This article contains still images from the interactive dashboards available in the original blog post. To follow the instructions in this article, please use the interactive dashboards. Furthermore, they allow you to uncover other insights as well.

Visit the blog to explore the full interactive dashboard

This interactive presentation contains the latest oil & gas production data from all 47,909 horizontal wells in the Permian (Texas & New Mexico) that started producing from 2001 onward, through January 2024.

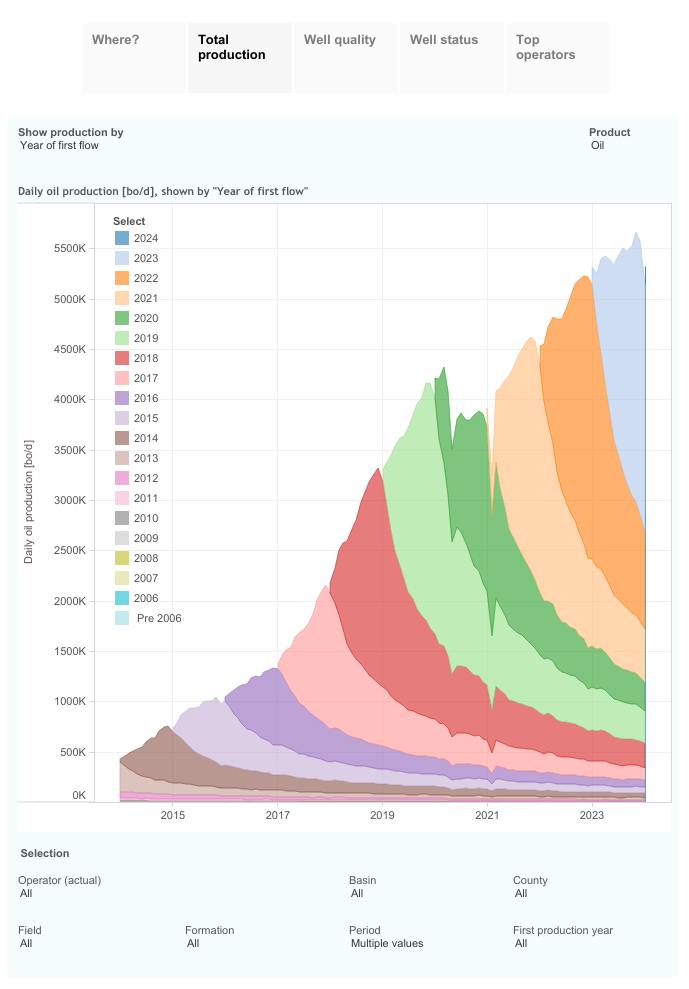

Total Production

Permian tight oil production came in at 5.4 million b/d in January (after upcoming revisions, horizontal wells only), 2% higher than a year earlier. Natural gas production was 22 Bcf/d, representing an annual increase of about 10%.

In 2023 5,822 horizontal wells started producing, almost the same number as the year before (5,869), which was the highest ever.

