BP has increased its stake in the $36bn Australian Renewable Energy Hub (AREH) to 63.57% by acquiring a 15.25% share from Macquarie, marking Macquarie’s exit from the asset. This follows BP’s initial acquisition of a 40.5% stake in Jun’22, which was later increased to 48.32% through share purchases from the original developers InterContinental Energy (ICE) and CWP.

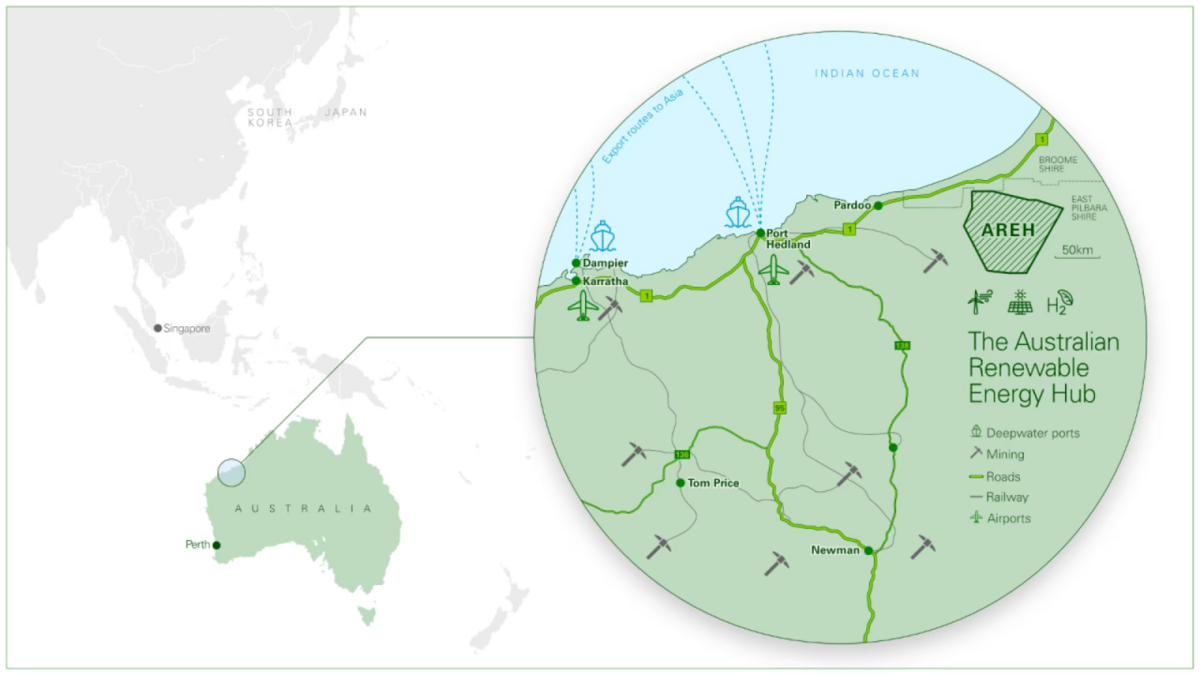

In 2017, the AREH was launched to provide 6 GW of emissions-free power to Indonesia via a subsea cable. Macquarie joined in 2019, doubling the project’s capacity to supply power to the Pilbara region. Later expansions increased the project’s size to 26 GW of solar and wind capacity, focusing on green ammonia production for export to countries like South Korea and Japan, while dropping plans to supply power to Indonesia. The asset now includes 14 GW of electrolyzers, capable of producing 1.6 million tonnes of renewable H2 or 9 million tonnes of green ammonia annually.

In their Feb’2023 strategy update, BP revealed plans to invest up to $65 billion in renewables, hydrogen, biofuels, and electric mobility from 2023 to 2030. They are actively expanding their hydrogen business, with over 10 projects underway across Europe, the US, and Australia. By 2030, BP aims to produce 0.5-0.7 million tonnes of low-carbon hydrogen annually. Additionally, in Feb’23, BP launched the HyVal green hydrogen cluster at its Castellon refinery in Spain, with potential investments reaching €2 billion by 2030.