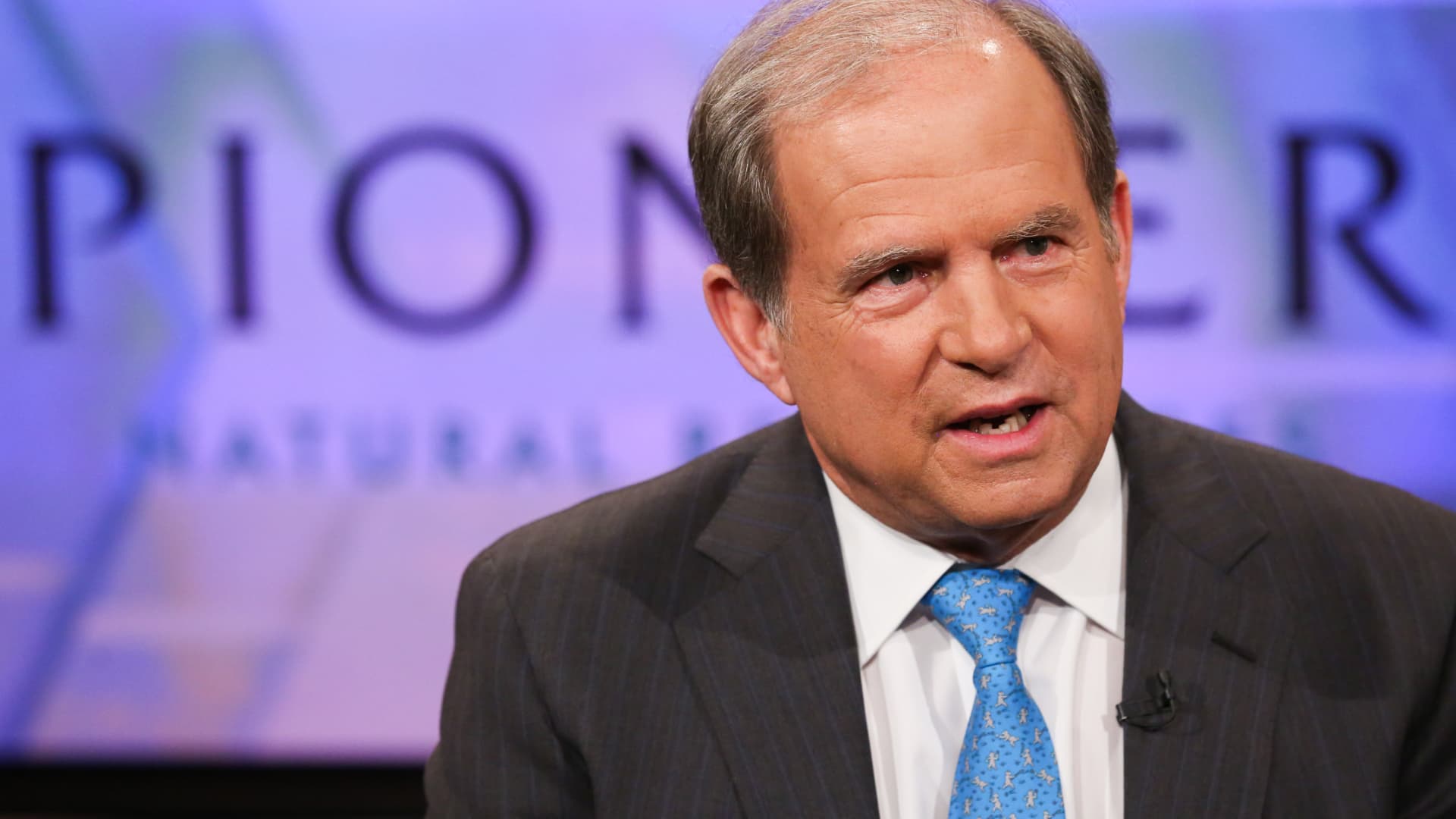

- The FTC alleges that former Pioneer Natural Resources CEO Scott Sheffield held private conversations with OPEC officials assuring them the company would keep oil output low.

- Sheffield was barred from serving on the Exxon board after the deal closes, which Exxon expects to happen Friday.

- The federal regulator has decided to refer the allegations to the Justice Department for a potential criminal investigation, people familiar with the matter told the Wall Street Journal.

The Federal Trade Commission on Thursday accused the former Pioneer Natural Resources CEO of colluding with OPEC to raise prices, and barred him from serving on the Exxon Mobil board of directors once its planned $65 billion acquisition of Pioneer closes.

The FTC filed a complaint alleging that Scott Sheffield attempted to collude with representatives of OPEC to reduce oil and gas output in an attempt to increase prices at the pump and inflate Pioneer’s profits.

The federal regulator has decided to refer the allegations to the Justice Department for a potential criminal investigation, people familiar with the matter told The Wall Street Journal. “The FTC has a responsibility to refer potentially criminal behavior and takes that obligation very seriously,” spokesman Doug Farrar told CNBC.

In response, Exxon agreed to keep Sheffield off its board and expects the deal with Pioneer to close Friday, the oil major said in a statement Thursday.

The FTC alleged that Sheffield repeatedly held private conversations with high-ranking OPEC representatives to assure them that Pioneer and its competitors in the Permian Basin were working to keep oil output artificially low.

“This was not a one-off event but rather part of Mr. Sheffield’s sustained and longrunning strategy to coordinate output reductions,” FTC Chair Lisa Khan and the other commissioners allege in the complaint.

Pioneer pushed back against the allegations in a statement Thursday, saying the FTC’s complaint reflects “a fundamental misunderstanding of the U.S. and global oil markets.” Sheffield never intended to circumvent the laws and principles that protect market competition, according to Pioneer.

“Notwithstanding, Pioneer and Mr. Sheffield are not taking any steps to prevent the merger from closing,” the company said in the statement.

— CNBC’s Pippa Stevens and Mary Catherine Wellons contributed to this report.