Saudi Arabia experiences forgone oil revenues by keeping domestic oil prices below market levels. This paper estimates that the true forgone oil revenues to the Saudi government may not be as high as anticipated. Most analyses of the value of forgone revenues use the difference between international market and domestic prices, multiplied by the quantity consumed domestically. This is called the price-gap method.

If Saudi Arabia were to raise domestic prices of oil products, domestic use of the fuels would be lowered. Those saved quantities could be then exported or not produced. If we consider that those quantities are exported – particularly in the short-term, international oil product prices may fall, which will have adverse effects on oil revenues. Using the conventional method may therefore overestimate the forgone revenues.

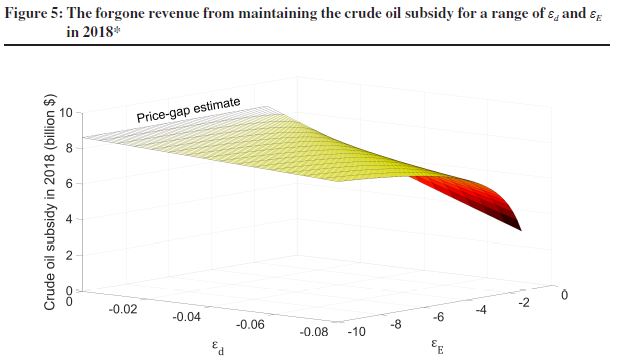

The paper linked above introduces an alternative formula that retains much of the simplicity of the price-gap method. Only one additional data set is required for the alternative method; exported quantities for a particular fuel. An application of the alternative method is shown below for Saudi forgone revenues for crude oil in 2018.

In addition to the alternative method, the paper highlights data sources and uses more fuels than other organizations that estimate Saudi energy subsidies. We also compare our price-gap estimates to those of the IMF and IEA.