The Los Angeles Times reported in early August that one in four vehicles sold in California during the second quarter were electric vehicles, while the state’s administrative body is openly hostile to the internal combustion engine, wanting to ban sales of new vehicles with gasoline-powered engines by 2035.

According to the article, cumulative electric vehicle sales in the state through April reached 1.5 million, with the California Energy Commission (CEC) reporting 223,298 light-duty zero-emission vehicle sales during the first half of 2023. Cumulative sales of light-duty ZEVs in the state, which include battery electric, plug-in hybrid electric, and fuel cell electric vehicles, totaled 1,623,211 at the end of the second quarter, according to CEC.

Statista, noting California is the most populated state in the United States, said there were approximately 31.4 million vehicles in California in 2021, with 14.3 million automobiles and 15.9 million private and commercial trucks. Loren McDonald with EVAdoption estimated about four out of 100 vehicles on the road in California in September 2022, were EVs and projected that ratio would increase to 36.5% in 2035. McDonald calculates that there will be nearly 24 million gasoline-powered vehicles in California in 2035.

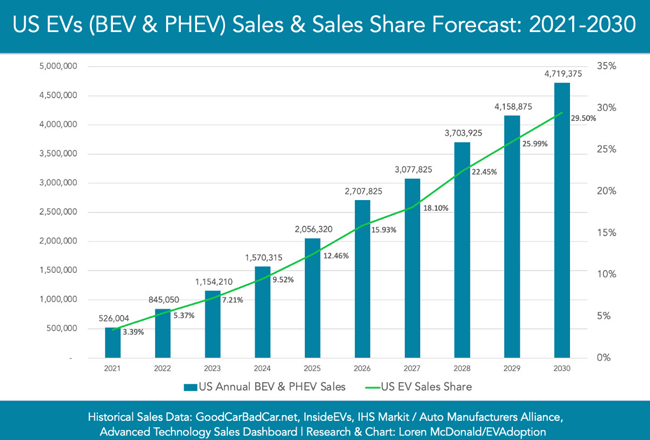

Forecasted U.S. EV sales from 2021-2030.

In concert with growing EV sales has been an aggressive transition to renewable diesel along the West Coast that is rapidly reducing demand for petroleum-based diesel fuel. The Energy Information Administration (EIA) said nearly all the renewable diesel produced in the United States is consumed in California, with the remaining volume going to Oregon and Washington. EIA data shows consumption of traditional distillate fuel along the West Coast in 2022 was the lowest since 2002, with the growing share of renewable diesel spurred by California’s Low Carbon Fuel Standard and Clean Fuel Programs in Oregon and Washington.

Demand for renewable diesel is outpacing biodiesel, notes EIA, pointing to its drop-in advantage. Renewable diesel, which is produced from fats, oils, or greases (FOG), is chemically identical to petroleum-based diesel. Although biodiesel is made from the same feedstocks, the FOGs, it is blended with distillate fuel in concentrations of 20% or less because it is chemically different than petroleum distillate.

Demand for renewable diesel is outpacing biodiesel, notes EIA, pointing to its drop-in advantage.

The production process also differs, with biodiesel produced through transesterification, which converts FOG feedstock through its reaction with alcohols and catalysts. Biodiesel produced in this manner is called FAME, an acronym for Fatty Acid Methyl Ester.

The production process for renewable diesel compares more closely to that of oil refining, with feedstock hydrotreated, leading to the finished product also being called hydrotreated vegetable oil or green diesel. Like oil refining, the feedstock is heated under pressure with hydrogen with water and then separated before moving into a distillation tower.

“Consequently, renewable diesel production facilities are increasingly converted parts of crude oil refineries or complete conversions of refineries. Some are entirely new refinery facilities,” explains Maria Gerveni and Scott Irwin with the University of Illinois and Todd Hubbs with the U.S. Department of Agriculture in their Feb. 8 farmdoc daily report, “Biodiesel and Renewable Diesel: What’s the Difference?”

In releasing second-quarter earnings in early August, Phillips 66 Company said it expects to begin commercial operations of its Rodeo Renewed refinery project in San Francisco in the first quarter of 2024, adding that it will be one of the world’s largest renewable fuels facilities. This is a complete conversion of an oil refinery, which was two facilities linked together by pipeline called the San Francisco Refinery. The Santa Maria facility, located 200 miles south of San Francisco in Arroyo Grande, produced intermediate refined products shipped to the Rodeo refinery in the San Francisco Bay. Operations at the refinery, which had a 9,500-bpd crude oil distillation capacity, ended in February. The Rodeo refinery at one time had a crude oil distillation capacity of 120,200 bpd. Once the transformation is completed, it will no longer process crude oil. Instead, the refinery will process FOG feedstock with a renewable fuel production capacity of a little more than 50,000 bpd, or 800 million gallons per year. The renewables will include renewable diesel, renewable gasoline, and sustainable aviation fuel.

“Consequently, renewable diesel production facilities are increasingly converted parts of crude oil refineries or complete conversions of refineries. Some are entirely new refinery facilities,” explained Gerveni, Irwin, and Hubbs.

