Opdenergy closes a $252mn financing package for two solar projects totalling 260 MWdc in the US. The financing comprises debt facility led by consortium of investors comprising BBVA, Intesa Sanpaolo and MUFG and tax equity commitment led by RBC Community Investments. Sharing notable highlights from Enerdatics:

Project Info: The financing was secured for the 100 MWdc Blake solar farm located in Virginia and 160 MWdc Elizabeth solar projects located in Louisiana. Both projects, which are currently under construction, are expected to be operational within the next few months. The assets have long-term PPAs with AEP Energy Partners and Entergy Louisiana respectively.

First financing in the US: The agreement is Opdenergy’s first capital raise in the country and the largest announced since their takeover tender announcement by Antin Infrastructure in June this year.

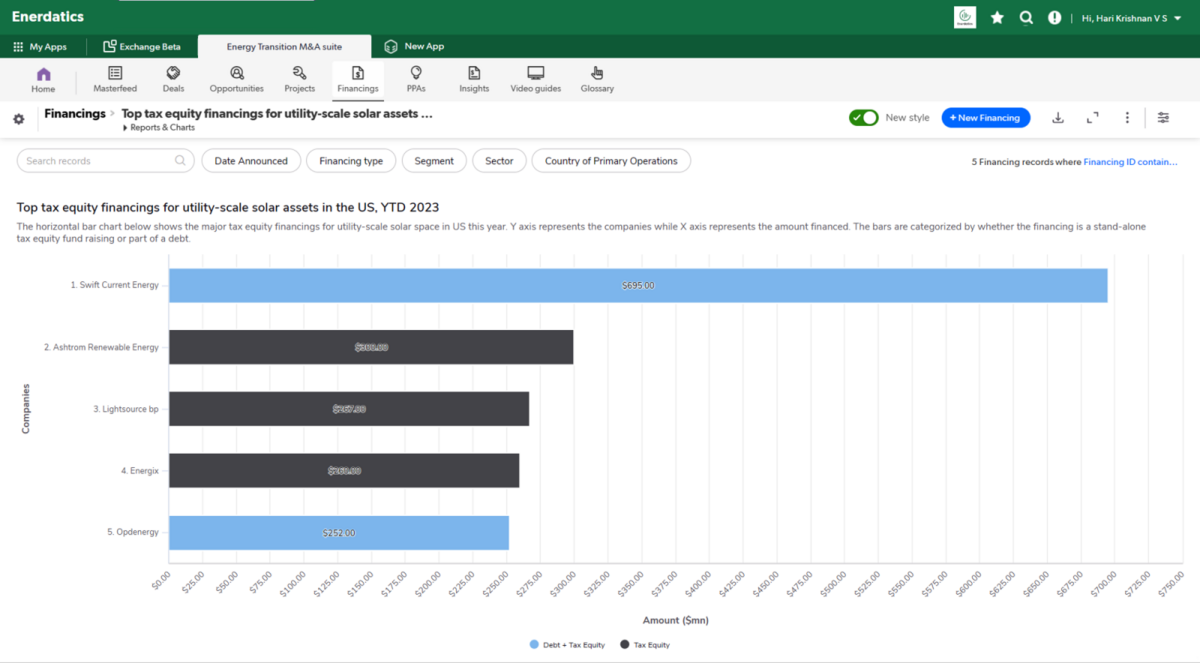

Tax equity financings continue to raise traction in the space: Enerdatics has noticed a growing trend among developers who are utilizing tax equity financing, with tax credits becoming more marketable due to the recent passing of the IRA. As a result, this has generated increased interest from entities that previously faced challenges in accessing traditional tax equity deals.