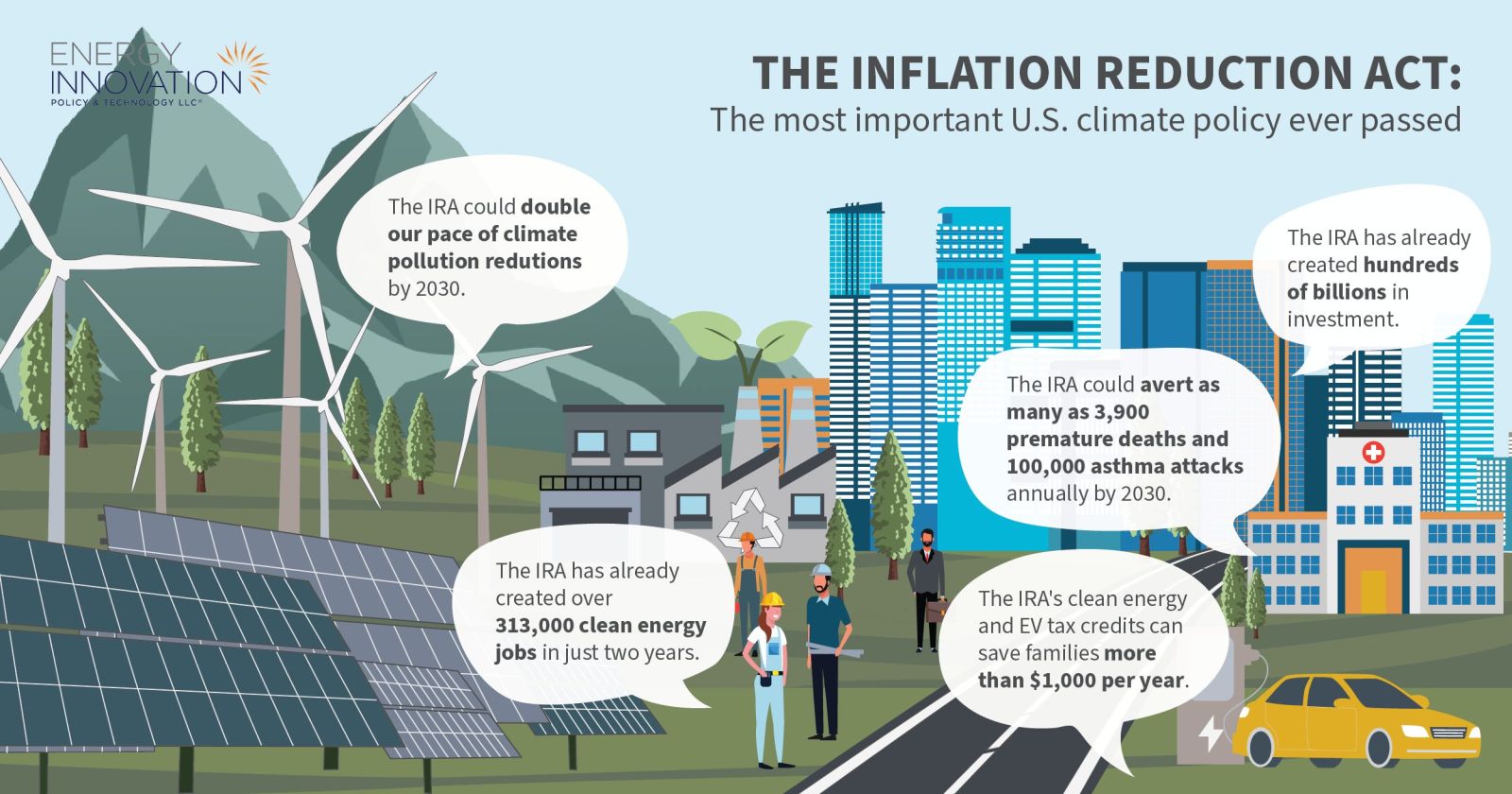

Two years after it passed Congress and was signed into law, the Inflation Reduction Act has become the most important climate legislation in United States history.

President Biden’s signature climate achievement is giving Americans the choice to stop burning fossil fuels and cut their energy bills – all while kick-starting a domestic manufacturing boom, cleaning our air, and creating good jobs.

Federal policies like the IRA, Infrastructure Investment and Jobs Act, CHIPS and Science Act, and U.S. Environmental Protection Agency standards to cut air pollution from vehicles and power plants, have more than doubled America’s annual pace of emissions reductions this decade compared to the rate achieved in the 2010s.

IRA provisions are the catalyst of this clean energy transition, and they’ve helped put U.S. emissions on pace to fall 37% below 2005 levels, about halfway to our national climate targets of 50-52% emissions reductions by 2030, en-route to net-zero emissions by 2050.

But the IRA isn’t just an environmental success – it has recharged America’s economy by onshoring manufacturing, creating jobs, saving consumers money, and attracting billions in new investments.

Following The Money

Clean energy incentives in the IRA empower the U.S. to transition off fossil fuels through $369 billion in new spending for clean energy projects, which Goldman Sachs estimates will catalyze $2.9 trillion cumulative investment by 2032.

IRA investments are paying off. In the two years since it became law, clean energy investments have created more than 334,000 new jobs and enacted corporations have invested nearly $500 billion in clean energy, more than half of total private investment nationwide and 64% higher than total oil and gas investment.