Under the title, “U.S. Renewable Diesel Fuel and Other Biofuels Plant Production Capacity as of January 1, 2023,” EIA reports 3 billion gallons of annual production capacity, with 370 million gallons situated along the West Coast in PADD 5. The West Coast total, 70% situated in California, includes 180 million gallons for the Rodeo facility, with a hydrotreater feedstock flexibility project reaching 120 million gallons per year in renewable diesel production in July 2021. Nameplate renewable diesel production capacity in the United States is projected to grow to 4.1 billion gallons by the end of 2023 and to 5.5 billion gallons in 2024 by farmdoc daily authors Gerveni, Irwin, and Hobbs in March, citing multiple sources in deriving their outlook. The authors strongly cautioned that such a projection was dependent on market conditions and, in previous reports, noted the dependency on government policy in driving demand.

In early July, with the release of its Short-term Energy Outlook (STEO), EIA reduced expected domestic production of renewable diesel for 2024 by 252,000 gallons per day or 2.8% to 9.198 million gallons per day following the Environmental Protection Agency’s (EPA) June 21 final rule for 2023 through 2025 volume requirements under the Renewable Fuel Standard (RFS).

EPA set the volume mandate for biomass-based diesel under the RFS at 2.82 billion gallons for 2023, 3.04 billion gallons for 2024, and 3.35 billion gallons for 2025. As noted, annual renewable diesel production capacity began 2023 at 3 billion gallons, while U.S. biodiesel plant capacity was 2.086 billion gallons.

“Prior to this month’s STEO, we assumed that some of the announced capacity additions for renewable diesel would not be completed because of the possibility of increased feedstock costs or decreased credit values. In response to the final RFS rule, we now assume lower plant utilizations and more proposed plants to be canceled than we did previously,” said EIA.

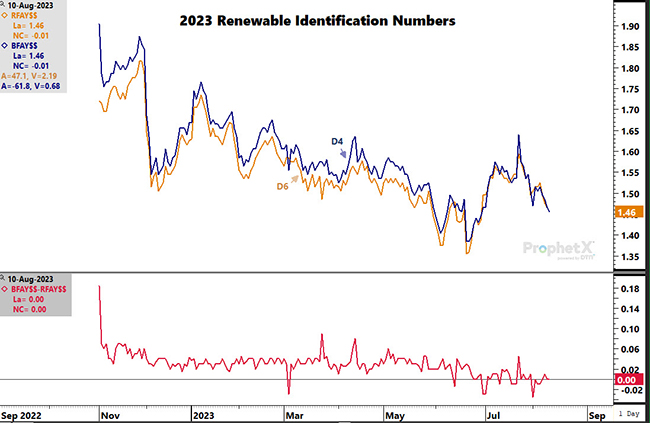

“Because [biomass-based diesel] plays the role of the marginal gallon for filling advanced undifferentiated and conventional mandates, the price of D5 and D6 RINs would also fall off a cliff,” said Gerveni, Irwin, and Hobbs.

Speculation as to why the final rule for biomass-based diesel volume requirements was set below production capacity, undermining the incentive to expand demand above the mandate, was to avoid pushing food prices and inflation higher. Yet, by setting the demand mandate below production capacity, D4 RIN prices will come under pressure since there is no incentive to expand supply. This scenario will, theoretically, lead to a collapse in D4 RIN prices.

“When this condition is violated, our analysis indicates that the consequences for [biomass-based diesel] and RIN prices would be dramatic,” explains Gerveni, Irwin, and Hobbs. “The D4 biodiesel RIN price is predicted to fall to zero because no additional incentive beyond the competitive market price is needed to incentivize [biomass-based diesel] production. Literally, the D4 RIN price falls off a cliff.”

Biomass-based diesel is considered the marginal gallon since there is not enough production of advanced biofuels, and ethanol demand falls short of reaching its volume mandate because of blending level restrictions, which is why D5 and D6 RIN prices have closely tracked D4 RIN prices.

2023 renewable identification numbers (RIN).

“Because [biomass-based diesel] plays the role of the marginal gallon for filling advanced undifferentiated and conventional mandates, the price of D5 and D6 RINs would also fall off a cliff,” said Gerveni, Irwin, and Hobbs.

Such a scenario would almost certainly force lower plant run rates and plant closures that would eventually return the subsidized market to balance. “However, the duration and volatility of this adjustment process is hard to predict,” explains the farmdoc daily authors.

Learn more about our industry insights and solutions.

About the author

A 27-year veteran of the energy industry, Brian L. Milne serves in multiple roles, including editor and analyst. He has delivered dozens of presentations on various topics related to the energy markets and has been quoted widely in the media, including The Wall Street Journal, Barron’s, USA Today, CNN, and major regional news outlets. Milne has authored numerous articles for international magazines exploring market dynamics and providing forward-thinking commentary and analysis. A graduate of Monmouth University in New Jersey, he has a B.A. in history and an interdisciplinary in political science (magna cum laude).