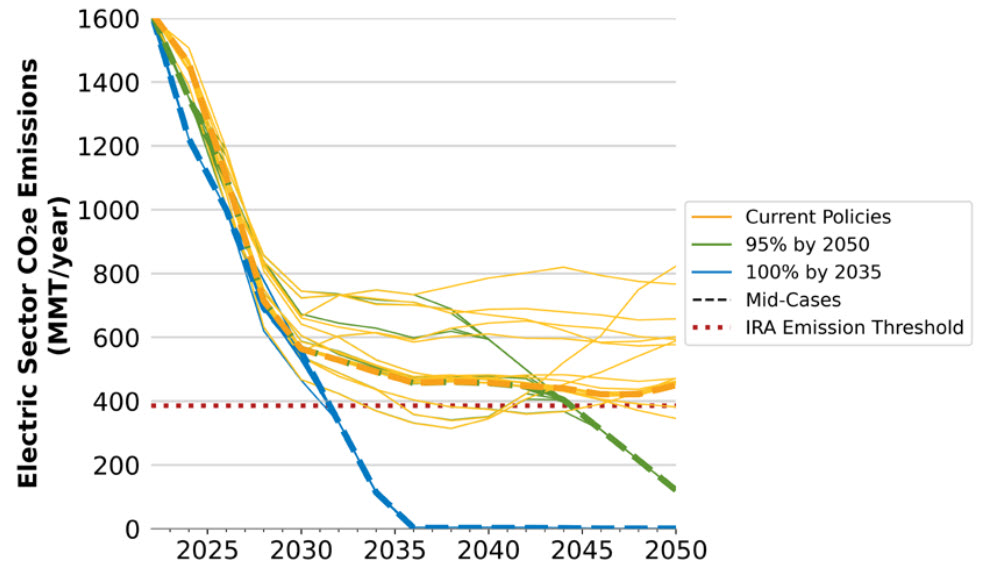

As more renewables are added to the system over time, the emissions from the power sector are expected to fall (visual top of page 19) according to a recent study by the National Renewable Energy Laboratory (NREL). But surprisingly it concluded that under current policies natural gas fired capacity would grow by 130 GW even under a scenario where the US manages to cut carbon emissions in the power sector 95% by 2050. That is because the sun goes down at the end of the day and is occasionally covered by clouds, and because the wind does not blow continuously or consistently, meaning that natural gas plants will be needed to fill the gaps. Historically, natural gas fired plants, including peaking plants and those with flexibility filled any shortfall in supply from other resources. And the grid operators, being ultra conservative, tend to stick with what they know works, most of the time.

