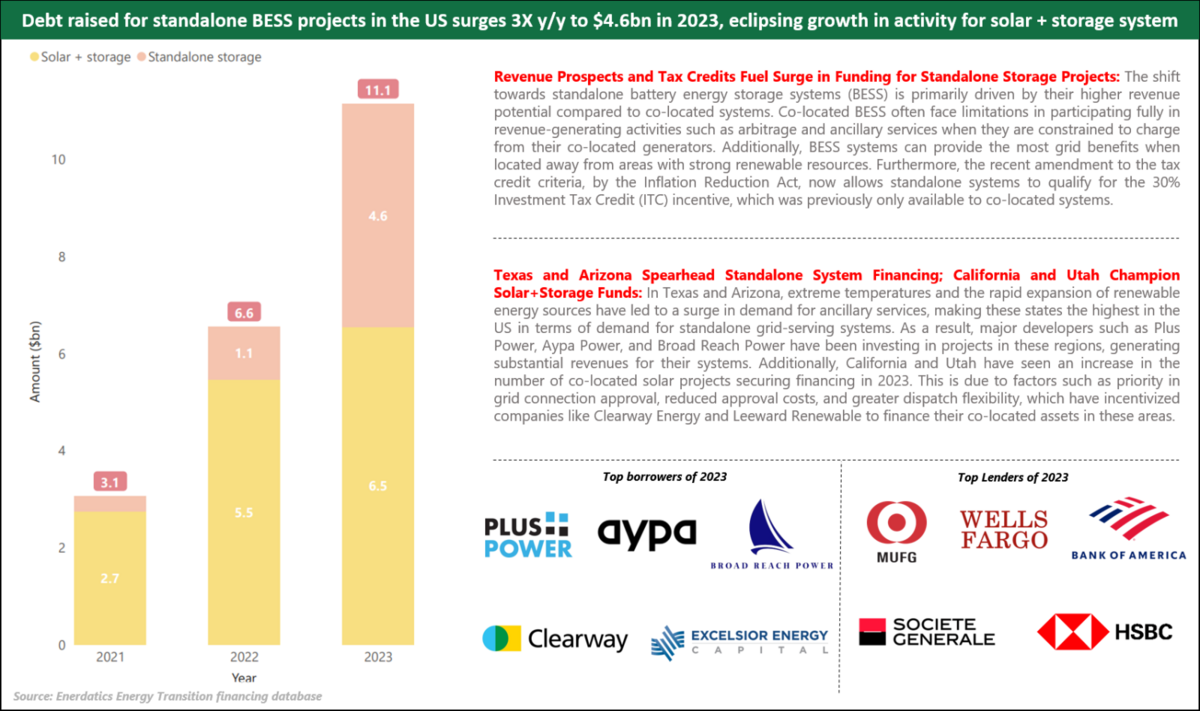

📈💡 2023 has witnessed a remarkable 3X surge in debt raised for standalone BESS projects in the US, hitting an impressive $4.6 billion. This growth outshines the progress in solar + storage systems. Here’s a quick dive into what’s fueling this trend:

— Higher Revenue Prospects: Standalone BESS projects offer more opportunities for revenue generation through arbitrage and ancillary services, unlike their co-located counterparts.

— Strategic Locations: These systems can deliver maximum grid benefits when positioned strategically, not necessarily in areas with abundant renewable resources.

— Tax Credit Incentives: Thanks to the Inflation Reduction Act, standalone BESS now qualifies for a 30% Investment Tax Credit, previously exclusive to co-located systems.

🌵🔋 In the forefront are Texas and Arizona, capitalizing on their need for ancillary services due to extreme temperatures and renewable energy expansion. Meanwhile, California and Utah are not far behind, focusing on co-located solar projects.

What do you think about this shift in the energy storage market?