Recently a friend sent me a YouTube video from the Climate Town channel called Who Actually Controls Gas Prices? I must say that the guy in the video is accurate on most of the issues. He assigns cause and effect where it belongs.

However, near the end of the video, he complained that after the Covid-19 pandemic and subsequent stay-at-home orders crashed oil prices, oil companies stopped drilling. He said that they would rather withhold production to make more money.

Outside of the irony of a climate change activist complaining that not enough oil is being produced to keep prices low, he got this part mostly wrong. Although the charge has often been leveled at oil companies over the past couple of years, after the Covid-19 crash the number of rigs drilling for oil steadily increased.

A year after the crash, the rig count had risen by over 50%. Two years later, it had doubled. And after two and a half years, the rig count had more than tripled from the levels of the crash.

So, contrary to the claims, oil companies were definitely drilling. But the nugget of truth is that they weren’t ramping up drilling as fast as they had in the past. They didn’t get back to pre-Covid levels, for a very simple reason. They had been burned multiple times over the past decade by over-drilling and causing prices to crash.

But it turns out that maybe the experts in the oil industry knew what they were doing, and the non-experts offering commentary on what they should be doing were way off base.

The fact is that oil production has been steadily rising since the Covid-19 crash. In each of President Biden’s first two years in office, production grew during the year. It will do so again this year.

By the beginning of 2023, it looked like the U.S. could set a new annual production record during the year. In fact, I made that one of my 2023 energy predictions in January.

I was less sure that the previous monthly production record — 13.0 million barrels per day (bpd) set in November 2019 — w0uld be broken. We started 2023 at 12.6 million bpd, and by May that was only up to 12.7 million bpd. But high oil prices during the summer resulted in a production surge, and with the recent official release of the August monthly numbers, a new record was set at 13.05 million bpd.

You can find oil production numbers at the Energy Information Administration (EIA) in multiple places. The U.S. Field Production of Crude Oil shows monthly averages, but they are always a couple of months behind. For example, as I write this on 11/8/23, August is the most recent month that is posted.

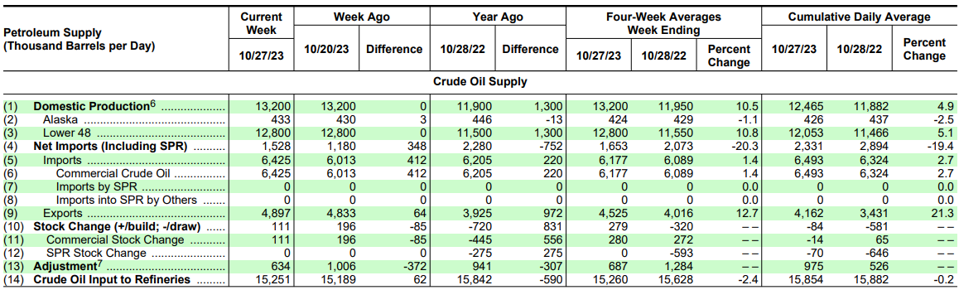

But you can find weekly production numbers in the EIA’s Petroleum Status Report that is published every Wednesday. There is a table from that report called U.S. Petroleum Balance Sheet, and it shows the status of U.S. oil production, inventories, imports, etc. for the previous week. Here is an excerpt from the latest release of that report, covering statistics through 10/27/23:

Note that each of the two most recent weeks, as well as the average for the past four weeks — covering nearly the whole of October — was 13.2 million bpd. That is well above the recently set monthly record from August 2023, as well as the previous record of 13.0 million bpd from November 2019.

Further, the previous annual record, set in 2019, was 12.3 million bpd. Every monthly production average this year has been above that level. With weekly production currently running at 13.2 million bpd, at this point it’s almost a foregone conclusion that 2023 will set a new annual oil production record. The previous monthly record has fallen, and (as I predicted in January) the annual record will fall as well.

None of this should take away from the fact that the Biden Administration has made many decisions that were opposed by the oil industry. But I have always maintained that a president’s impact on oil production (and gasoline prices) is greatly overrated. Yes, they can have an impact, but it’s almost always long-term. The decisions President Biden is making now can impact oil production, but not for several years.

But ultimately, the biggest factor impacting oil production is the price of oil. Nevertheless, headed into an election year it’s going to be more challenging to run against Biden’s energy policies, when he can point to all-time high oil production and say “I must be doing something right.”

Follow Robert Rapier on Twitter, LinkedIn, or Facebook