These economic benefits are bipartisan. 85% of all investments have gone to Republican-controlled Congressional districts, and Energy Innovation modeling forecasts Texas ($15 billion GDP, 100,000 new jobs) and Florida ($10 billion GDP, 85,000 new jobs) will be the two states that benefit most economically from IRA clean energy tax credits by 2030.

It’s important to note the IRA economic boom is reaching communities most in need of good jobs. 81% of total investment dollars have gone to counties with below-average wages. Clean energy jobs pay about 21% higher wages than average, and can usually be obtained without a four-year degree.

Unlike past economic recoveries, increased clean technology deployment is decoupling U.S. job and economic growth from greenhouse gas emissions – the U.S. is now on track to cut GDP greenhouse gas intensity 57% by 2030 compared to 2005 levels.

Switching To Clean Energy

IRA provisions are also giving Americans the choice to save money by switching from fossil fuels to clean energy.

The U.S. Treasury reports IRA provisions have already saved consumers $1 billion on EV sales, equal to $18,000-$24,00 in total consumer savings on fuel and maintenance per vehicle. Leasing an EV is now the cheapest option for new car buyers across the U.S., and recharging an EV is cheaper than filling up a gas tank in every state.

The same is true for electricity bills. The Internal Revenue Service reports more than 3.4 million American families have already claimed $8.4 billion in residential clean energy and home energy efficiency credits against their 2023 federal income taxes, saving up to $3,100 per year based on the installed technology. And new utility-scale clean energy generation supported by IRA tax credits will save customers $4.4 billion on their power bills.

So, what are all these IRA provisions that are helping Americans get good jobs, breathe cleaner air, and save money?

Accelerating Electric Transportation

The IRA provisions have jump-started clean transportation as America’s vehicle fleet transitions from expensive fossil fuels to affordable electric power.

- Income-eligible consumers receive a credit of up to $7,500 to purchase new electric vehicles, including light- and medium-duty trucks along with personal vehicles, and new electric vehicles are now more affordable than conventional gas cars.

- Electric vehicle sales have accelerated to more than 9% of total U.S. vehicle sales and are on track to hit 11% of total sales this year – up from roughly 2% in 2020.

- Automakers and battery manufacturers have announced $88 billion in new domestic factories to produce electric vehicles and their supply-chain components, enhancing our global competitiveness by building a “Battery Belt” across the Midwest and Southeast U.S.

Building Clean, Affordable Homes

Rebates for buildings and homes are helping Americans lower energy costs, improve housing affordability, cut carbon emissions, and enhance social equity.

- The IRA allocated $8.8 billion in federal funding for home and building rebate programs, targeting the one in seven U.S. families who live in energy poverty.

- The Home Electrification and Appliance Rebates (HEAR) program dedicates $4.5 billion to help low- and middle-income households adopt energy-efficient equipment like heat pumps and water heaters, as well as energy efficiency measures like insulation and air sealing.

- The Home Efficiency Rebates (HOMES) program provides $4.3 billion for energy-saving retrofits for single-family and multi-family households, with double the incentives for low- and middle-income homes or dwelling units in multifamily buildings.

- The 45L Energy Efficient Home Credit offers incentives for builders to construct U.S. Environmental Protection Agency-certified Energy Star and U.S. Department of Energy (DOE)-certified Zero Energy Ready homes, while the HEAR and HOMES programs offer dedicated incentives for contractors that do the work, provided the installation is done in a disadvantaged community.

Recharging America’s Power Grid

Electricity is having an infrastructure renaissance as much of the expected IRA impact is from the electricity sector, especially the tax credits.

Manufacturing A Clean Industrial Renaissance

U.S. industrial emissions are on track to be the country’s biggest polluter within a decade, but IRA provisions are powering a Made-in-America clean industrial renaissance.

- IRA funding includes a nearly $6 billion dollar investment to transform America’s industrial sector through the U.S. DOE’s Industrial Demonstrations Program. This funding will commercialize new technologies meant to cut industrial emissions.

- The IRA also allocates more than $4 billion dollars to green public procurement programs for low carbon materials like asphalt, concrete, cement and glass.

- The new 45X advanced manufacturing production tax credit expands domestic production of specific components for wind, solar, and batteries. It also covers the production of thermal batteries, which can eliminate emissions from industrial process heating and cut its costs by two thirds.

- The new 48C project credit directly incentivizes emissions reduction by offering a 30 percent investment tax credit for projects that retrofit an industrial facility with equipment that reduces emissions by at least 20 percent. It also offers a 30 percent investment tax credit to projects that retrofit, expand, or establish new industrial facilities to manufacture clean energy technologies or critical minerals.

- The IRA granted additional loan authority to the DOE’s Loan Programs Office, enabling financing for early deployments of innovative industrial technologies.

A Clean Economy Is A Healthy Economy

Anniversaries are an opportunity to reflect on what’s happened and consider what’s to come.

Two years into its existence, the IRA has jumpstarted a clean economic transition that’s cleaning our air, creating good jobs, saving Americans money, and fighting climate change.

While some IRA provisions like 48V are still being finalized, and others like the HOMES and HEAR program are still being implemented, the future is bright for America’s most important climate action – and every state will benefit from it.