This is the fourth article in a series on the recently released 2023 Statistical Review of World Energy. Previous articles discussed the trends in global carbon dioxide emissions, the overall highlights of the Review, and the production and consumption of petroleum.

Today I delve into the data on natural gas production and consumption.

Natural Gas Production

The U.S. dominated global natural gas production until the 1980s, at which time it ceded the lead to Russia. The Middle East has also grown its natural gas production at a rapid pace over the past 50 years and was on a trajectory to overtake the U.S. and Russia as the world’s leading natural gas-producing region.

But then the fracking boom in the U.S. reversed years of decline and began to boost production in 2005. Natural gas production in the U.S. doubled from 2005 to 2022, which pushed the U.S. back into the global lead among natural gas producers.

In 2022, U.S. production grew by 3.6% to a new all-time high of 94.7 billion cubic feet per day (BCF/d). This new record eclipsed the previous record set in 2021. The U.S. retained a commanding 24.2% share of global production, followed by Russia (15.3% share) and Iran (6.4% share).

To put U.S. natural gas production into perspective, 2022 production was greater than all Middle East natural gas production (69.8 BCF/d; 17.8% share).

Although the U.S. maintains a substantial lead over other countries, over the past decade Iran, China, Australia, and Azerbaijan have all grown natural gas production at a faster average annual rate.

Natural Gas Consumption

U.S. consumption has grown rapidly over the past 20 years as power plants have turned increasingly to natural gas as both a replacement for coal-fired power and a backup for new renewable capacity.

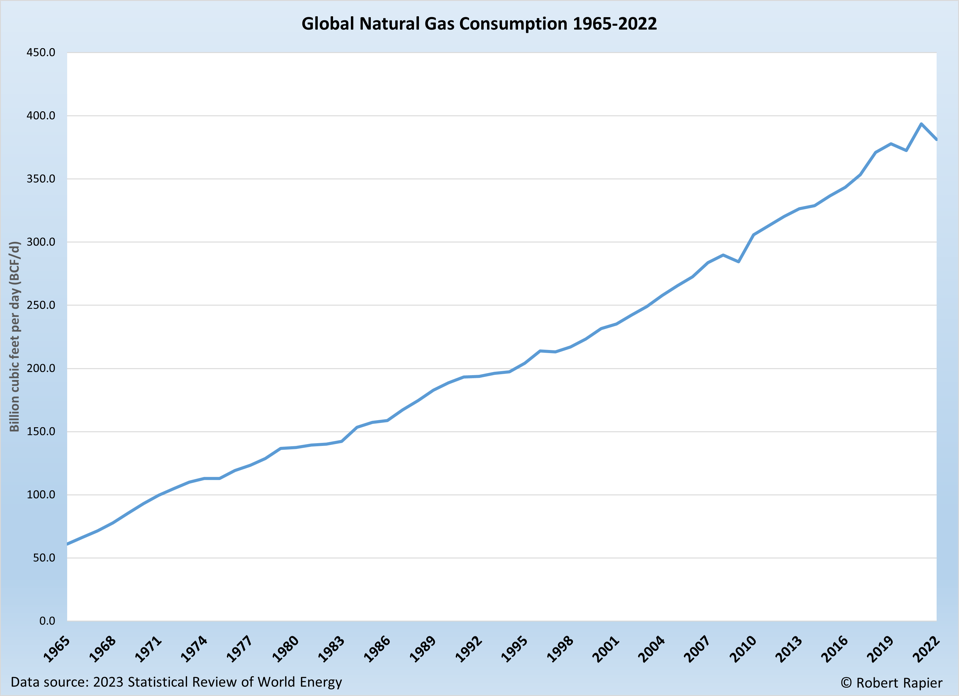

The net impact of growing natural gas supplies and conversion of power plants has caused natural gas to become the fastest-growing fossil fuel. Over the past decade, global natural gas consumption has grown at an average annual rate of 2.0%, versus 0.9% for oil and 0.2% for coal.

Global natural gas demand fell in 2022. This decline was driven primarily by a double-digit decline in Europe, a consequence of Russia’s invasion of Ukraine. The only other major declines in demand took place in 2020 in response to the Covid-19 pandemic, and then during the 2008 housing crisis, after which consumption growth returned to its normal trend. U.S. demand grew by a robust 5.4% in 2022, more than double the 10-year average growth rate.

Natural Gas Exports

Another result of the boom in natural gas production has been substantial growth in the gas exports of certain countries. U.S. exports, both via pipeline and as liquefied natural gas (LNG), have surged over the past 10 years. U.S. LNG exports grew last year to 104.3 billion cubic meters (BCM). For perspective, in 2010 that number was 1.5 BCM. U.S. LNG export growth over the past decade has been an astounding 63.3% per year on average.

The U.S. remains the 3rd largest LNG exporter, behind Qatar (114.1 BCM) and Australia (112.3 BCM). However, U.S. growth is on a pace to pace these two countries within three years.

Pipeline exports from the U.S. have also surged, more than doubling since 2014 t0 82.7 BCM. Mexico has been the largest growth market for pipeline exports, with 56.5 BCM of the total in 2022. Canada was the other destination of U.S. pipeline exports at 26.2 BCM.

Natural Gas Reserves

The U.S. may continue to lead the world in natural gas production for a few more years, but the level of proved natural gas reserves implies that our lead could be short-lived.

The Middle East’s proved natural gas reserves at the end of 2020 were 2.7 quadrillion cubic feet, versus U.S. proved reserves of 446 trillion cubic feet. For perspective, U.S. proved reserves are only 6.7% of the global total.

Russia has more proved natural gas reserves than any other country with 1.3 quadrillion cubic feet, followed by Iran with 1.1 quadrillion cubic feet. Total proved natural gas reserves at the end of 2020 were enough to satisfy 2020 global production rates for 48.8 years.

Follow Robert Rapier on Twitter, LinkedIn, or Facebook