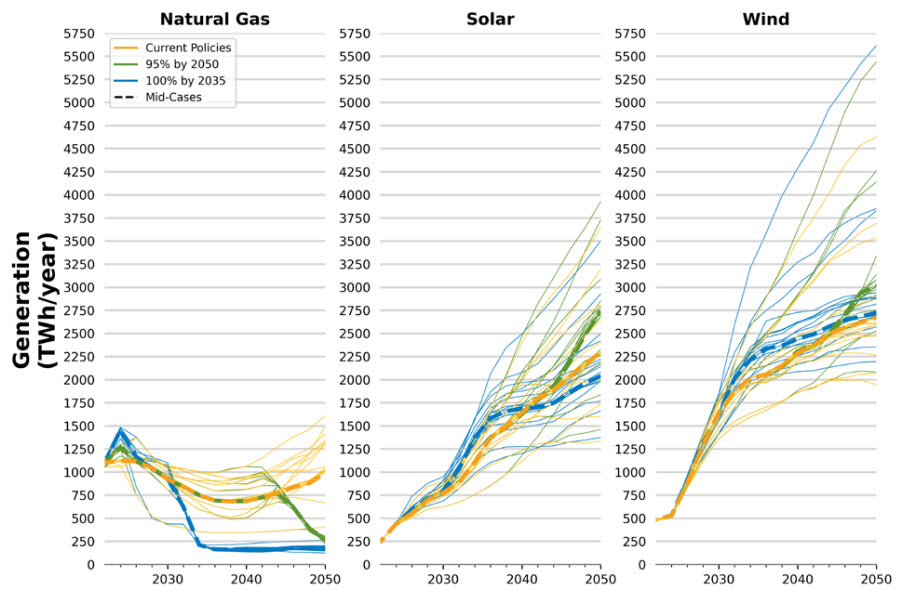

This paradox – increased penetration of renewables, significant reduction in emissions yet continued reliance on natural gas fired plans – is visually illustrated in the 2nd graph below where generation from natural gas, solar and wind to 2050 are shown under different scenarios (other resources play a role but not shown here).

Clearly solar and wind are the dominant sources of supply, yet natural gas is still needed to make up any shortfalls.Emission fall, yet reliance on natural gas remains

|

Source: 2023 Standard scenario report: A US electricity sector outlook, NREL, Dec 2023 |

What is wrong with this picture? If the aim is to decarbonize the electricity sector, why do we need so much natural gas in 2050? The short answer is that,

- We don’t yet have the capability to absorb and integrate all renewable output from utility-scale or distributed resources when they are available;

- Neither do we have the means to store the generation more than demand in large enough quantities for long duration;

- Nor can we reliably adjust demand to respond to fluctuations in supply in reasonable scale.

The preceding article focused on the rise of storage, the second bullet point above. Only recently, demand flexibility, the last item, is beginning to get the attention that it deserves.

|

Lots of solar and wind – and natural gas – generation

Source: 2023 Standard scenario report, NREL, Dec 2023 |

What role can demand play in this context? It can act as a shock absorber, absorbing the excess generation when renewable generation exceeds demand while avoiding usage during periods of scarcity and high prices. Flexible demand combined with storage can go even further by feeding some of the excess stored energy back to the grid when needed. None of this is new. Yet to date it has not been easy to do.

Wholesale markets, of course, provide useful signals to generators when to sell and to retailers when to buy from the market. But the price signals typically do not reach the ultimate customers to entice them to respond. Moreover, the savings from shifting loads to take advantage of low prices and/or avoid high prices, are not large enough to get most customers excited. The behavioral research suggests that the only practical way to get small customers – residential and small commercial ones – to engage is through automation – set and forget schemes – or even better, through a trusted aggregator, agent, or broker to handle the details and pass any savings to them without asking them to move a finger.

Going after the low hanging fruits first, there are many ways to encourage customers, large and small, to soak up the solar, wind or hydro generation when it is plentiful and cheap. Many customers can adjust their usage patterns with proper incentives and through automation. Electric vehicles and electric water heaters are obvious examples where excess generation can be stored for use at later times when prices are high, and supplies are scarce. Commercial and residential buildings can be pre-cooled or pre-heated to avoid high demand periods. As described in the following article, OFGEM, the UK’s energy regulator has been supportive of new schemes being developed and tested to entice large numbers of customers to participate in demand flexibility events.

|

Electric heat pump

|

Beyond these are more sophisticated attempts to aggregate large portfolios of customer-owned distributed energy resources (DERs) which can be managed as virtual power plants (VPPs). A new report by Guidehouse Insights argues that while challenges to DER integration are being worked out, aggregators may be best served by looking to alternative ways that such resources can participate in the energy system in large-scale and with predictable and dependable results. Only when that happens will the grid operators be able to dispatch VPPs as they currently do with physical power plants.

According to Guidehouse Insights, local flexibility markets operating at specific points on the distribution grid could help in managing grid operations. Under such a system, an aggregator enrolls asset owners and submits bids to the marketplace to provide certain localized services.

For all the obvious reasons demand flexibility, localized or otherwise, large or small, is already coveted and will become even more valuable over time.