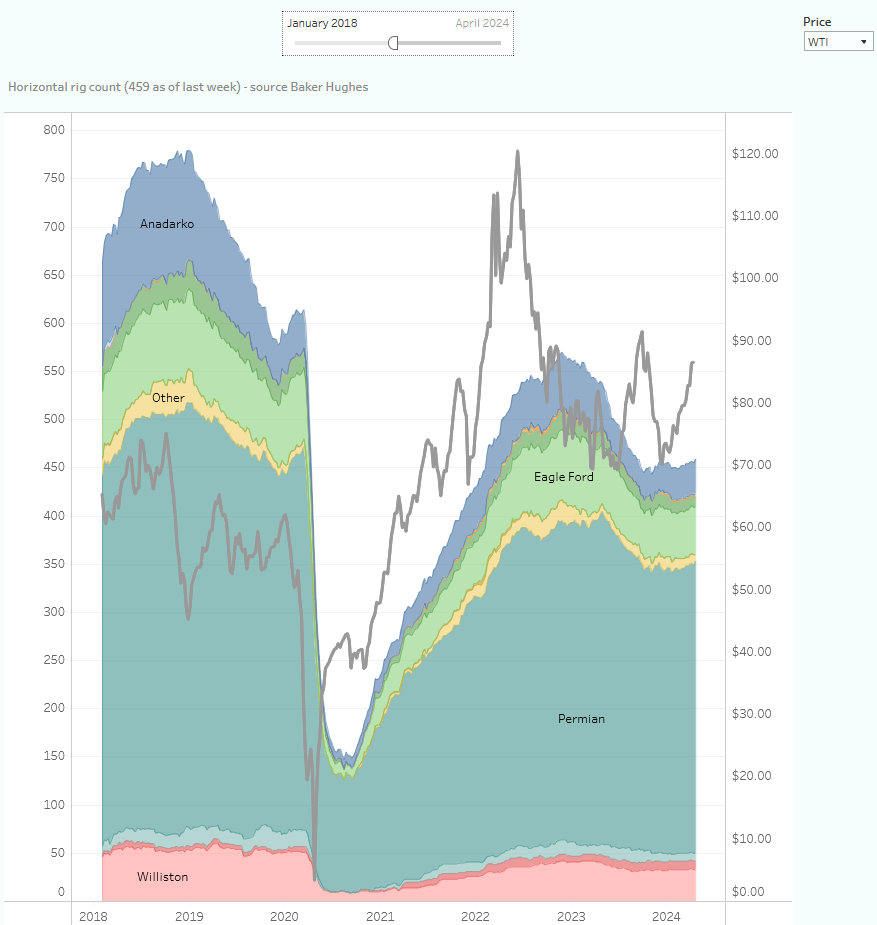

Drilling Activity

Drilling activity in the Permian Basin has edged up again since the start of this year with the increase in WTI. Currently, 303 rigs are drilling unconventional oil wells in the Permian, or 2/3rds of the US total (source: Baker Hughes):

Number of oil-directed rigs drilling horizontal wells in the US, by basin. Source: Baker Hughes. WTI (dark curve) is shown on the right-hand axis.

The number of data customers that Novi Labs has is growing fast, and many of these customers who are on the operational side have agreed to share data with us, especially completion and production data, which we call the Novi Data Network. A good portion of these customers have also allowed to republish data within our data products. In the Texas side of the Permian for example, we are now receiving production data from proprietary sources for over 1/3rd of the total unconventional oil production. This means that we don’t need to allocate lease-level production, which is the common way to estimate well level production data in Texas. Furthermore, that has allowed us to further finetune our lease allocation methods for the cases where we don’t have proprietary data. The result of all that is that not only is our production data way more accurate, but it also allows making far better production forecasts, which Novi Labs’ models were already very good at. As part of our data schema, customers can identify exactly which data came from proprietary sources. We’re excited that every month new customers sign up for this program.

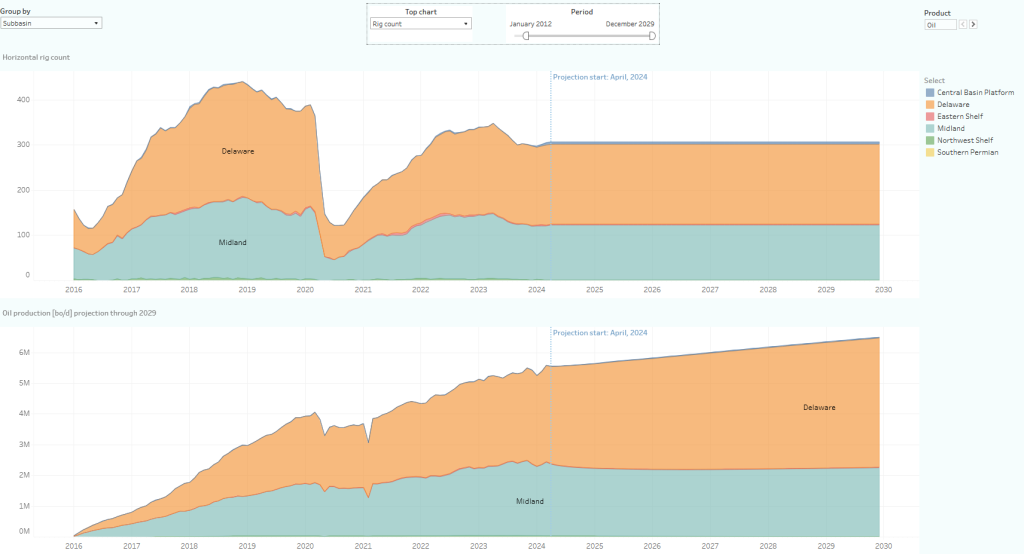

Supply projection

The current level of drilling & completion activity should be enough to further expand the production capacity of the Permian Basin, all else being equal:

Supply Projection for the Permian Basin. The horizontal rig count is shown in the top chart, and historical & projected oil production in the bottom, by subbasin.

As you can see, the Delaware has become the most prolific part of the basin, and on the current trend would produce almost twice as much as the Midland by the end of the decade.

Well productivity

In the next overview you can find how well performance has developed over time in each of the subbasins of the Permian, as well as the key completion parameters (lateral length & proppant loadings):

Well productivity, and completion designs, in the Permian subbasins. Horizontal oil wells completed since 2016 only.

Recent well results in the Midland basin have improved again, while you can still observe a negative trend in the Delaware basin in the past 2 years, based on the average cumulative oil production during the first 3 months.

Well performance is the result of many competing factors, including geology, completion designs and well spacing. Novi Labs’ analytics software allows operators to optimize these factors to improve overall economic outcomes.

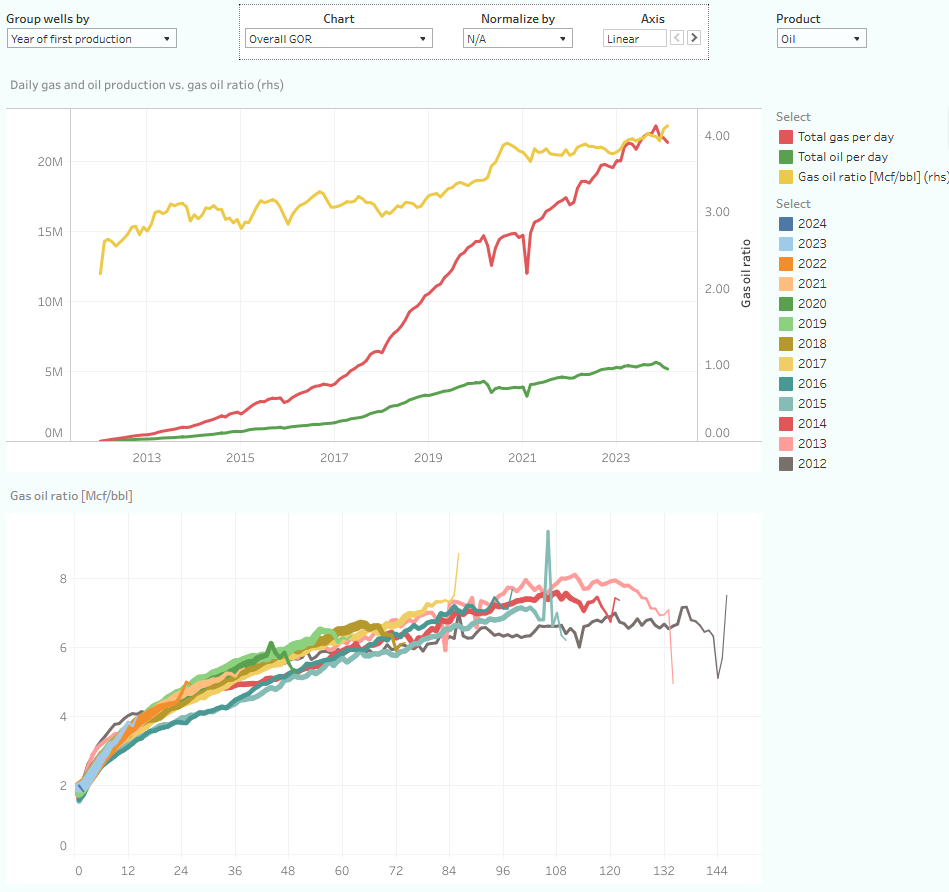

Gas oil ratios

The Permian Basin is one of the few US basins where natural gas production is still rapidly growing, mostly due to its production next to the more profitable oil stream. This gas-oil ratio (GOR) is furthermore increasing over time, as the following charts reveal:

Gas oil ratios in the Permian Basin, overall (yellow curve, top chart), and by vintage of first production (bottom chart). Horizontal wells starting production since 2012 only.

Finally

Production and completion data are subject to revisions.

Note that a significant portion of production in the Permian comes from vertical wells and/or wells that started production before 2001, which are excluded from these presentations.

Sources

For these presentations, I used data gathered from the following sources:

- Texas RRC. Oil production is estimated for individual wells, based on a number of sources, such as lease & pending production data, well completion & inactivity reports, regular well tests, and oil production data.

- OCD in New Mexico. Individual well production data is provided.

- FracFocus.org

Visit our blog to read the full post and use the interactive dashboards to gain more insight: https://novilabs.com/blog/permian-update-through-jan-2024/